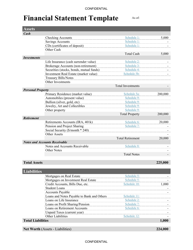

Loan Amortization Schedule Template

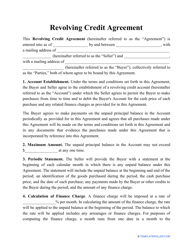

What Is a Loan Amortization Schedule?

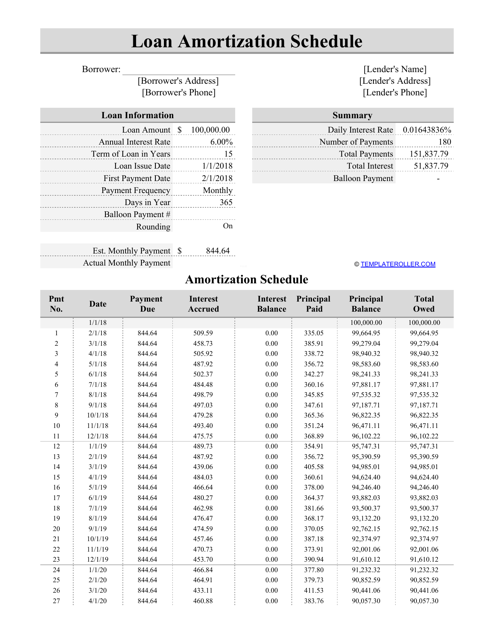

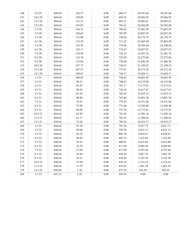

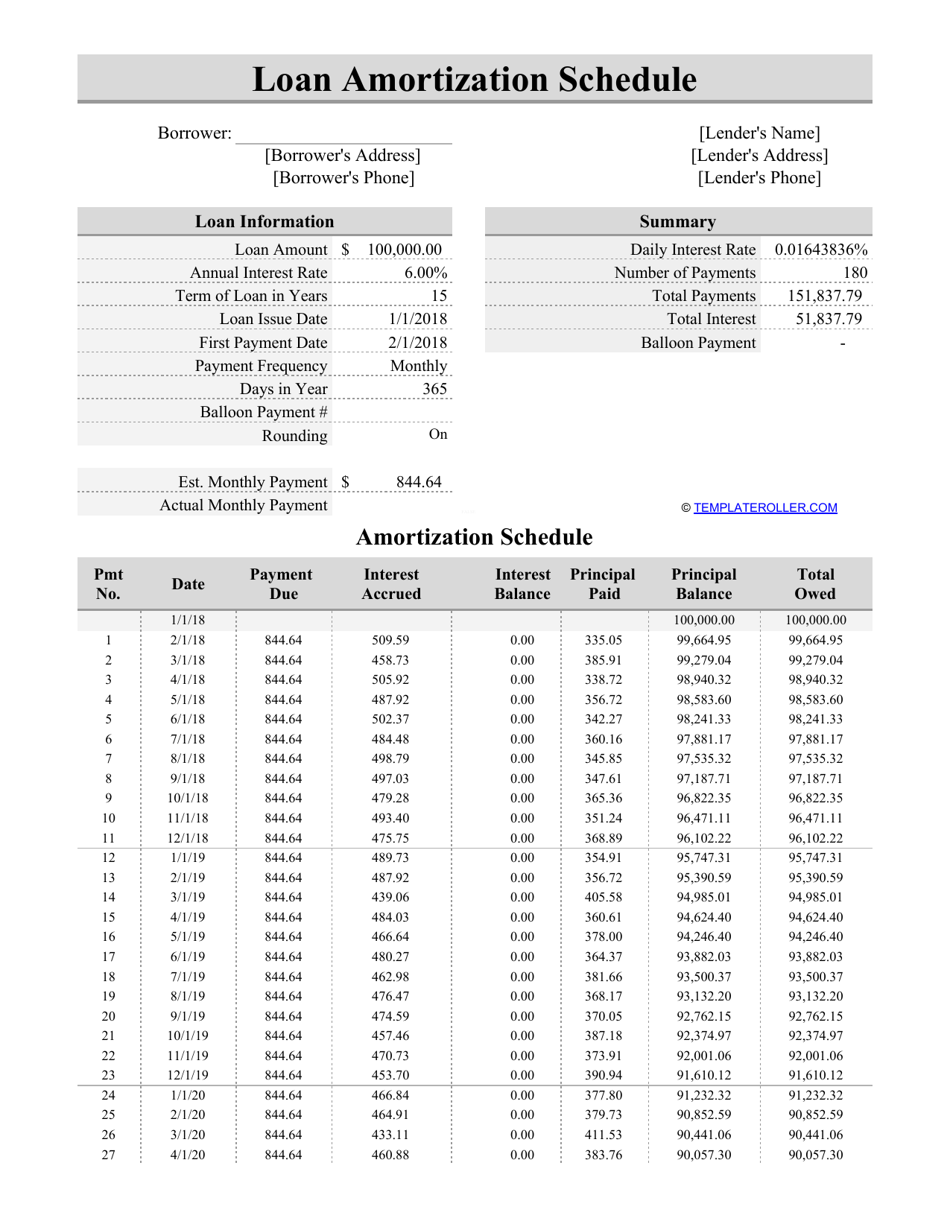

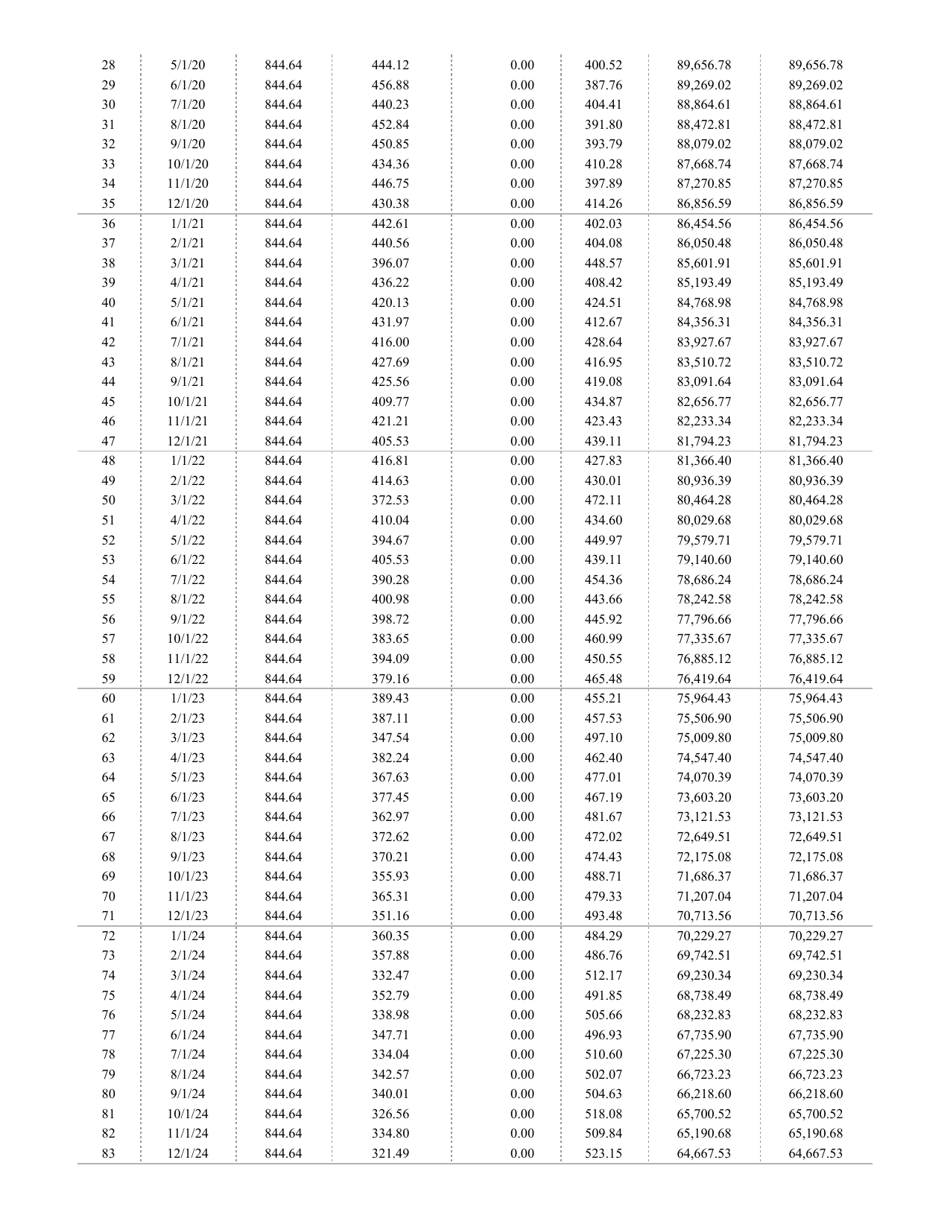

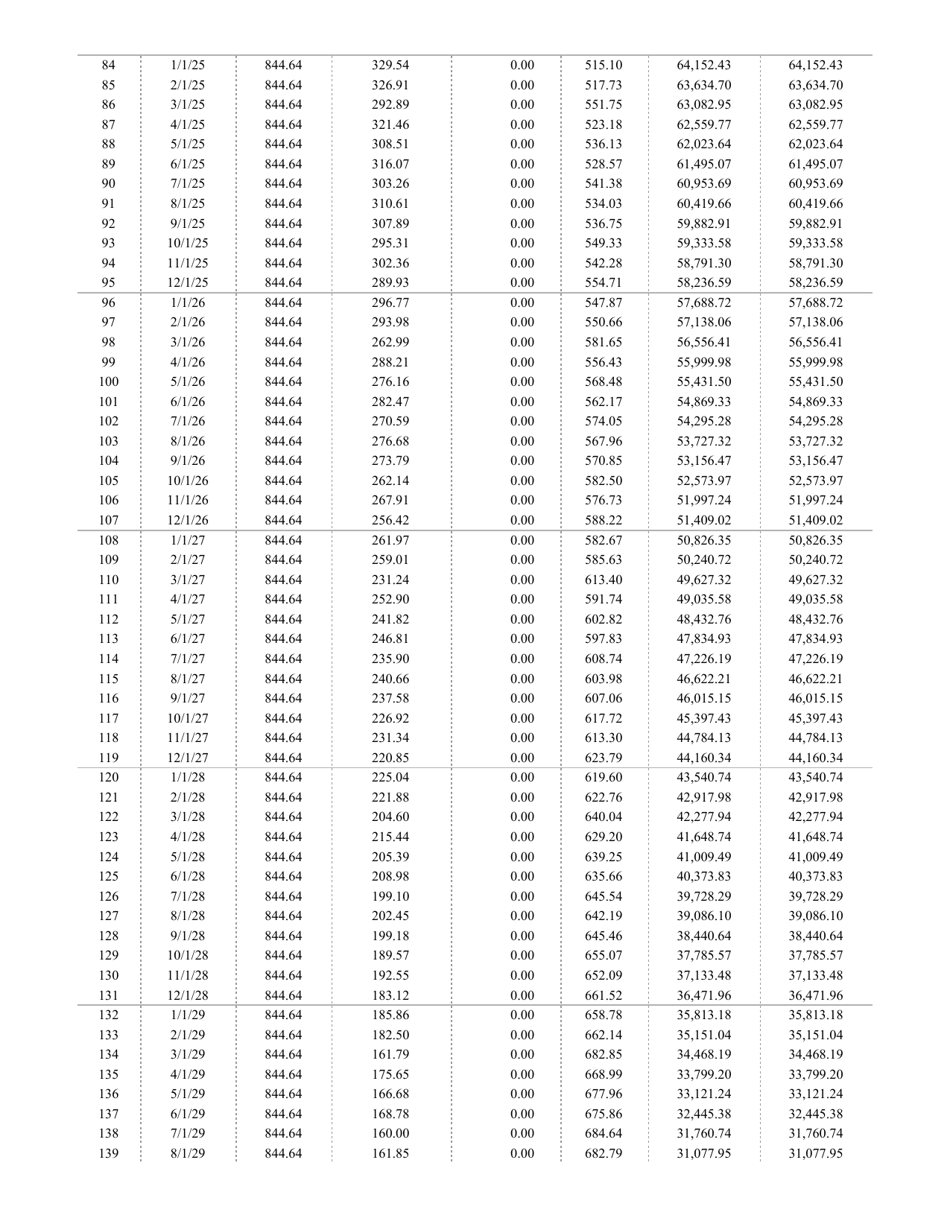

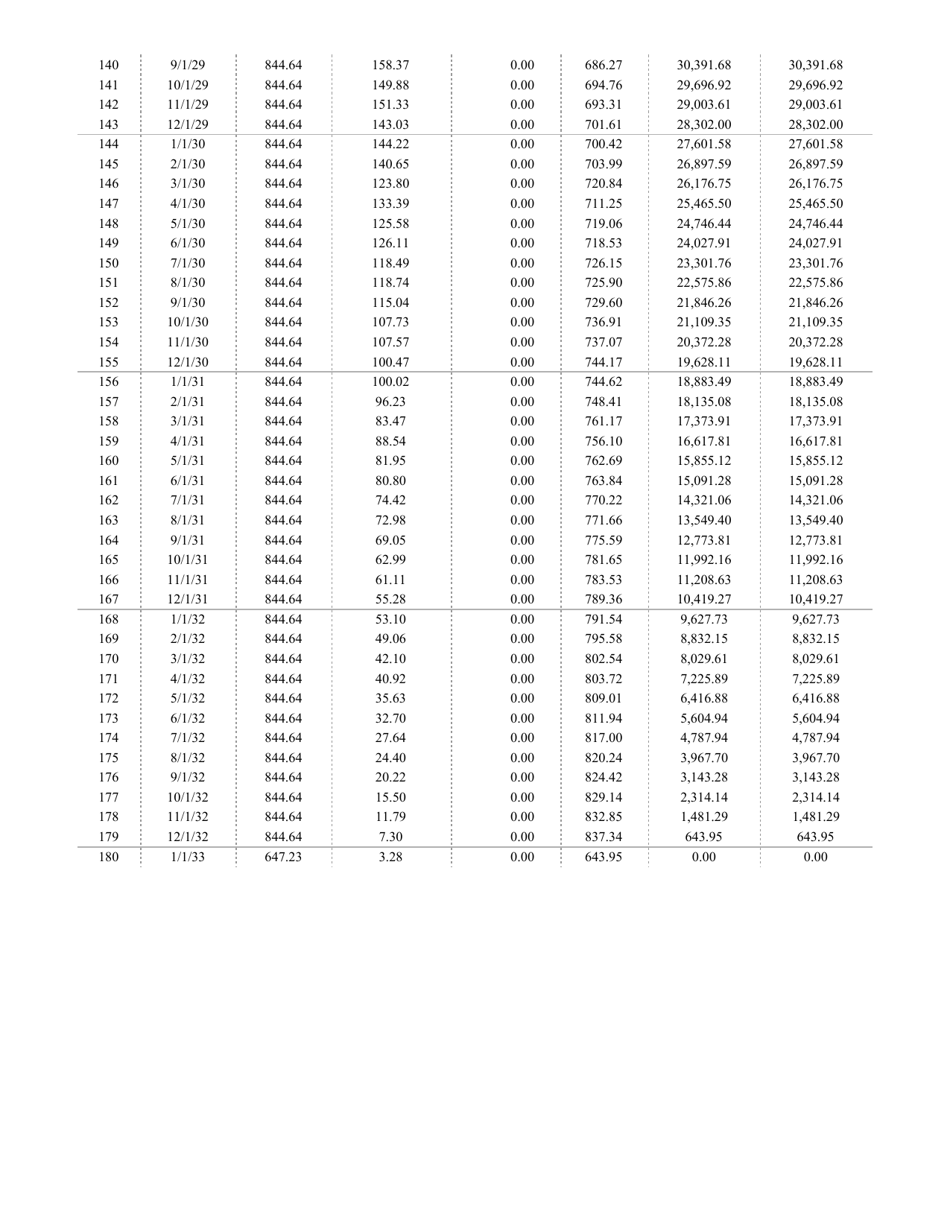

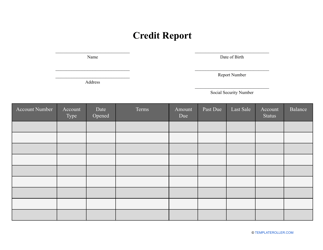

A Loan Amortization Schedule is a typed or handwritten table that outlines every single payment for the loan, calculates the money that goes toward the lender and to the interest until the borrower pays off the entire amount of the loan. This document will clarify how much money you need to pay each month and will help you to stay on track by demonstrating the calculation of interest.

Once you find out the loan interest you owe to the lender, you are encouraged to handle the main payments as soon as you can. Extra payments will also lower the future payments that will cover the interest. With the help of a schedule, you can clearly see the advantages of extra payments and early payments that will lead to faster amortization and will let you manage the budget and save money on interest expense. A Loan Amortization Schedule template available in Excel can be downloaded through the link below.

How to Create a Loan Amortization Schedule?

Follow these steps to draft an Amortization Schedule for a loan:

- Draw a table of four columns - the amount paid towards interest, the amount paid towards the lender, and the remaining balance.

- Write down the amount of payment in the first column for as many payments as you have (for instance, you might have a 12-month loan that requires 12 payments of $300 - write $300 12 times).

- Multiply the remaining balance of the loan by the interest rate.

- Subtract the amount of payment from the amount from the "paid toward the interest" column and enter the result in the "paid toward the lender" column.

- Subtract the latest result from the loan balance and indicate the amount you got in the "remaining balance" column.

- To compute future payments, apply the same calculations, but begin with the remaining balance from the first month, not the total amount of the loan.

How to Calculate a Loan Amortization Schedule?

A Loan Amortization Schedule Calculator will help you to determine the proper amount of each payment or compute the loan payments yourself. This document usually includes all the payments you have to make with two main amounts - money for the lender and money for the interest. Additionally, you can see the loan's remaining balance you still have to pay after each consecutive payment - this is how you are able to observe the way your debt decreases when you gradually pay the loan back.

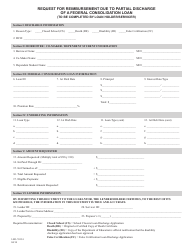

You may also cover other items that a mortgage payment commonly includes - hazard insurance, private mortgage insurance, and property taxes. For instance, a Car Loan Amortization Schedule can include auto insurance you pay for every month or year. All these variables will have an impact on your schedule - contact your lender to find out whether you have to include them into your schedule to learn the correct payment amount.

What Happens When a Loan Is Negatively Amortized?

A negatively amortized loan means that the interest costs become bigger than the payments you make. This kind of loan may lead to the rise of the loan balance - the lender is now forced to add unpaid interest charges to the balance you already owed in accordance with the loan and as a result, you will deal with bigger future payments. Negative amortization often impacts mortgages and student loans. Despite the flexibility of the negative amortization, do not delay paying interest for months and years - it may seem like a good idea in the short term, but it will lead to a spike of interest rates in the months or even years to come.

Still looking for a particular template? Take a look at the related templates below: