Balance Sheet Template

What Is a Balance Sheet?

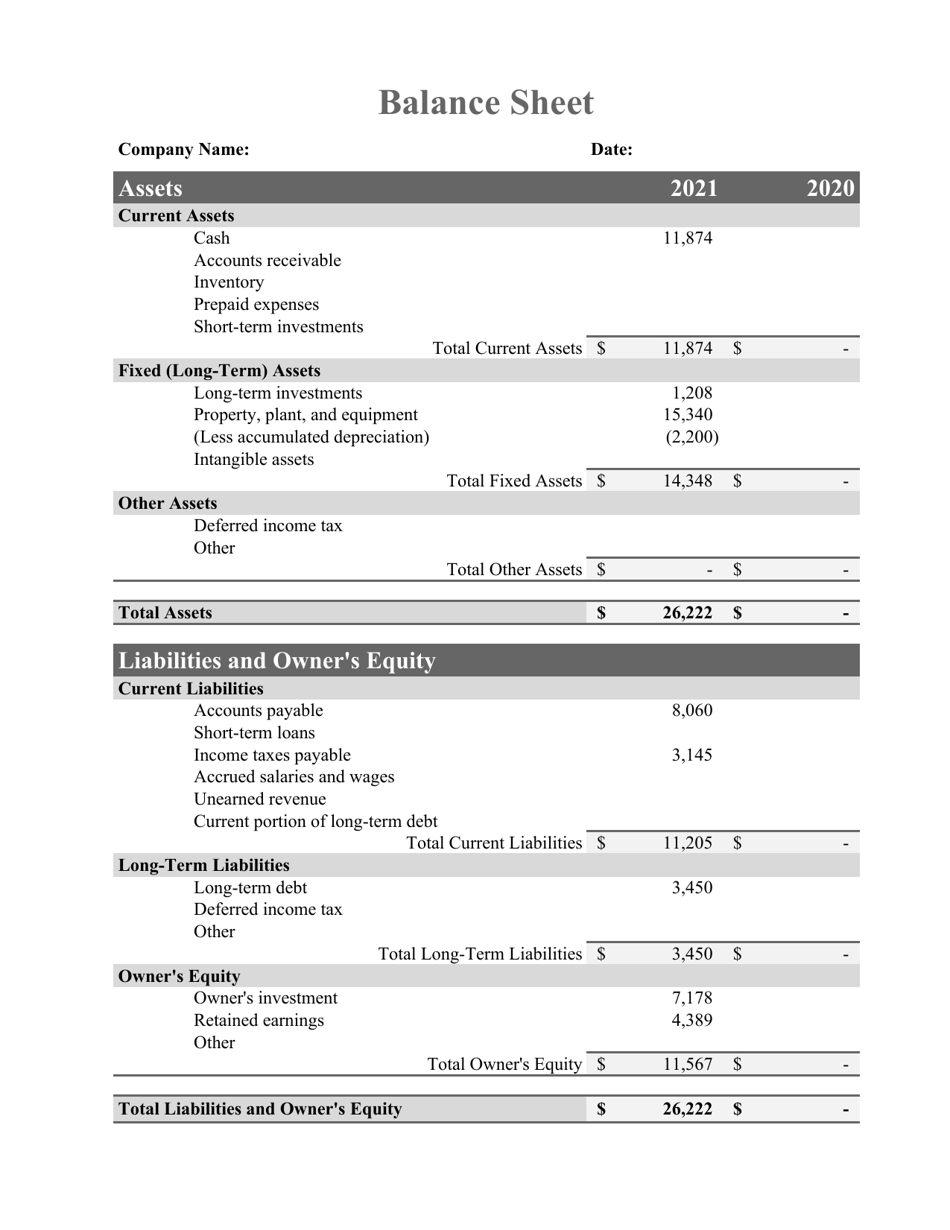

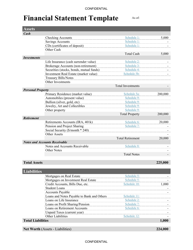

A Balance Sheet refers to one of the main financial statements created for any business to outline their equity, liabilities, and assets and analyze their financial performance. It is a breakdown of items the organization owns, money it owes, and funds invested by owners and shareholders over the years. You can download a Balance Sheet Template through the link below.

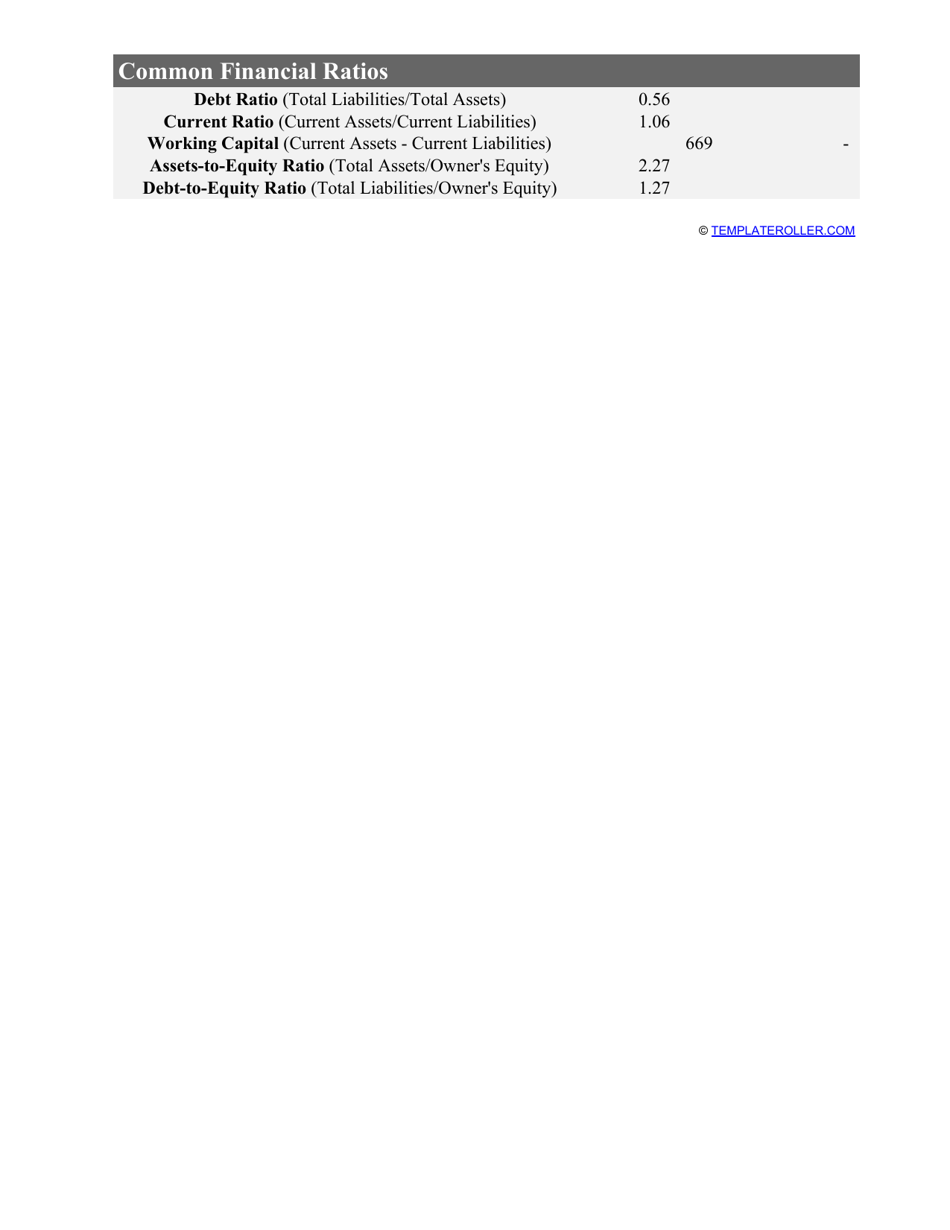

Properly-drafted and calculated Financial Statements allow business owners and accountants to scrutinize the company's financial health, evaluate the market position of the business, and see the overall ability to handle outstanding debts. You will be able to compare the data from consecutive months and years and find out the best way to comply with your financial obligations.

There are different ways to summarize information from the Balance Sheet accounts:

- It is possible to compose a trial Balance Sheet - it will be an internal document that remains in the company records and lists the debit and credit balance amounts. Unlike a general Balance Sheet, it is not distributed to anyone outside the company and just serves as a draft before the main document is issued;

- Accountants benefit from completing a common-size Balance Sheet - this document represents the relative percentage of all accounts. It is utilized by accounting departments and external accountants who later create a final Balance Sheet anyone, not only professionals, can read.

How to Read a Balance Sheet?

To be able to investigate your company's or another business's assets, liabilities, and equity, you have to learn about the components of the Balance Sheet and figure out how their figures represent the finances of the organization. A Balance Sheet must be analyzed this way:

- Examine current (short-term) assets of your entity - the valuable items you may turn into cash within a short amount of time which include products you have on hand and accounts receivable.

- Study non-current (long-term) assets - these items cannot become cash quickly in case of a financial emergency, for example, property, equipment, patents, and copyrights.

- Understand ongoing and long-lasting liabilities of the entity - money owed to your creditors, business partners, and customers.

- Review shareholders' equity - it constitutes the organization's net worth. It represents the total amount of funds invested in the business once it was founded and financial support in the form of shares.

How to Make a Balance Sheet?

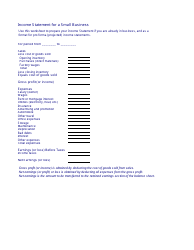

Follow these steps to make your Balance Sheet:

- Set up a Balance Sheet by listing your assets (property owned by the business), liabilities (debts of the entity), and equity (various contributions to the company and its past earnings). You need to comply with the basic Balance Sheet formula: the total amount of assets must equal the sum of liabilities and equity.

- Indicate the date you choose to include - it demonstrates the finances of the company on a certain day of the year. Since the most common Balance Sheet format is a table, you can simply indicate the date in the top row.

- List all current and non-current assets in a particular order - it is recommended to sort them by their convertibility into cash - and enter their total value.

- Figure out current and fixed liabilities of your company - debts that must be paid within twelve months and obligations that cannot be quickly dealt with. Add their amounts and record the figure that represents liabilities.

- Calculate equity by summing up common stock, treasury stock, and retained earnings.

- Make sure you have reached a balance, and if you notice any discrepancies, it means you have omitted accounts and transactions - perform another check to match the components of the sheet.

You may not only see the historical analysis of your finances but also plan for the future and project potential income and see which assets you will be able to retain in the upcoming months and years. To do so, you can draft a pro forma Balance Sheet - this accounting tool will show you additional funds you can get from selling equipment, inventory, or other superfluous items.

Where Is Accumulated Depreciation on a Balance Sheet?

A Balance Sheet changes and fluctuates over time. Every small variation will influence the company's value and taxes you have to report and pay. Sometimes organizations deal with depreciation of short-term assets - goods and items the company uses within a year. However, when an entity encounters a significant decline in the value of long-standing assets, it means you have to deal with accumulated depreciation. It is associated with the intangible and tangible property alike - real estate, equipment, copyrights, etc. When you compose a Balance Sheet, accumulated depreciation will be recorded as a credit until you sell or retire impacted assets marking them as a debit and giving these items a positive value.

How Do You Calculate Retained Earnings on a Balance Sheet?

You need to figure out retained earnings once every accounting period is over (one time in a quarter or year). To do so, add the income to the earning you retained in the previous reporting period. If you do not have any net income, you have to subtract net losses from the prior retained earnings. After that, subtract net dividends you have paid to shareholders and you get the amount representing retained earnings, whether negative or positive - it depends on the loss or income your business has generated.

Not what you were looking for? Check out these related templates: