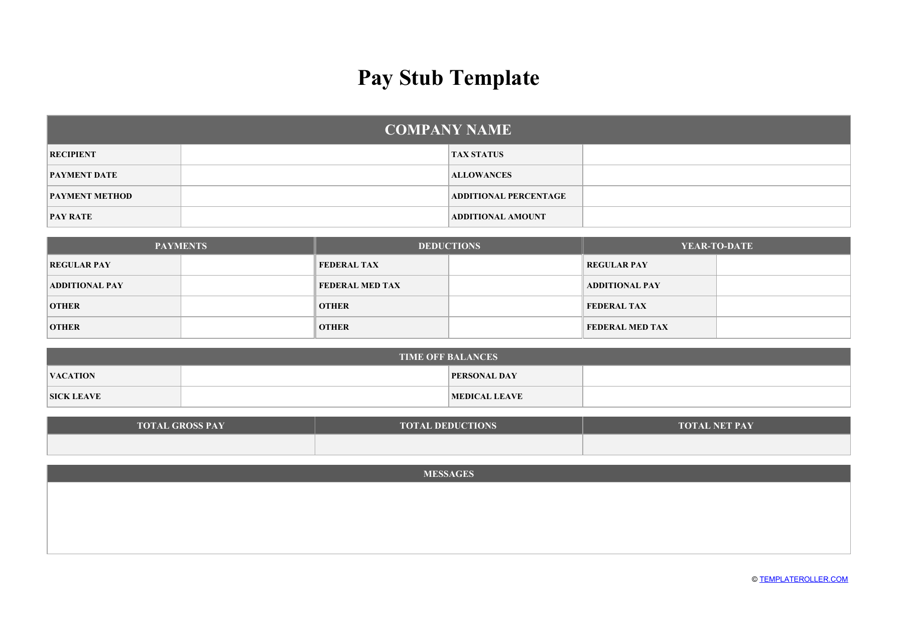

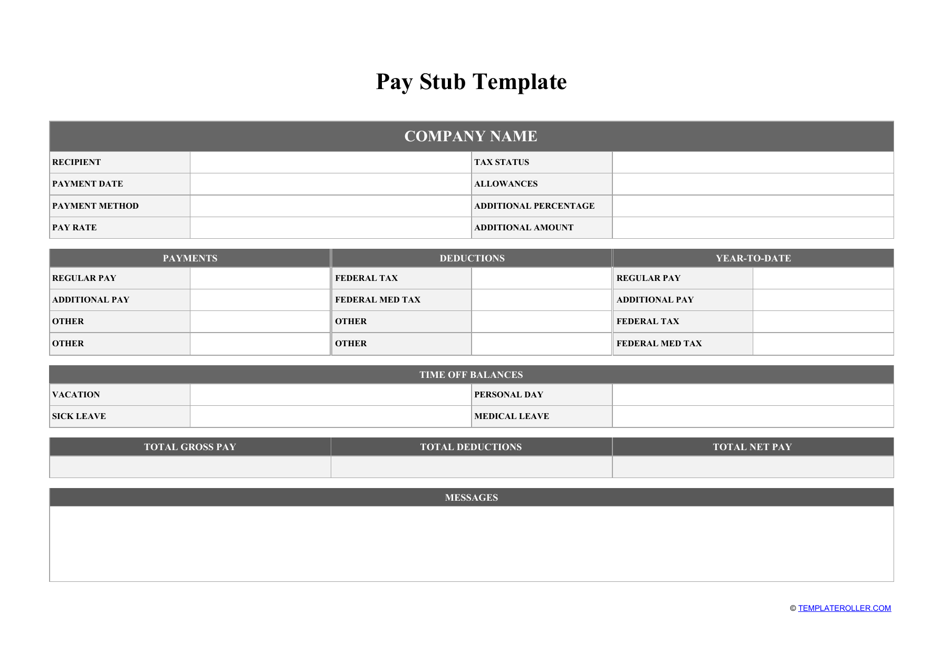

Pay Stub Template

What Is a Pay Stub?

A Pay Stub is a document that contains an official record that an employee got paid from their employer. Employees are supposed to receive the document with their salary, however, some employers provide their employees with an electronic Pay Stub that can be obtained online.

Alternate Name:

- Pay Slip.

The document can be used for many different purposes, which can include the following:

- The document can be used as evidence that the employee's salary has been paid to them in case any disputes occur.

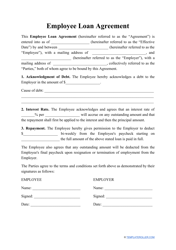

- If the employee wants to apply for a loan, the document can be used as proof of income from their employment.

- The document provides information for the employee about how much they have received, how much was deducted, withheld, tax information, etc.

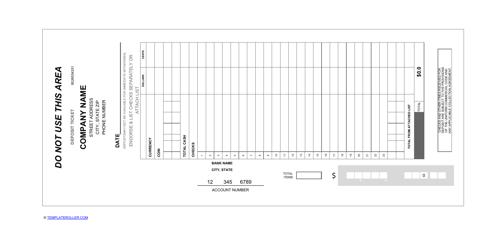

A printable Pay Stub template can be downloaded below.

How to Read a Pay Stub?

How the Pay Slip looks depends on the state where the employee is getting paid and the payroll provider the employer is using. They can be formatted differently, however, the content will be fairly similar.

To understand what kind of information the document is providing to the employee, they should look it through carefully. Generally, the document will provide the employee with financial data, such as their earnings, pre-tax deductions/contributions, employee taxes, post-tax deductions/contributions, summary, etc.

The summary is the most important part of the document for the employee since from there the employee will find all of their essential information. In this part, the employee will see their gross pay, pre-tax deductions, employee taxes, post-tax deduction, net pay. The net pay is what the employee received as their salary. The net pay can be calculated using a formula: the gross pay minus pre-tax deductions, minus employee taxes, minus post-tax deductions.

How to Make a Pay Stub?

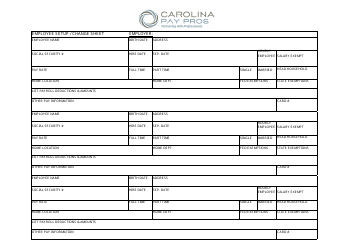

Usually, employers use a Pay Stub generator to create this document. The document should follow a certain structure and contain sections, which can include:

- Introduction . The document should start with information about the employee (their name) and their pay period;

- Employee Earnings . Here the employer should designate the employee's gross pay which is calculated from the hours that the employee has worked and their hourly rate;

- Pre-Tax Deductions or Contributions . In this part of the document, the employer must state the contributions that are being made before taxes are calculated on the Pay Stub (such as health insurance). They should designate their description, type, and the amount deducted;

- Employee Taxes Withheld . This section can include information about Federal Income Tax, Social Security, Medicare, state income tax, some local taxes, etc:

- Employer Contributions . Contributions (such as health care contributions) made by the employer are supposed to be entered in this section of the document;

- Employer Taxes . Company taxes which can include Social Security, Medicare, Federal Unemployment Tax, state income tax, should be designated here;

- Post-Tax Deductions or Contributions . These types of deductions are made after the employee's taxes were calculated and can include any garnishments if it is applicable for the employee;

- Summary . In the last part of the stub, the employer should sum up all of the information and present the final numbers in one table.

All of the data from the Pay Slip is usually presented in two numbers: for the current paycheck and over the course of the year. It can help to keep track of how much money is being put towards important things, such as healthcare and Medicare. In addition, it can help the employee to figure out their annual income tax deduction as well as other important data that can later be used for different tax forms.

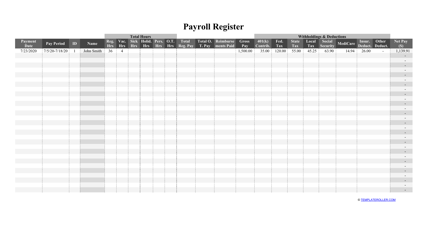

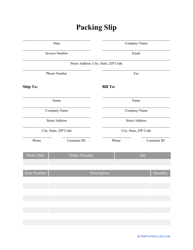

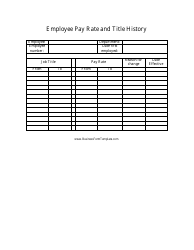

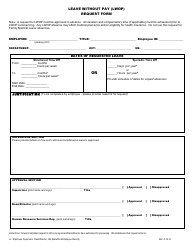

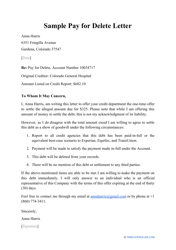

Haven't found the template you're looking for? Take a look at the related templates below: