This version of the form is not currently in use and is provided for reference only. Download this version of

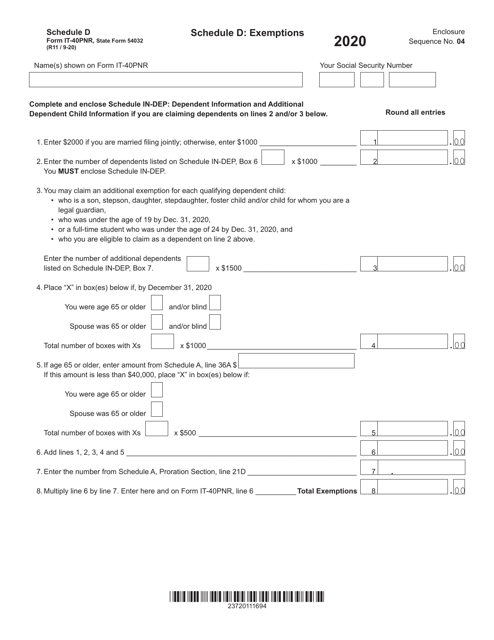

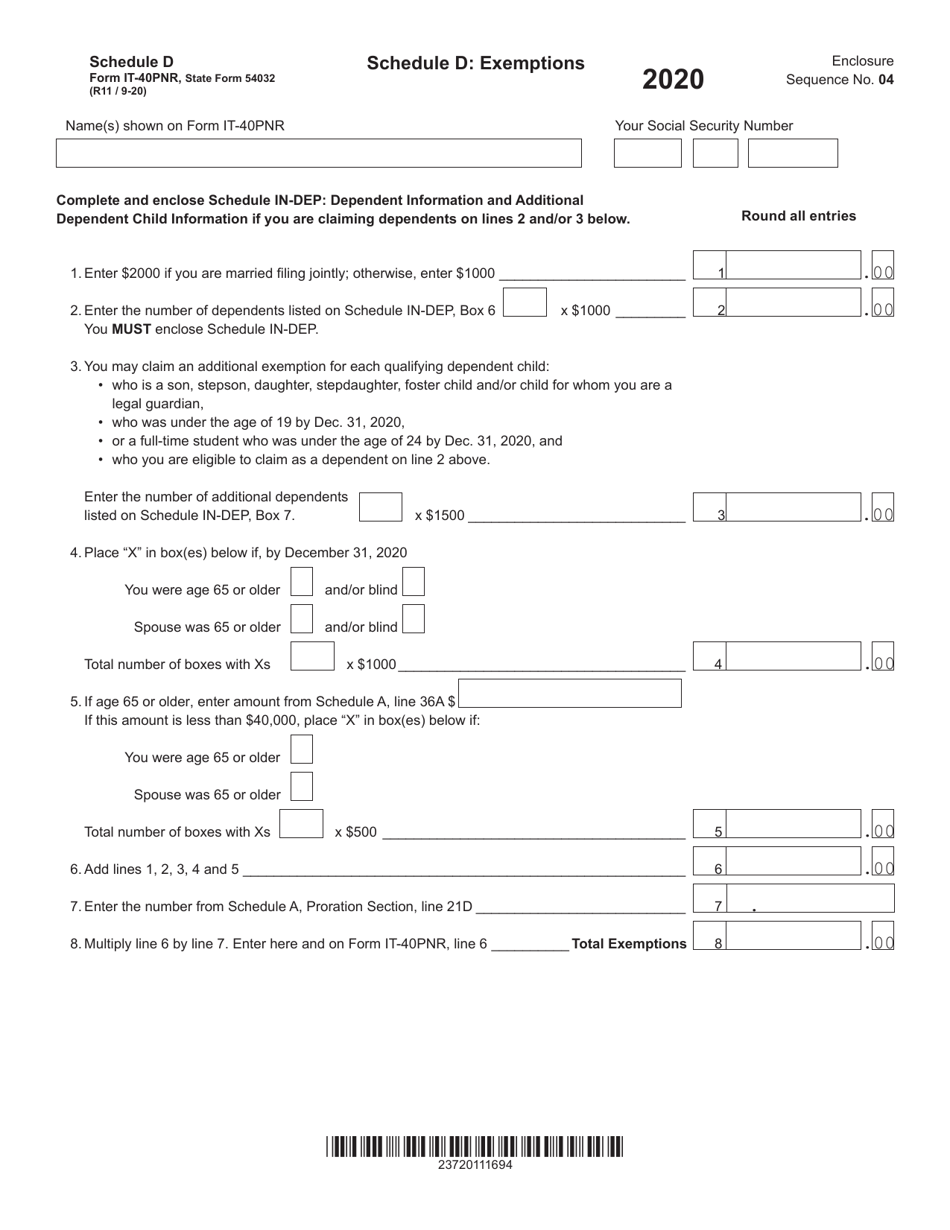

Form IT-40PNR (State Form 54032) Schedule D

for the current year.

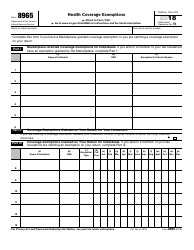

Form IT-40PNR (State Form 54032) Schedule D Exemptions - Indiana

What Is Form IT-40PNR (State Form 54032) Schedule D?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40PNR, Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40PNR?

A: Form IT-40PNR is an Indiana state tax form for Part-Year or Nonresident taxpayers.

Q: What is Schedule D?

A: Schedule D is a section of Form IT-40PNR that deals with exemptions.

Q: What are exemptions?

A: Exemptions are deductions that can reduce your taxable income.

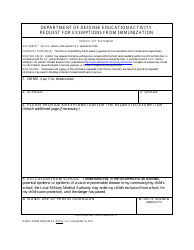

Q: Who should file Schedule D?

A: Part-Year or Nonresident taxpayers who qualify for exemptions should file Schedule D.

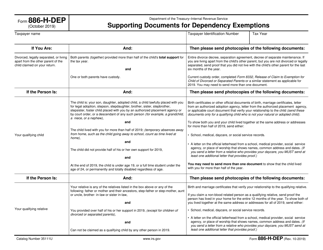

Q: What information is required on Schedule D?

A: Schedule D requires information about the taxpayer's exemptions, including the Social Security numbers of each dependent.

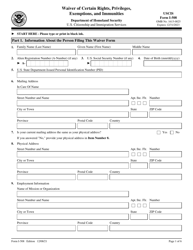

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40PNR (State Form 54032) Schedule D by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.