This version of the form is not currently in use and is provided for reference only. Download this version of

Form SC-40 (State Form 44404)

for the current year.

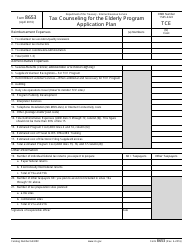

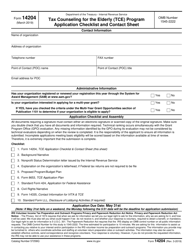

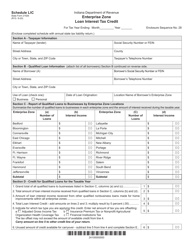

Form SC-40 (State Form 44404) Unified Tax Credit for the Elderly - Indiana

What Is Form SC-40 (State Form 44404)?

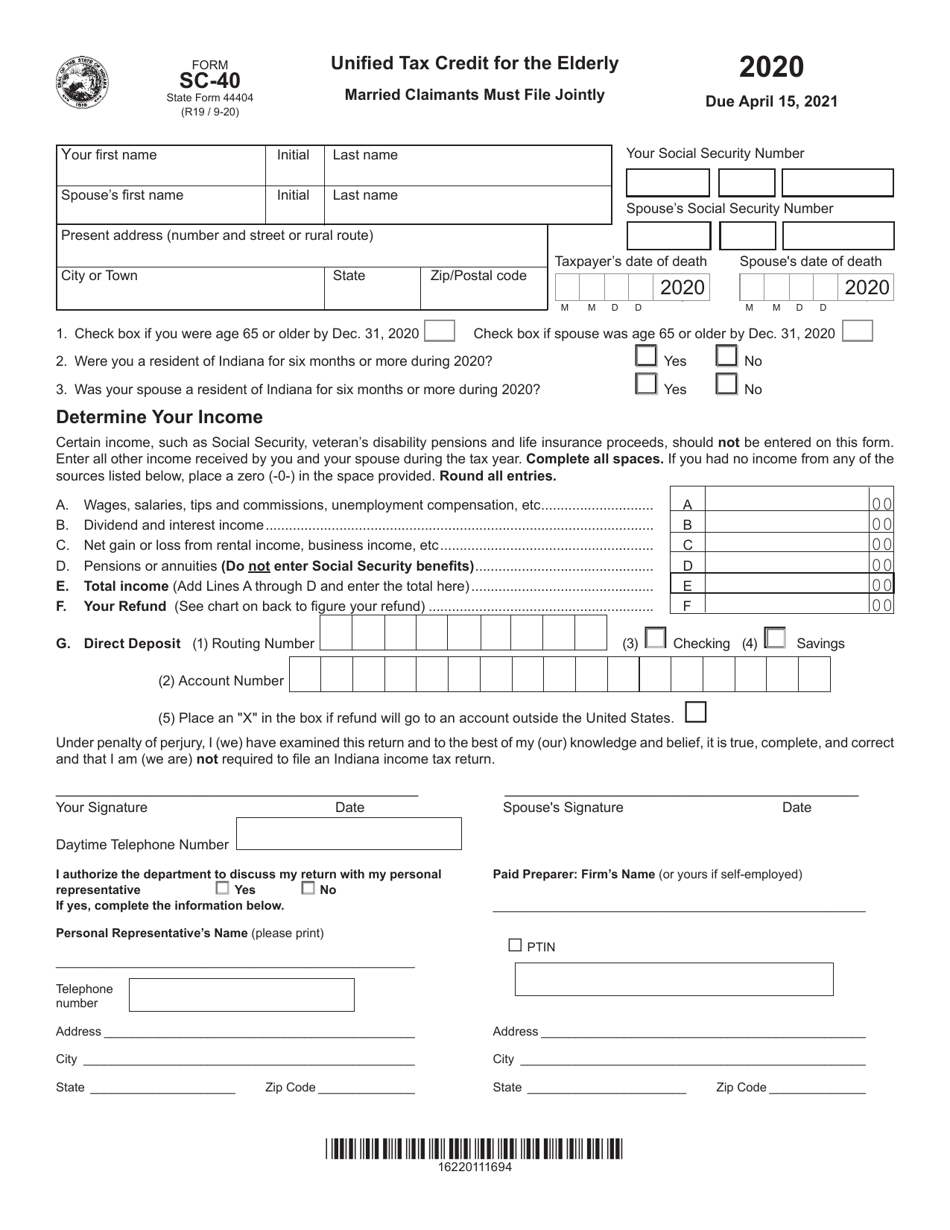

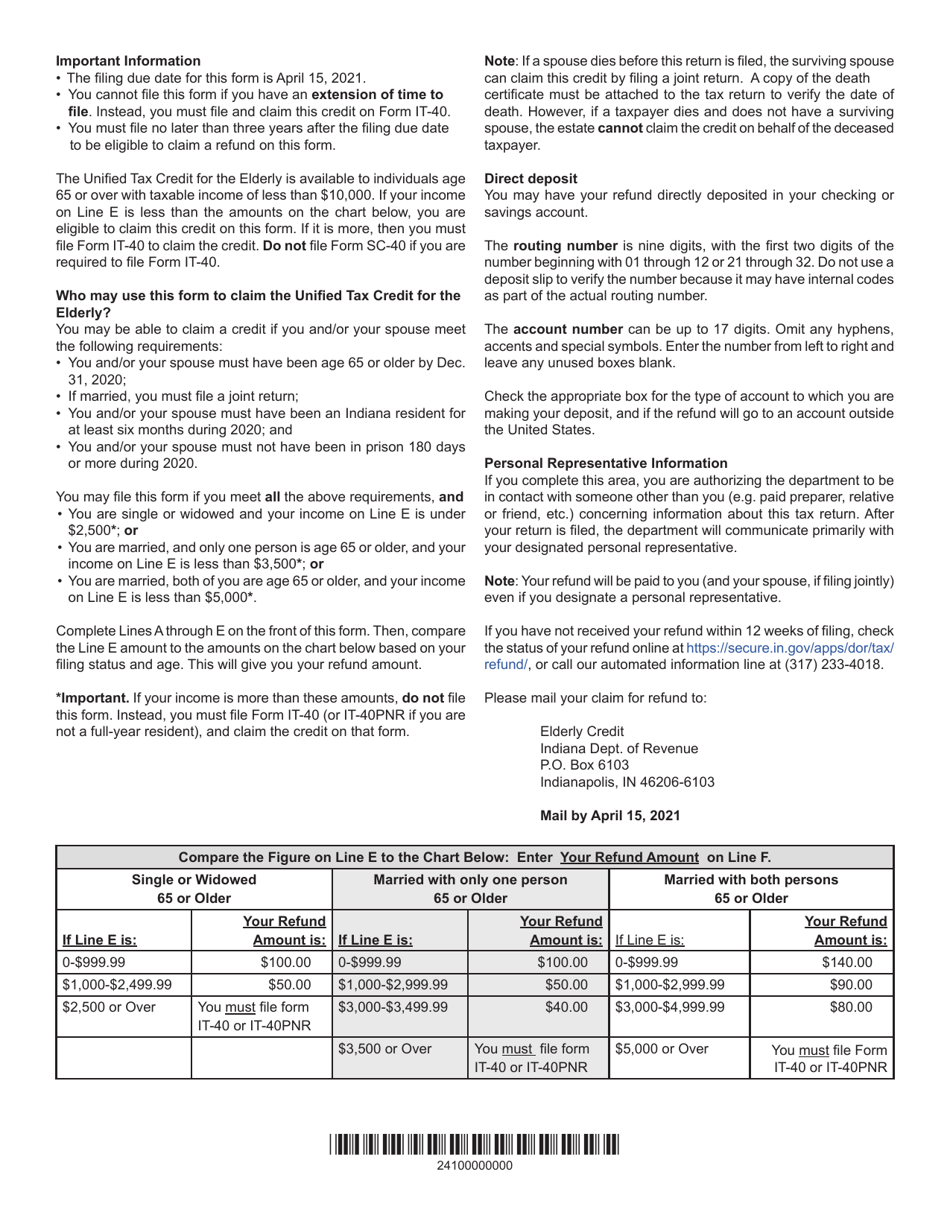

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC-40?

A: Form SC-40 is the Unified Tax Credit for the Elderly form in Indiana.

Q: What is the purpose of Form SC-40?

A: The purpose of Form SC-40 is to claim the Unified Tax Credit for the Elderly in Indiana.

Q: Who is eligible to use Form SC-40?

A: Indiana residents who are 65 years of age or older are eligible to use Form SC-40.

Q: What is the Unified Tax Credit for the Elderly?

A: The Unified Tax Credit for the Elderly is a tax credit available to qualifying older adults in Indiana.

Q: When is the deadline to file Form SC-40?

A: The deadline to file Form SC-40 in Indiana is typically April 15th, the same as the federal tax deadline.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SC-40 (State Form 44404) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.