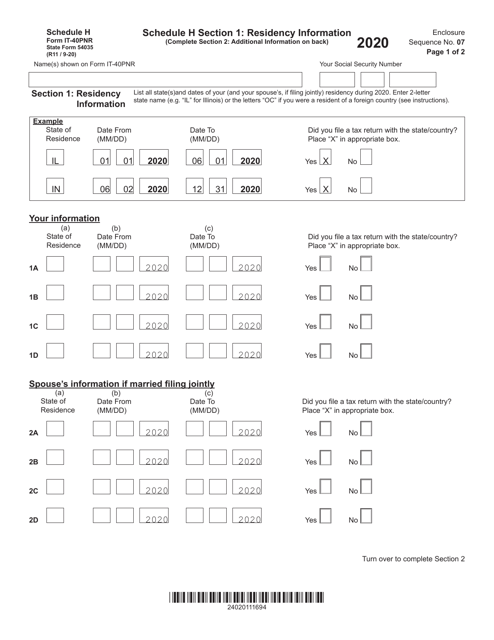

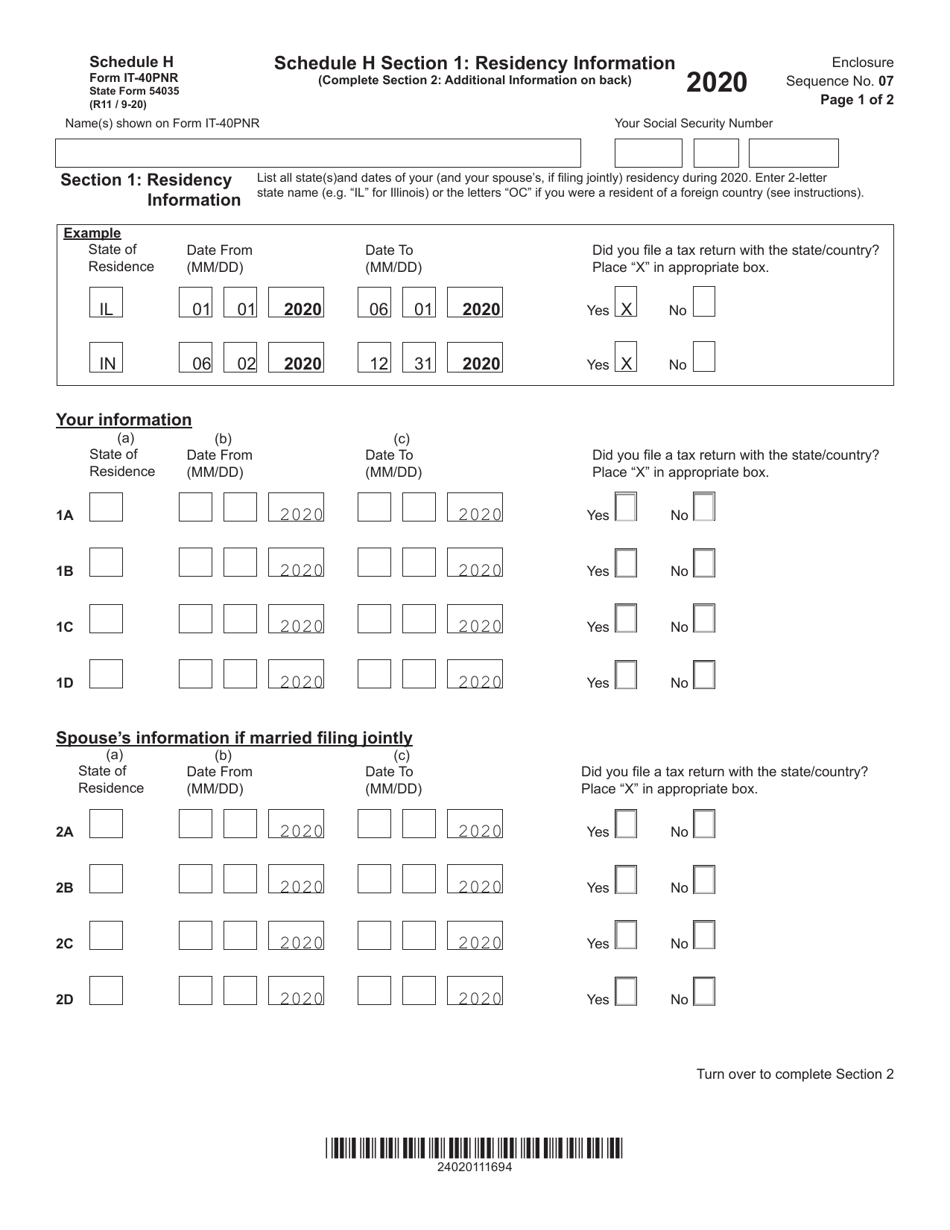

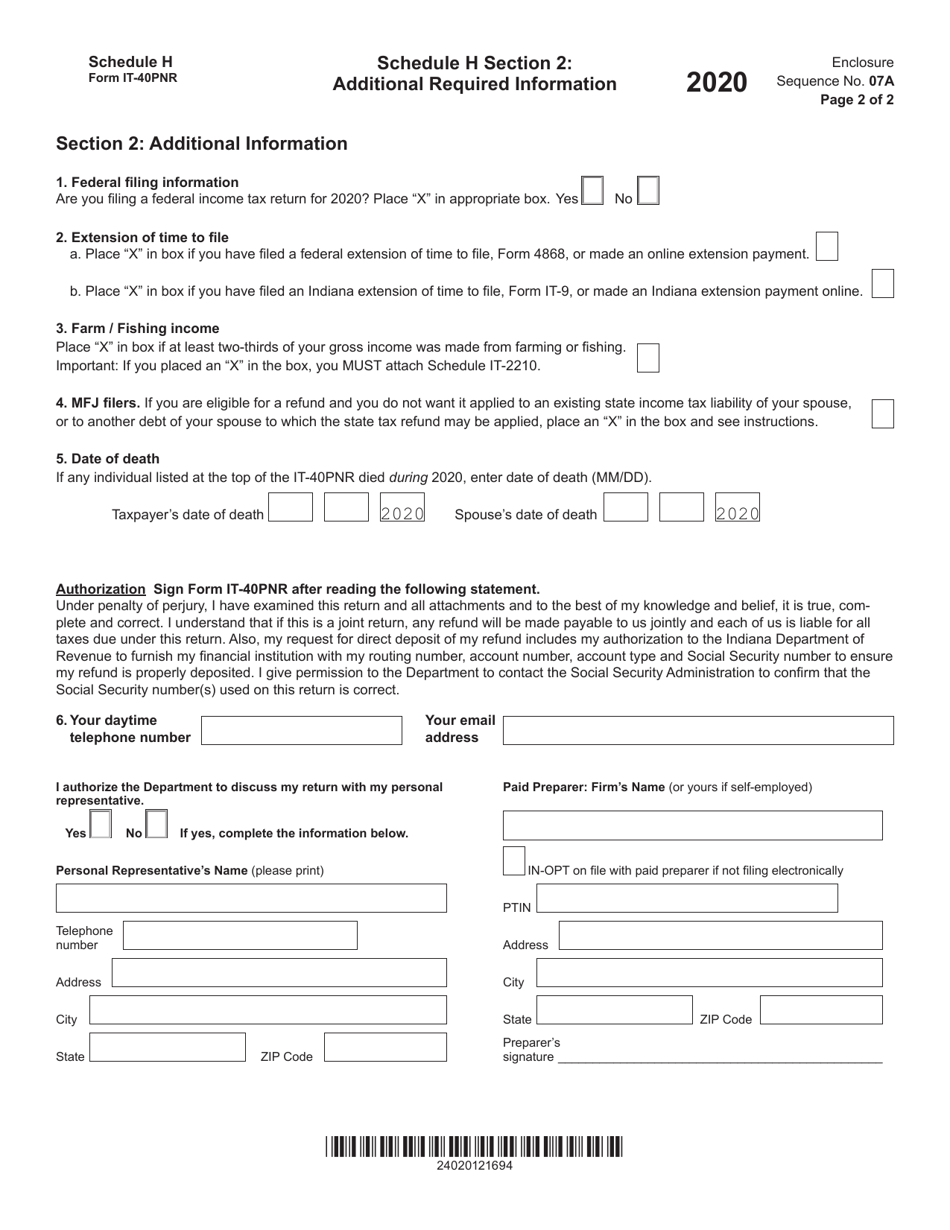

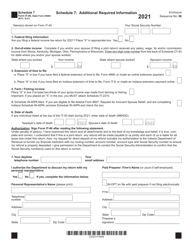

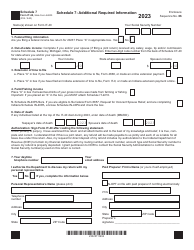

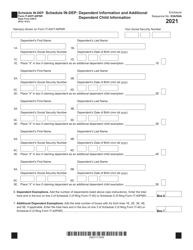

State Form 54035 (IT-40PNR) Schedule H Additional Required Information - Indiana

What Is State Form 54035 (IT-40PNR) Schedule H?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40PNR, Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 54035?

A: State Form 54035 (IT-40PNR) is a tax form used for filing income taxes in the state of Indiana.

Q: What is Schedule H?

A: Schedule H is an additional required information form that accompanies State Form 54035 (IT-40PNR) in Indiana.

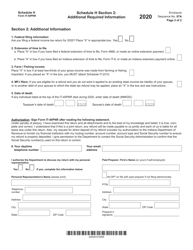

Q: What information is required on Schedule H?

A: Schedule H requires additional information related to your residency, exemptions, and deductions.

Q: When do I need to file State Form 54035 (IT-40PNR) and Schedule H?

A: You need to file these forms when filing your income taxes in Indiana.

Q: Are there any penalties for not filing State Form 54035 and Schedule H?

A: Yes, failure to file these forms or providing incorrect information may result in penalties and interest charges.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 54035 (IT-40PNR) Schedule H by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.