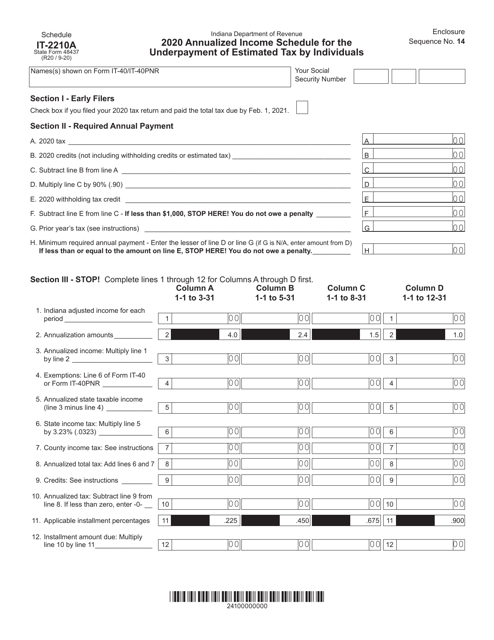

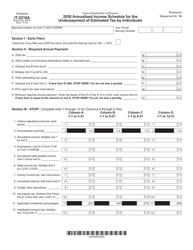

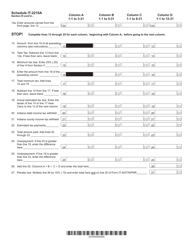

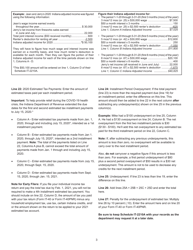

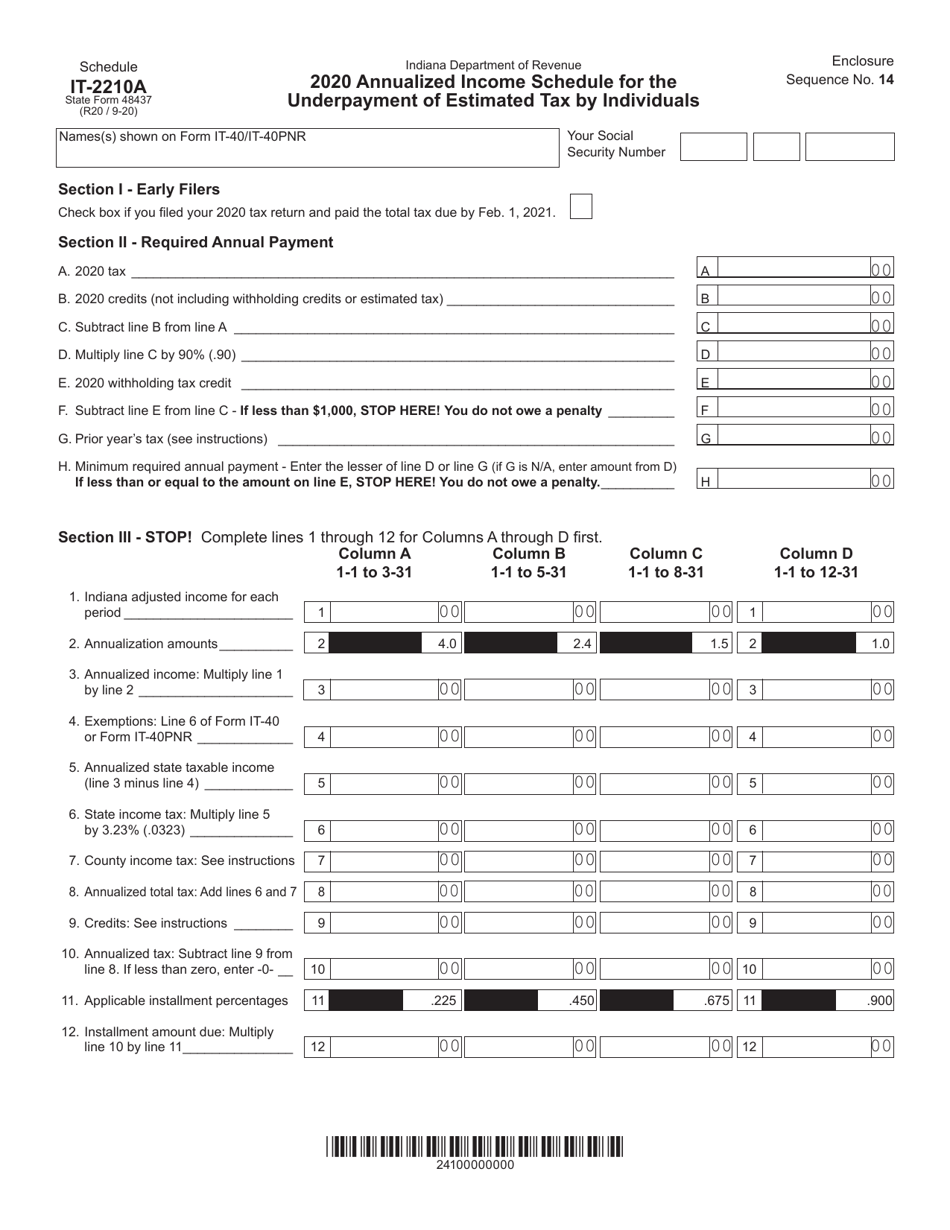

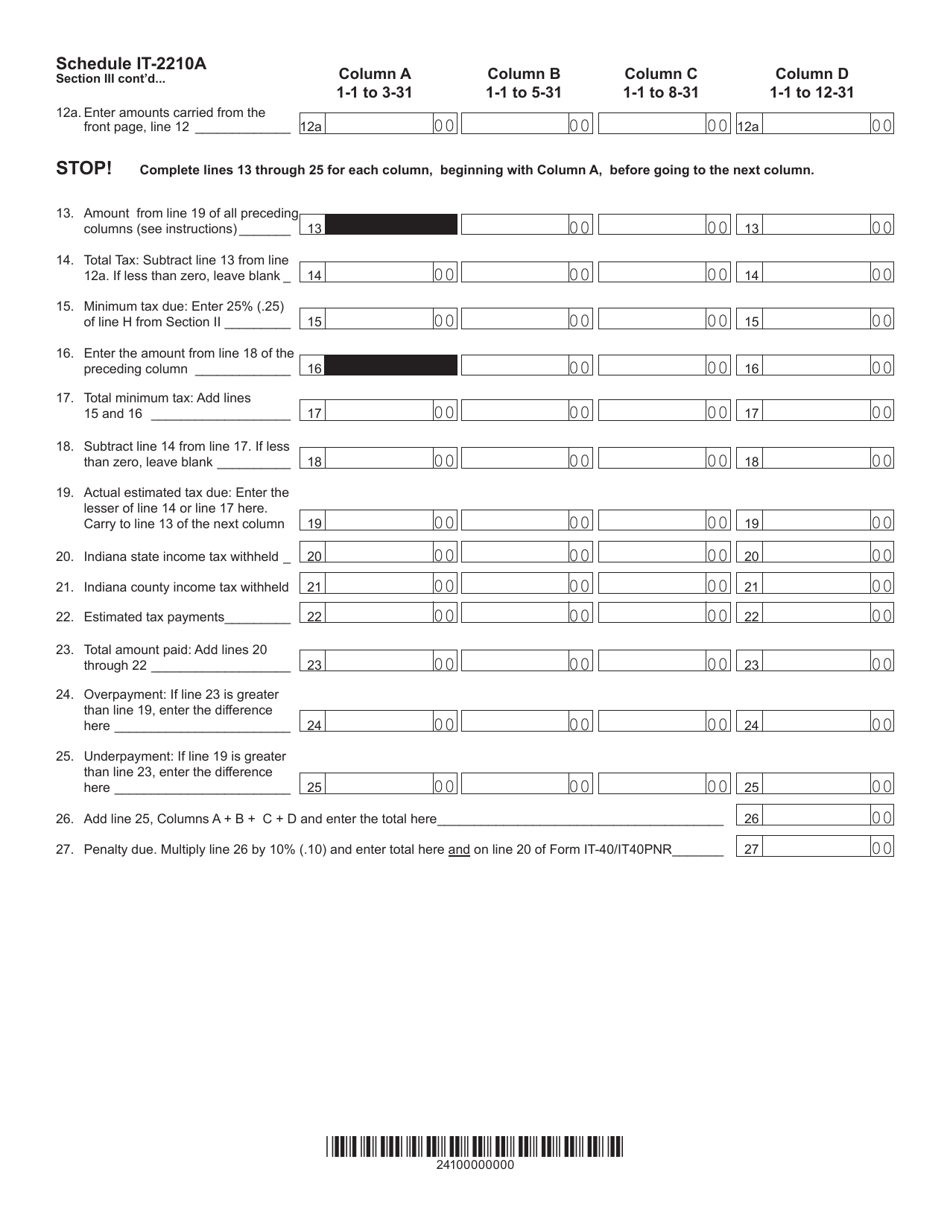

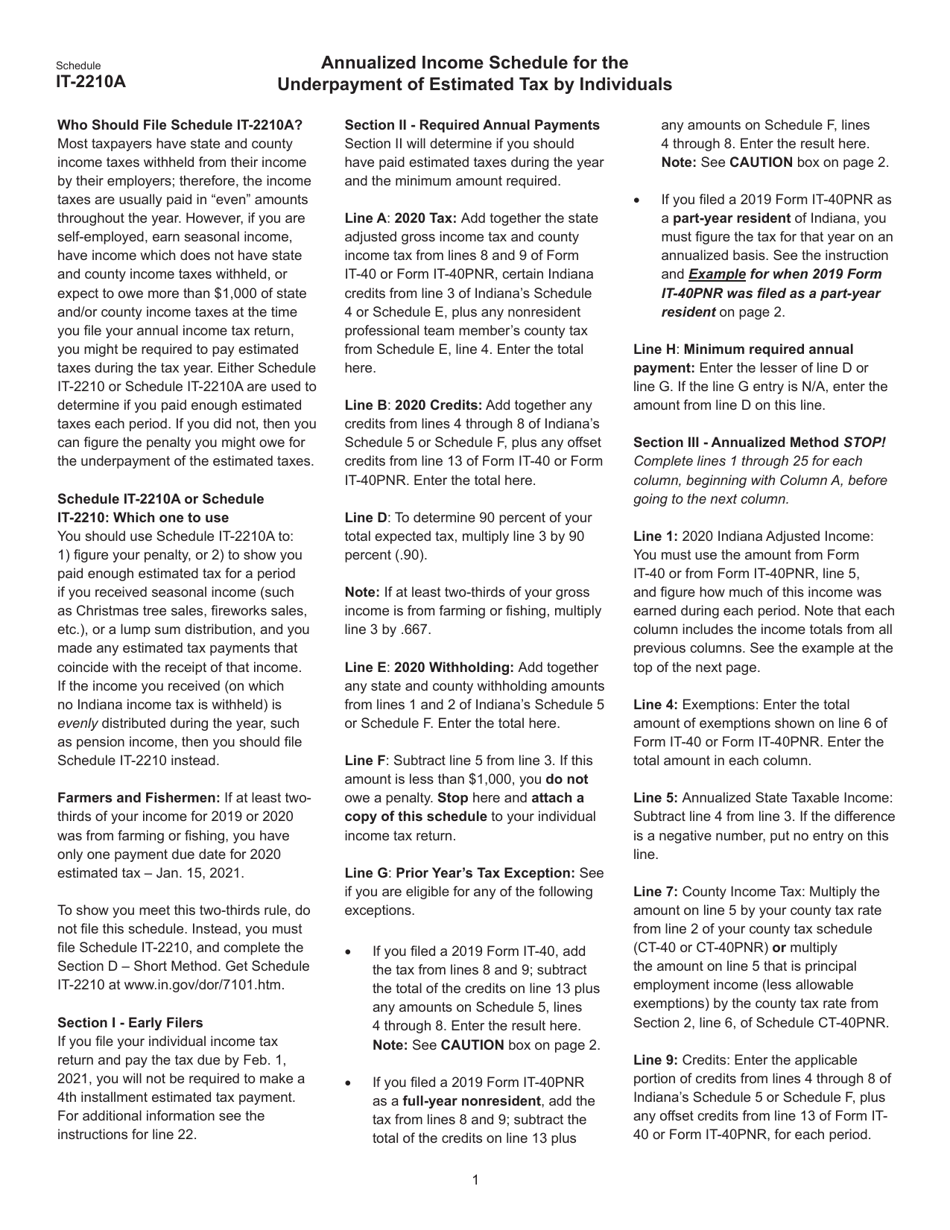

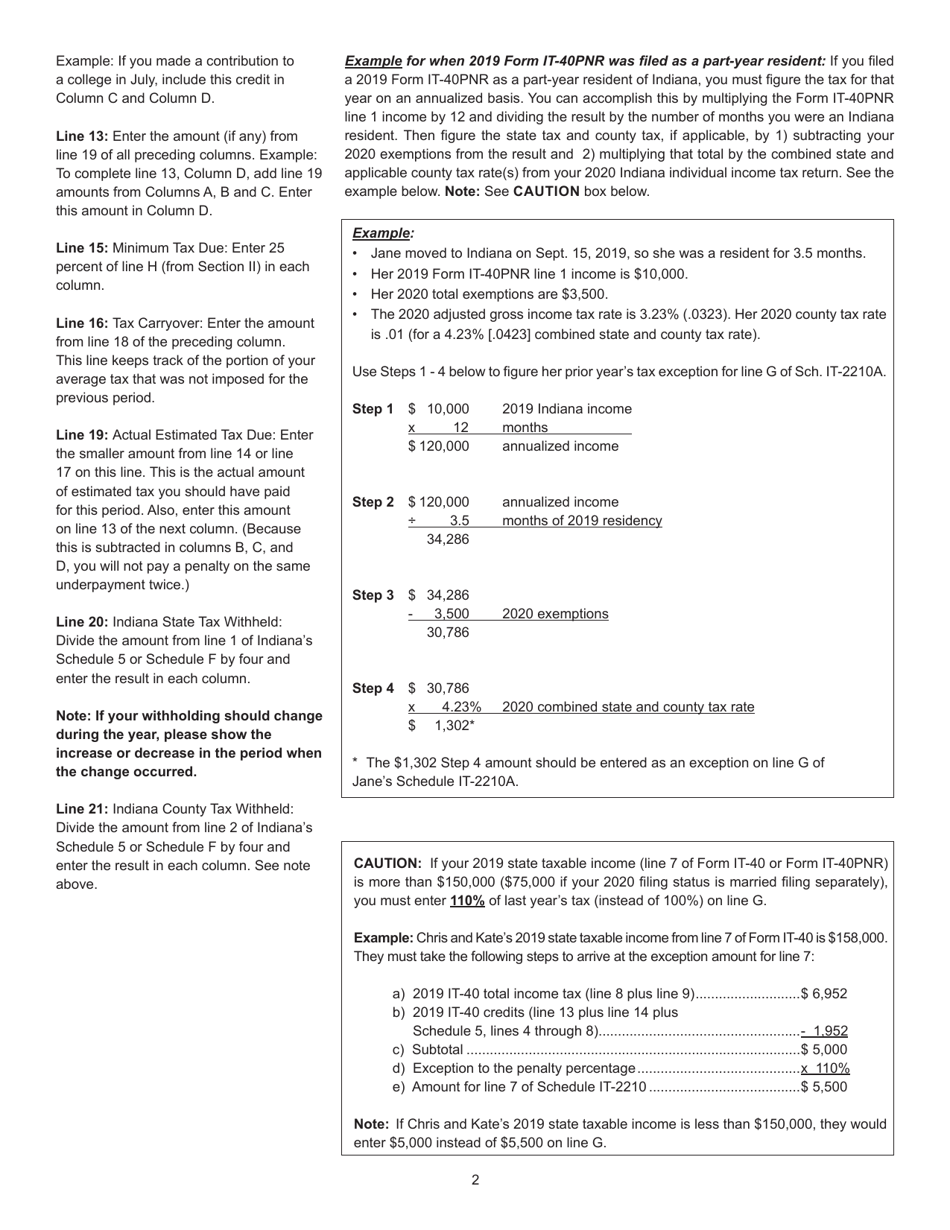

Form IT-2210A (State Form 48437) Annualized Income Schedule for the Underpayment of Estimated Tax by Individuals - Indiana

What Is Form IT-2210A (State Form 48437)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-2210A?

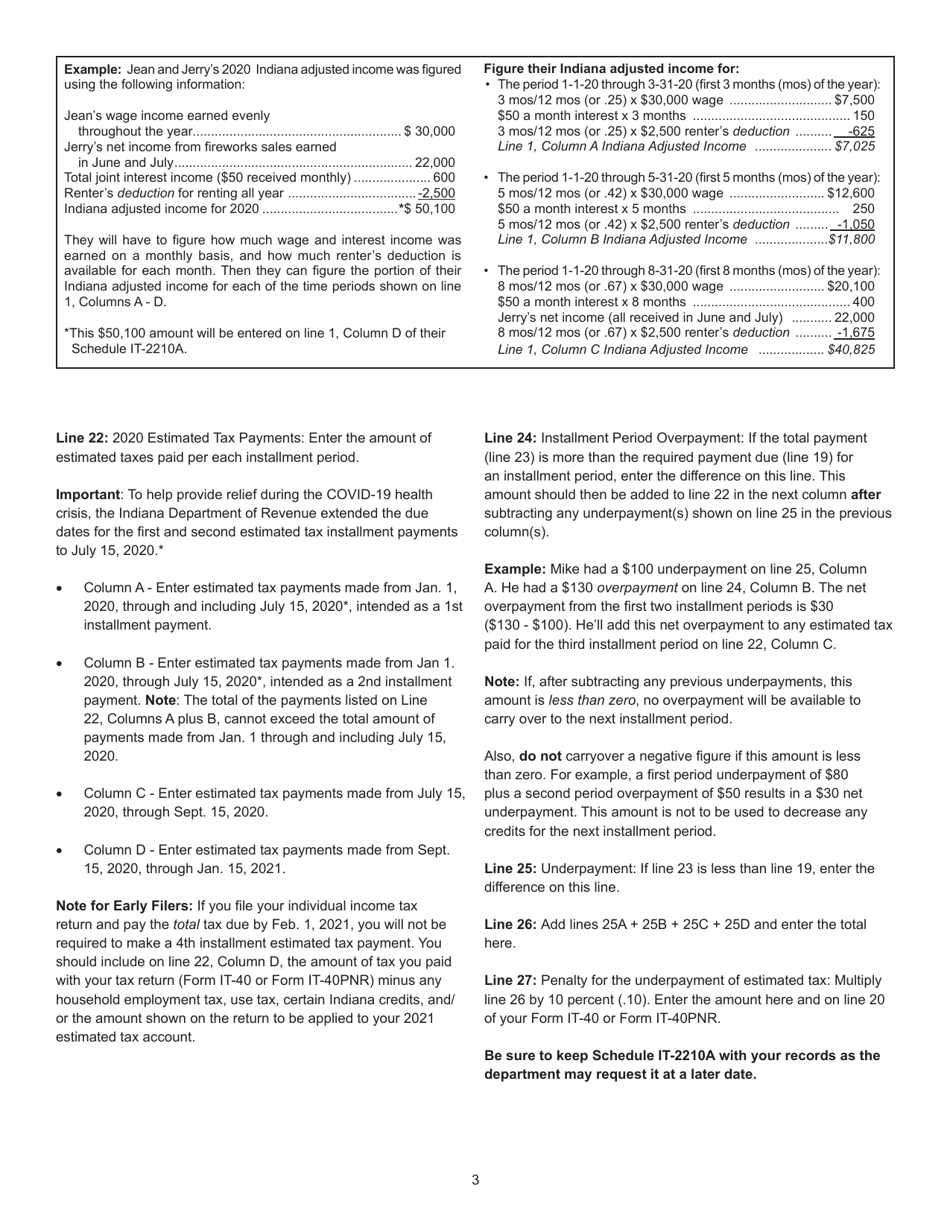

A: Form IT-2210A is the Annualized Income Schedule for the Underpayment of Estimated Tax by Individuals in Indiana.

Q: Who needs to file Form IT-2210A?

A: Individuals in Indiana who have underpaid their estimated tax throughout the year may need to file Form IT-2210A.

Q: What is the purpose of Form IT-2210A?

A: The purpose of Form IT-2210A is to calculate and report the underpayment of estimated tax by individuals in Indiana.

Q: How do I use Form IT-2210A?

A: You will need to fill out the form based on your income and estimated tax payments made throughout the year.

Q: When is Form IT-2210A due?

A: Form IT-2210A is typically due on the same date as your Indiana state tax return, which is usually April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: What happens if I don't file Form IT-2210A?

A: If you are required to file Form IT-2210A and fail to do so, you may face penalties for underpayment of estimated tax.

Q: Can I e-file Form IT-2210A?

A: Yes, Indiana allows for the electronic filing of Form IT-2210A.

Q: Do I need to include Form IT-2210A with my federal tax return?

A: No, Form IT-2210A is specific to Indiana state taxes and should not be included with your federal tax return.

Q: Is there a fee to file Form IT-2210A?

A: There is no fee to file Form IT-2210A with the Indiana Department of Revenue.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2210A (State Form 48437) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.