This version of the form is not currently in use and is provided for reference only. Download this version of

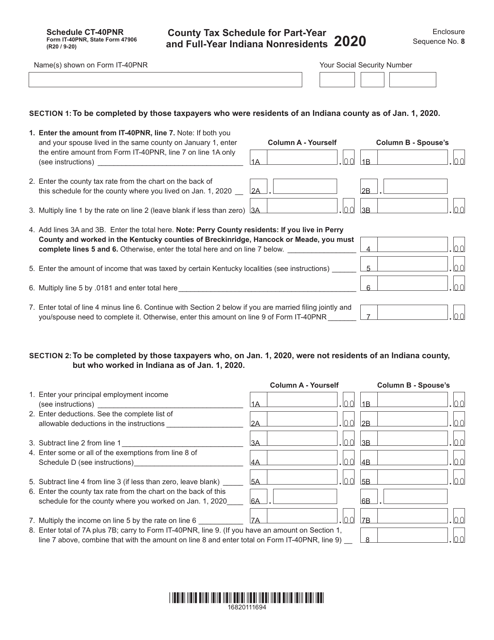

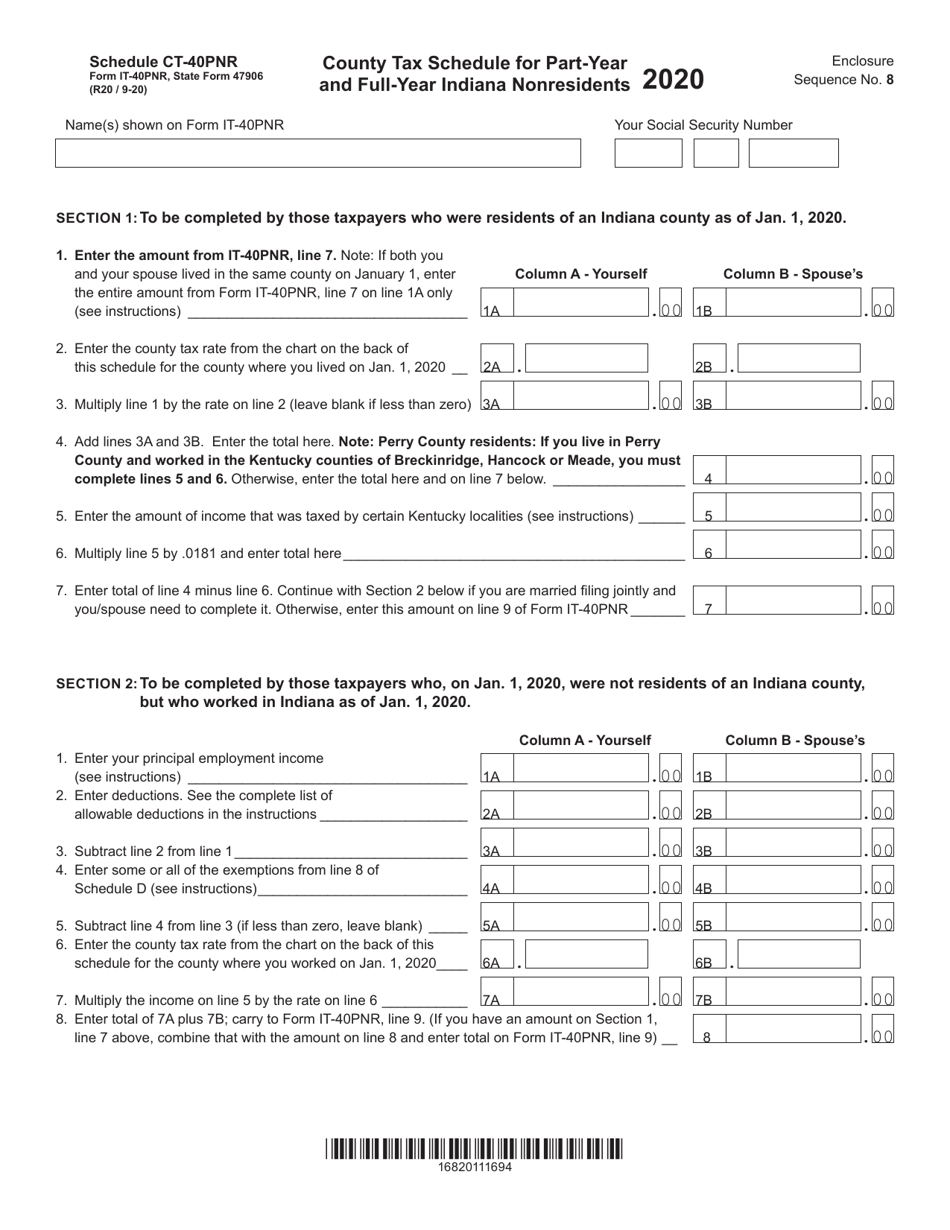

Form IT-40PNR (State Form 47906) Schedule CT-40PNR

for the current year.

Form IT-40PNR (State Form 47906) Schedule CT-40PNR County Tax Schedule for Part-Year and Full-Year Indiana Nonresidents - Indiana

What Is Form IT-40PNR (State Form 47906) Schedule CT-40PNR?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40PNR, Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40PNR?

A: Form IT-40PNR is the Indiana state tax form for Part-Year and Full-Year Indiana Nonresidents.

Q: What is Schedule CT-40PNR?

A: Schedule CT-40PNR is the County Tax Schedule for Part-Year and Full-Year Indiana Nonresidents.

Q: Who should use Form IT-40PNR?

A: Form IT-40PNR is used by individuals who were nonresidents of Indiana for part or all of the tax year.

Q: What is the purpose of Schedule CT-40PNR?

A: The purpose of Schedule CT-40PNR is to calculate county income tax for Part-Year and Full-Year Indiana Nonresidents.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40PNR (State Form 47906) Schedule CT-40PNR by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.