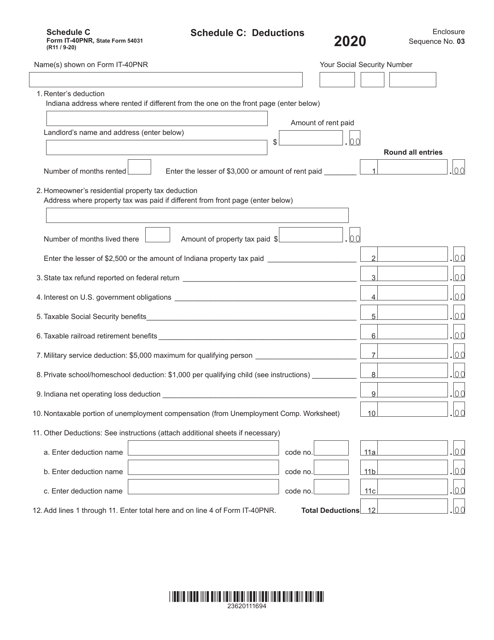

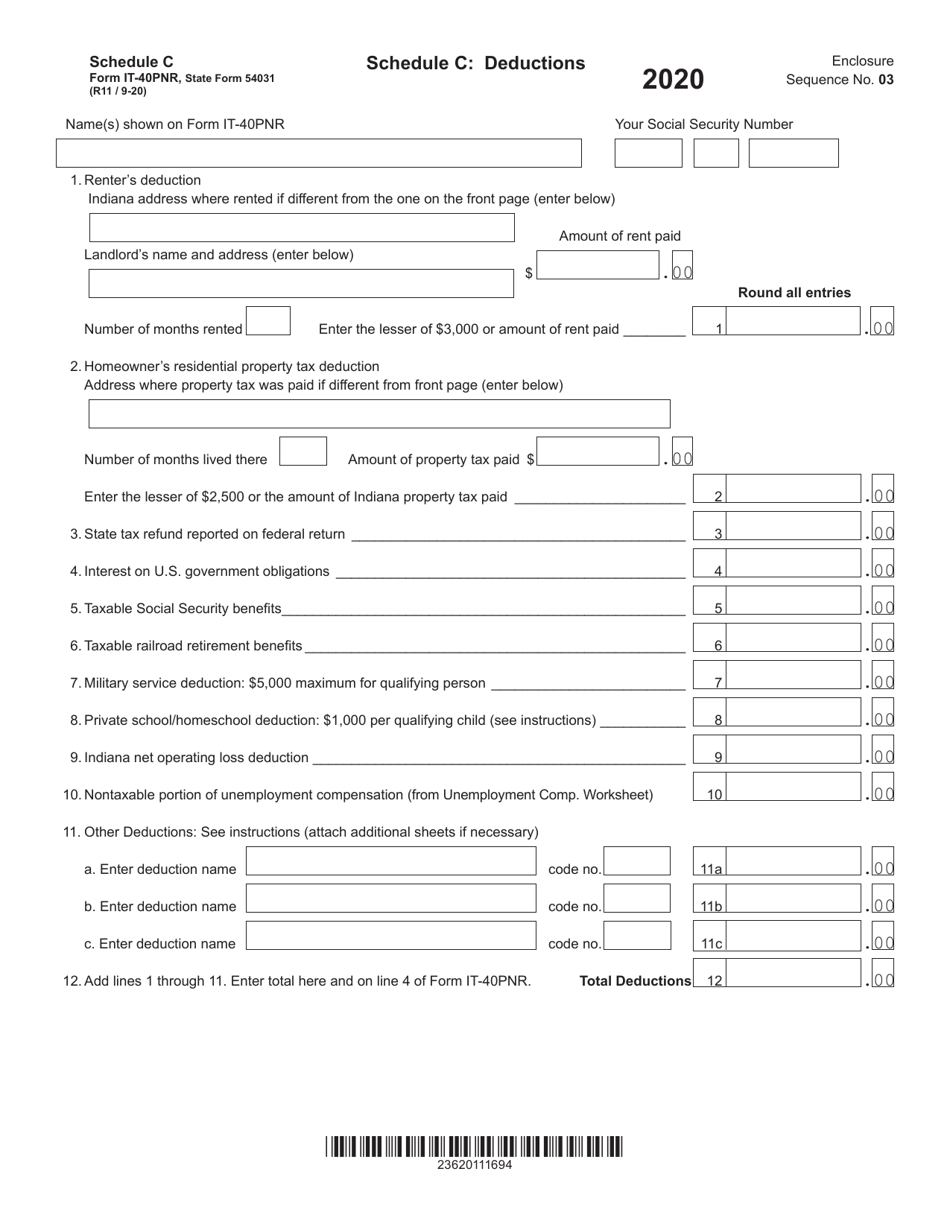

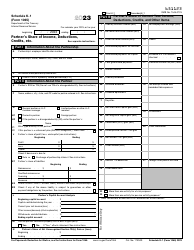

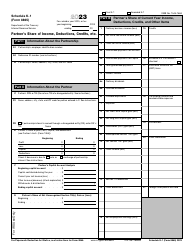

State Form 54031 (IT-40PNR) Schedule C Deductions - Indiana

What Is State Form 54031 (IT-40PNR) Schedule C?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40PNR, Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54031 (IT-40PNR) Schedule C Deductions?

A: Form 54031 (IT-40PNR) Schedule C Deductions is a specific schedule for claiming deductions related to business income and expenses on your Indiana state tax return.

Q: What is the purpose of the Schedule C Deductions?

A: The Schedule C Deductions is used to report deductions related to self-employment income or business income reported on your Indiana state tax return.

Q: Who needs to file the Schedule C Deductions?

A: You need to file the Schedule C Deductions if you have self-employment income or business income to report on your Indiana state tax return.

Q: What kind of deductions can be claimed on the Schedule C Deductions?

A: You can claim deductions related to your business expenses, such as office supplies, travel expenses, advertising costs, and more.

Q: Do I need to include supporting documents for the deductions claimed on the Schedule C Deductions?

A: You should keep supporting documents, such as receipts and invoices, in case of an audit. However, you do not need to submit them with your tax return.

Q: When is the deadline to file Form 54031 (IT-40PNR) Schedule C Deductions?

A: The deadline to file Form 54031 (IT-40PNR) Schedule C Deductions is the same as your Indiana state tax return deadline, which is usually April 15th.

Q: Can I e-file Form 54031 (IT-40PNR) Schedule C Deductions?

A: Yes, you can e-file Form 54031 (IT-40PNR) Schedule C Deductions if you are filing your Indiana state tax return electronically.

Q: Is there a separate Form for federal Schedule C deductions?

A: Yes, the federal Schedule C deductions are reported on Form 1040, Schedule C. The Indiana Schedule C Deductions is specifically for reporting deductions on your state tax return.

Q: I am not sure if I need to file the Schedule C Deductions. What should I do?

A: If you are unsure whether or not you need to file the Schedule C Deductions, it is recommended to consult with a tax professional or contact the Indiana Department of Revenue for guidance.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 54031 (IT-40PNR) Schedule C by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.