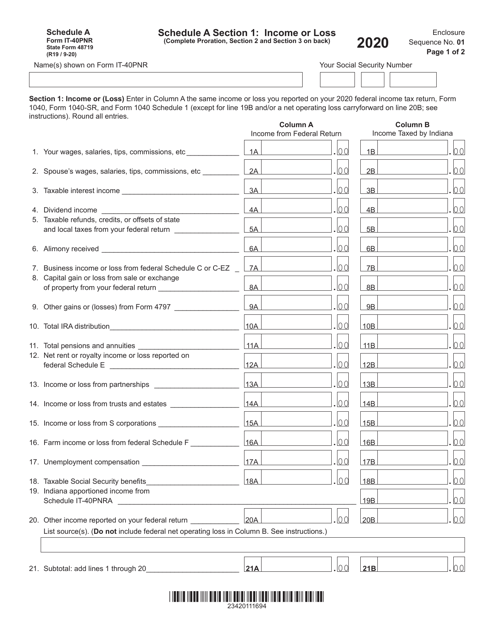

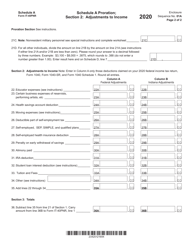

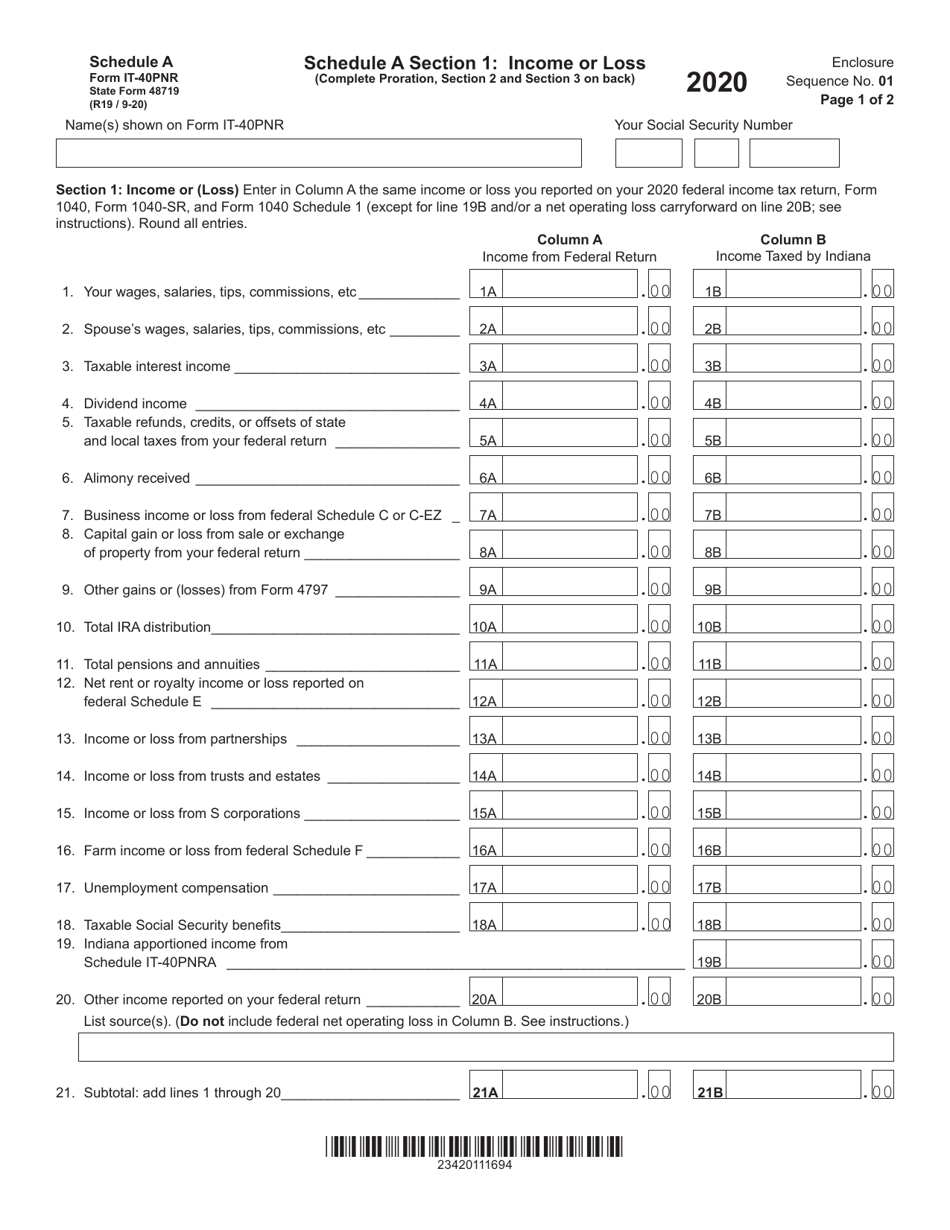

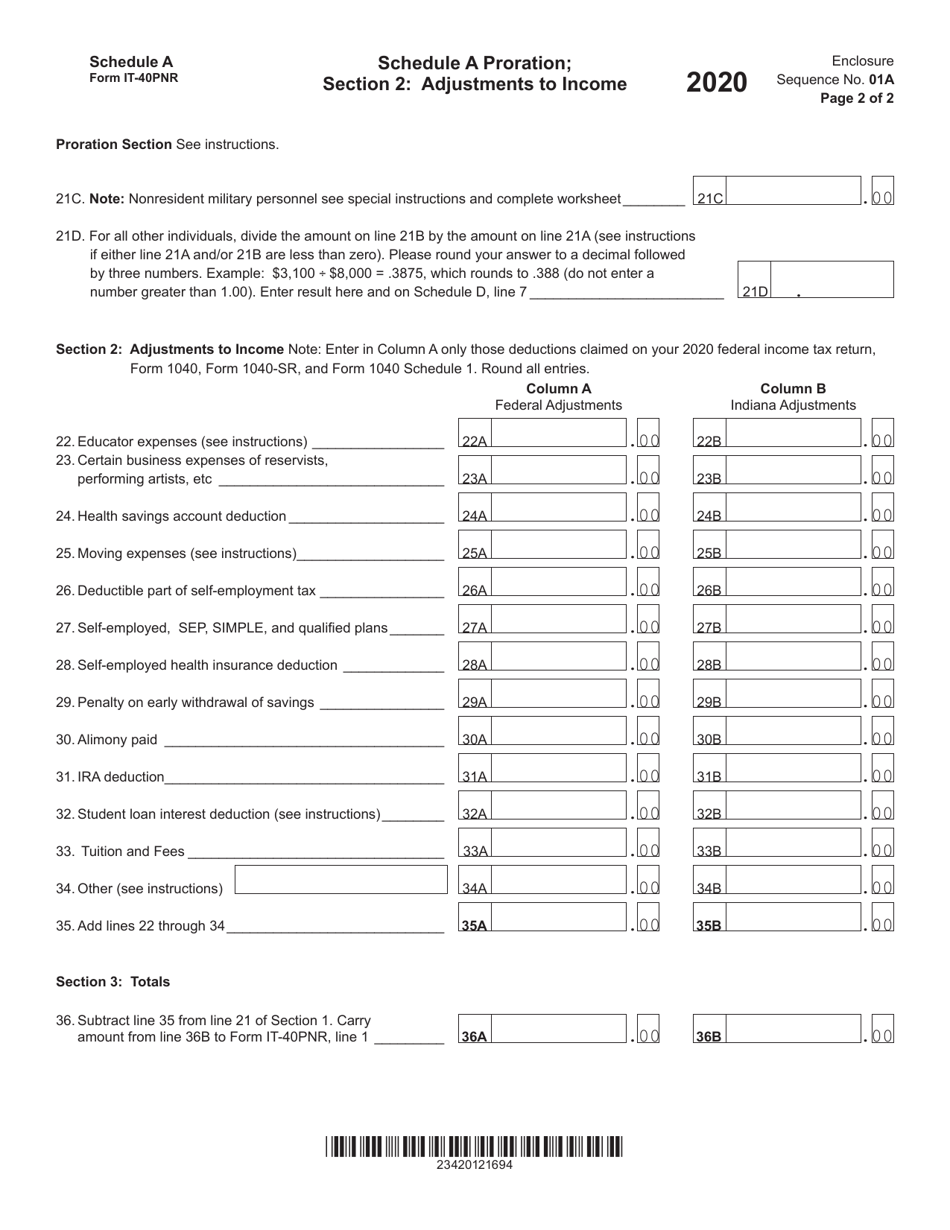

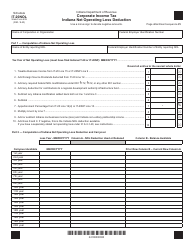

State Form 48719 (IT-40PNR) Schedule A Income / Loss, Proration & Adjustments to Income - Indiana

What Is State Form 48719 (IT-40PNR) Schedule A?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40PNR, Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 48719?

A: State Form 48719 is the form used in Indiana for Schedule A Income/Loss, Proration & Adjustments to Income for resident individuals.

Q: What is IT-40PNR?

A: IT-40PNR is the specific form number used for the Indiana individual tax return for nonresidents and part-year residents.

Q: What is Schedule A?

A: Schedule A is a section of the IT-40PNR form that is used to report income or loss, proration, and adjustments to income for Indiana residents.

Q: Who can use State Form 48719?

A: State Form 48719 can be used by Indiana resident individuals who need to report income or loss, proration, and adjustments to income on their tax return.

Q: What should be included in Schedule A?

A: Schedule A should include all relevant information regarding income or loss, proration, and adjustments to income for Indiana residents.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 48719 (IT-40PNR) Schedule A by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.