This version of the form is not currently in use and is provided for reference only. Download this version of

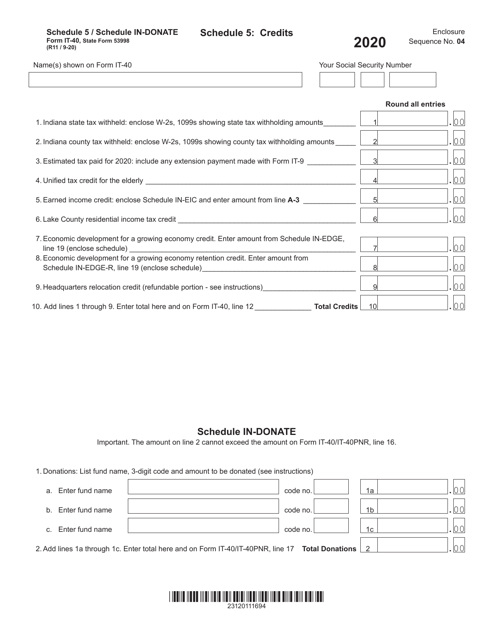

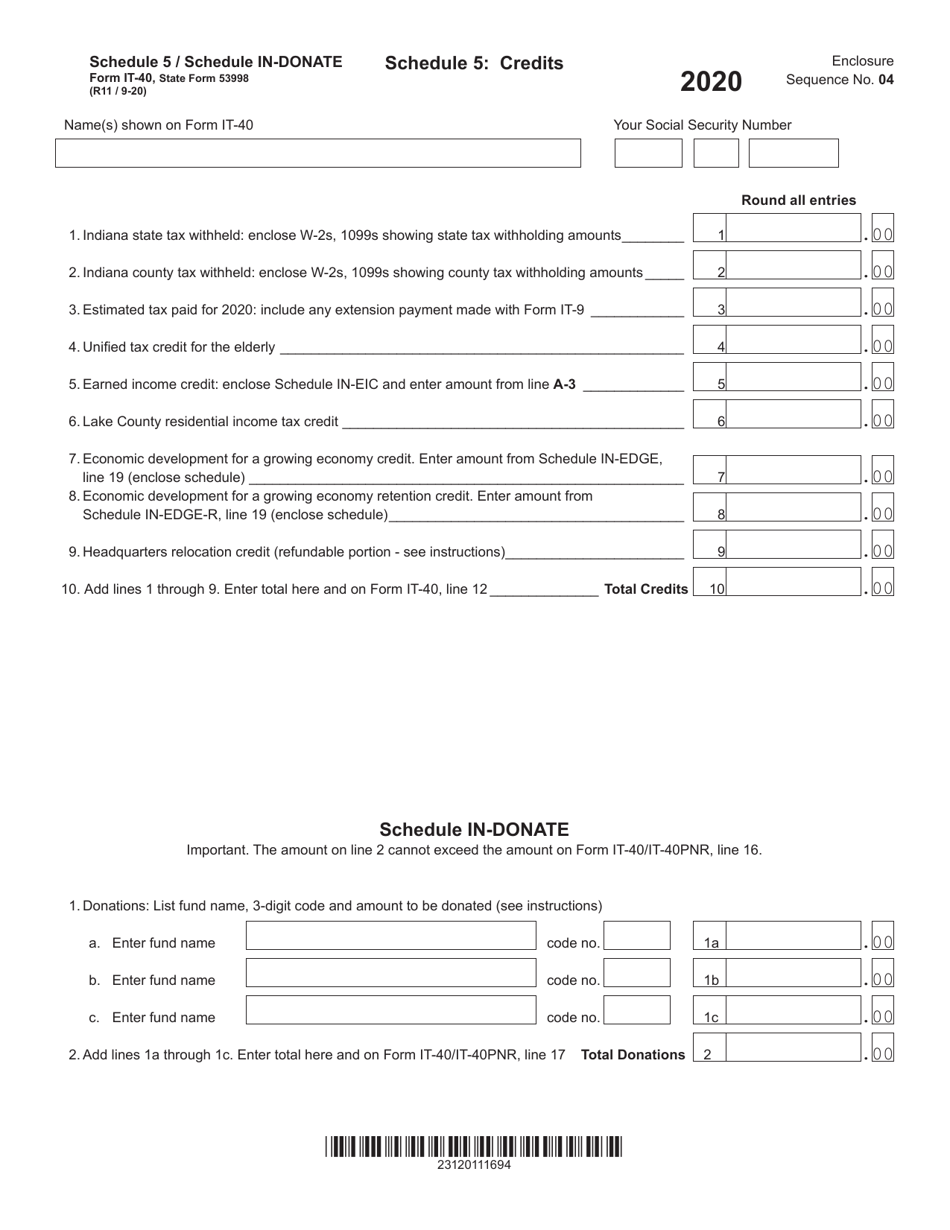

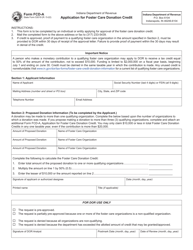

Form IT-40 (State Form 53998) Schedule 5, IN-DONATE

for the current year.

Form IT-40 (State Form 53998) Schedule 5, IN-DONATE Credits / Donations - Indiana

What Is Form IT-40 (State Form 53998) Schedule 5, IN-DONATE?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40, Indiana Full-Year Resident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is a tax form used by Indiana residents to report their income and calculate their state income tax.

Q: What is Schedule 5?

A: Schedule 5 is a part of Form IT-40 that is used to report credits and donations.

Q: What is IN-DONATE credit?

A: IN-DONATE credit is a tax credit available to Indiana taxpayers who make qualified donations to eligible nonprofits.

Q: What can I deduct on Schedule 5?

A: You can deduct eligible donations made to qualifying charitable organizations, foster care expenses, or organ donation expenses on Schedule 5.

Q: How do I claim the IN-DONATE credit?

A: To claim the IN-DONATE credit, you need to complete Schedule 5, provide information about your qualifying donations, and calculate the credit amount.

Q: What is the purpose of Schedule 5?

A: The purpose of Schedule 5 is to help Indiana residents report and claim credits and deductions related to charitable donations and other eligible expenses.

Q: Is the IN-DONATE credit refundable?

A: No, the IN-DONATE credit is nonrefundable, which means it can only be used to reduce your Indiana state tax liability.

Q: What documentation do I need to support my donations?

A: You should keep records of your donations, such as receipts or acknowledgement letters from the charitable organizations, to support your deductions and credits.

Q: Can I claim the IN-DONATE credit if I itemize deductions?

A: No, the IN-DONATE credit is not available if you choose to itemize deductions on your federal tax return. It is only available to Indiana taxpayers who claim the standard deduction.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (State Form 53998) Schedule 5, IN-DONATE by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.