This version of the form is not currently in use and is provided for reference only. Download this version of

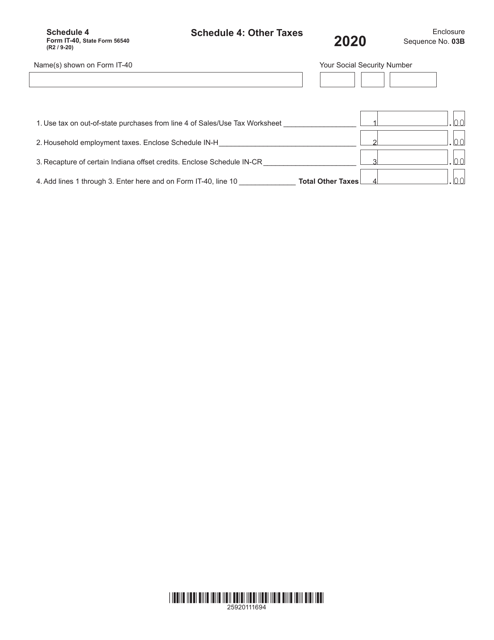

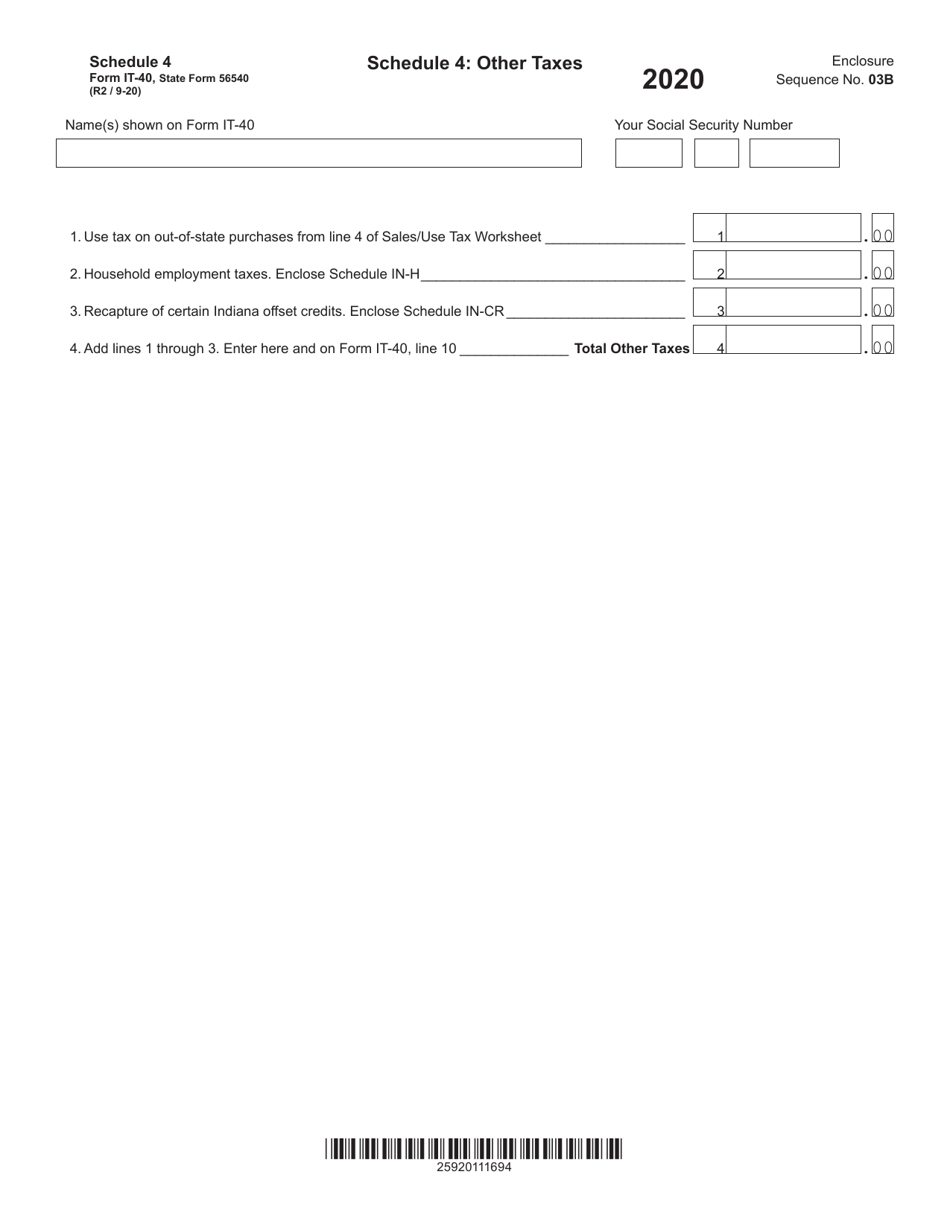

Form IT-40 (State Form 56540) Schedule 4

for the current year.

Form IT-40 (State Form 56540) Schedule 4 Other Taxes - Indiana

What Is Form IT-40 (State Form 56540) Schedule 4?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40, Indiana Full-Year Resident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is the Indiana individual income tax return form.

Q: What is Schedule 4?

A: Schedule 4 is a section of Form IT-40 that is used to report other taxes owed by the taxpayer.

Q: What are considered other taxes for Schedule 4?

A: Other taxes for Schedule 4 may include county innkeeper's tax, Indiana alcohol tax, county option income tax, and more.

Q: How do I fill out Schedule 4?

A: To fill out Schedule 4, you need to provide the required information for each specific tax being reported, including the amount owed.

Q: When is the deadline to file Form IT-40?

A: The deadline to file Form IT-40 is usually on or around April 15th, unless an extension has been granted.

Q: Do I need to file Schedule 4?

A: You need to file Schedule 4 only if you have other taxes to report that are not included in other sections of Form IT-40.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (State Form 56540) Schedule 4 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.