This version of the form is not currently in use and is provided for reference only. Download this version of

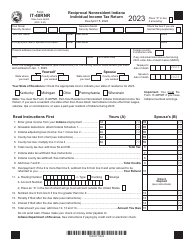

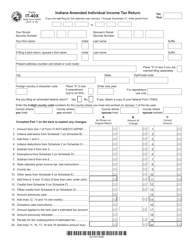

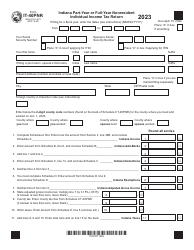

Form IT-40 (State Form 154)

for the current year.

Form IT-40 (State Form 154) Indiana Full-Year Resident Individual Income Tax Return - Indiana

What Is Form IT-40 (State Form 154)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

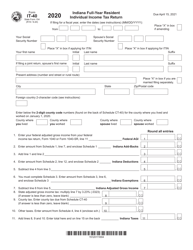

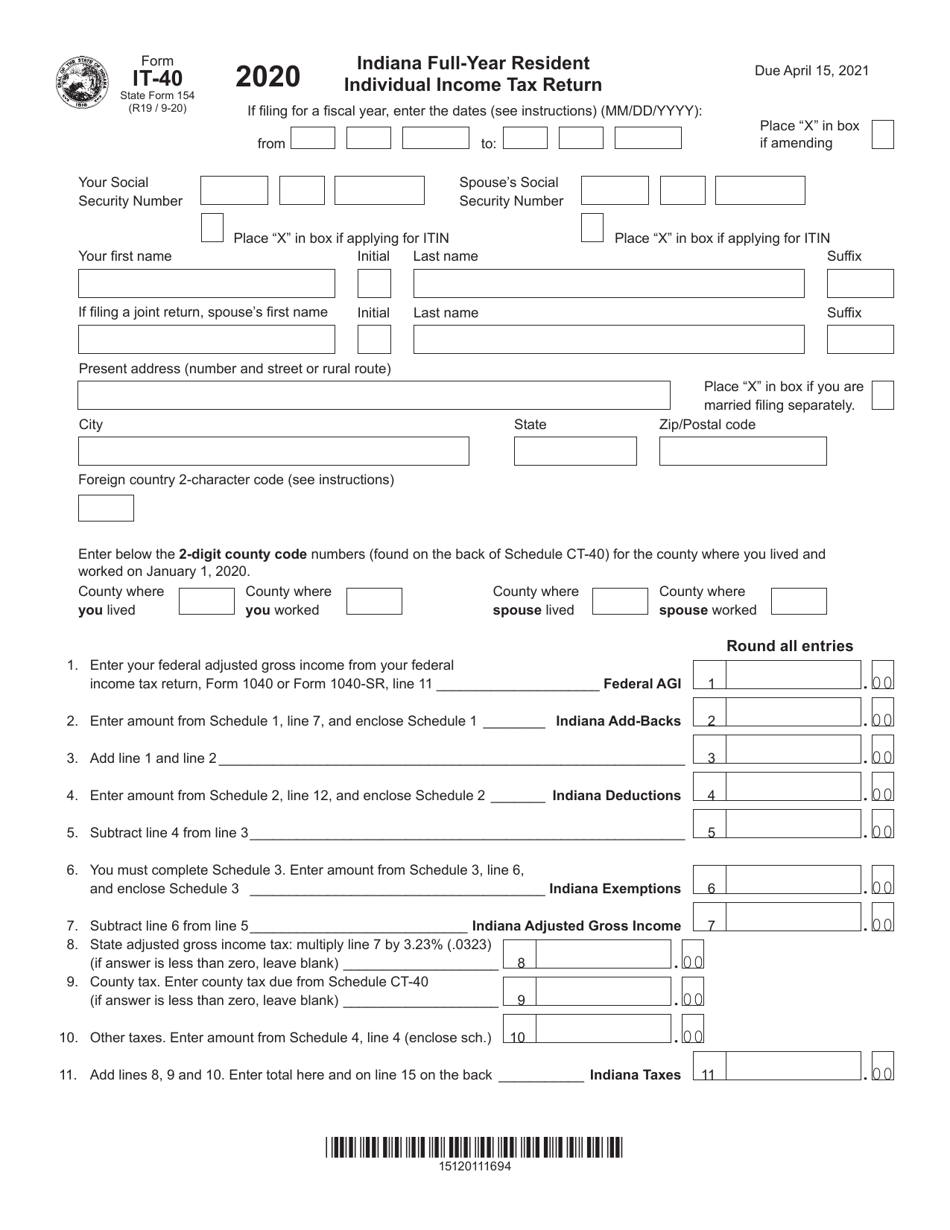

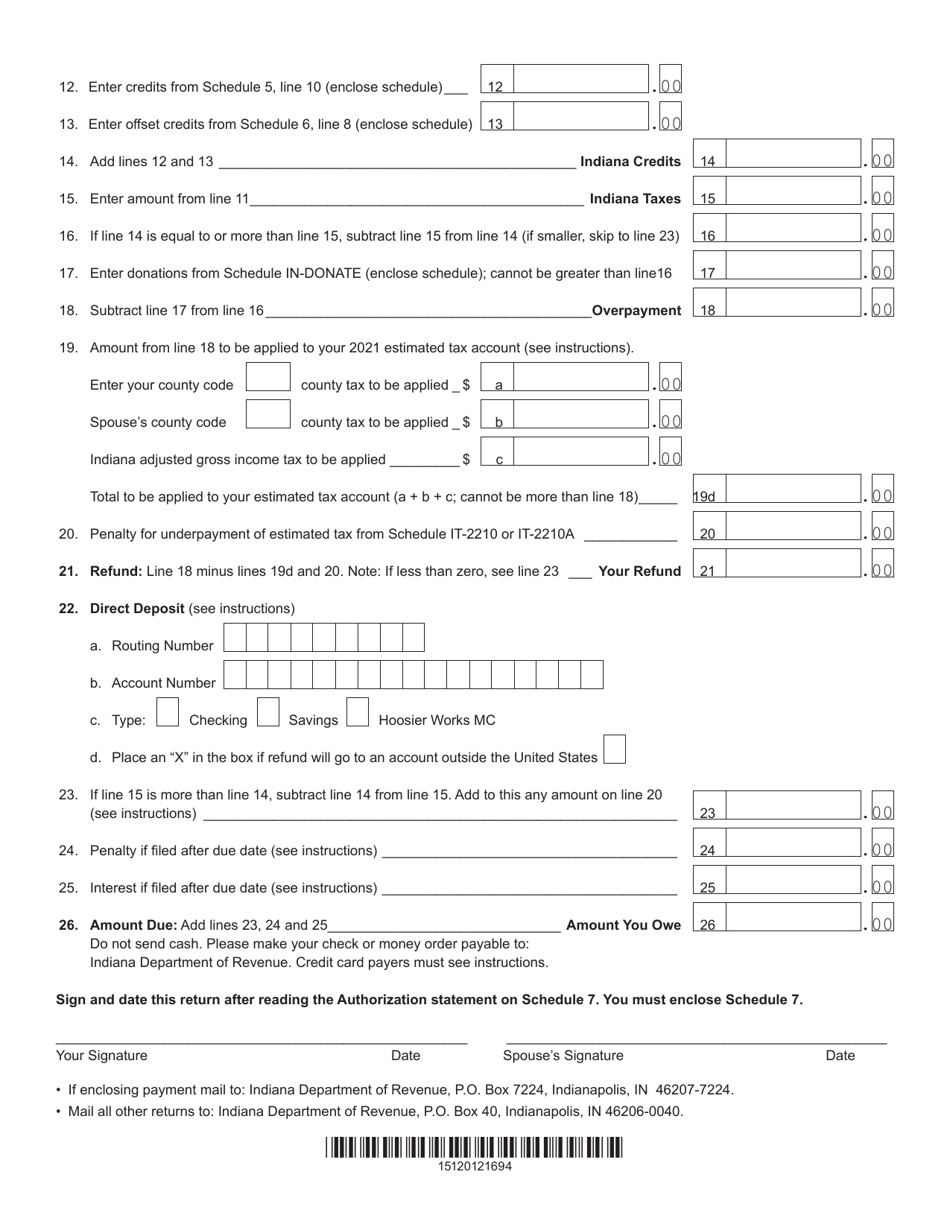

Q: What is Form IT-40?

A: Form IT-40 is the Indiana Full-Year Resident Individual Income Tax Return.

Q: Who should file Form IT-40?

A: Indiana residents who need to report their income and claim any applicable tax credits.

Q: What is the purpose of Form IT-40?

A: The purpose of Form IT-40 is to calculate and pay the amount of state income tax owed by Indiana residents.

Q: When is Form IT-40 due?

A: Form IT-40 is due by April 15th of the following year, unless an extension is requested.

Q: What information do I need to complete Form IT-40?

A: You will need information about your income, deductions, and any tax credits you are eligible for.

Q: Can I e-file Form IT-40?

A: Yes, you can e-file Form IT-40 using approved tax software or through a tax professional.

Q: Are there any special instructions for completing Form IT-40?

A: Yes, you should carefully read the instructions provided with the form to ensure accurate completion.

Q: What happens if I don't file Form IT-40?

A: If you are required to file Form IT-40 and fail to do so, you may incur penalties and interest.

Q: Can I file Form IT-40 if I am not a full-year resident of Indiana?

A: No, if you are not a full-year resident of Indiana, you will need to file a different tax form based on your specific residency status.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (State Form 154) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.