This version of the form is not currently in use and is provided for reference only. Download this version of

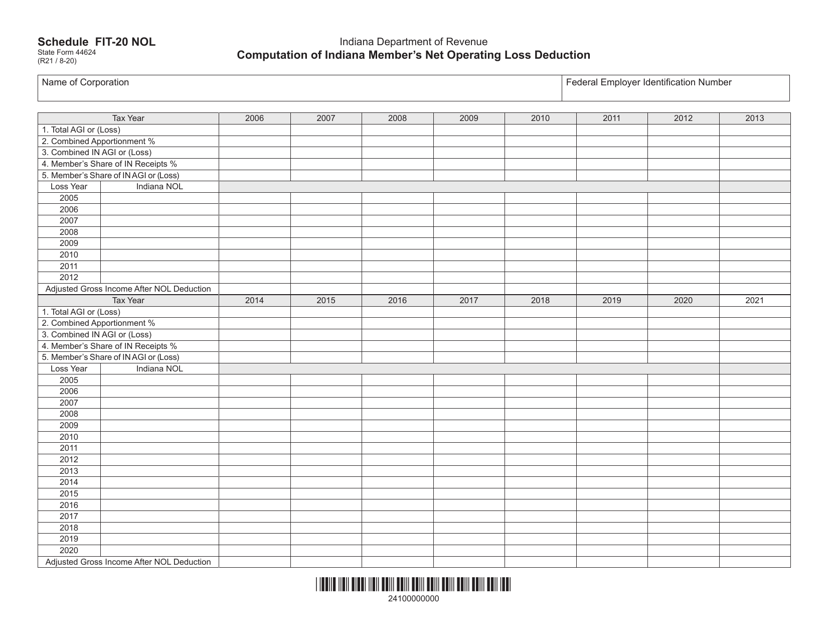

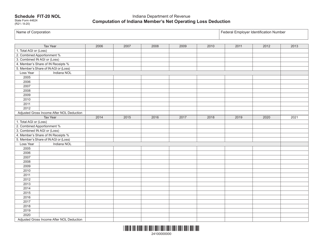

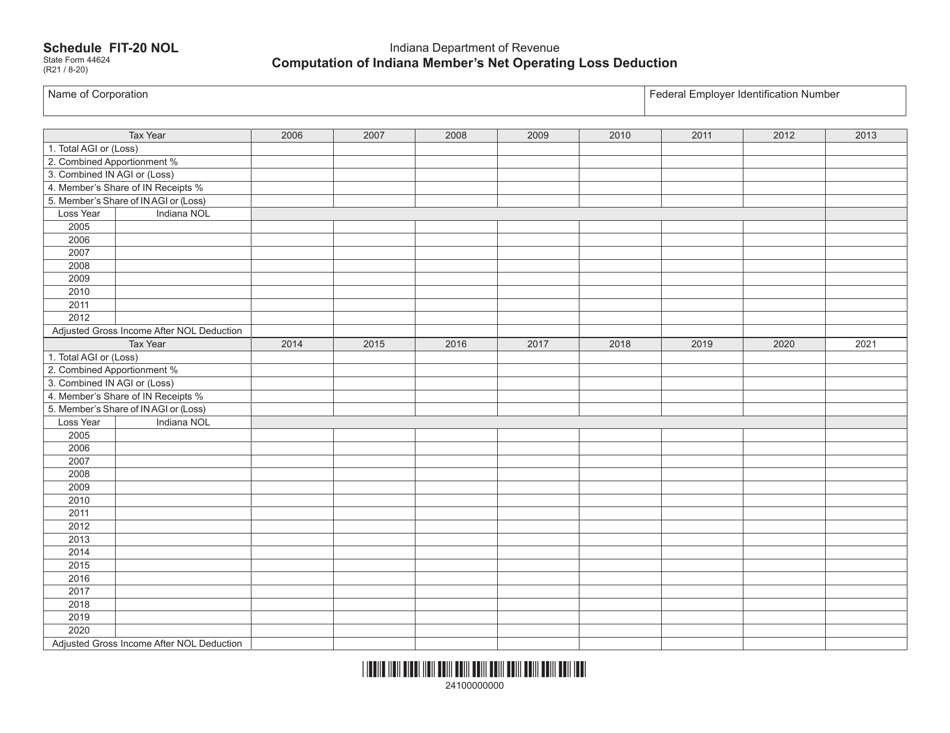

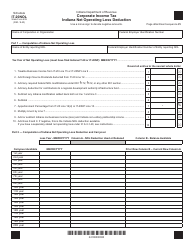

State Form 44624 Schedule FIT-20 NOL

for the current year.

State Form 44624 Schedule FIT-20 NOL Computation of Indiana Member's Net Operating Loss Deduction - Indiana

What Is State Form 44624 Schedule FIT-20 NOL?

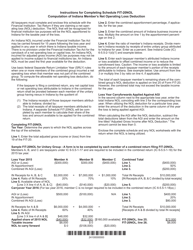

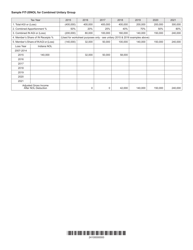

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 44624?

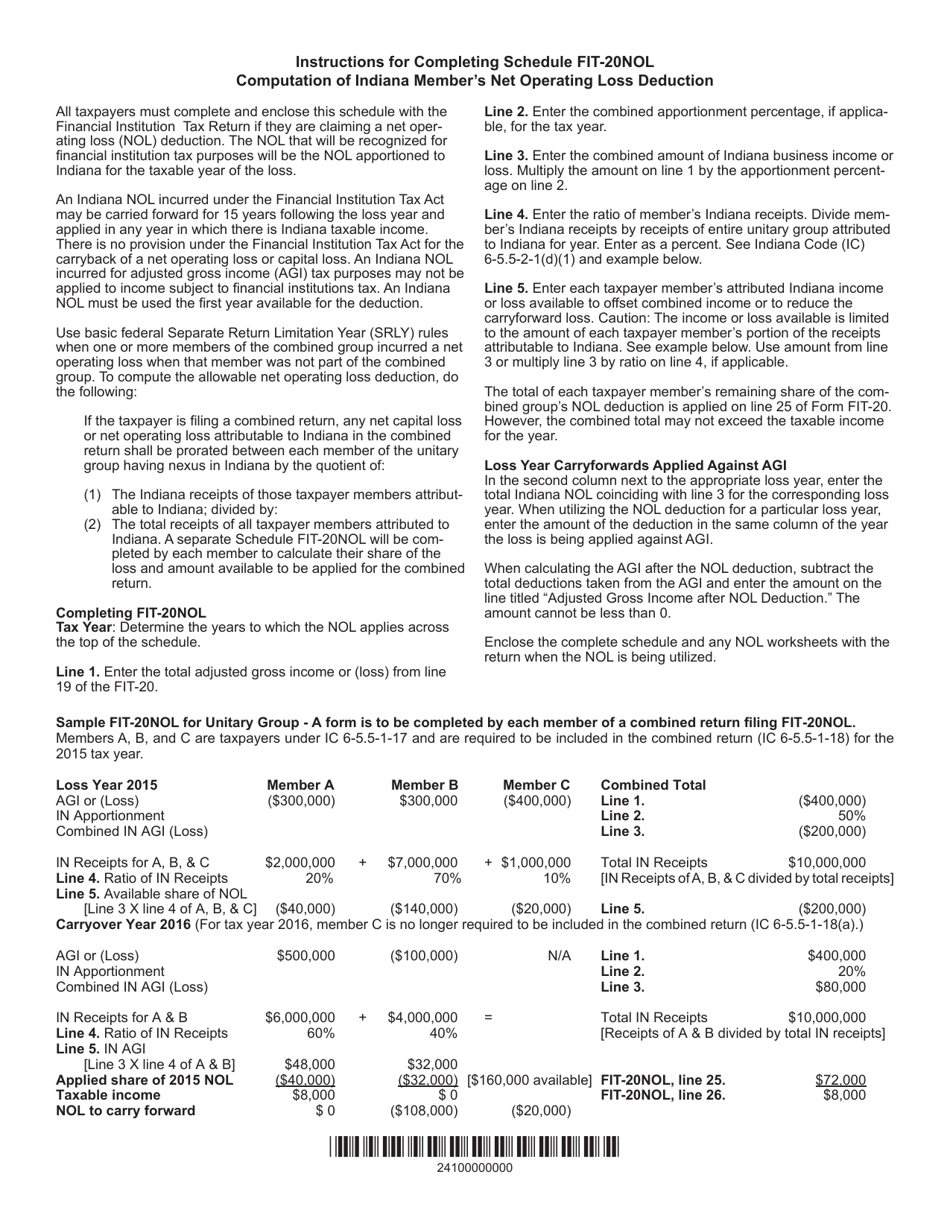

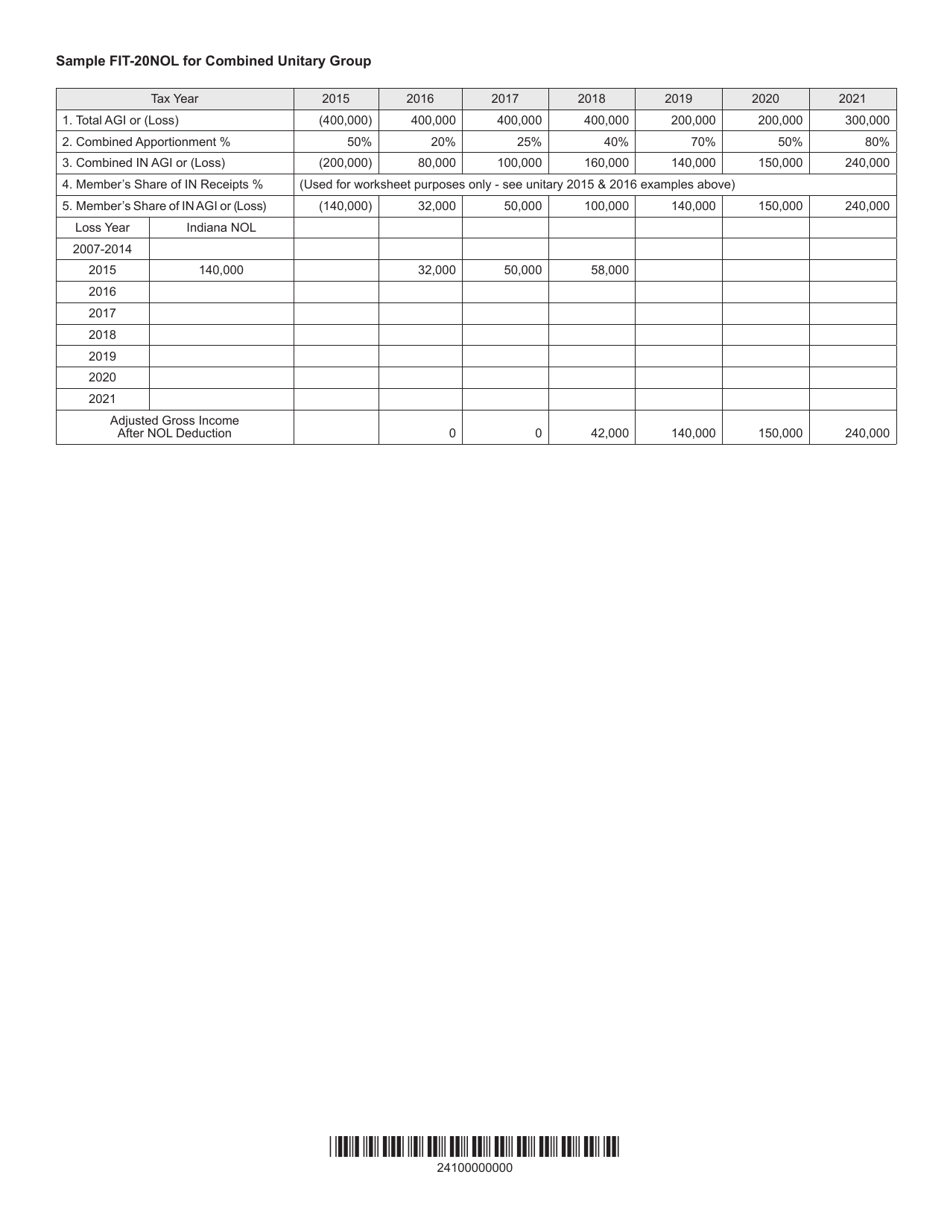

A: Form 44624 is a state tax form used to compute the net operating loss (NOL) deduction for Indiana taxpayers.

Q: What is Schedule FIT-20?

A: Schedule FIT-20 is a specific section of Form 44624 that focuses on the computation of Indiana member's net operating loss deduction.

Q: What is a net operating loss?

A: A net operating loss is when a taxpayer's allowable deductions exceed their taxable income.

Q: Who is required to use Form 44624?

A: Indiana taxpayers who have a net operating loss and want to claim the NOL deduction must use Form 44624.

Q: What is the purpose of the net operating loss deduction?

A: The net operating loss deduction allows taxpayers to offset their current or future income by using their previous year's losses.

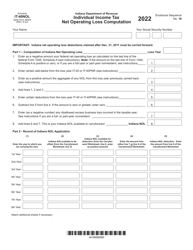

Q: What information is needed to complete Schedule FIT-20?

A: To complete Schedule FIT-20, taxpayers will need to provide information related to their net operating loss, including carryforward amounts and any NOL adjustments.

Q: Can I e-file Form 44624?

A: Yes, Indiana taxpayers have the option to e-file Form 44624.

Q: When is the deadline to file Form 44624?

A: The deadline to file Form 44624 varies each year and is typically the same as the deadline for filing your Indiana income tax return.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 44624 Schedule FIT-20 NOL by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.