This version of the form is not currently in use and is provided for reference only. Download this version of

State Form 54084 Schedule IN-PAT

for the current year.

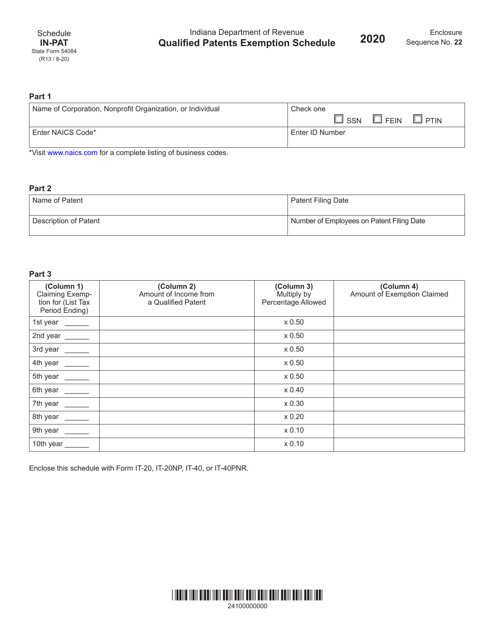

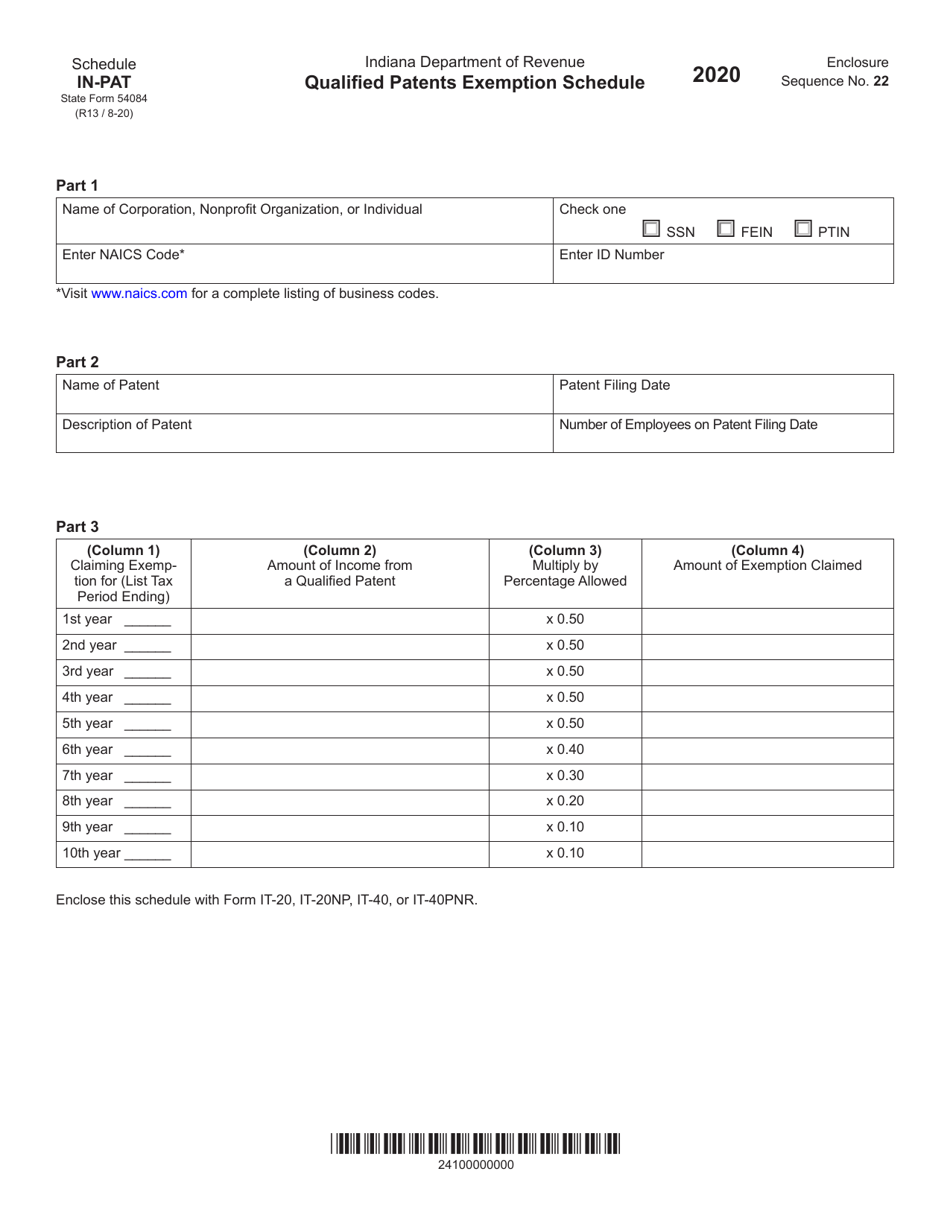

State Form 54084 Schedule IN-PAT Qualified Patents Exemption Schedule - Indiana

What Is State Form 54084 Schedule IN-PAT?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54084?

A: Form 54084 is the Schedule IN-PAT (Qualified Patents Exemption Schedule) for Indiana.

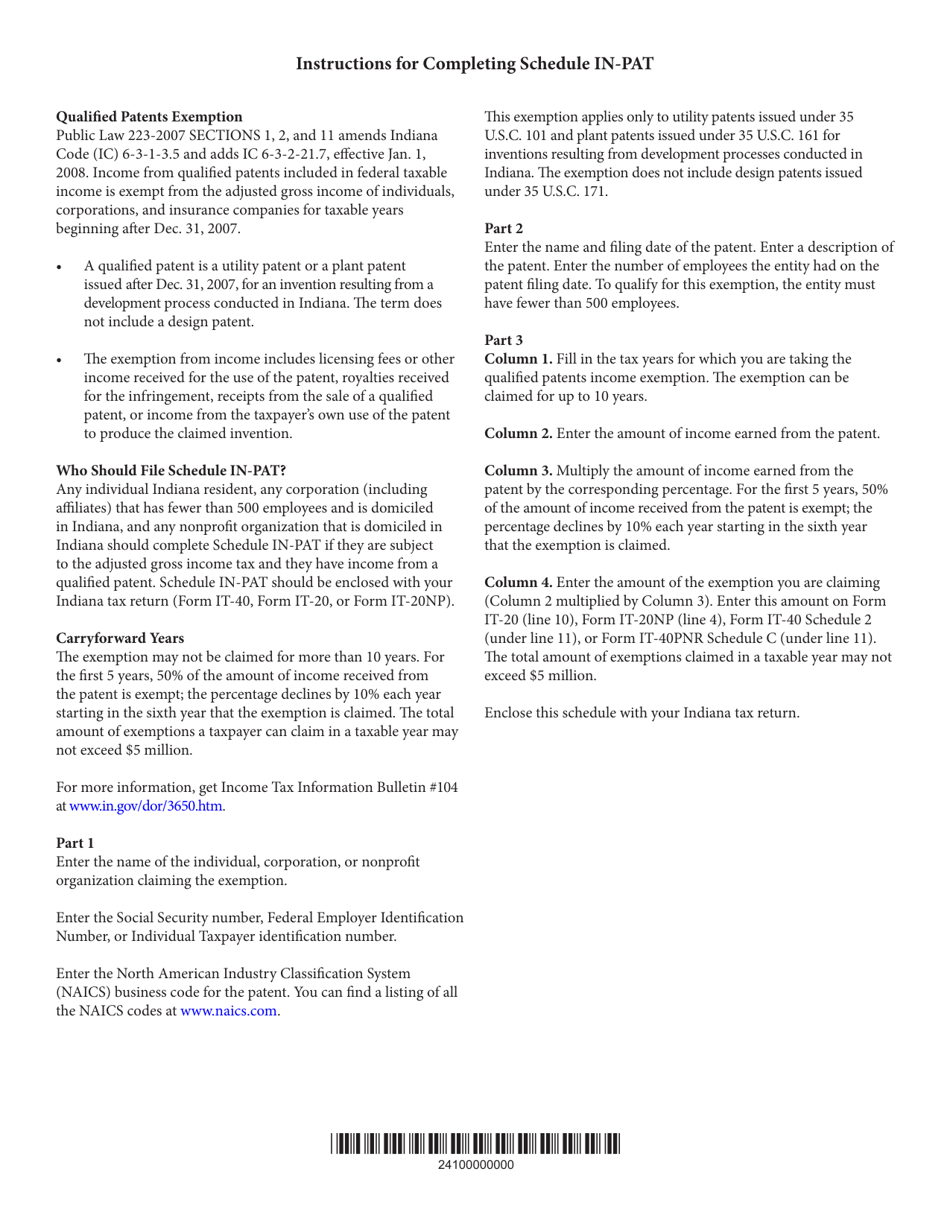

Q: What is the purpose of Schedule IN-PAT?

A: The purpose of Schedule IN-PAT is to claim a qualified patents exemption on your Indiana state tax return.

Q: Who is eligible for the qualified patents exemption?

A: Individuals, estates, and trusts that own qualified patents are eligible for the exemption.

Q: What are qualified patents?

A: Qualified patents are patents that have been granted by the United States Patent and Trademark Office.

Q: Why should I claim the qualified patents exemption?

A: Claiming the exemption can reduce your taxable income and lower your state tax liability.

Q: How do I complete Schedule IN-PAT?

A: You need to provide details of your qualified patents, including patent numbers, issue dates, and any licensing or royalty income.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 54084 Schedule IN-PAT by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.