This version of the form is not currently in use and is provided for reference only. Download this version of

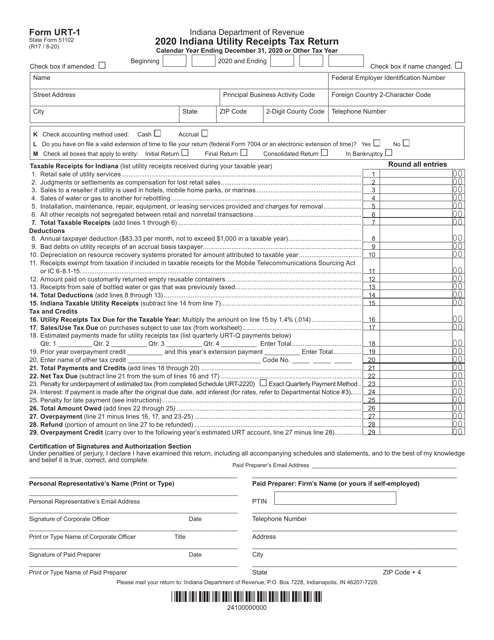

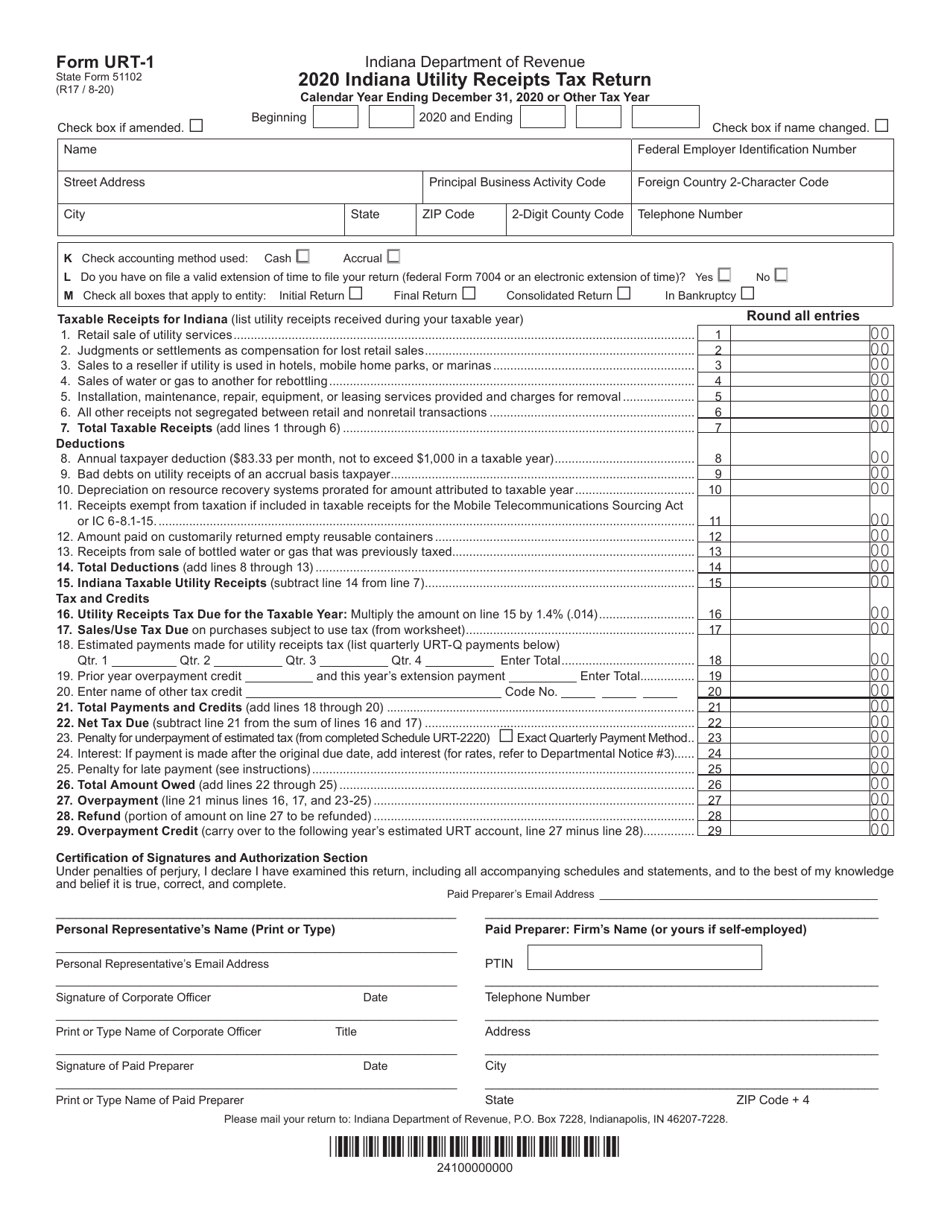

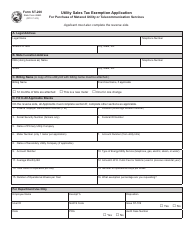

Form URT-1 (State Form 51102)

for the current year.

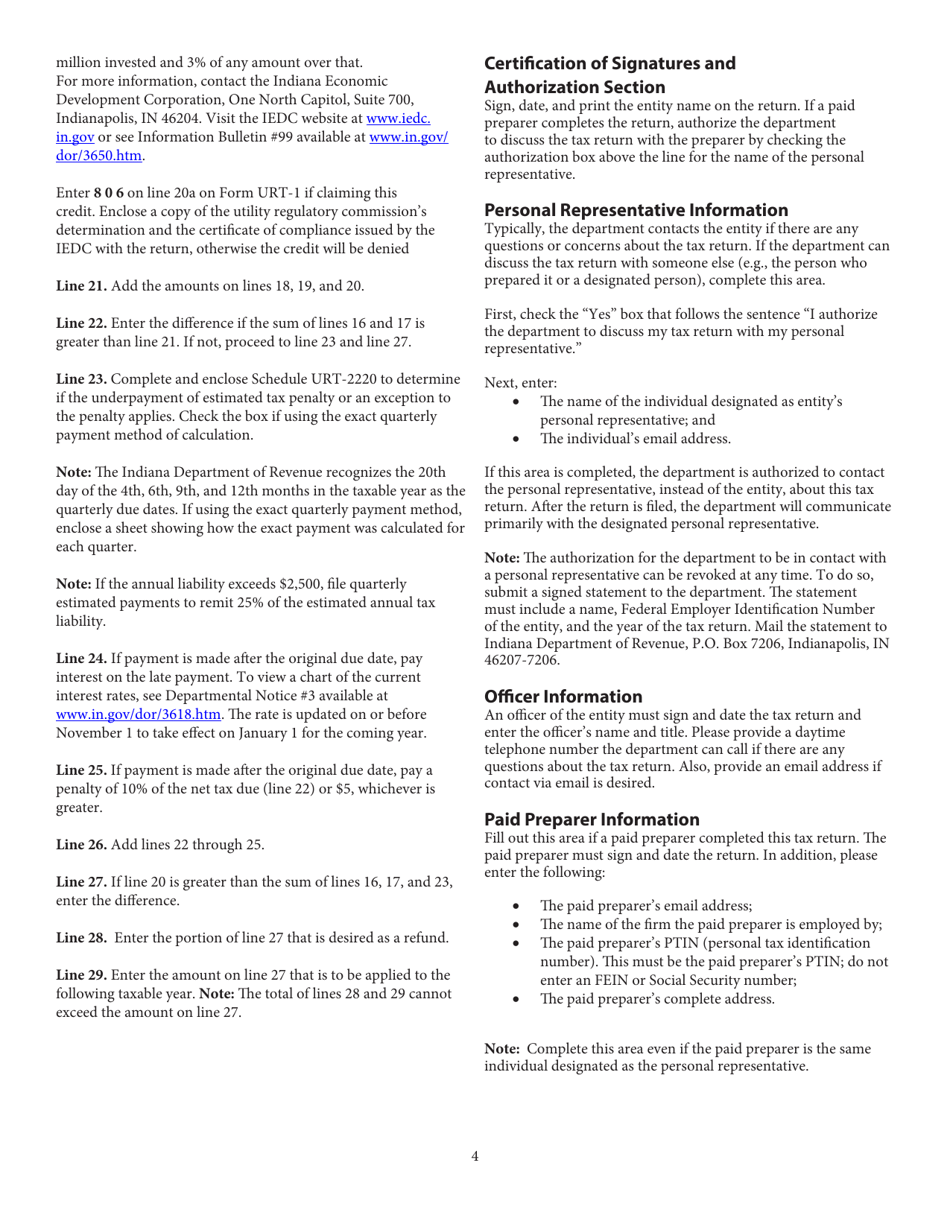

Form URT-1 (State Form 51102) Indiana Utility Receipts Tax Return - Indiana

What Is Form URT-1 (State Form 51102)?

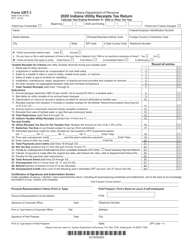

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the URT-1 form?

A: The URT-1 form is the Indiana Utility Receipts Tax Return.

Q: What is the State Form 51102?

A: The State Form 51102 is the form number for the URT-1.

Q: Who needs to file the URT-1 form?

A: Utility companies in Indiana need to file the URT-1 form.

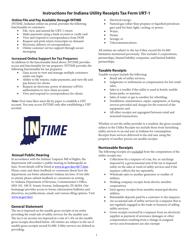

Q: What is the Indiana Utility Receipts Tax?

A: The Indiana Utility Receipts Tax is a tax imposed on utility companies based on their gross receipts.

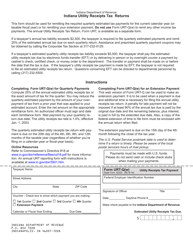

Q: When is the URT-1 form due?

A: The due date for the URT-1 form varies, but it is usually due on a quarterly basis.

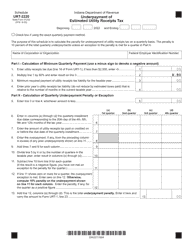

Q: Are there any penalties for late filing of the URT-1 form?

A: Yes, there are penalties for late filing of the URT-1 form. It is important to file the form by the due date to avoid any penalties.

Q: What information is required on the URT-1 form?

A: The URT-1 form requires information such as total gross receipts, deductions, and the calculated tax amount.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form URT-1 (State Form 51102) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.