This version of the form is not currently in use and is provided for reference only. Download this version of

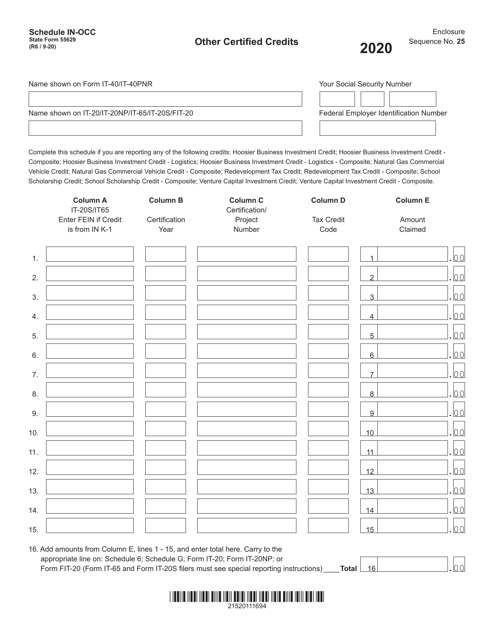

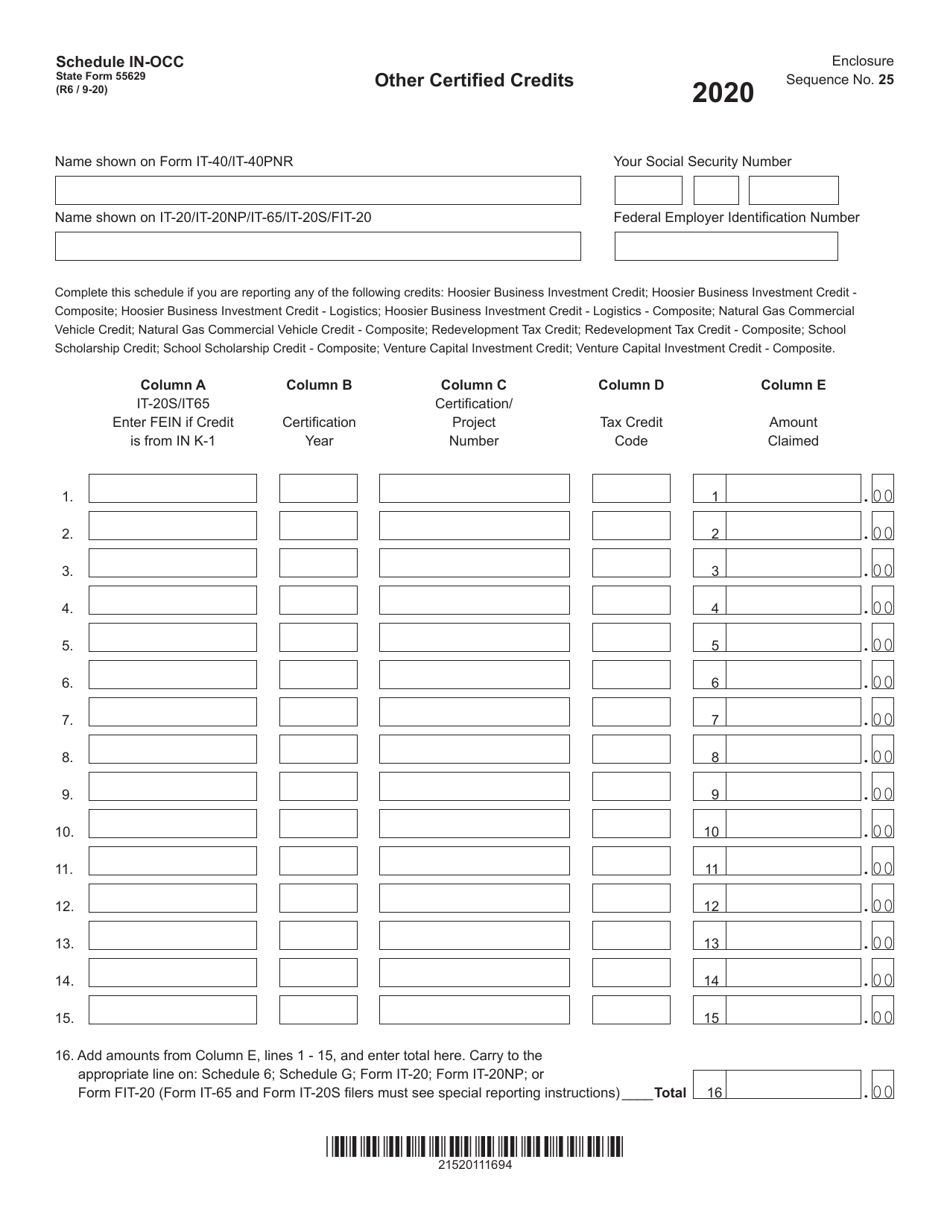

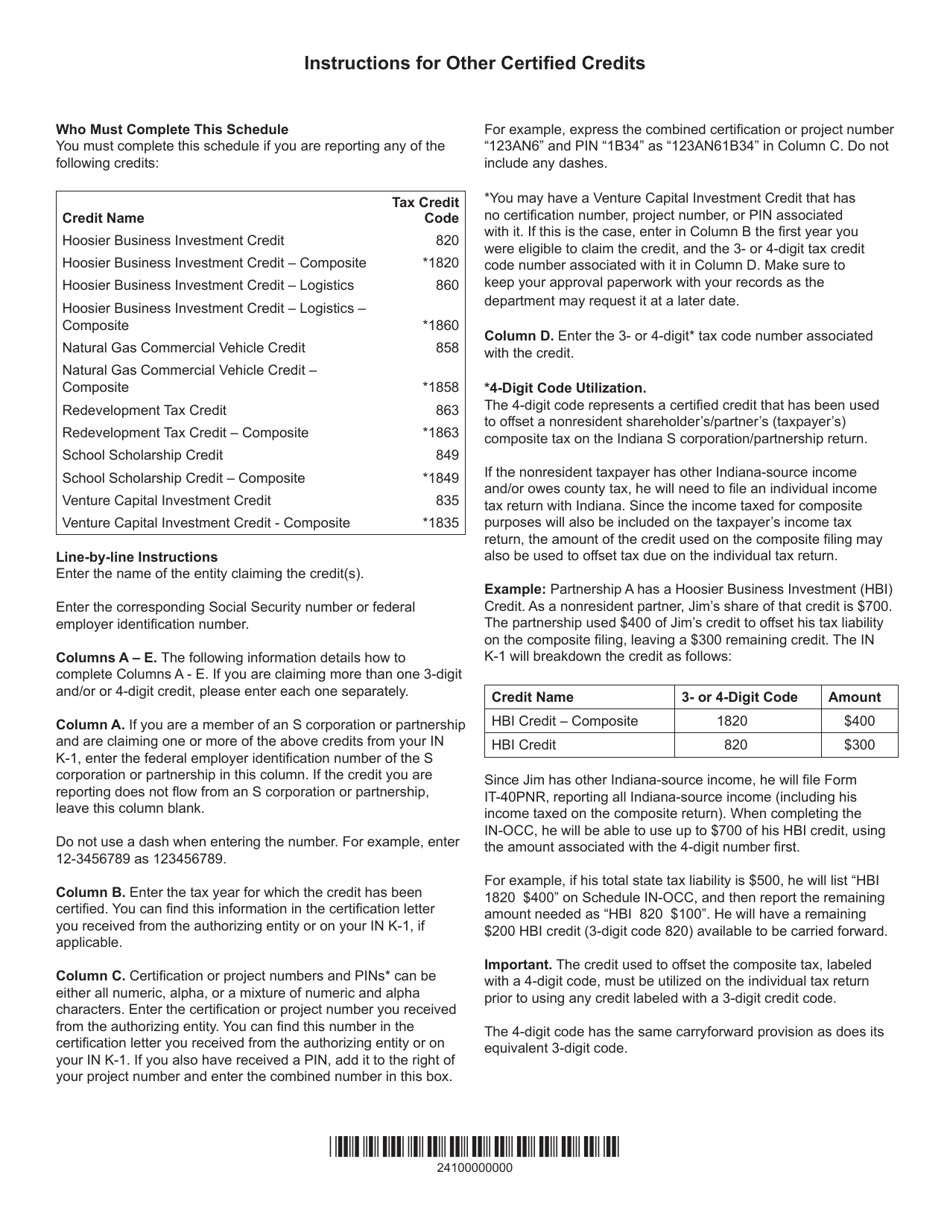

State Form 55629 Schedule IN-OCC

for the current year.

State Form 55629 Schedule IN-OCC Other Certified Credits - Indiana

What Is State Form 55629 Schedule IN-OCC?

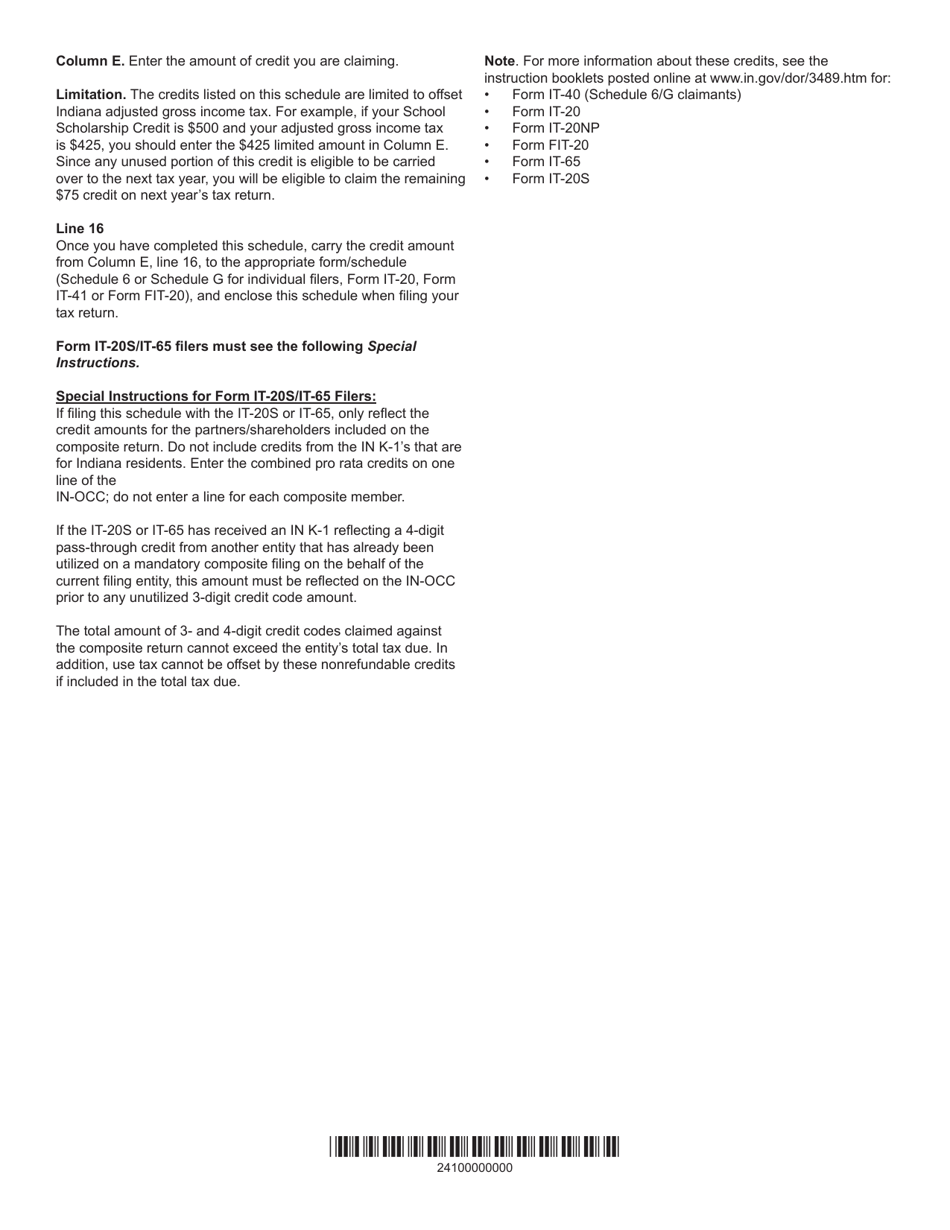

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55629 Schedule IN-OCC?

A: Form 55629 Schedule IN-OCC is a specific tax form used in the state of Indiana.

Q: What is the purpose of Schedule IN-OCC?

A: The purpose of Schedule IN-OCC is to report other certified credits in Indiana.

Q: What are other certified credits?

A: Other certified credits are tax credits that are not included in other tax forms, and they need to be reported separately.

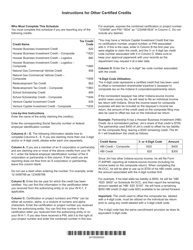

Q: Who needs to file Schedule IN-OCC?

A: Any taxpayer in Indiana who has other certified credits to report needs to file Schedule IN-OCC.

Q: Can I e-file Schedule IN-OCC?

A: Yes, you can e-file Schedule IN-OCC if you are filing your Indiana state taxes electronically.

Q: Is Schedule IN-OCC required for federal taxes?

A: No, Schedule IN-OCC is specific to Indiana state taxes and is not required for federal taxes.

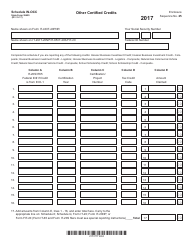

Q: What information do I need to complete Schedule IN-OCC?

A: To complete Schedule IN-OCC, you will need information regarding your other certified credits, including their amounts and applicable certification numbers.

Q: When is the deadline to file Schedule IN-OCC?

A: The deadline to file Schedule IN-OCC is typically the same as the deadline to file your Indiana state tax return, which is usually April 15th, but it can vary.

Q: Can I get assistance in completing Schedule IN-OCC?

A: Yes, you can seek assistance from a tax professional or contact the Indiana Department of Revenue for any questions or guidance regarding Schedule IN-OCC.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55629 Schedule IN-OCC by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.