This version of the form is not currently in use and is provided for reference only. Download this version of

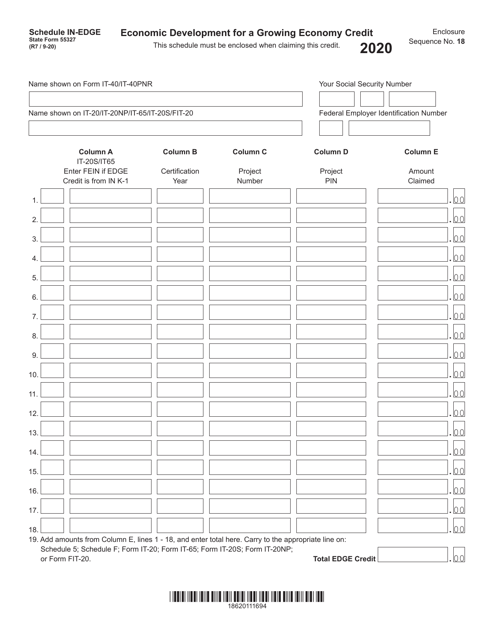

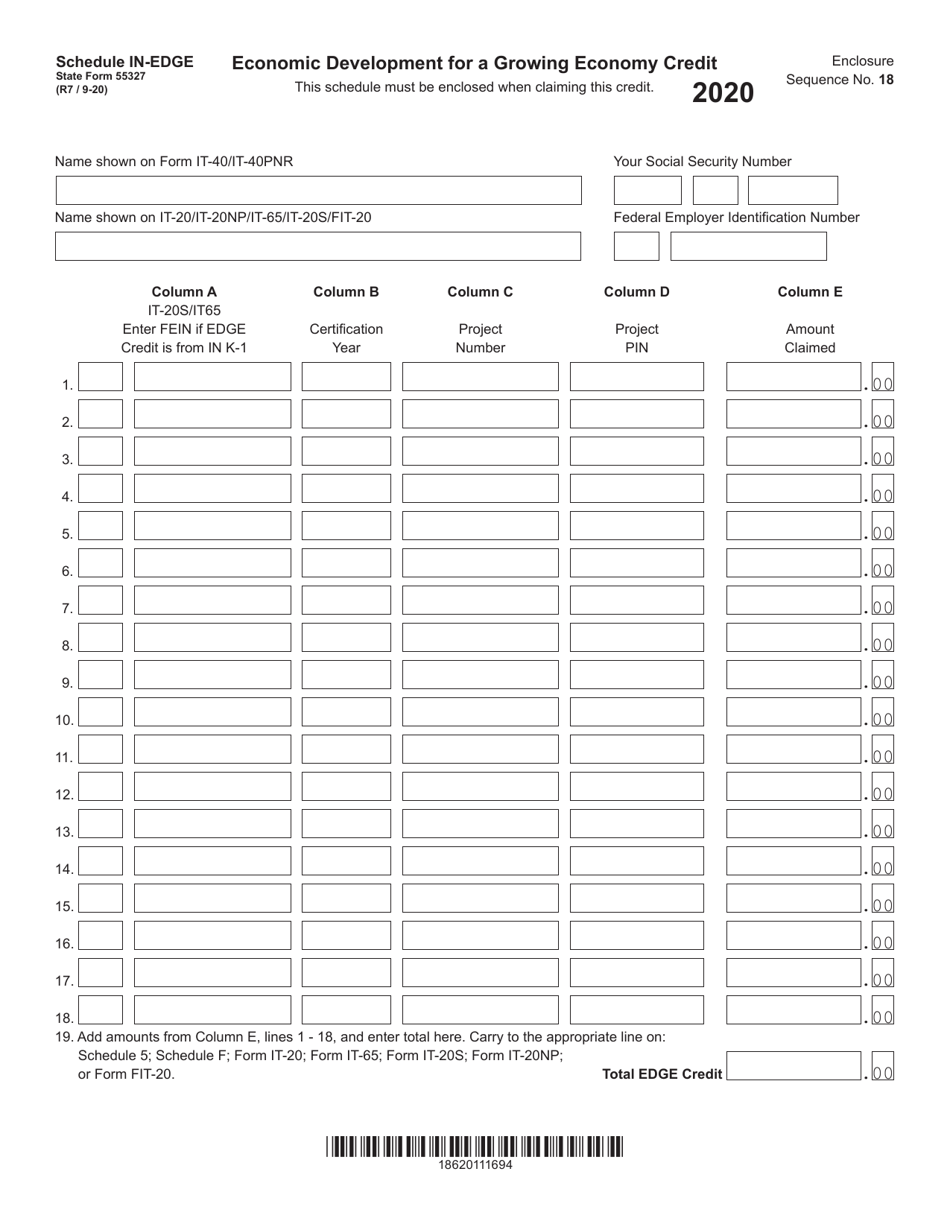

State Form 55327 Schedule IN-EDGE

for the current year.

State Form 55327 Schedule IN-EDGE Economic Development for a Growing Economy Credit - Indiana

What Is State Form 55327 Schedule IN-EDGE?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55327 Schedule IN-EDGE?

A: Form 55327 Schedule IN-EDGE is a tax form related to the Economic Development for a Growing Economy (EDGE) credit in the state of Indiana.

Q: What is the purpose of the IN-EDGE Economic Development for a Growing Economy Credit?

A: The IN-EDGE Economic Development for a Growing Economy Credit is designed to encourage businesses to expand and create new jobs in Indiana.

Q: Who is eligible for the IN-EDGE Economic Development for a Growing Economy Credit?

A: Eligibility for the IN-EDGE credit is limited to businesses that meet certain criteria set by the state of Indiana, including job creation and capital investment requirements.

Q: How is the IN-EDGE credit calculated?

A: The IN-EDGE credit is calculated based on a formula that takes into account the number of jobs created, wages paid to employees, and the amount of capital investment made by the business.

Q: Is there a maximum credit amount for the IN-EDGE Economic Development for a Growing Economy Credit?

A: Yes, there is a maximum credit amount that can be claimed by a business under the IN-EDGE program, which is determined by the Indiana Economic Development Corporation (IEDC).

Q: How can businesses claim the IN-EDGE Economic Development for a Growing Economy Credit?

A: Businesses can claim the IN-EDGE credit by completing Form 55327 Schedule IN-EDGE and submitting it to the Indiana Department of Revenue along with their annual tax return.

Q: Are there any deadlines for claiming the IN-EDGE credit?

A: Yes, businesses must submit their completed Form 55327 Schedule IN-EDGE and claim the credit on or before the due date of their annual tax return for the year in which the credit is being claimed.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55327 Schedule IN-EDGE by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.