This version of the form is not currently in use and is provided for reference only. Download this version of

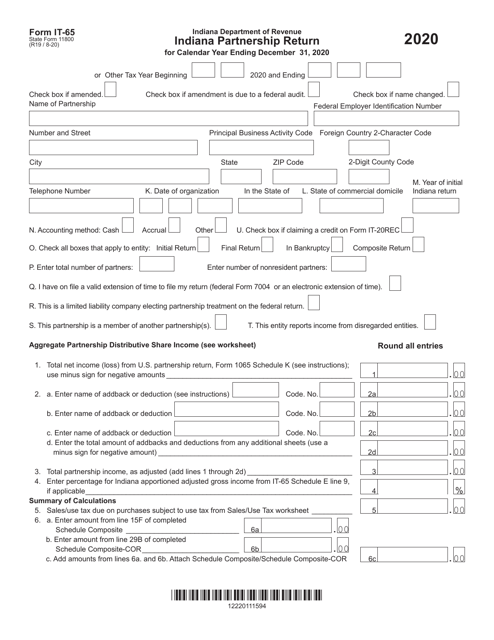

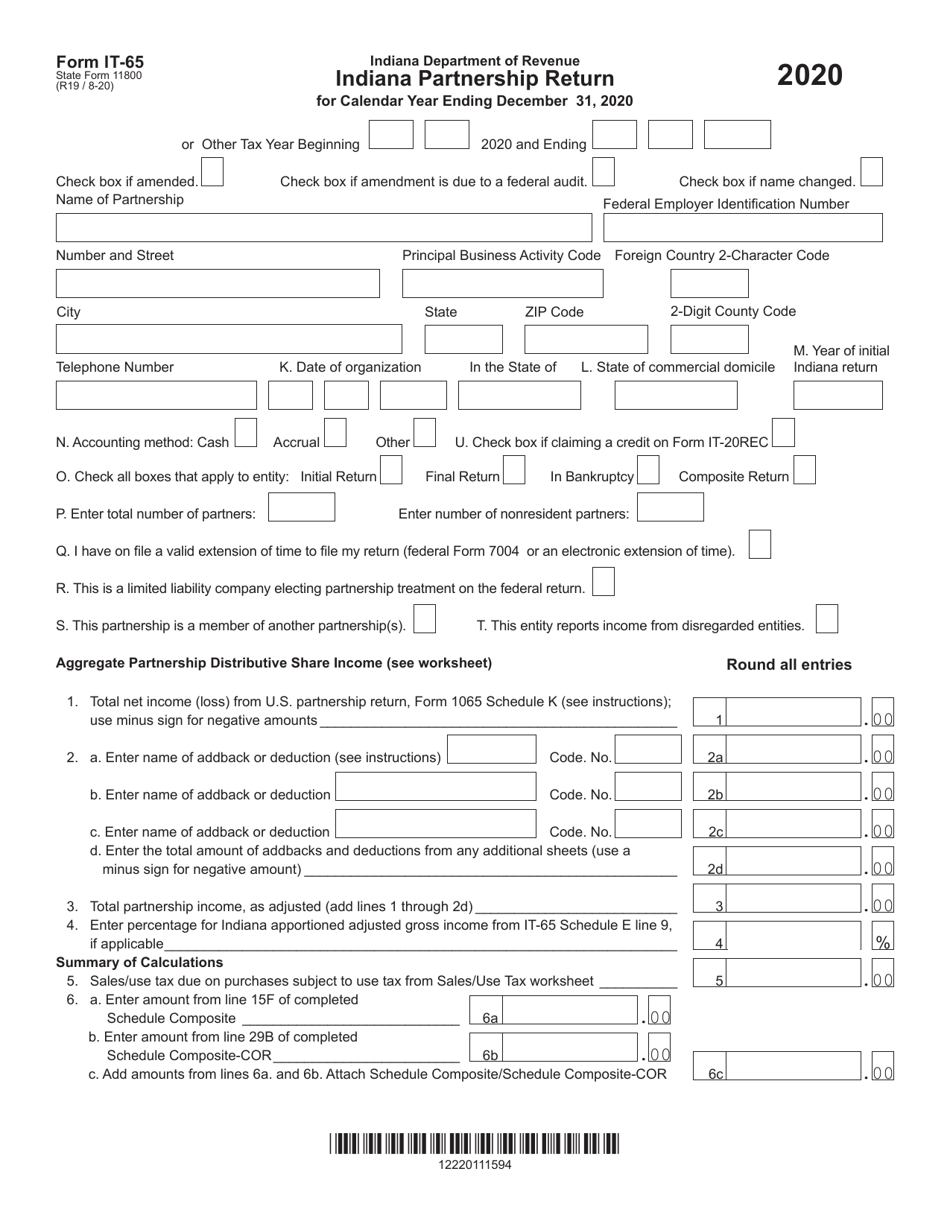

Form IT-65 (State Form 11800)

for the current year.

Form IT-65 (State Form 11800) Indiana Partnership Return - Indiana

What Is Form IT-65 (State Form 11800)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-65?

A: Form IT-65 is the Indiana Partnership Return.

Q: Who needs to file Form IT-65?

A: Partnerships doing business in Indiana are required to file Form IT-65.

Q: What is the purpose of Form IT-65?

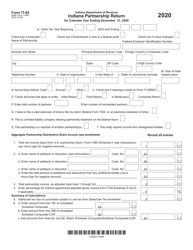

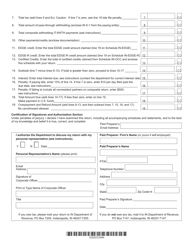

A: The purpose of Form IT-65 is to report the partnership's income, deductions, credits, and other tax-related information to the state of Indiana.

Q: When is Form IT-65 due?

A: Form IT-65 is due on the 15th day of the 4th month following the close of the tax year, which is typically April 15th for calendar year partnerships.

Q: Are there any penalties for late filing of Form IT-65?

A: Yes, there are penalties for late filing of Form IT-65. It is important to file the form on time to avoid these penalties.

Q: Is there a fee for filing Form IT-65?

A: No, there is no fee for filing Form IT-65.

Q: What attachments should be included with Form IT-65?

A: Form IT-65 requires certain attachments, such as Schedule IN-K-1 and Schedule IN-20NP, depending on the specific circumstances of the partnership.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-65 (State Form 11800) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.