This version of the form is not currently in use and is provided for reference only. Download this version of

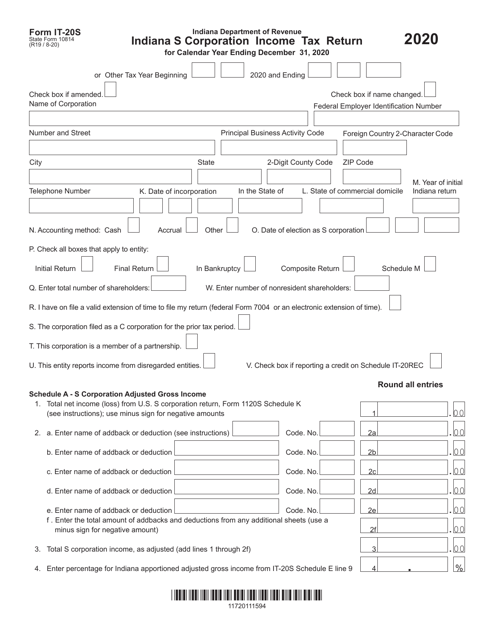

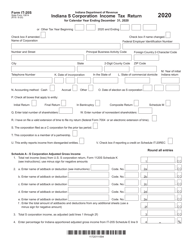

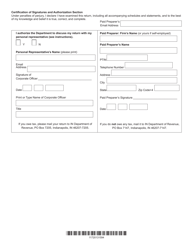

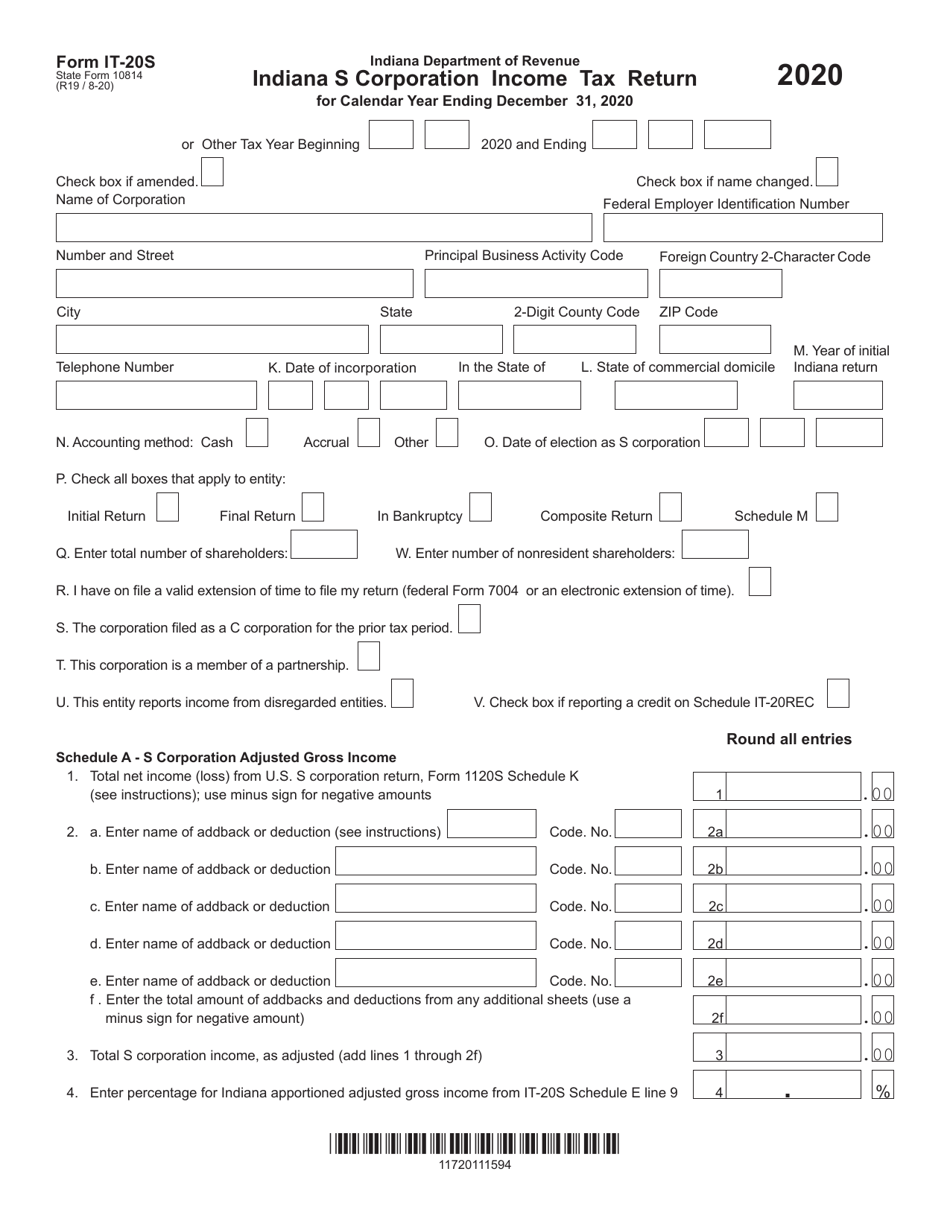

Form IT-20S (State Form 10814)

for the current year.

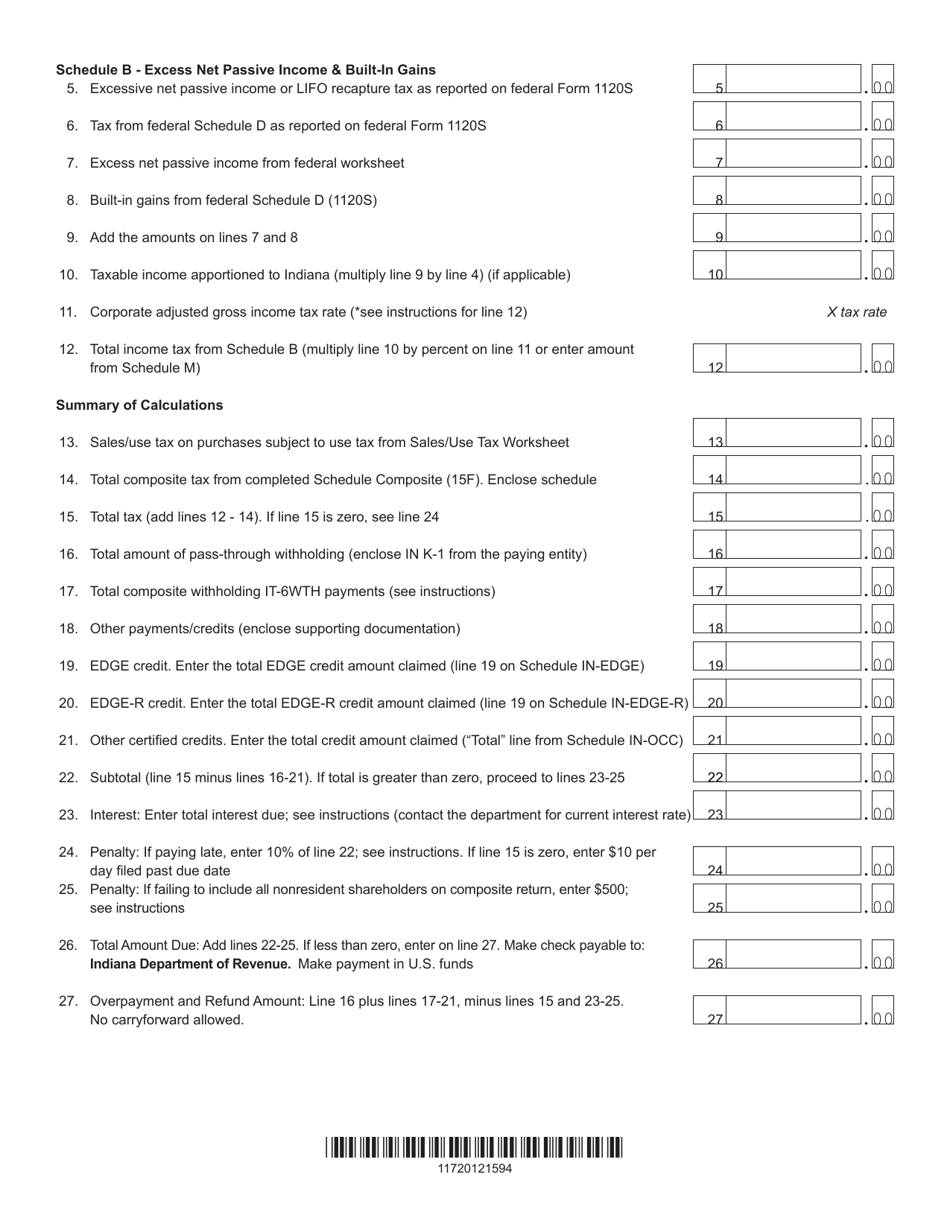

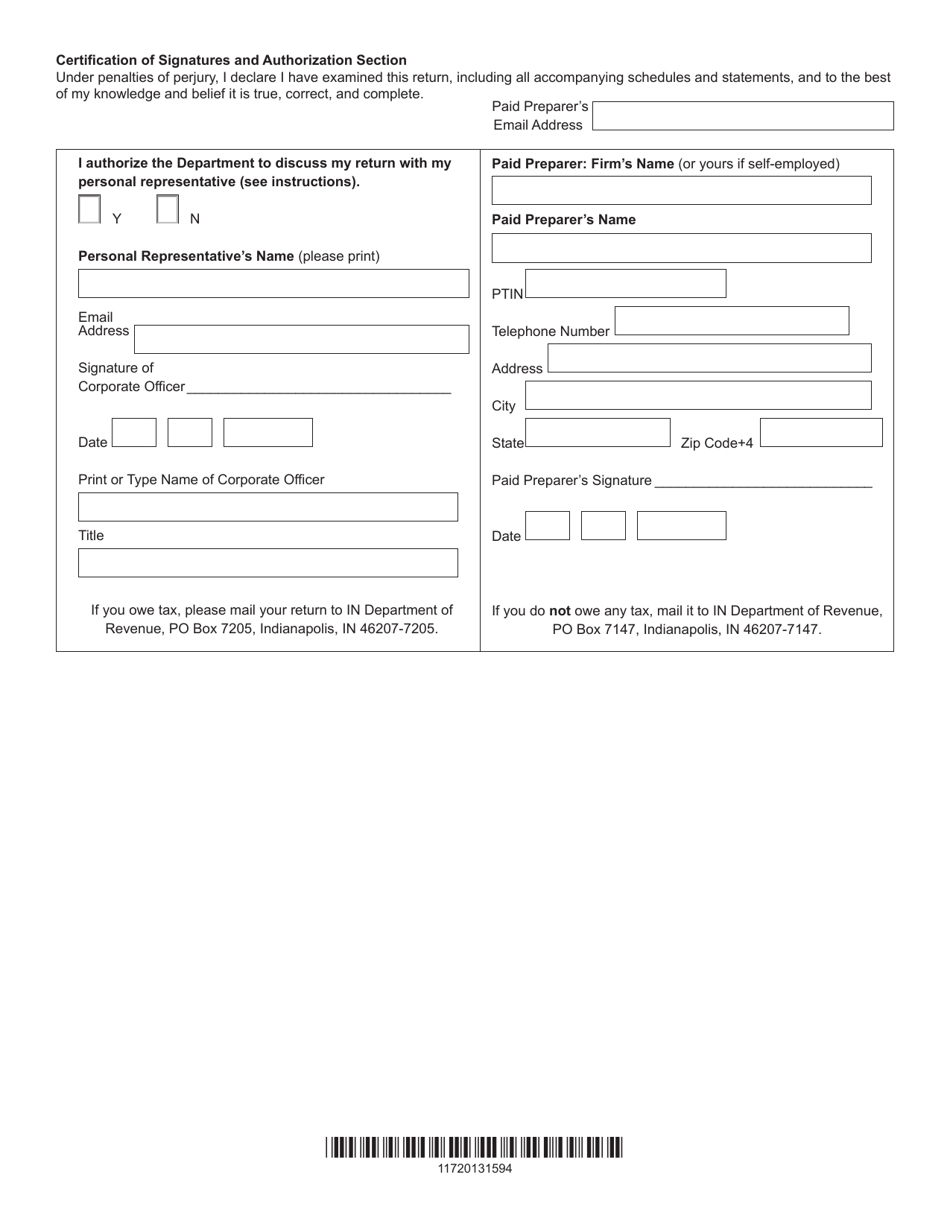

Form IT-20S (State Form 10814) Indiana S Corporation Income Tax Return - Indiana

What Is Form IT-20S (State Form 10814)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-20S?

A: Form IT-20S is the Indiana S Corporation Income Tax Return.

Q: Who needs to file Form IT-20S?

A: Any corporation that elects to be treated as an S corporation for federal income tax purposes and has income derived from Indiana sources must file Form IT-20S.

Q: What is the purpose of Form IT-20S?

A: Form IT-20S is used to report the income, deductions, credits, and other relevant information of an S corporation in Indiana.

Q: When is Form IT-20S due?

A: Form IT-20S is due on the 15th day of the 3rd month following the close of the corporation's tax year.

Q: Are there any extensions available for filing Form IT-20S?

A: Yes, you can request a 6-month extension to file Form IT-20S by submitting Form IT-9.

Q: Is there a penalty for late filing of Form IT-20S?

A: Yes, there is a penalty for late filing of Form IT-20S. The penalty amount depends on the amount of tax due and the length of the delay.

Q: Are there any payment requirements associated with Form IT-20S?

A: Yes, you must pay the full amount of tax due with your Form IT-20S by the original due date or an extension due date, if applicable.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-20S (State Form 10814) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.