This version of the form is not currently in use and is provided for reference only. Download this version of

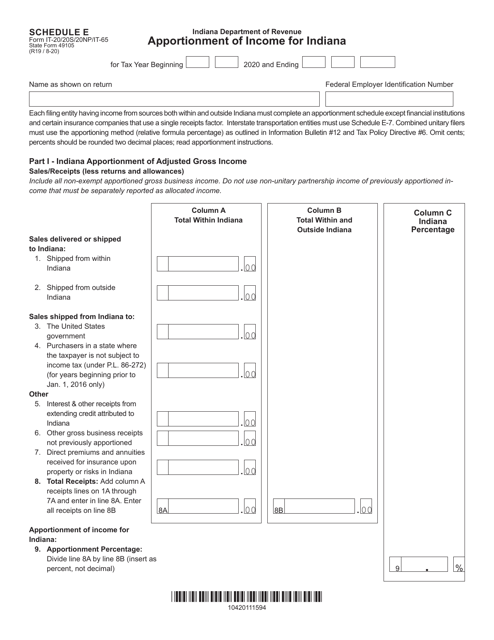

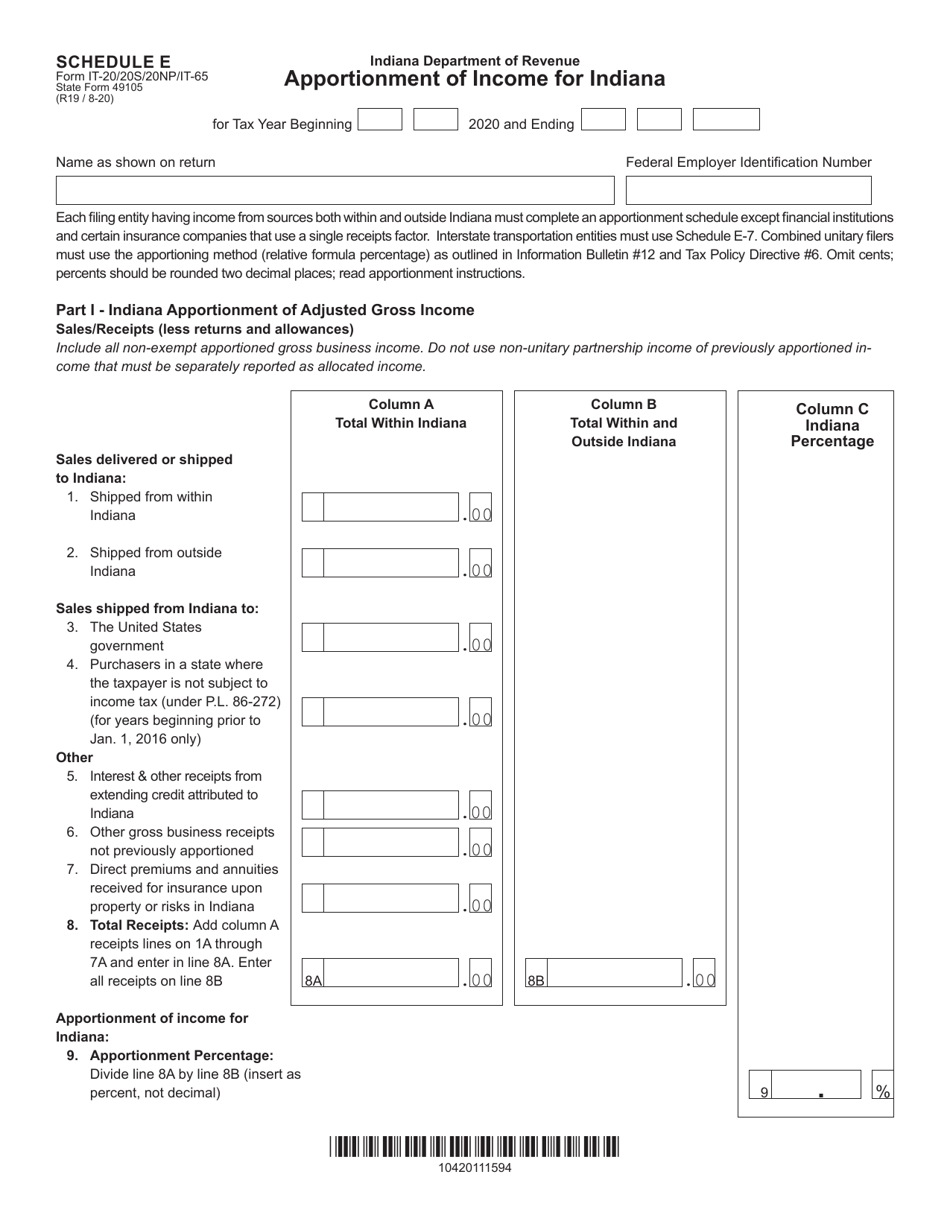

Form IT-20 (IT-20S; IT-20NP; IT-65; State Form 49105) Schedule E

for the current year.

Form IT-20 (IT-20S; IT-20NP; IT-65; State Form 49105) Schedule E Apportionment of Income for Indiana - Indiana

What Is Form IT-20 (IT-20S; IT-20NP; IT-65; State Form 49105) Schedule E?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-20?

A: Form IT-20 is the corporate income tax return form for businesses in Indiana.

Q: What are the other related forms?

A: Other related forms include IT-20S, IT-20NP, IT-65, and State Form 49105.

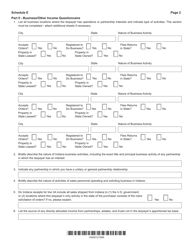

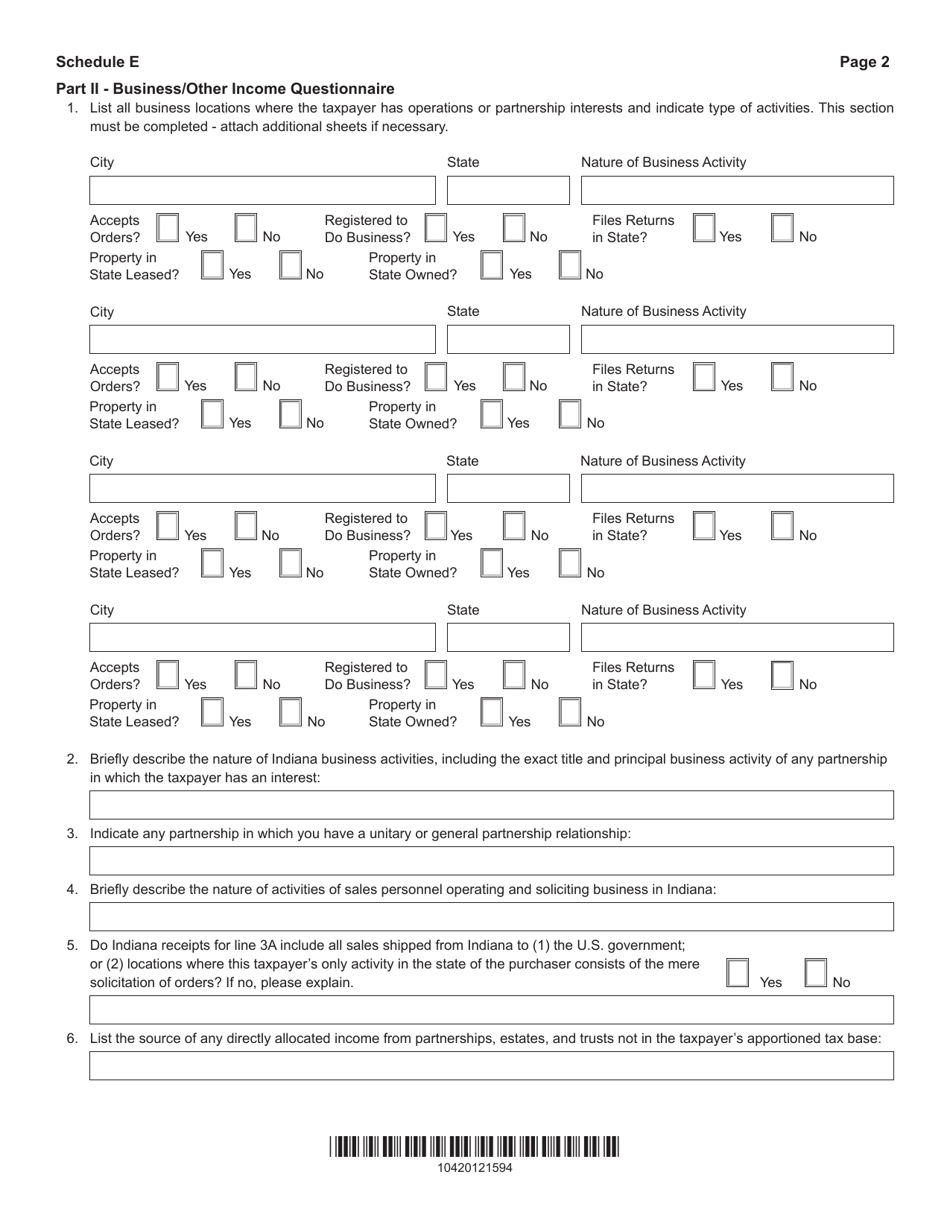

Q: What is Schedule E?

A: Schedule E is a part of Form IT-20 that is used to apportion income for Indiana.

Q: What is apportionment of income?

A: Apportionment of income is the process of determining how much of a corporation's income is taxable in a particular state.

Q: Who needs to file Form IT-20?

A: Corporations doing business in Indiana need to file Form IT-20.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-20 (IT-20S; IT-20NP; IT-65; State Form 49105) Schedule E by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.