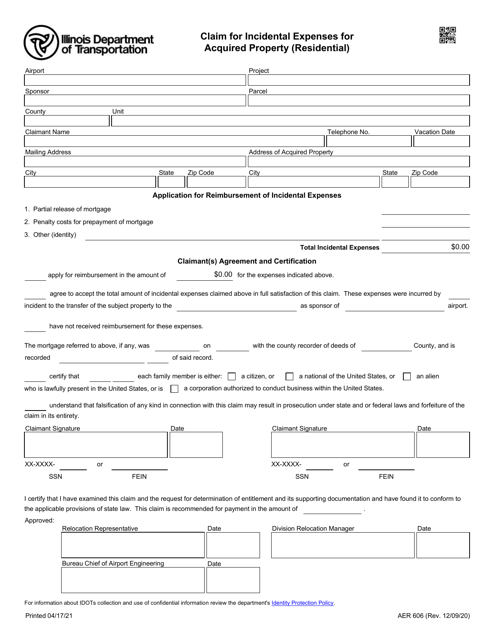

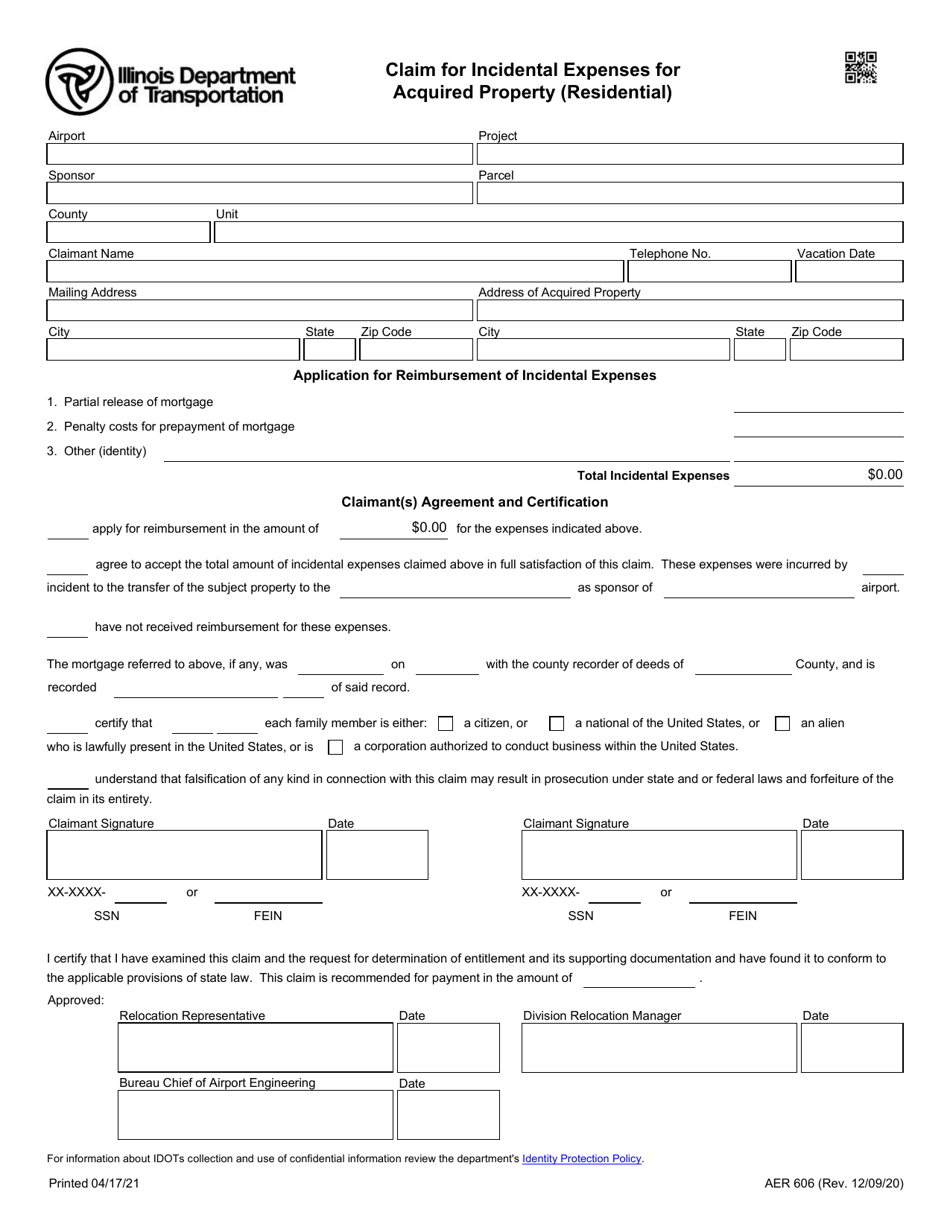

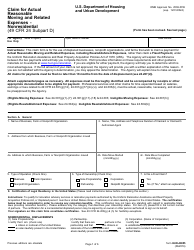

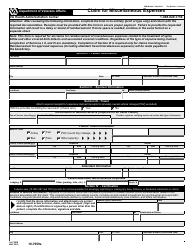

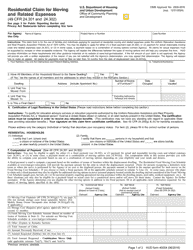

Form AER606 Claim for Incidental Expenses for Acquired Property (Residential) - Illinois

What Is Form AER606?

This is a legal form that was released by the Illinois Department of Transportation - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AER606?

A: Form AER606 is a claim form for incidental expenses for acquired residential property in Illinois.

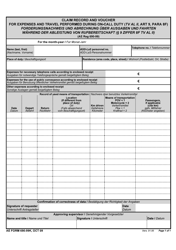

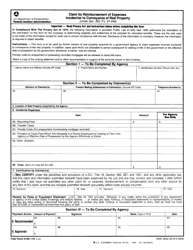

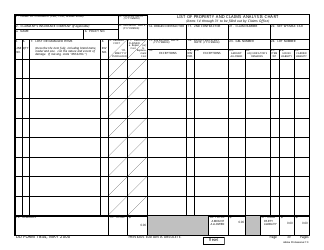

Q: What are incidental expenses for acquired residential property?

A: Incidental expenses refer to additional expenses incurred when acquiring a residential property, such as closing costs, legal fees, and inspection fees.

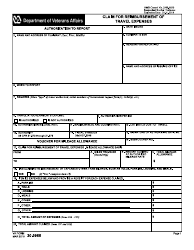

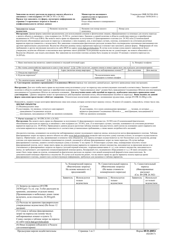

Q: Who can use Form AER606?

A: Form AER606 can be used by individuals who have acquired residential property in Illinois.

Q: What information is required on Form AER606?

A: Form AER606 requires information such as the property address, acquisition date, and details of the incidental expenses.

Q: What should I do after completing Form AER606?

A: After completing Form AER606, you should submit it to the Illinois Department of Revenue along with any supporting documentation.

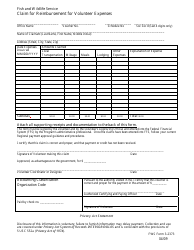

Form Details:

- Released on December 9, 2020;

- The latest edition provided by the Illinois Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AER606 by clicking the link below or browse more documents and templates provided by the Illinois Department of Transportation.