This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-20NP (State Form 148)

for the current year.

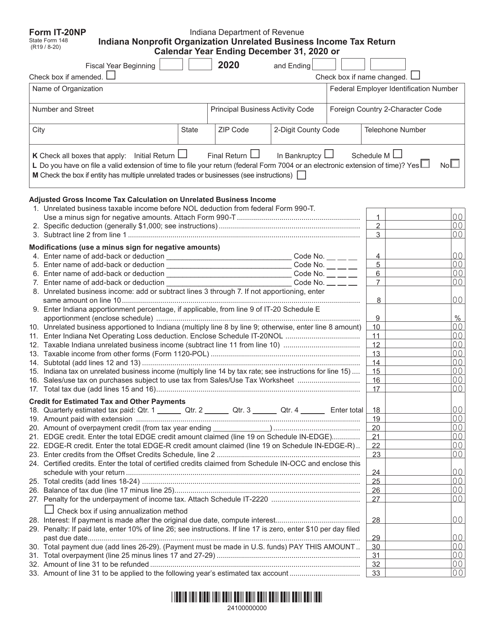

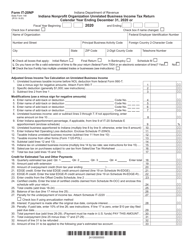

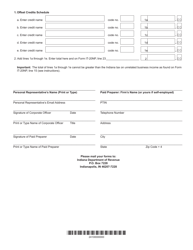

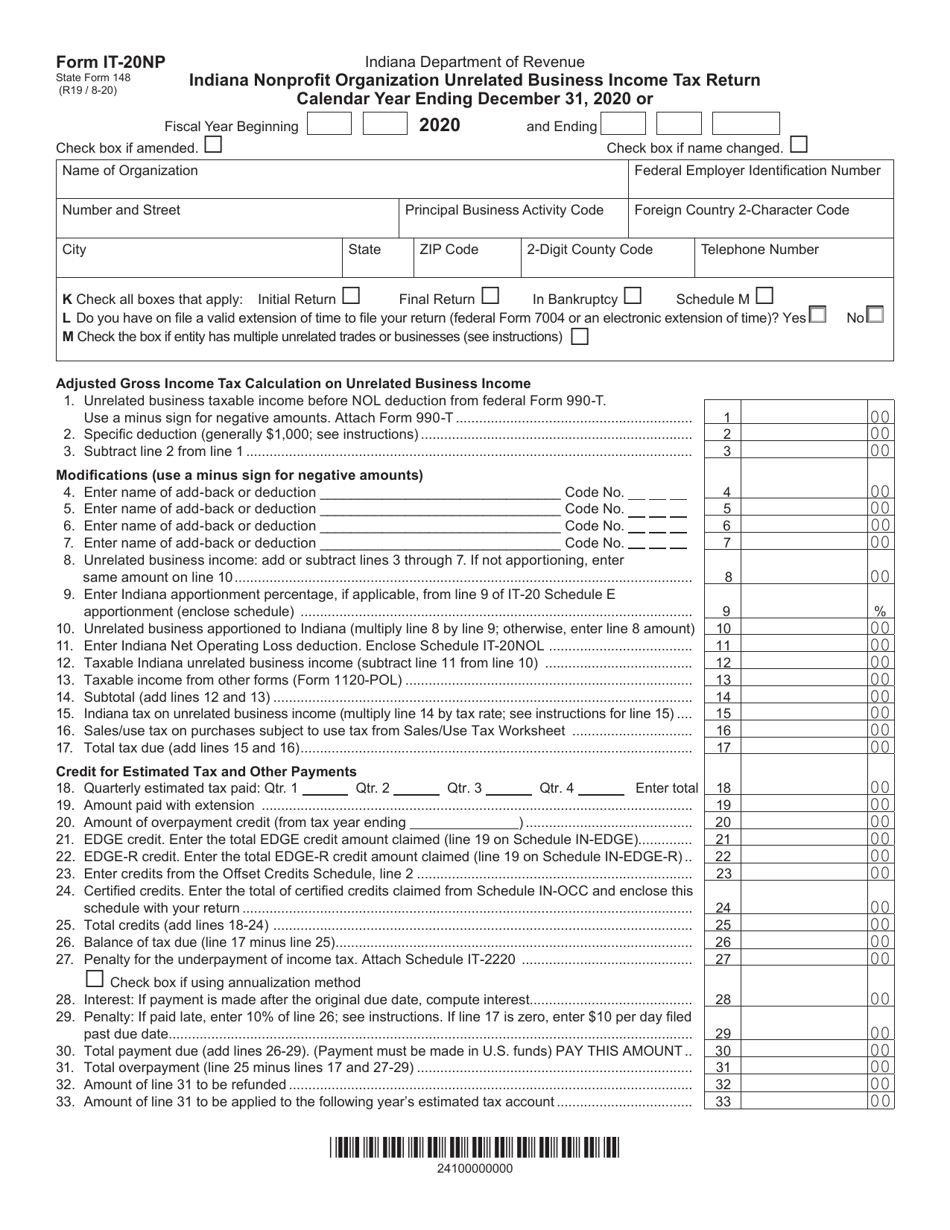

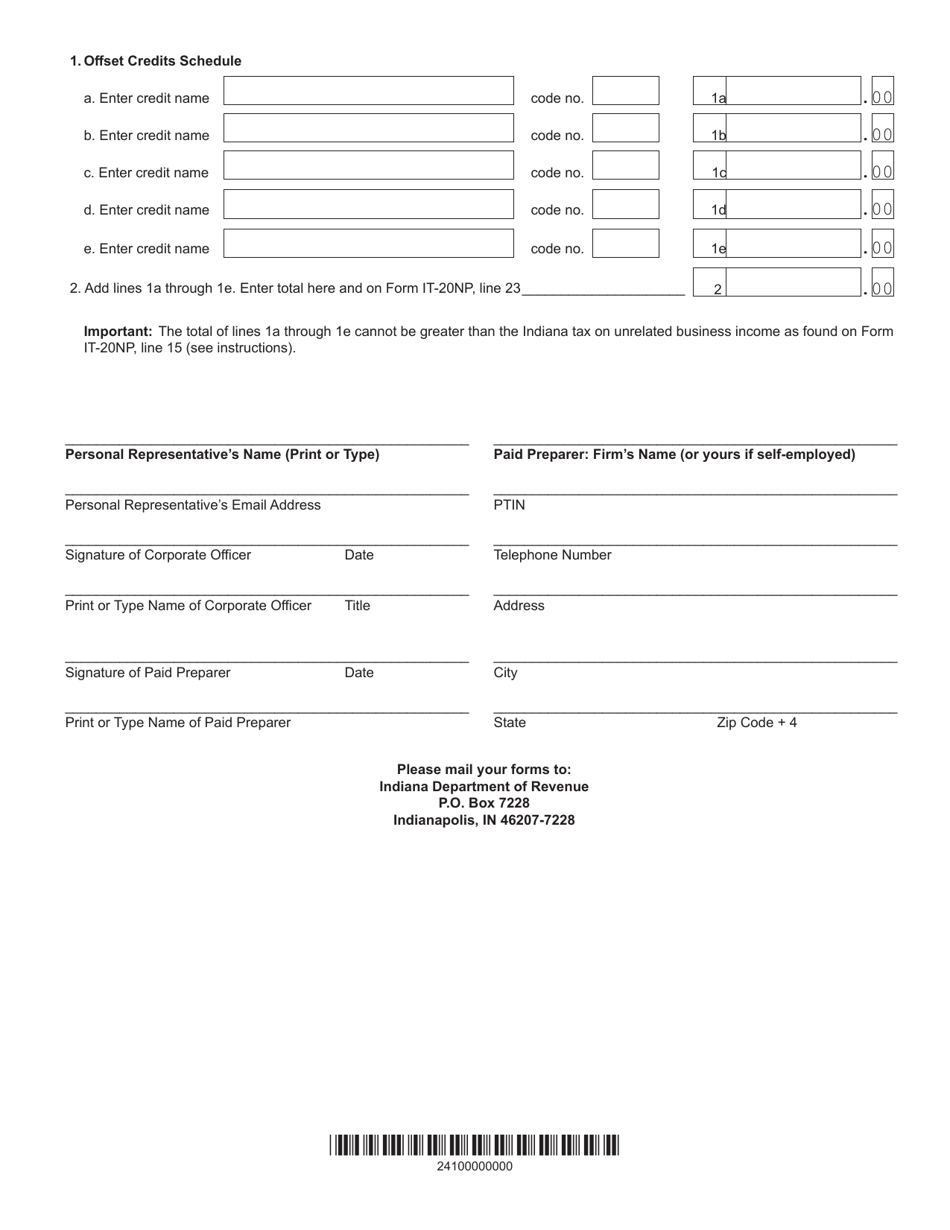

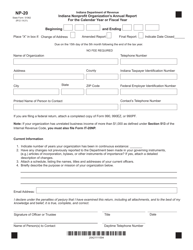

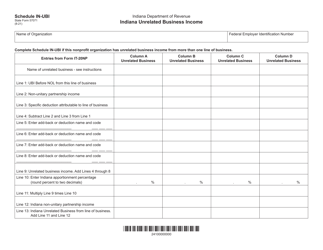

Form IT-20NP (State Form 148) Indiana Nonprofit Organization Unrelated Business Income Tax Return - Indiana

What Is Form IT-20NP (State Form 148)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-20NP?

A: Form IT-20NP is the Indiana Nonprofit OrganizationUnrelated Business Income Tax Return.

Q: What is State Form 148?

A: State Form 148 is another name for the Form IT-20NP.

Q: Who needs to file Form IT-20NP?

A: Nonprofit organizations in Indiana that have unrelated business income need to file Form IT-20NP.

Q: What is unrelated business income?

A: Unrelated business income refers to income earned by a nonprofit organization that is not related to its tax-exempt purpose.

Q: What is the purpose of Form IT-20NP?

A: The purpose of Form IT-20NP is to report and pay taxes on unrelated business income for nonprofit organizations in Indiana.

Q: Are there any penalties for late filing of Form IT-20NP?

A: Yes, there may be penalties for late filing of Form IT-20NP. It is best to file the form on time to avoid any penalties or interest charges.

Q: Are there any exemptions for nonprofit organizations filing Form IT-20NP?

A: Yes, there are exemptions available for certain types of nonprofit organizations. It is important to review the instructions for Form IT-20NP to determine if your organization qualifies for any exemptions.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-20NP (State Form 148) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.