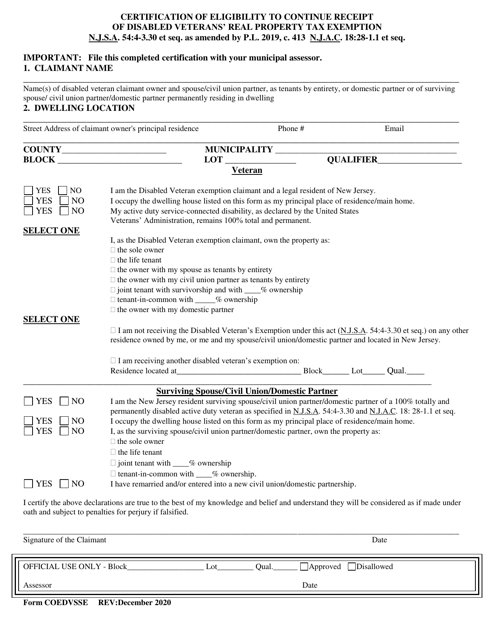

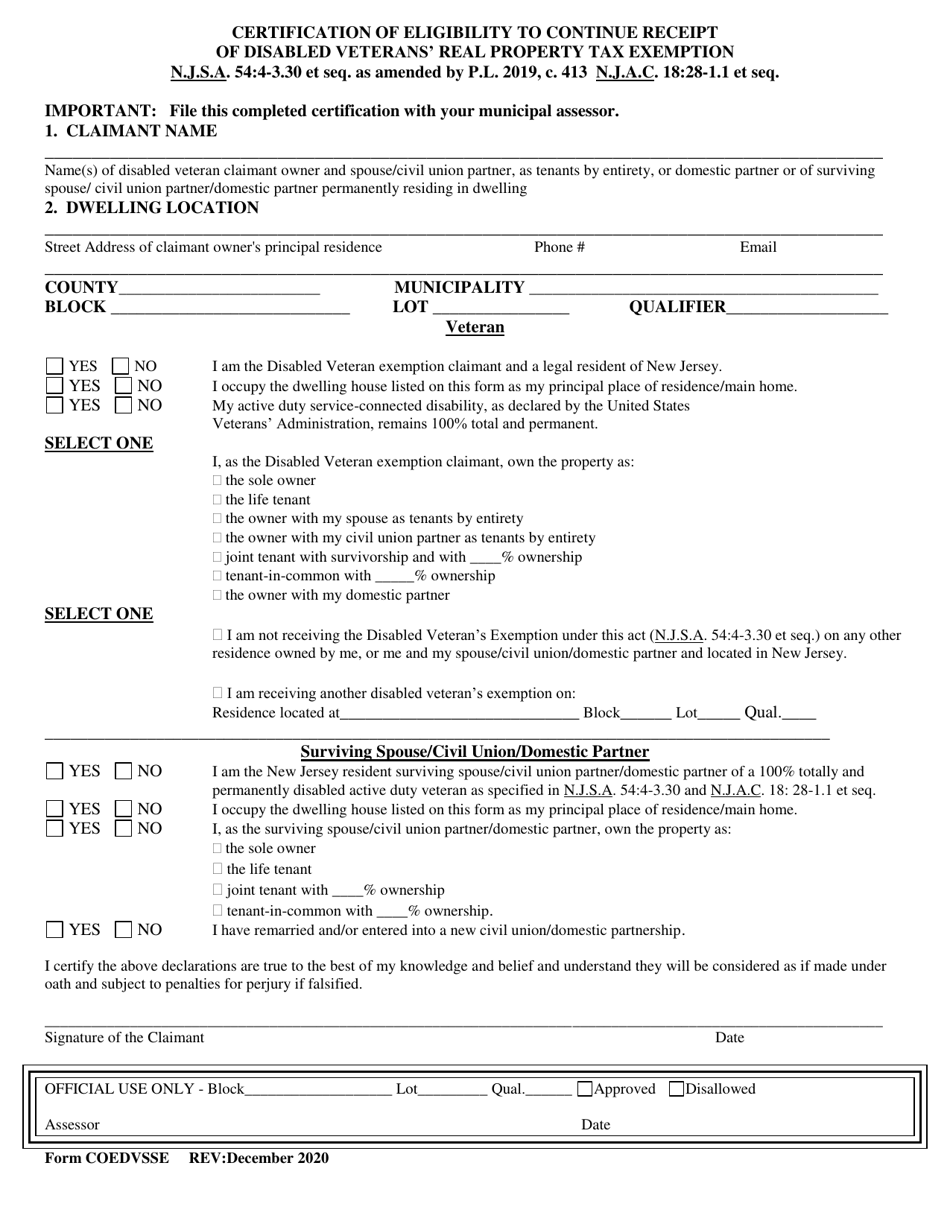

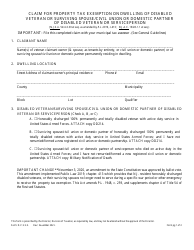

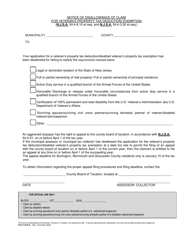

Form COEDVSSE Certification of Eligibility to Continue Receipt of Disabled Veterans' Real Property Tax Exemption - New Jersey

What Is Form COEDVSSE?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the COEDVSSE Certification?

A: The COEDVSSE Certification is a document used in New Jersey to continue receiving the Disabled Veterans' Real Property Tax Exemption.

Q: Who is eligible for the Disabled Veterans' Real Property Tax Exemption?

A: Disabled veterans who meet certain criteria can be eligible for the exemption.

Q: What is the purpose of the COEDVSSE Certification?

A: The purpose of the COEDVSSE Certification is to confirm that the disabled veteran is still eligible for the tax exemption.

Q: How can I obtain the COEDVSSE Certification?

A: You can obtain the COEDVSSE Certification from the local tax assessor's office or the county veterans service office.

Q: What information is required for the COEDVSSE Certification?

A: The COEDVSSE Certification requires information such as the veteran's name, address, disability rating, and proof of continued eligibility.

Q: When do I need to submit the COEDVSSE Certification?

A: The COEDVSSE Certification needs to be submitted annually, usually by January 15th.

Q: What happens if I don't submit the COEDVSSE Certification?

A: If you fail to submit the COEDVSSE Certification, you may lose your eligibility for the Disabled Veterans' Real Property Tax Exemption.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form COEDVSSE by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.