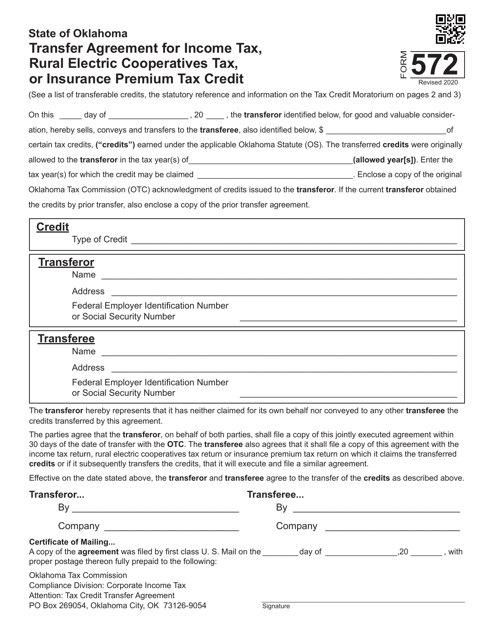

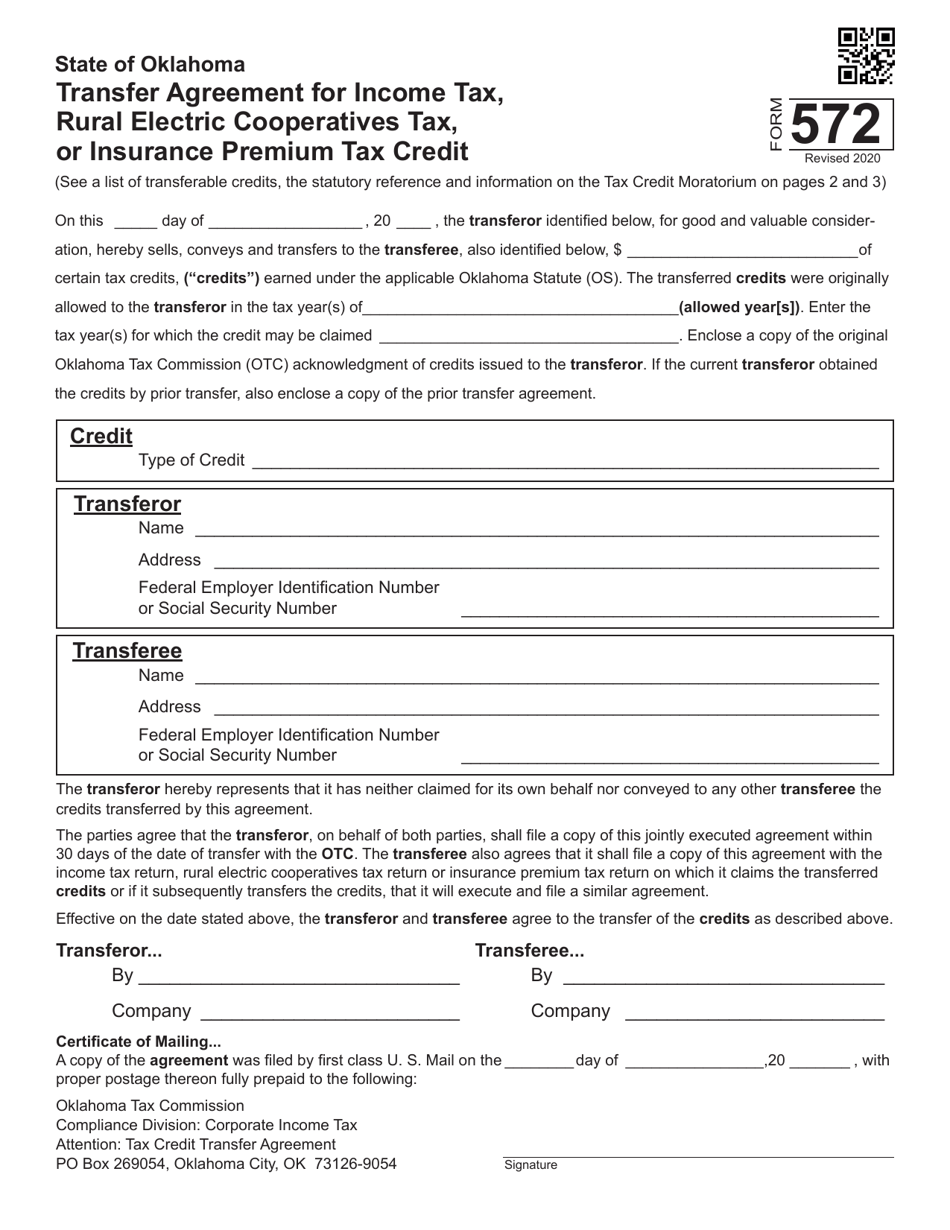

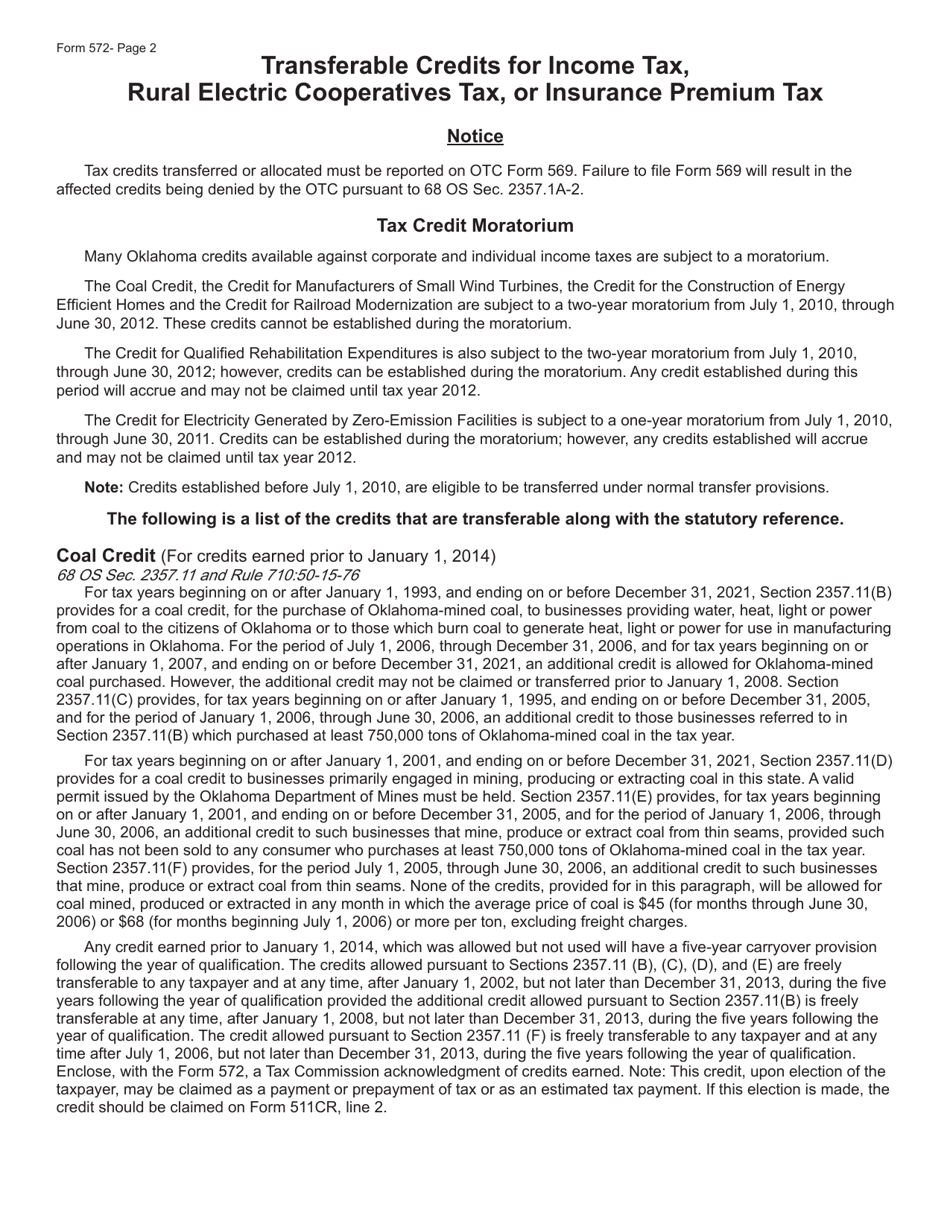

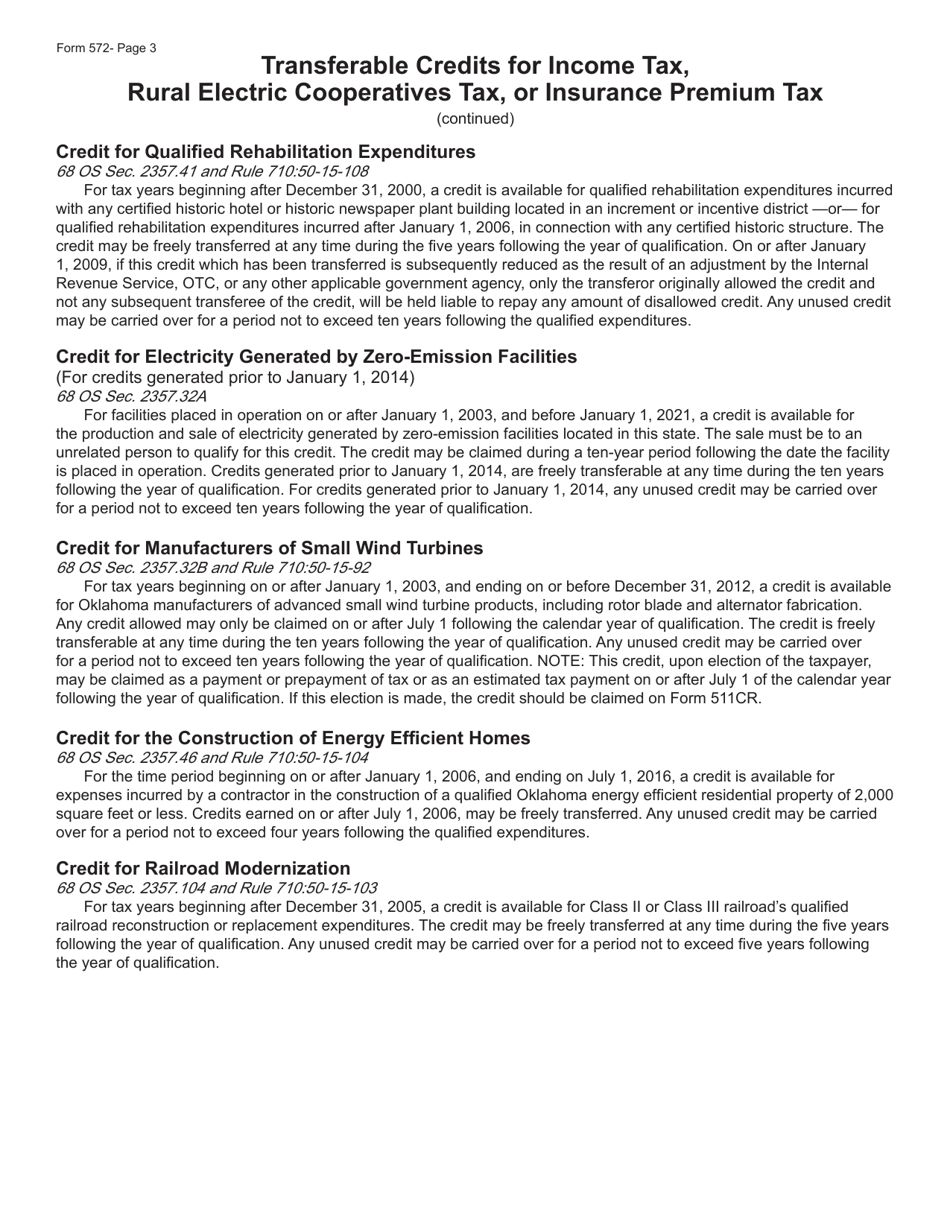

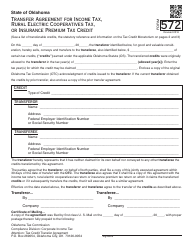

Form 572 Transfer Agreement for Income Tax, Rural Electric Cooperatives Tax, or Insurance Premium Tax Credit - Oklahoma

What Is Form 572?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 572?

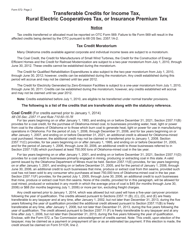

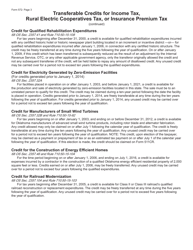

A: Form 572 is the Transfer Agreement for Income Tax, Rural Electric Cooperatives Tax, or Insurance PremiumTax Credit in Oklahoma.

Q: What is the purpose of Form 572?

A: The purpose of Form 572 is to transfer income tax credits, rural electric cooperatives tax credits, or insurance premium tax credits in Oklahoma.

Q: Who needs to file Form 572?

A: Form 572 needs to be filed by taxpayers who want to transfer their tax credits to another party.

Q: When should Form 572 be filed?

A: Form 572 should be filed at least 60 days before the transfer of the tax credits.

Q: Are there any fees associated with filing Form 572?

A: No, there are no fees associated with filing Form 572.

Q: What information is required on Form 572?

A: Form 572 requires information about the taxpayer, the recipient of the tax credits, and details of the transfer.

Q: Can I transfer tax credits to multiple parties using Form 572?

A: Yes, you can transfer tax credits to multiple parties using separate copies of Form 572 for each transfer.

Q: What should I do after completing Form 572?

A: After completing Form 572, you should submit it to the Oklahoma Tax Commission for processing.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 572 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.