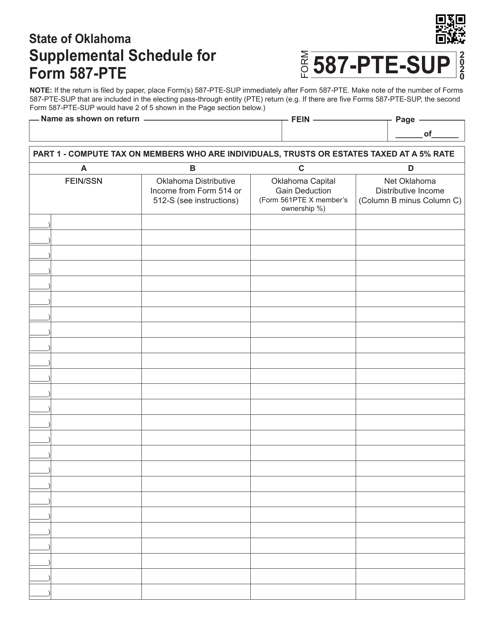

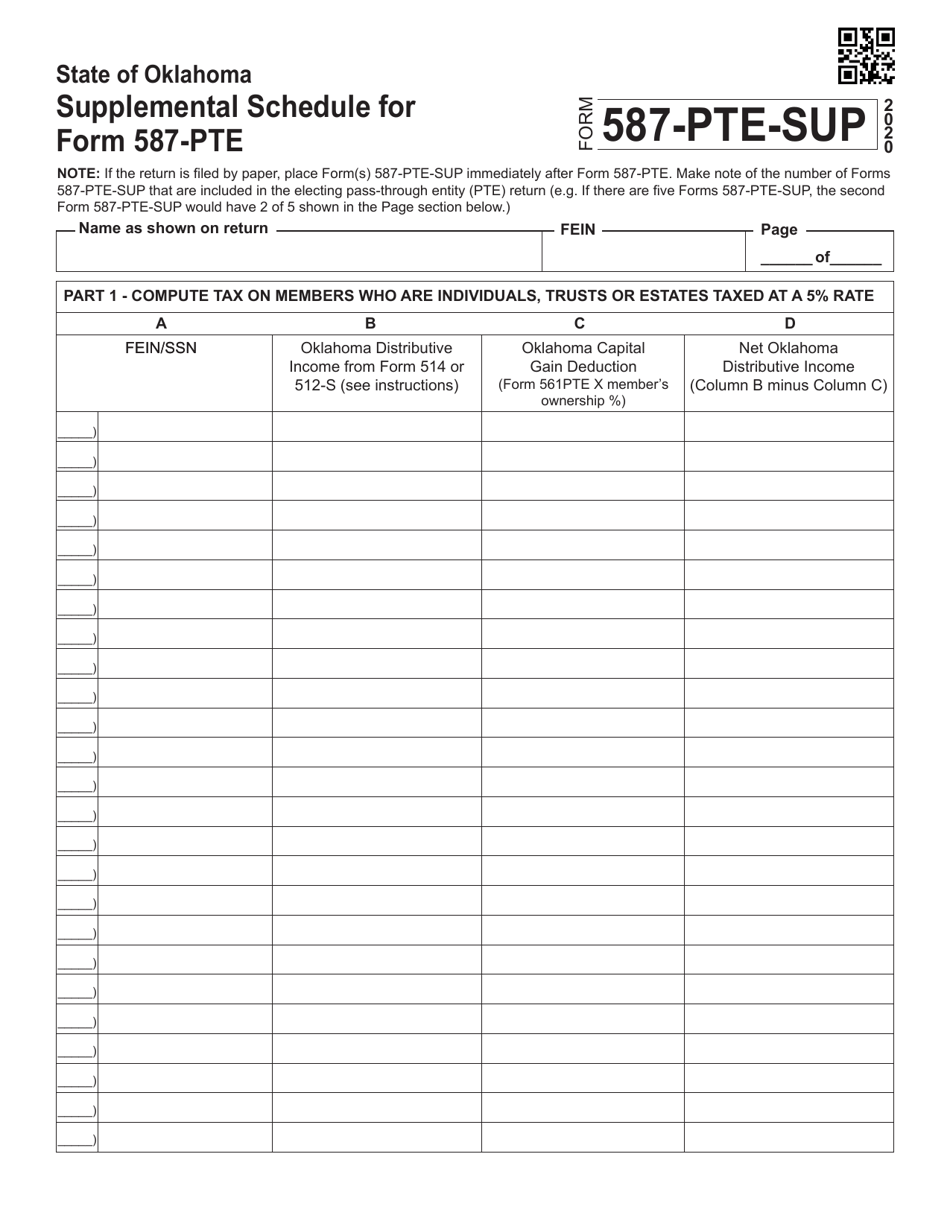

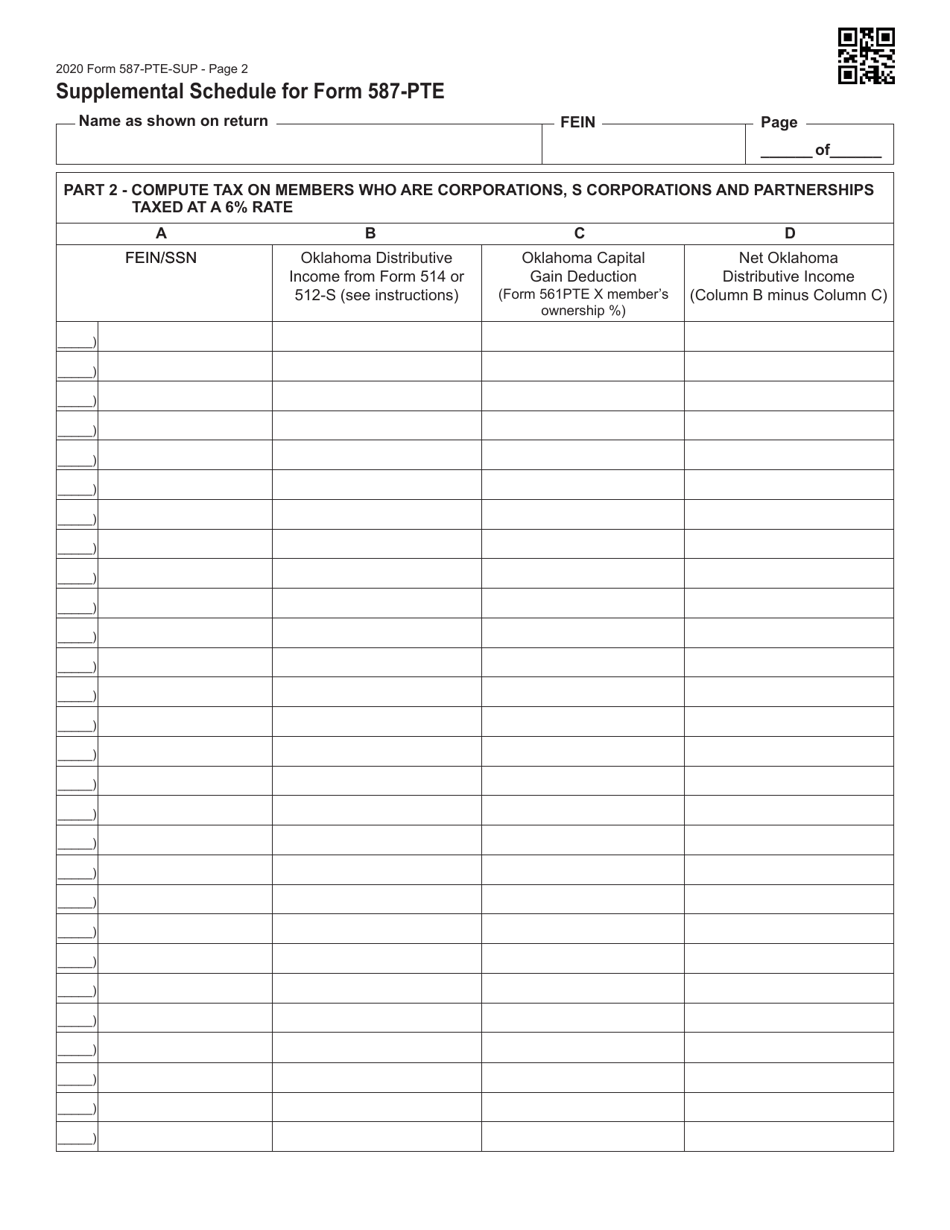

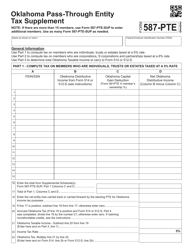

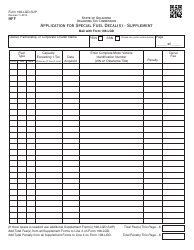

Form 587-PTE-SUP Supplement Schedule for Form 587-pte - Oklahoma

What Is Form 587-PTE-SUP?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 587-PTE-SUP?

A: Form 587-PTE-SUP is a supplement schedule for Form 587-PTE which is used in Oklahoma.

Q: What is Form 587-PTE used for?

A: Form 587-PTE is used to report and pay the tax due on the income or gain derived from the business activity of a pass-through entity in Oklahoma.

Q: Why is Form 587-PTE-SUP required?

A: Form 587-PTE-SUP is required to provide additional information and details about the income or gain reported on Form 587-PTE.

Q: Who needs to file Form 587-PTE-SUP?

A: The pass-through entity that files Form 587-PTE is required to file Form 587-PTE-SUP.

Q: When is the deadline to file Form 587-PTE-SUP?

A: Form 587-PTE-SUP is due on or before the 15th day of the fourth month following the close of the pass-through entity's tax year.

Q: Are there any penalties for not filing Form 587-PTE-SUP?

A: Yes, failure to file Form 587-PTE-SUP or filing it late may result in penalties and interest.

Q: Can Form 587-PTE-SUP be filed electronically?

A: Yes, Form 587-PTE-SUP can be filed electronically using the Oklahoma Taxpayer Access Point (OKTAP) system.

Q: What information is required on Form 587-PTE-SUP?

A: Form 587-PTE-SUP requires details about the pass-through entity's income or gain from specific sources and certain tax credits.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 587-PTE-SUP by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.