This version of the form is not currently in use and is provided for reference only. Download this version of

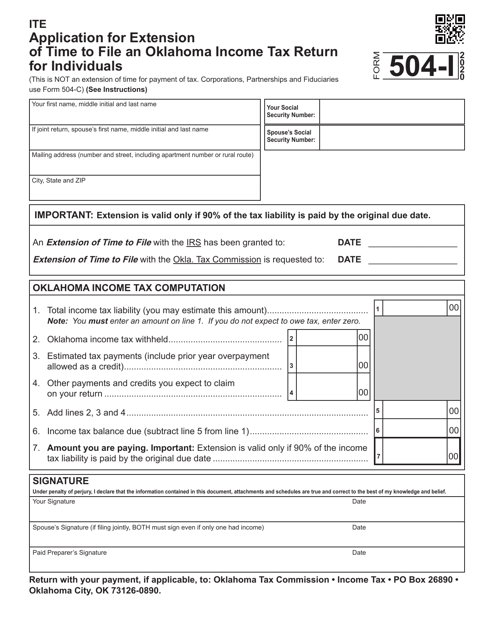

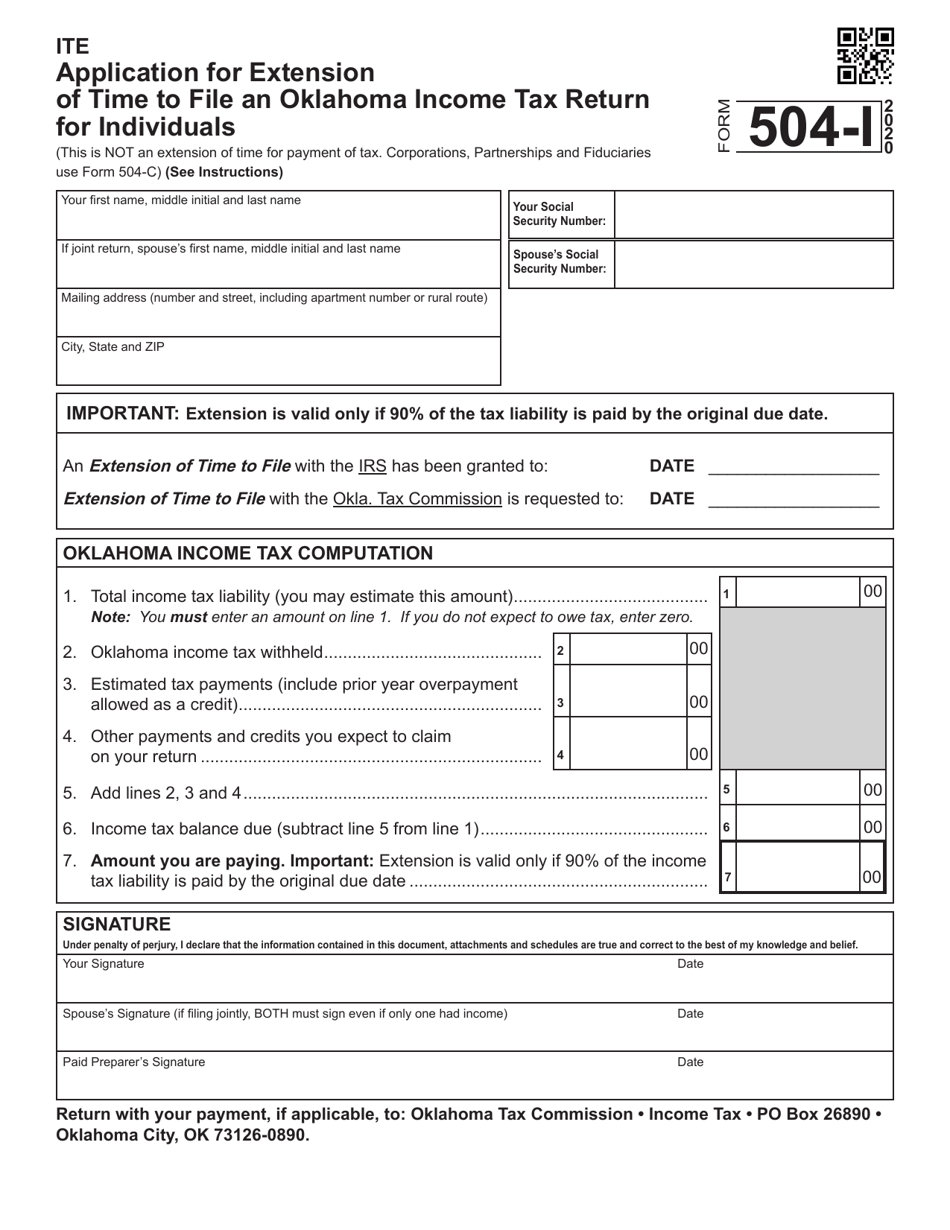

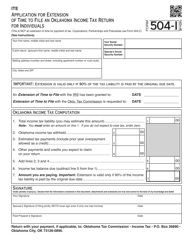

Form 504-I

for the current year.

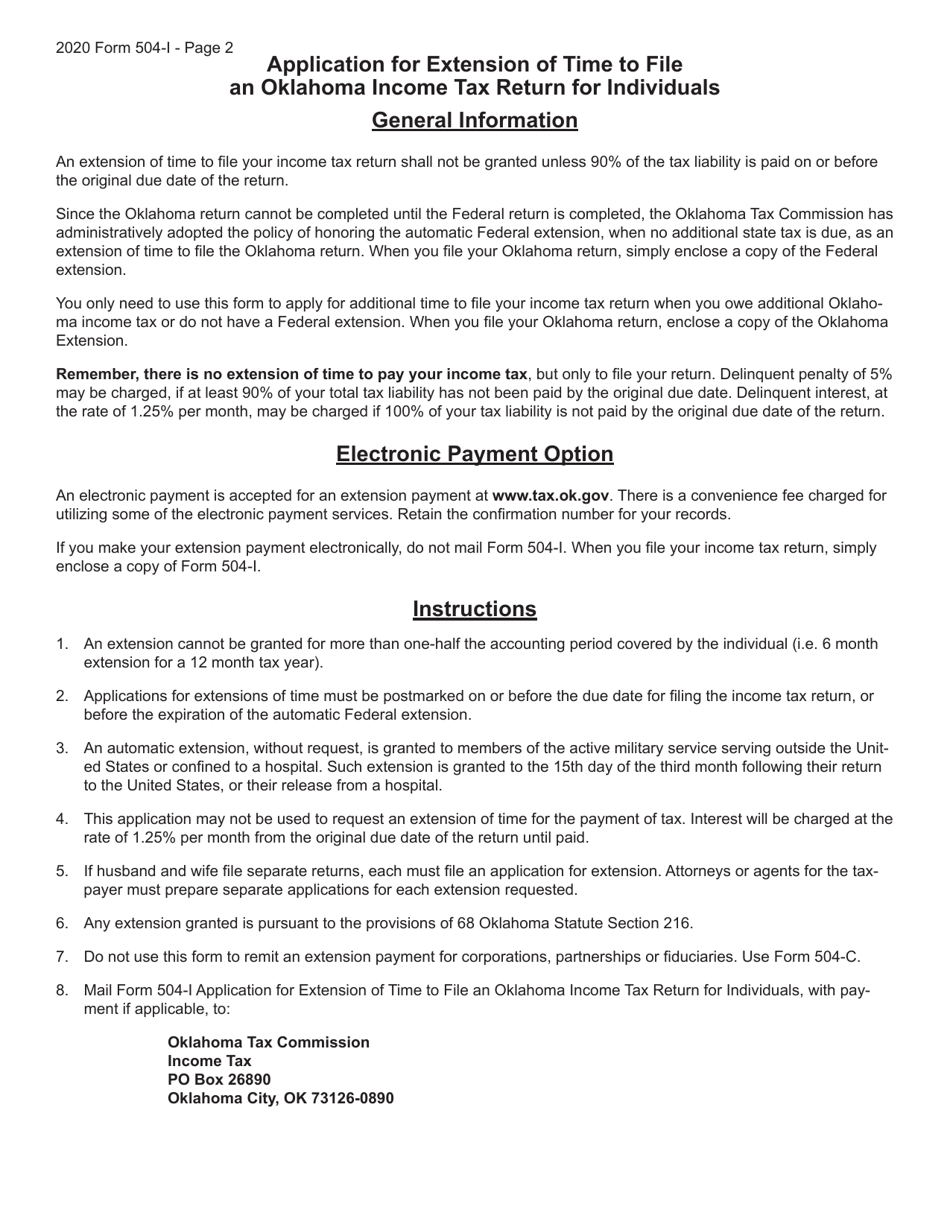

Form 504-I Application for Extension of Time to File an Oklahoma Income Tax Return for Individuals - Oklahoma

What Is Form 504-I?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 504-I?

A: Form 504-I is an Application for Extension of Time to File an Oklahoma Income Tax Return for Individuals.

Q: Who can use Form 504-I?

A: Individuals who need additional time to file their Oklahoma income tax return.

Q: What is the purpose of Form 504-I?

A: The purpose of Form 504-I is to request an extension of time to file your Oklahoma income tax return.

Q: How do I file Form 504-I?

A: You can file Form 504-I electronically through the Oklahoma Taxpayer Access Point (OKTAP) or by mail.

Q: What is the deadline to file Form 504-I?

A: Form 504-I must be filed on or before the original due date of your Oklahoma income tax return.

Q: How long of an extension does Form 504-I provide?

A: Form 504-I provides an extension of up to 6 months.

Q: Do I have to pay any estimated tax with Form 504-I?

A: Yes, if you expect to owe Oklahoma income tax, you must pay at least 90% of your total tax liability with Form 504-I.

Q: What happens if I don't file Form 504-I or pay my taxes by the original due date?

A: If you don't file Form 504-I or pay your taxes by the original due date, you may be subject to penalties and interest.

Q: Can I e-file my Oklahoma income tax return after filing Form 504-I?

A: Yes, you can e-file your Oklahoma income tax return after filing Form 504-I and receiving an extension.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 504-I by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.