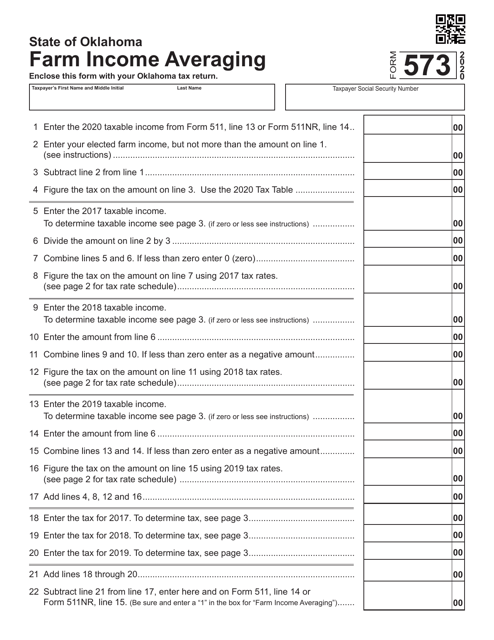

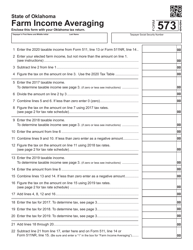

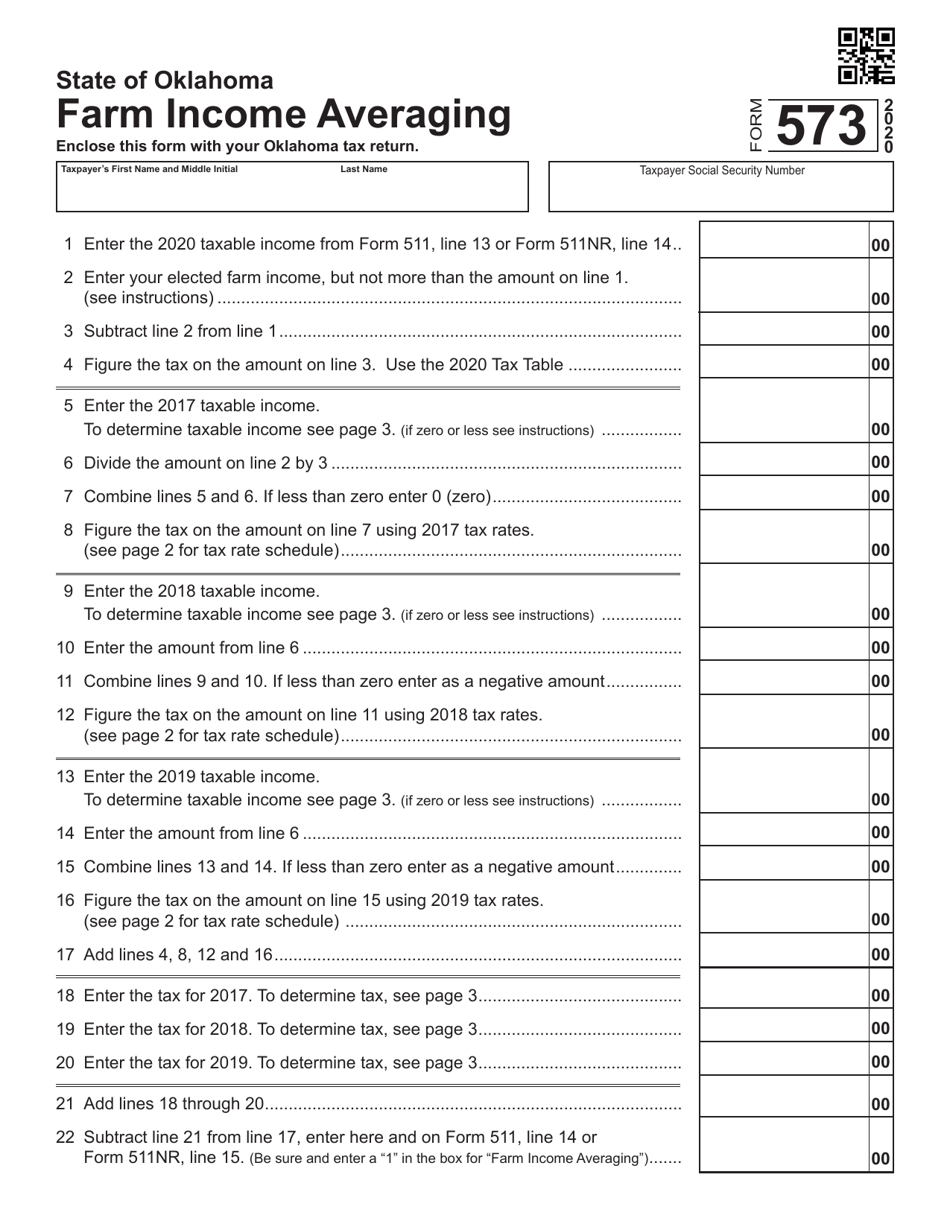

Form 573 Farm Income Averaging - Oklahoma

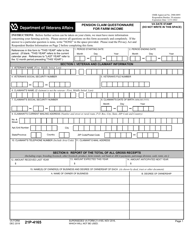

What Is Form 573?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 573 Farm Income Averaging?

A: Form 573 is an IRS tax form used by farmers in Oklahoma to calculate and report their income averaging for tax purposes.

Q: Who can use Form 573?

A: Form 573 is specifically designed for farmers in Oklahoma.

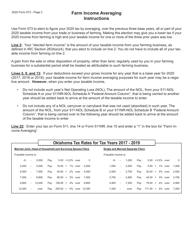

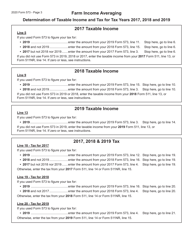

Q: What is income averaging?

A: Income averaging allows farmers to spread their income over several years, potentially reducing their overall tax liability.

Q: Why would a farmer choose to use income averaging?

A: Farmers may choose to use income averaging to smooth out fluctuations in their annual income and reduce their tax burden.

Q: When should Form 573 be filed?

A: Form 573 should be filed with the IRS by the due date of the taxpayer's tax return, usually April 15th.

Q: Are there any eligibility requirements for using income averaging?

A: Yes, farmers must meet certain criteria to be eligible for income averaging. They must have had income from the sale of livestock, crops, or other products in at least 3 of the past 5 years, and their current year's income must be less than their base year's income.

Q: Can only farmers in Oklahoma use income averaging?

A: No, income averaging is available to farmers in all states. However, Form 573 is specific to Oklahoma farmers.

Q: Is income averaging a guaranteed way to lower taxes?

A: Income averaging can help reduce taxes for farmers, but it depends on individual circumstances and income levels. It is best to consult with a tax professional to determine if it is beneficial for your specific situation.

Q: What other tax benefits are available for farmers?

A: There are several other tax benefits available for farmers, such as deductions for farm-related expenses, depreciation of farm assets, and tax credits for certain activities like conservation or renewable energy production. It is advisable to consult with a tax professional to fully understand and take advantage of these benefits.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 573 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.