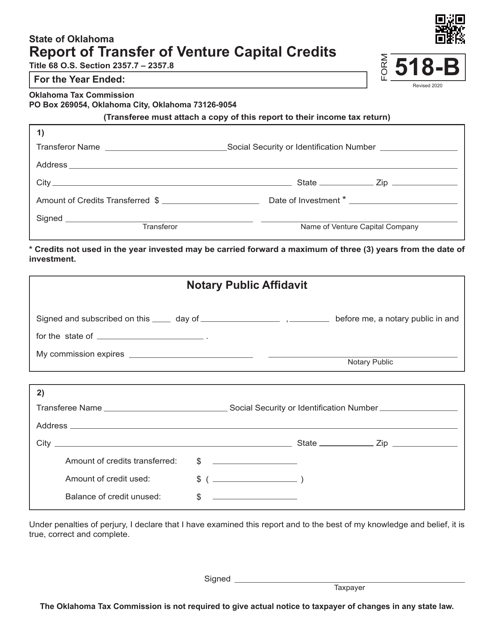

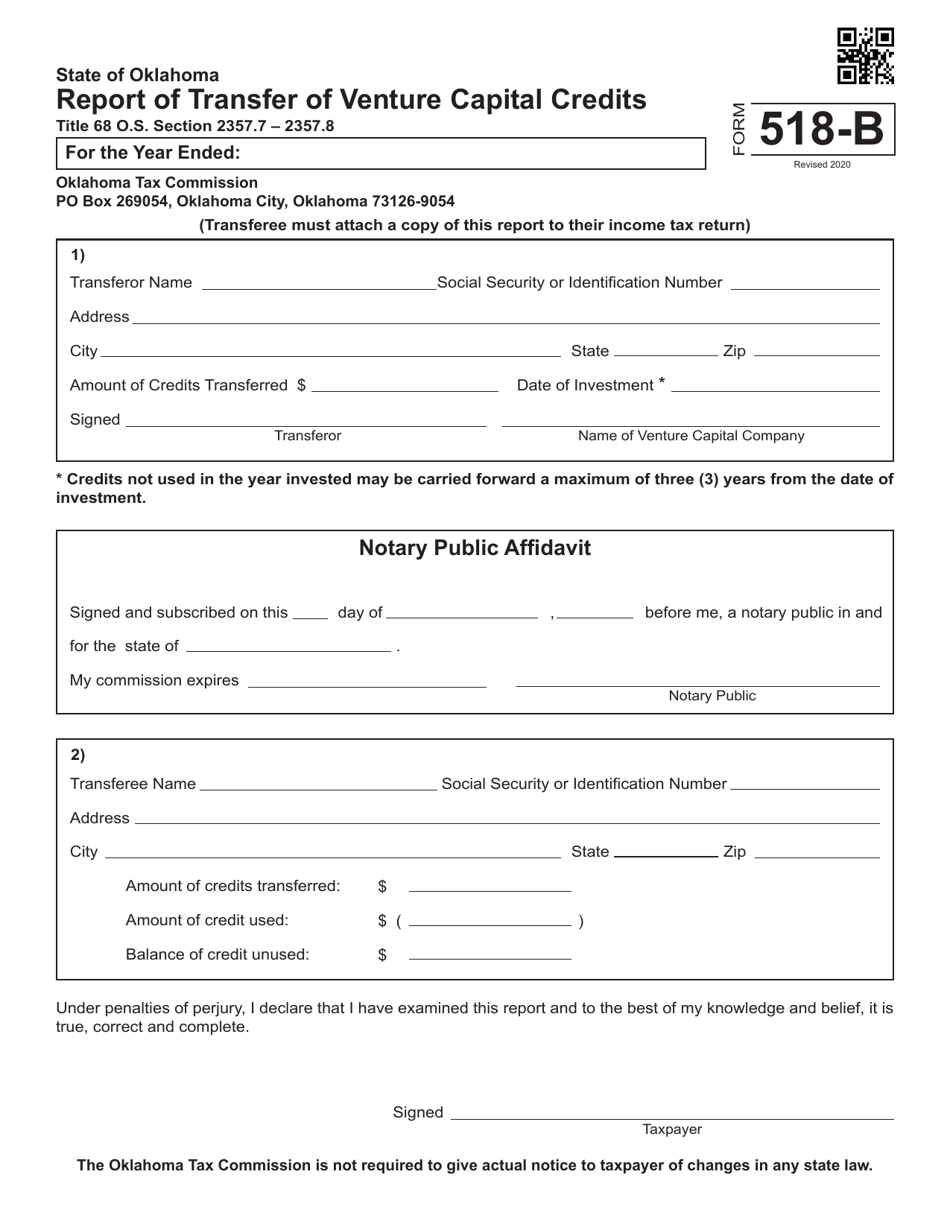

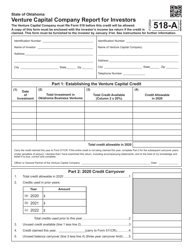

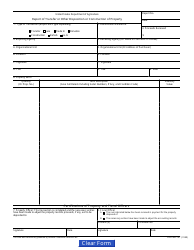

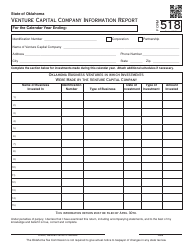

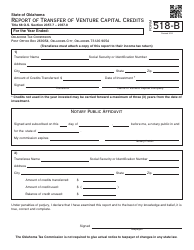

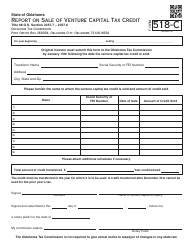

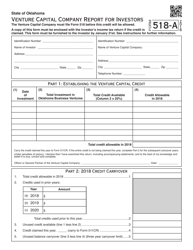

Form 518-B Report of Transfer of Venture Capital Credits - Oklahoma

What Is Form 518-B?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 518-B?

A: Form 518-B is a report used in Oklahoma to document the transfer of venture capital credits.

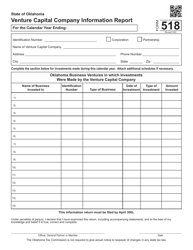

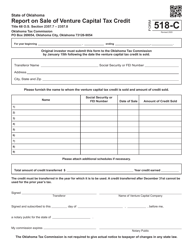

Q: What is a venture capital credit?

A: Venture capital credits are tax credits provided by the state to encourage investment in certain industries.

Q: Who needs to file Form 518-B?

A: Anyone transferring venture capital credits in Oklahoma needs to file Form 518-B.

Q: When should Form 518-B be filed?

A: Form 518-B should be filed within 30 days of the transfer of venture capital credits.

Q: Are there any fees associated with filing Form 518-B?

A: There are no fees associated with filing Form 518-B.

Q: What information is required on Form 518-B?

A: Form 518-B requires information about the transferor and transferee, details of the transfer, and verification of the transferor's tax liability.

Q: What are the consequences of not filing Form 518-B?

A: Failure to file Form 518-B may result in penalties and interest charges.

Q: Is Form 518-B specific to Oklahoma?

A: Yes, Form 518-B is specific to Oklahoma and is not used in any other state.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 518-B by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.