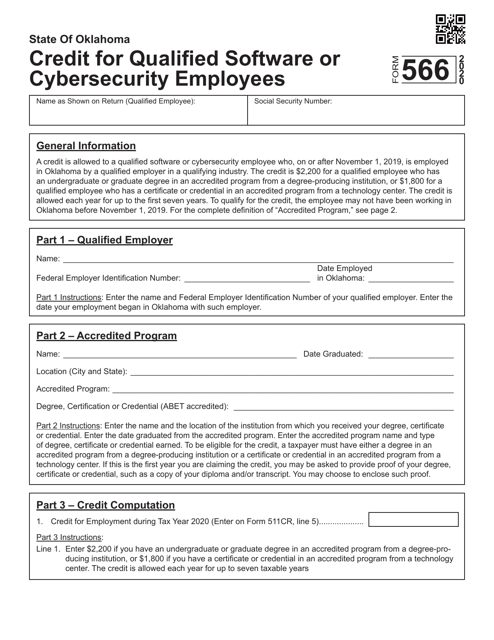

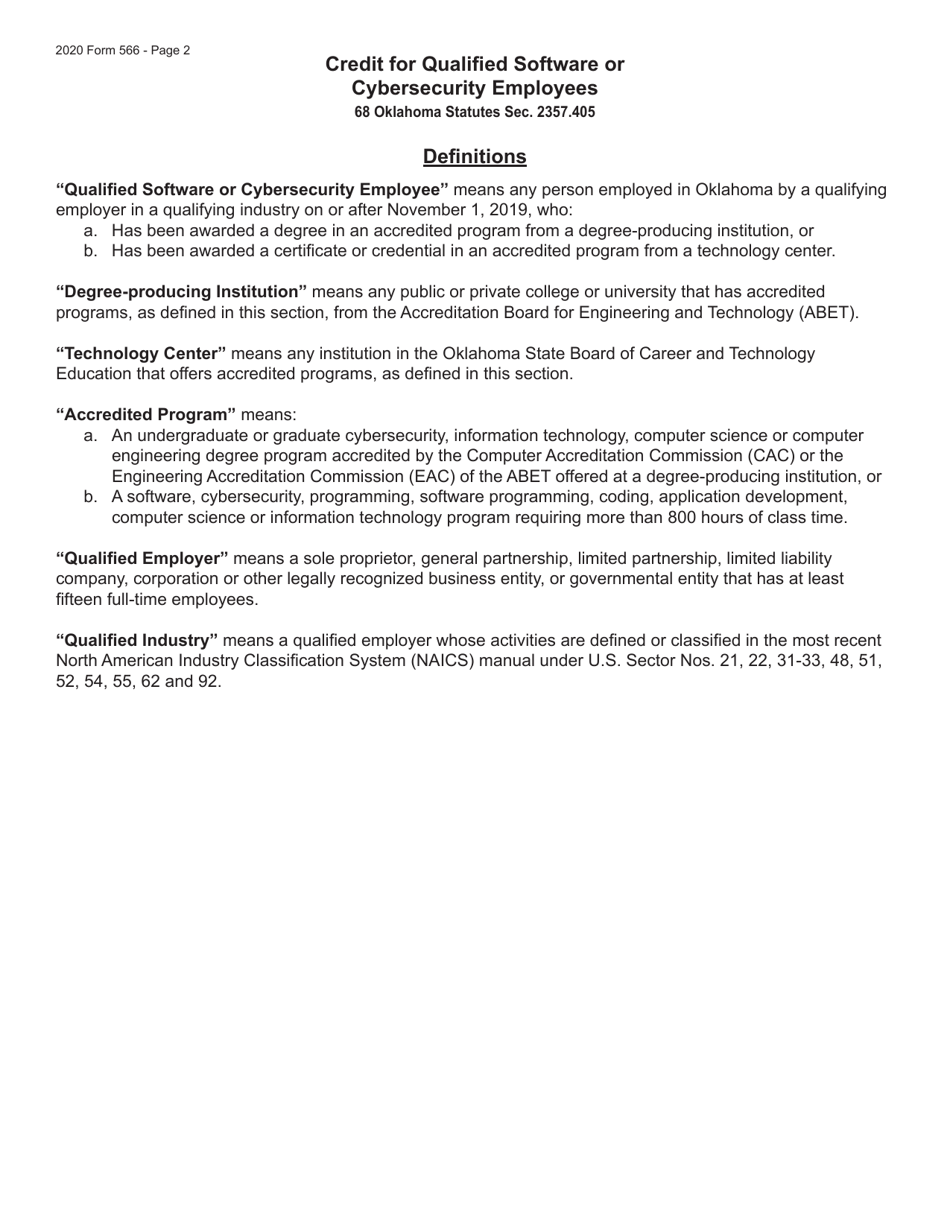

Form 566 Credit for Qualified Software or Cybersecurity Employees - Oklahoma

What Is Form 566?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 566?

A: Form 566 is the Credit for Qualified Software or Cybersecurity Employees - Oklahoma.

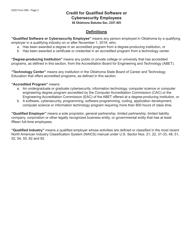

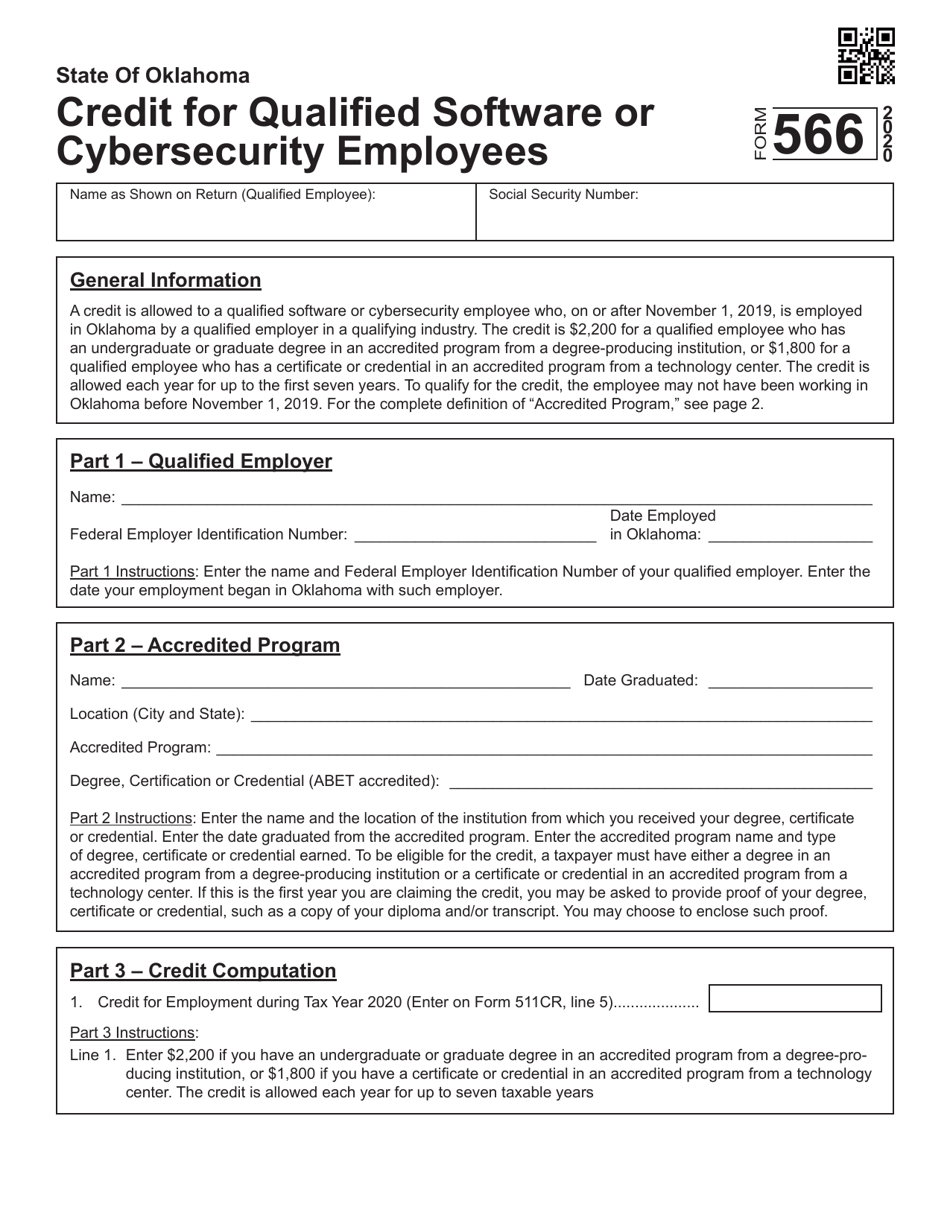

Q: Who can claim the credit?

A: Qualified employers in Oklahoma can claim the credit.

Q: What is the purpose of the credit?

A: The credit aims to encourage the growth of technology and cybersecurity industries in Oklahoma.

Q: What are the eligibility criteria for the credit?

A: To be eligible, employers must meet certain requirements, such as having qualified employees and being engaged in software or cybersecurity activities.

Q: How much is the credit?

A: The credit amount varies depending on the number of qualified employees and their compensation.

Q: What is the process to claim the credit?

A: Employers must complete and file Form 566 with the Oklahoma Tax Commission.

Q: Are there any deadlines for claiming the credit?

A: Yes, employers must file Form 566 by the 15th day of the fourth month following the close of the tax year.

Q: Is the credit refundable?

A: No, the credit is non-refundable but can be carried forward for up to five years.

Q: Can the credit be transferred?

A: No, the credit cannot be transferred to another employer.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 566 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.