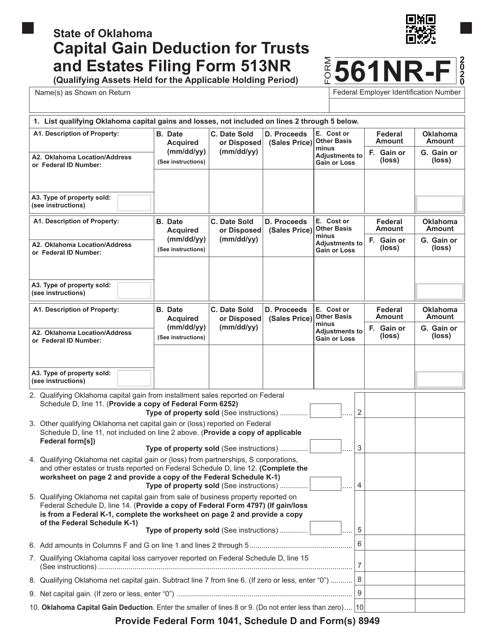

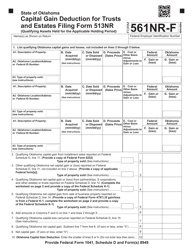

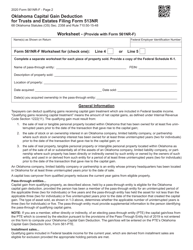

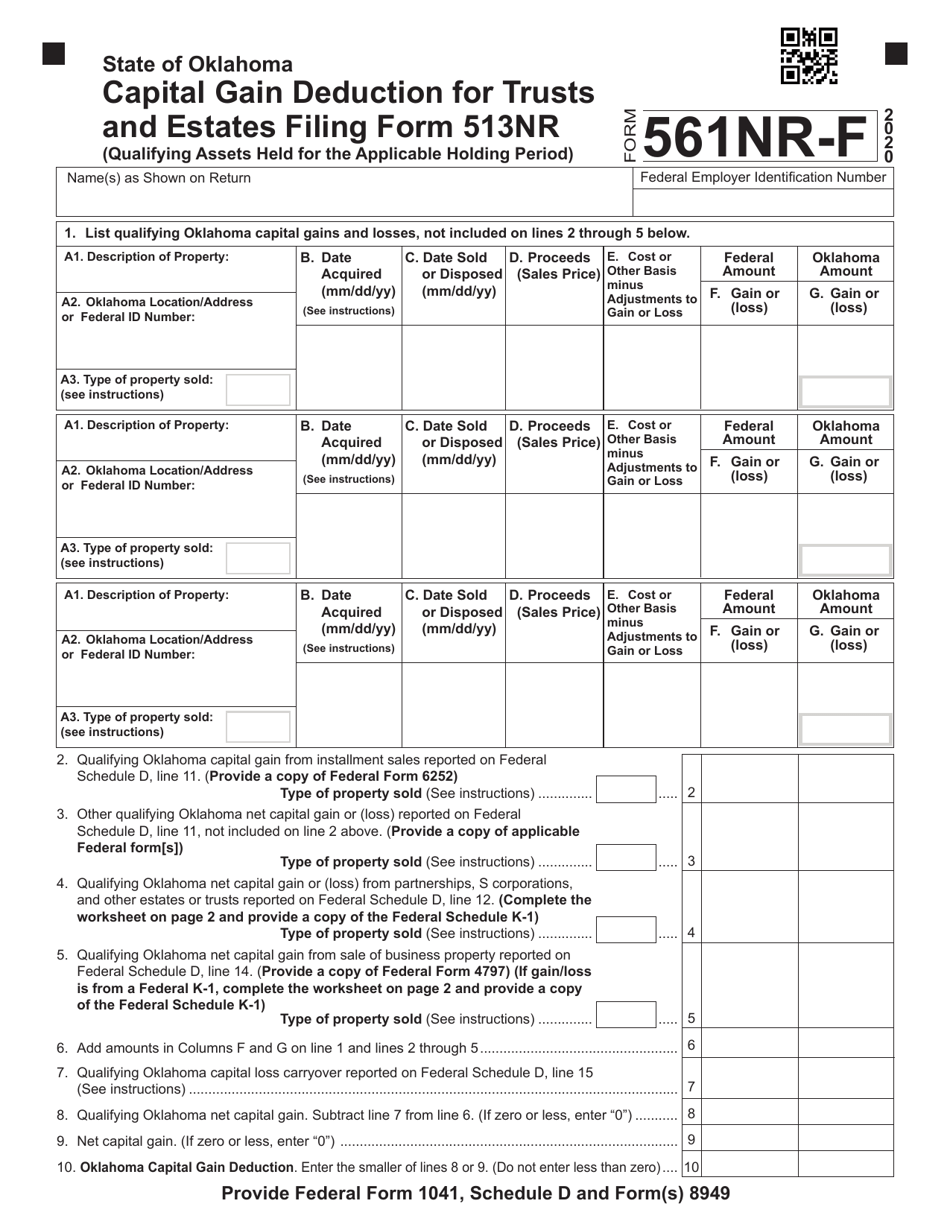

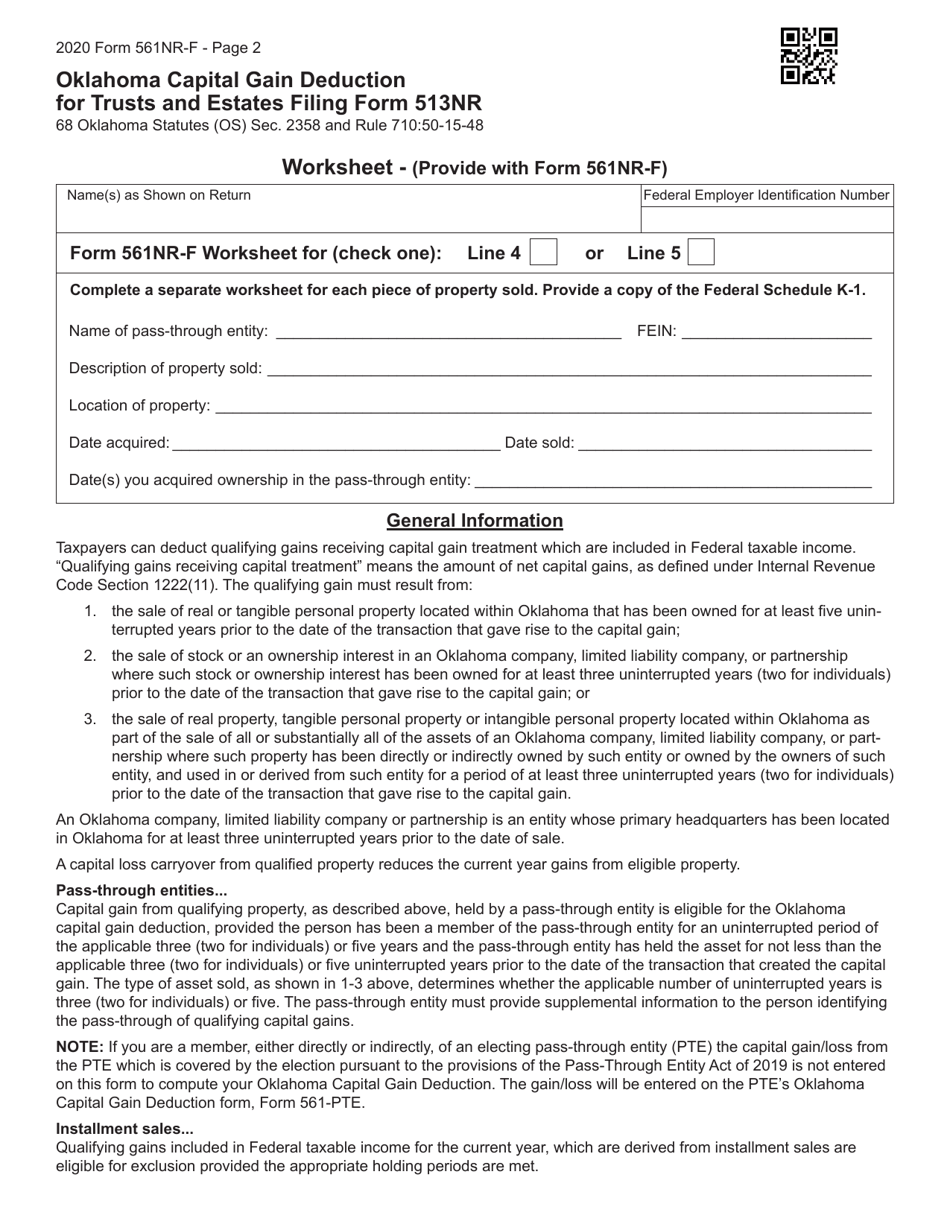

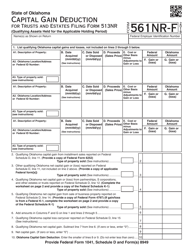

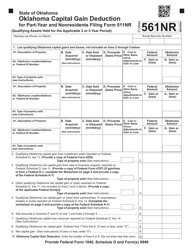

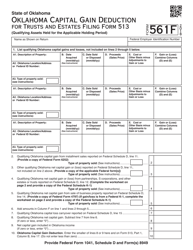

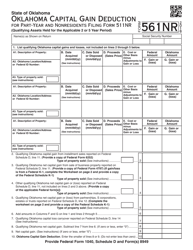

Form 561NR-F Capital Gain Deduction for Trusts and Estates Filing Form 513nr - Oklahoma

What Is Form 561NR-F?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 561NR-F?

A: Form 561NR-F is the Capital Gain Deduction for Trusts and Estates filing Form 513NR in Oklahoma.

Q: What is the purpose of Form 561NR-F?

A: The purpose of Form 561NR-F is to claim a capital gain deduction for trusts and estates in Oklahoma.

Q: Who is eligible to file Form 561NR-F?

A: Trusts and estates that are filing Form 513NR in Oklahoma may be eligible to file Form 561NR-F.

Q: What is the capital gain deduction?

A: The capital gain deduction is a tax deduction that can reduce the taxable capital gains of a trust or estate.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

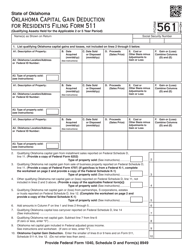

Download a fillable version of Form 561NR-F by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.