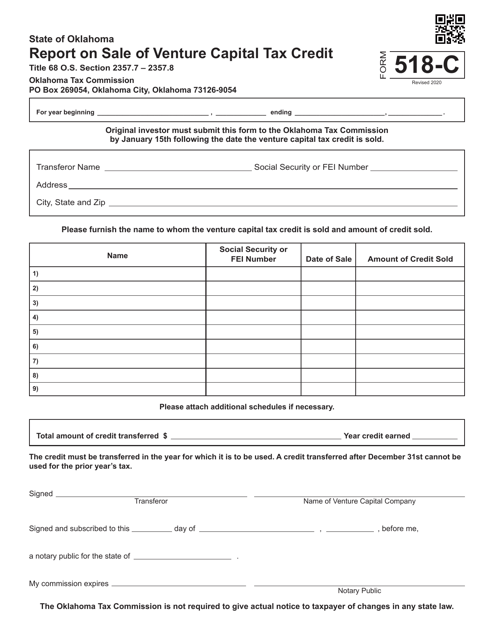

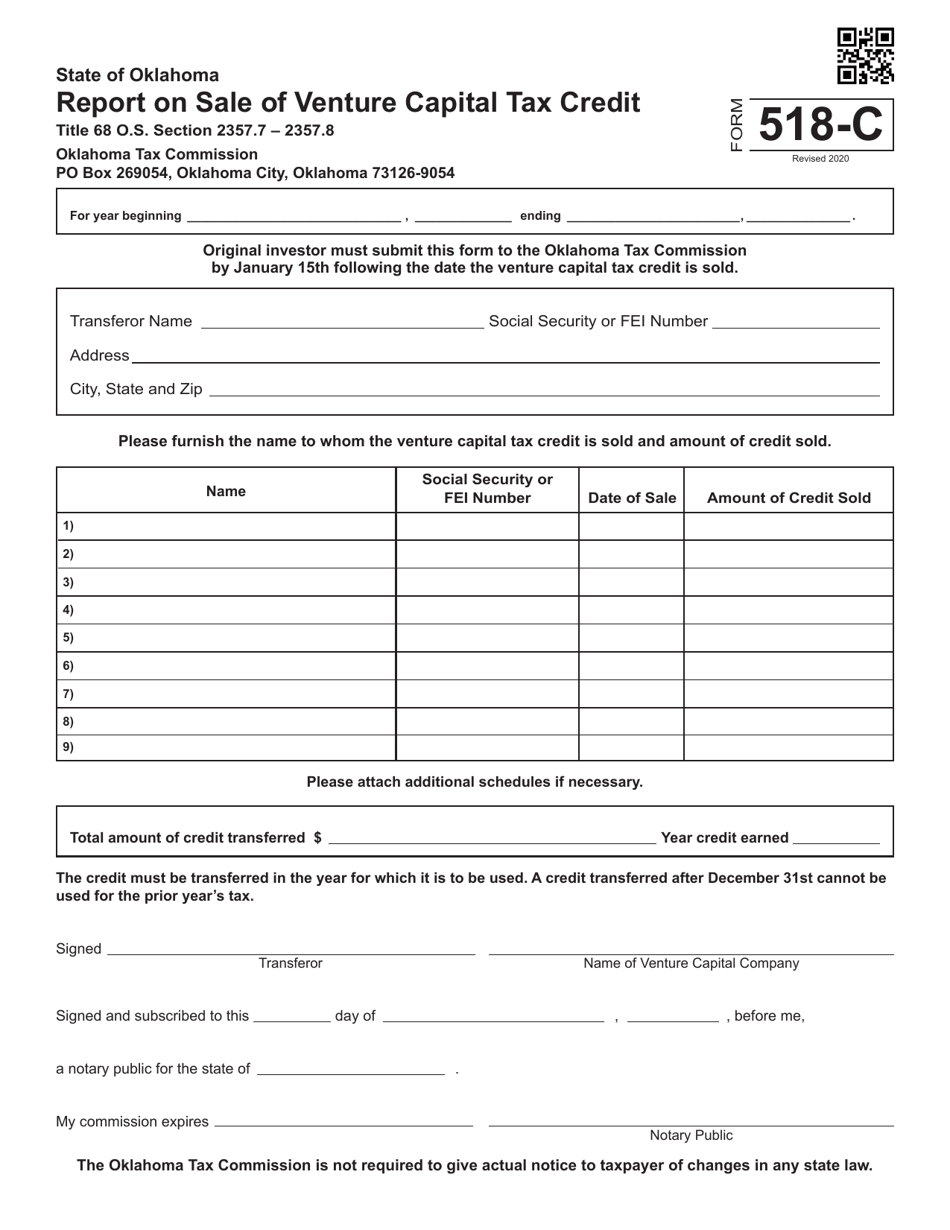

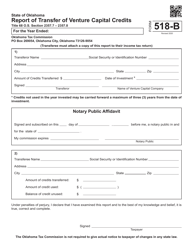

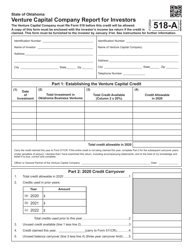

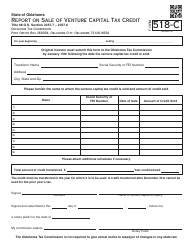

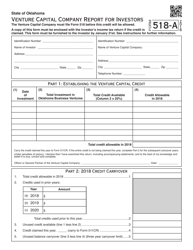

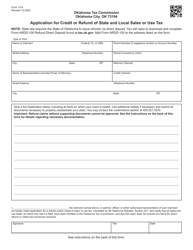

Form 518-C Report on Sale of Venture Capital Tax Credit - Oklahoma

What Is Form 518-C?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 518-C?

A: The Form 518-C is a report on the sale of venture capital tax credit in Oklahoma.

Q: What is the purpose of Form 518-C?

A: The purpose of Form 518-C is to report the sale of venture capitaltax credits in Oklahoma.

Q: Who needs to file Form 518-C?

A: Anyone who has sold venture capital tax credits in Oklahoma needs to file Form 518-C.

Q: Are there any fees associated with filing Form 518-C?

A: There are no fees associated with filing Form 518-C.

Q: When is the deadline to file Form 518-C?

A: The deadline to file Form 518-C is typically March 1st of the year following the sale of the venture capital tax credits.

Q: What information do I need to provide on Form 518-C?

A: You need to provide information about the buyer, seller, and details of the sale of the venture capital tax credits on Form 518-C.

Q: What happens after I file Form 518-C?

A: After you file Form 518-C, the Oklahoma Tax Commission will review your submission and process the sale of the venture capital tax credits.

Q: Is there any penalty for not filing Form 518-C?

A: Yes, there may be penalties for not filing Form 518-C, including late fees and interest charges.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 518-C by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.