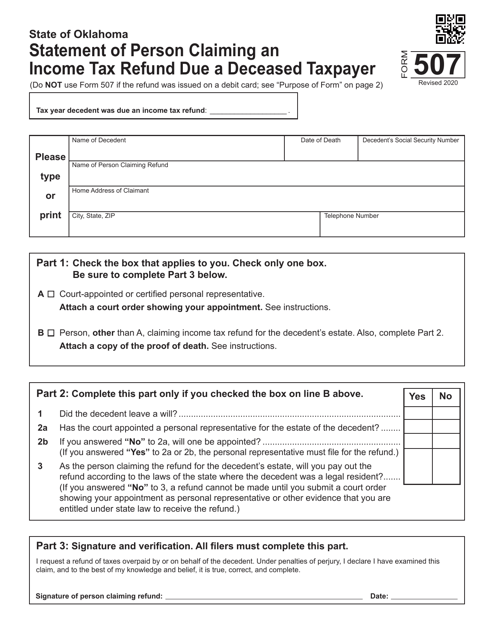

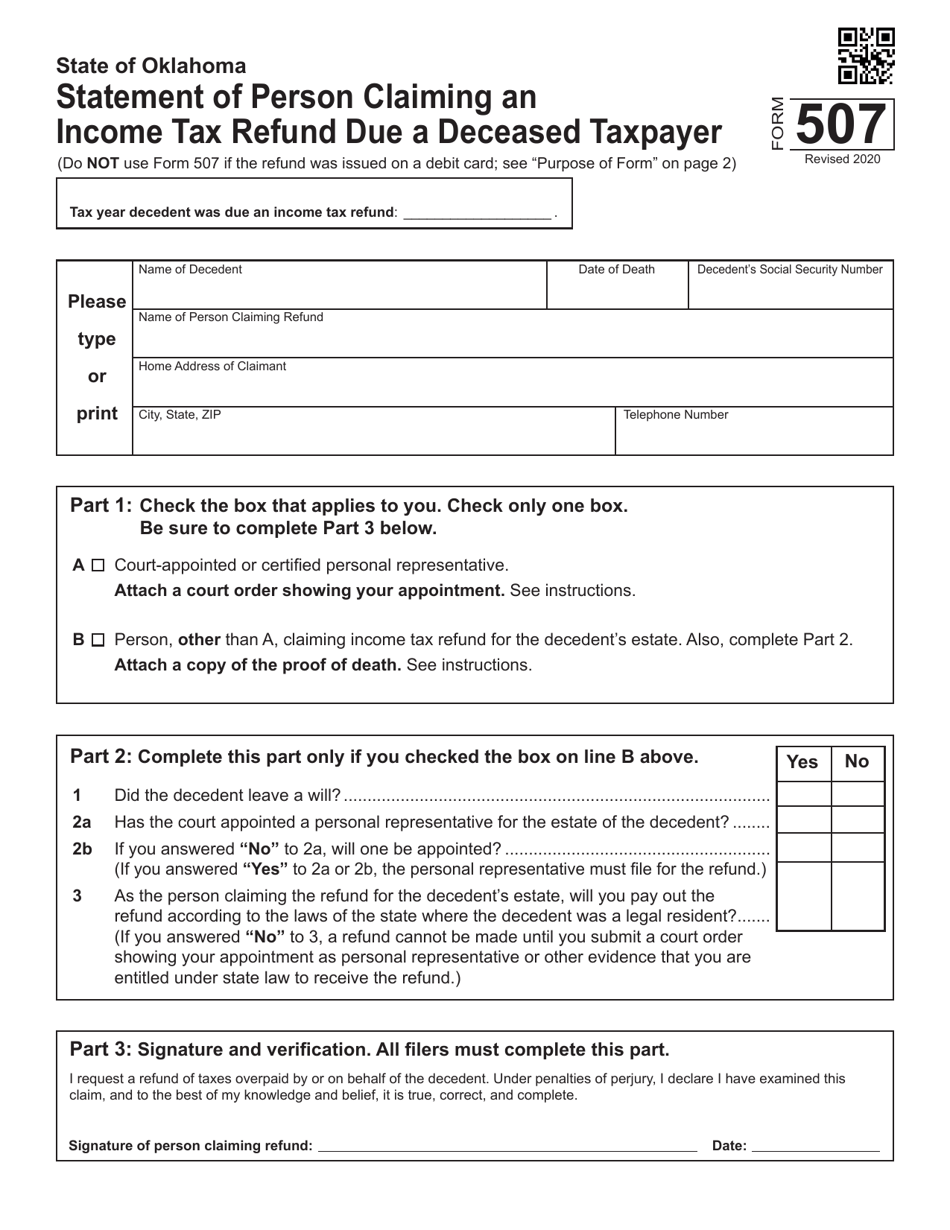

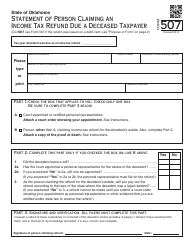

Form 507 Statement of Person Claiming an Income Tax Refund Due a Deceased Taxpayer - Oklahoma

What Is Form 507?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 507?

A: Form 507 is a statement used by a person claiming an income tax refund that was due to a deceased taxpayer in Oklahoma.

Q: Who can use Form 507?

A: Any person who is claiming an income tax refund that was due to a deceased taxpayer in Oklahoma can use Form 507.

Q: What information is required on Form 507?

A: Form 507 requires information such as the deceased taxpayer's name, social security number, date of death, and information about the person claiming the refund.

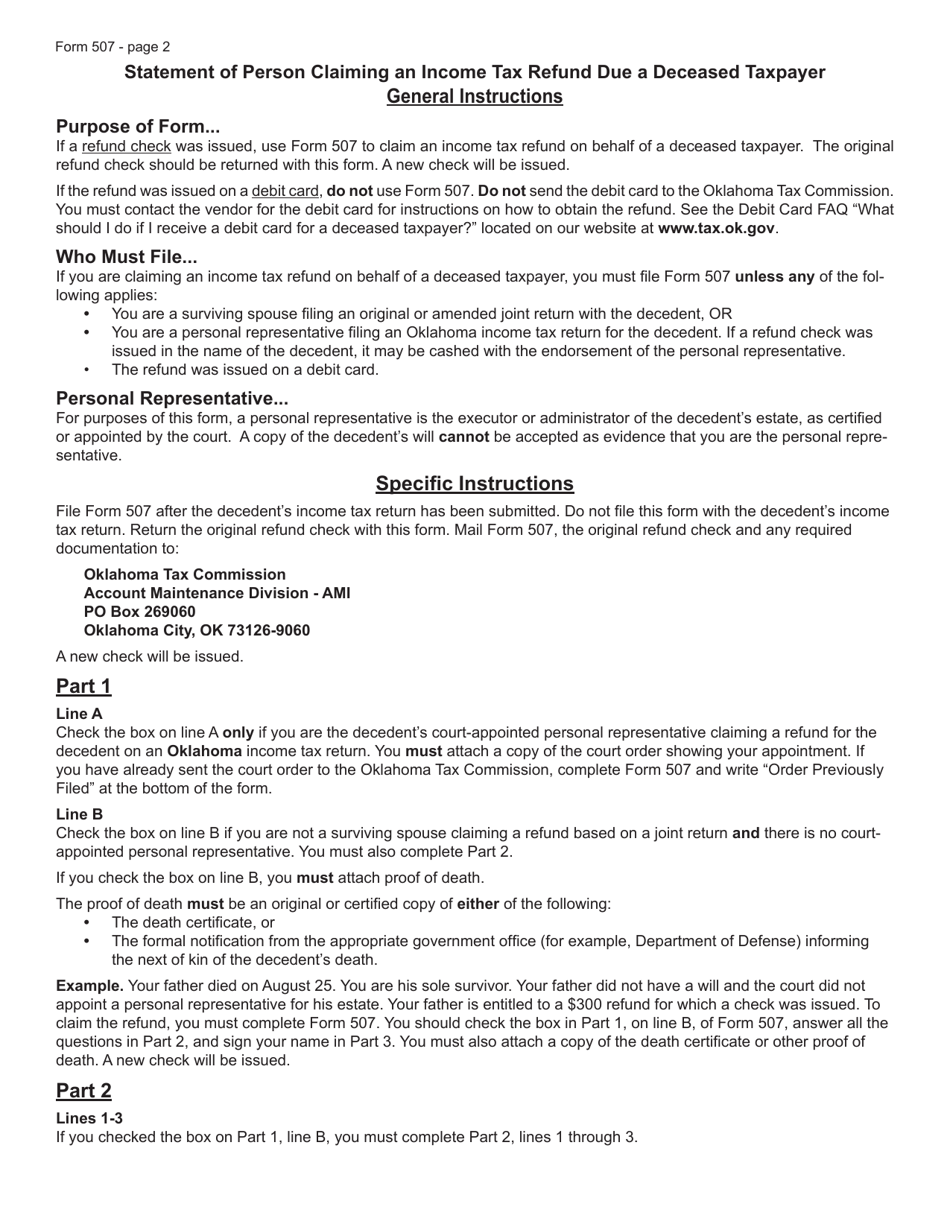

Q: Is there a deadline for filing Form 507?

A: Yes, Form 507 must be filed within three years from the due date of the original tax return or two years from the date of payment, whichever is later.

Q: Can I e-file Form 507?

A: No, Form 507 can only be filed by mail.

Q: What if I have additional questions about Form 507?

A: If you have additional questions about Form 507, you can contact the Oklahoma Tax Commission for assistance.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 507 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.