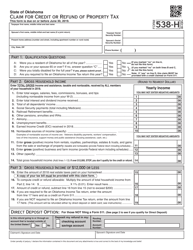

This version of the form is not currently in use and is provided for reference only. Download this version of

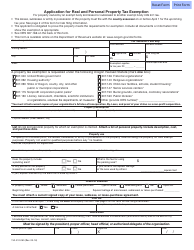

Form 538-H

for the current year.

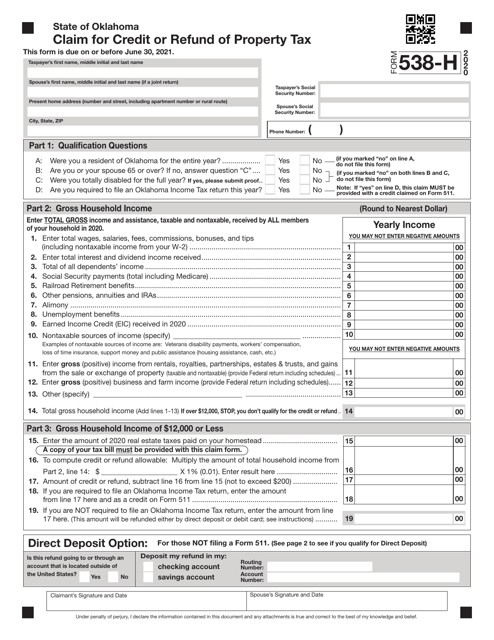

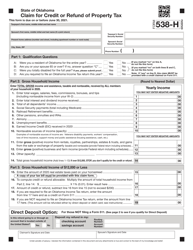

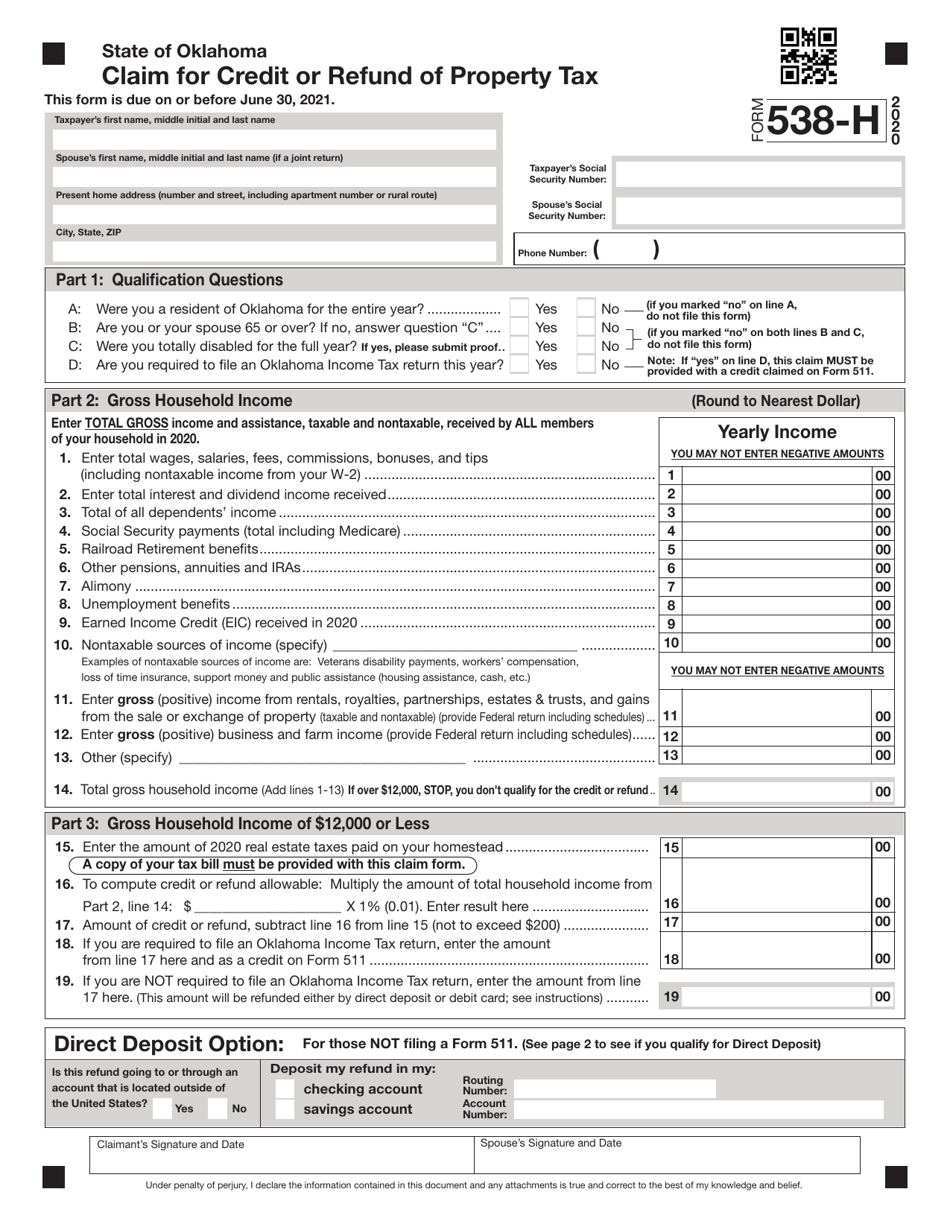

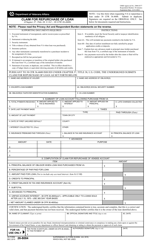

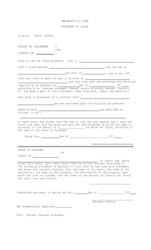

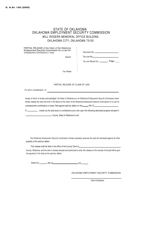

Form 538-H Claim for Credit or Refund of Property Tax - Oklahoma

What Is Form 538-H?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 538-H?

A: Form 538-H is a claim for credit or refund of property tax in Oklahoma.

Q: Who can use form 538-H?

A: Any individual or business who has paid property tax in Oklahoma and wants to claim a credit or refund can use form 538-H.

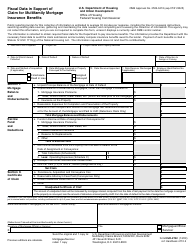

Q: What information do I need to fill out form 538-H?

A: You will need to provide your personal information, property tax information, and the reason for the claim.

Q: What is the deadline to file form 538-H?

A: The deadline to file form 538-H is generally three years from the due date of the original property tax payment.

Q: How long does it take to process form 538-H?

A: The processing time for form 538-H varies, but it typically takes several weeks to receive a response from the Oklahoma Tax Commission.

Q: What should I do if my claim is denied?

A: If your claim is denied, you have the option to appeal the decision with the Oklahoma Tax Commission.

Q: Can I claim a credit or refund for property tax paid in previous years?

A: Yes, you can use form 538-H to claim a credit or refund for property tax paid in previous years as long as it is within the three-year deadline.

Q: Is there a fee to file form 538-H?

A: No, there is no fee to file form 538-H.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 538-H by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.