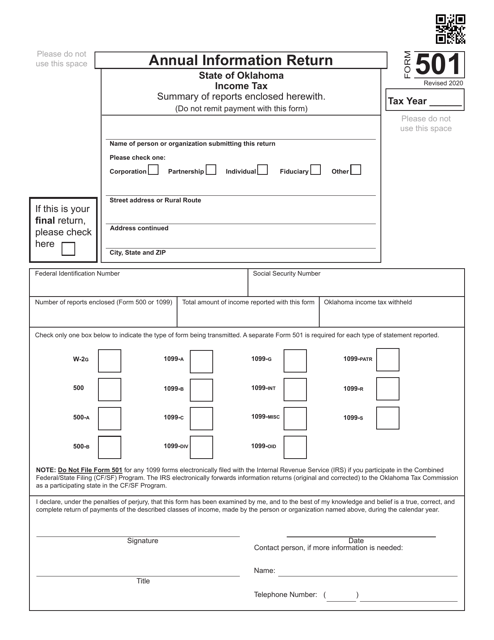

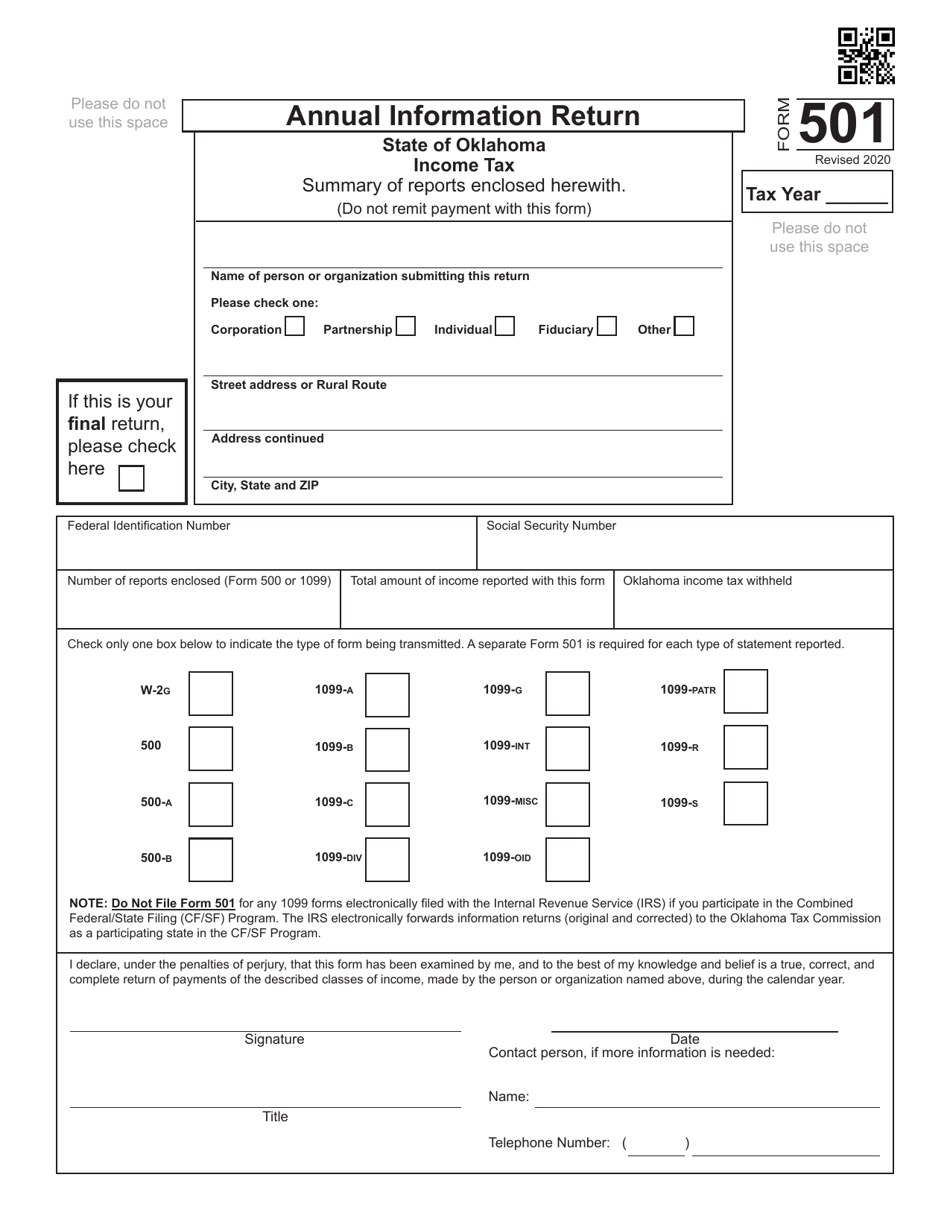

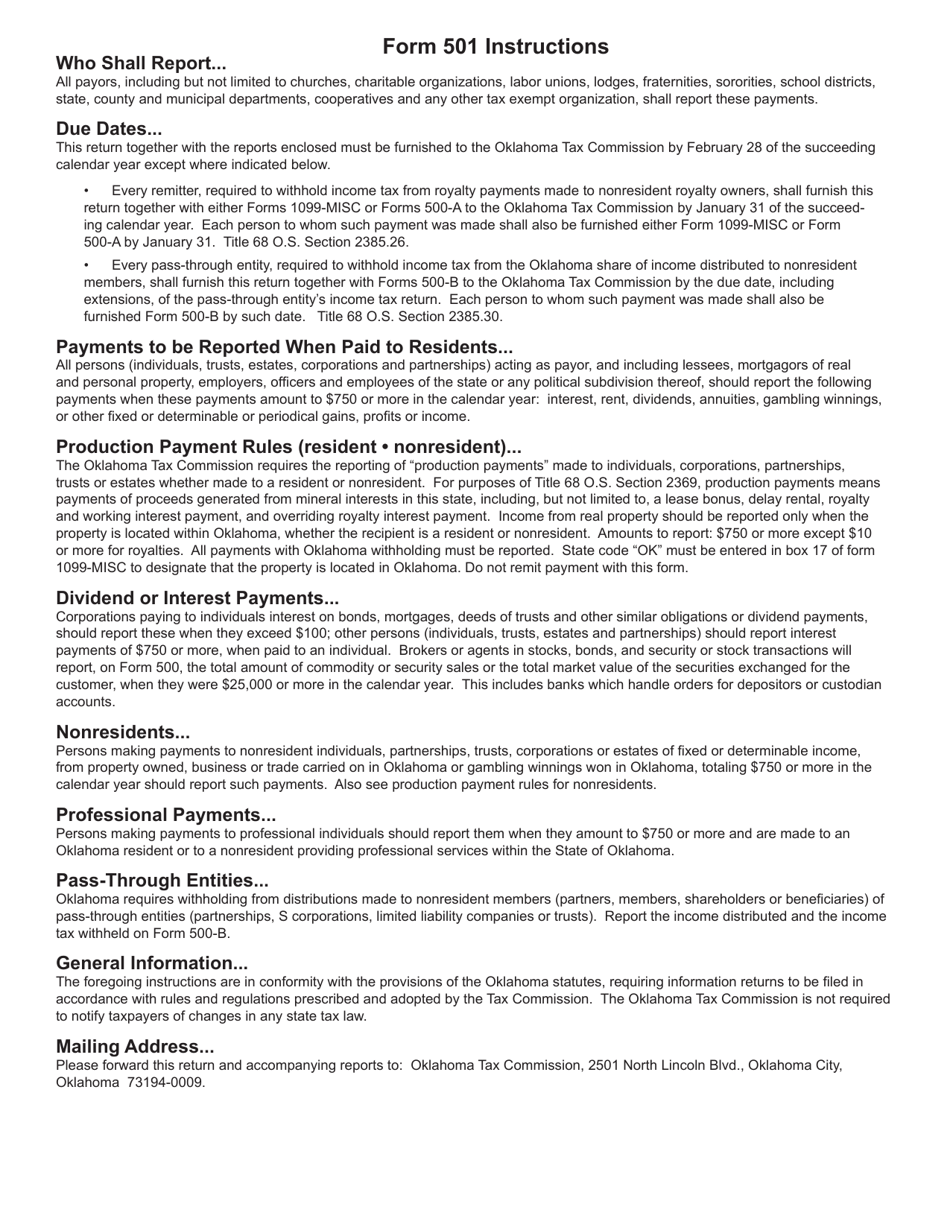

Form 501 Annual Information Return - Oklahoma

What Is Form 501?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 501?

A: Form 501 is the Annual Information Return for Oklahoma.

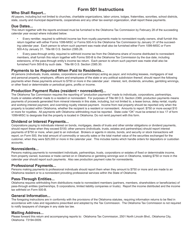

Q: Who needs to file Form 501?

A: Nonprofit organizations in Oklahoma need to file Form 501.

Q: What information is required on Form 501?

A: Form 501 requires information about the organization's activities, finances, and governance.

Q: When is Form 501 due?

A: Form 501 is due on the 15th day of the 5th month after the close of the organization's fiscal year.

Q: Are there any fees for filing Form 501?

A: Yes, there is a fee for filing Form 501.

Q: What happens if I don't file Form 501?

A: Failure to file Form 501 can result in penalties and the loss of tax-exempt status.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 501 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.