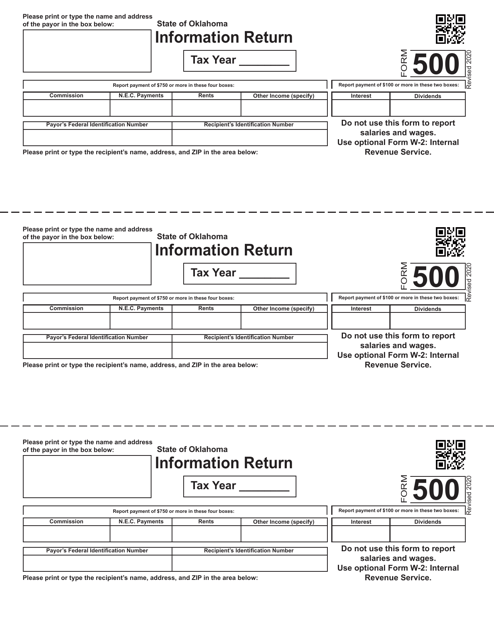

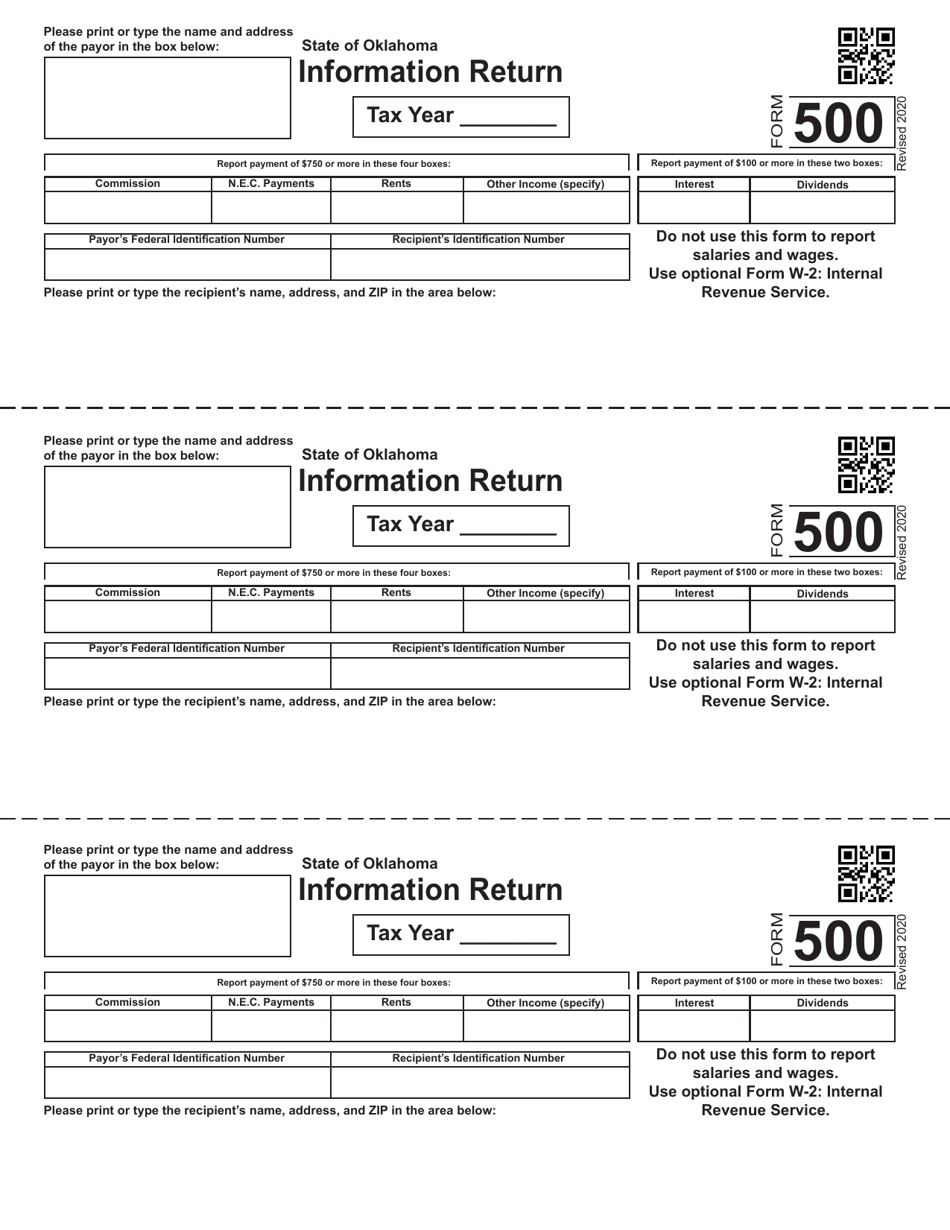

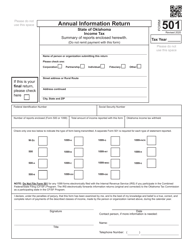

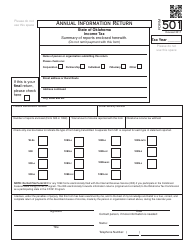

Form 500 Information Return - Oklahoma

What Is Form 500?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 500?

A: Form 500 is an Information Return for the state of Oklahoma.

Q: Who needs to file Form 500?

A: Any business or organization that is required to report income to the state of Oklahoma needs to file Form 500.

Q: What information is required on Form 500?

A: Form 500 requires information about the business or organization, including income, deductions, and credits.

Q: When is the deadline to file Form 500?

A: The deadline to file Form 500 is typically on or before April 15th of each year.

Q: Are there any penalties for not filing Form 500?

A: Yes, there may be penalties for not filing Form 500, including late filing penalties and interest charges on unpaid taxes.

Q: Is there a fee for filing Form 500?

A: No, there is no fee for filing Form 500.

Q: Do I need to include supporting documents with Form 500?

A: Yes, you may be required to include supporting documents, such as income statements and receipts, with Form 500.

Q: Can I amend Form 500 if I make a mistake?

A: Yes, you can file an amended Form 500 to correct any errors or omissions.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 500 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.