This version of the form is not currently in use and is provided for reference only. Download this version of

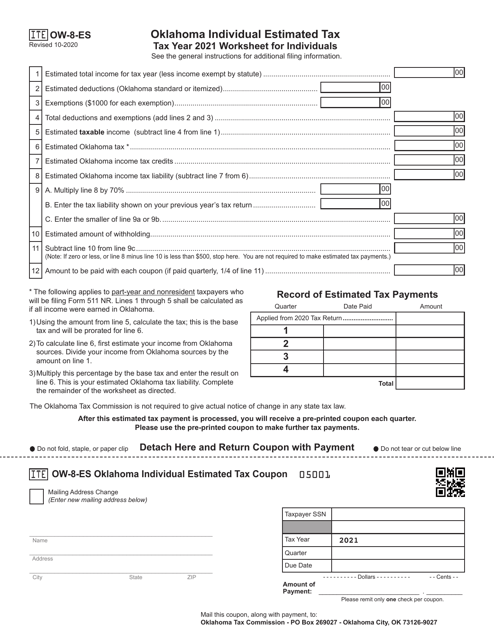

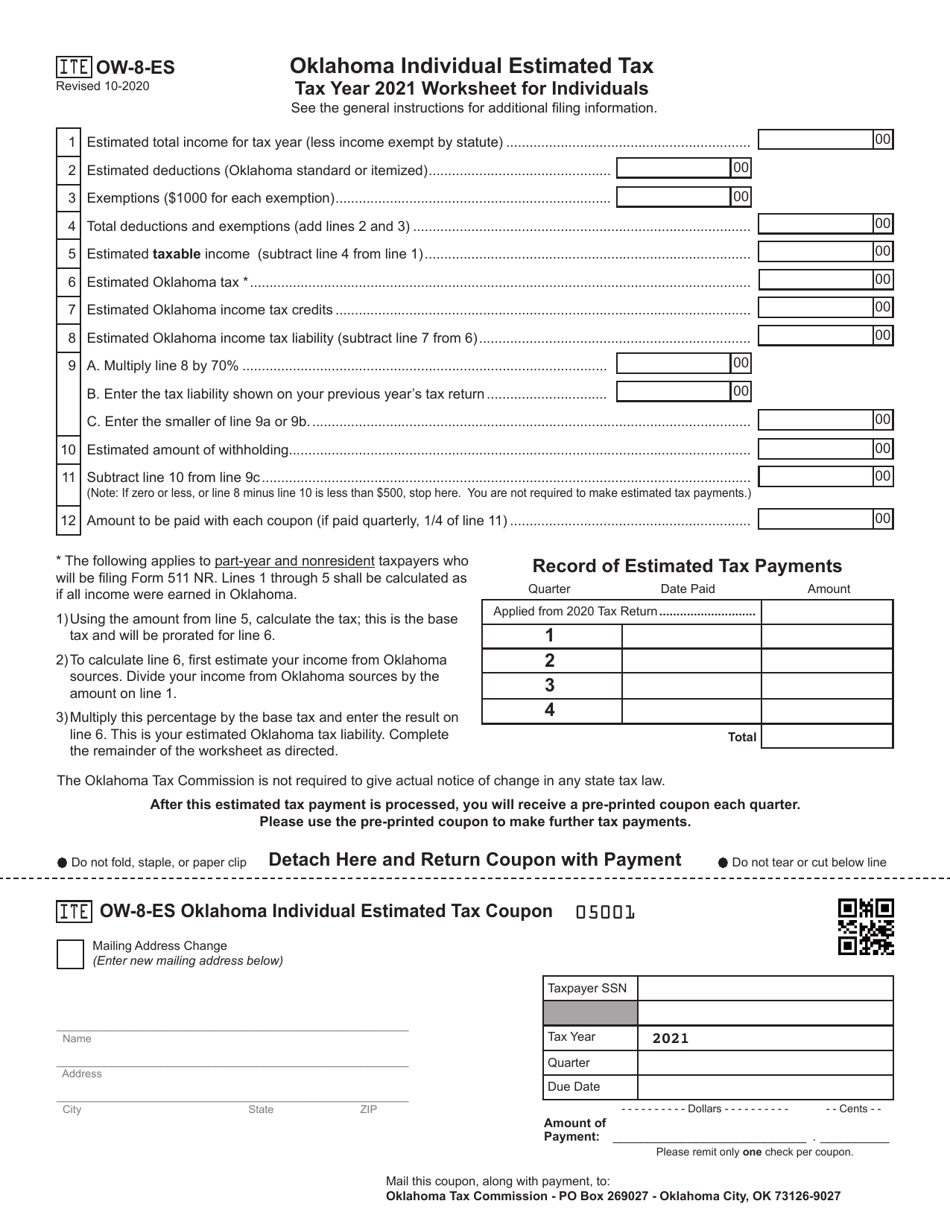

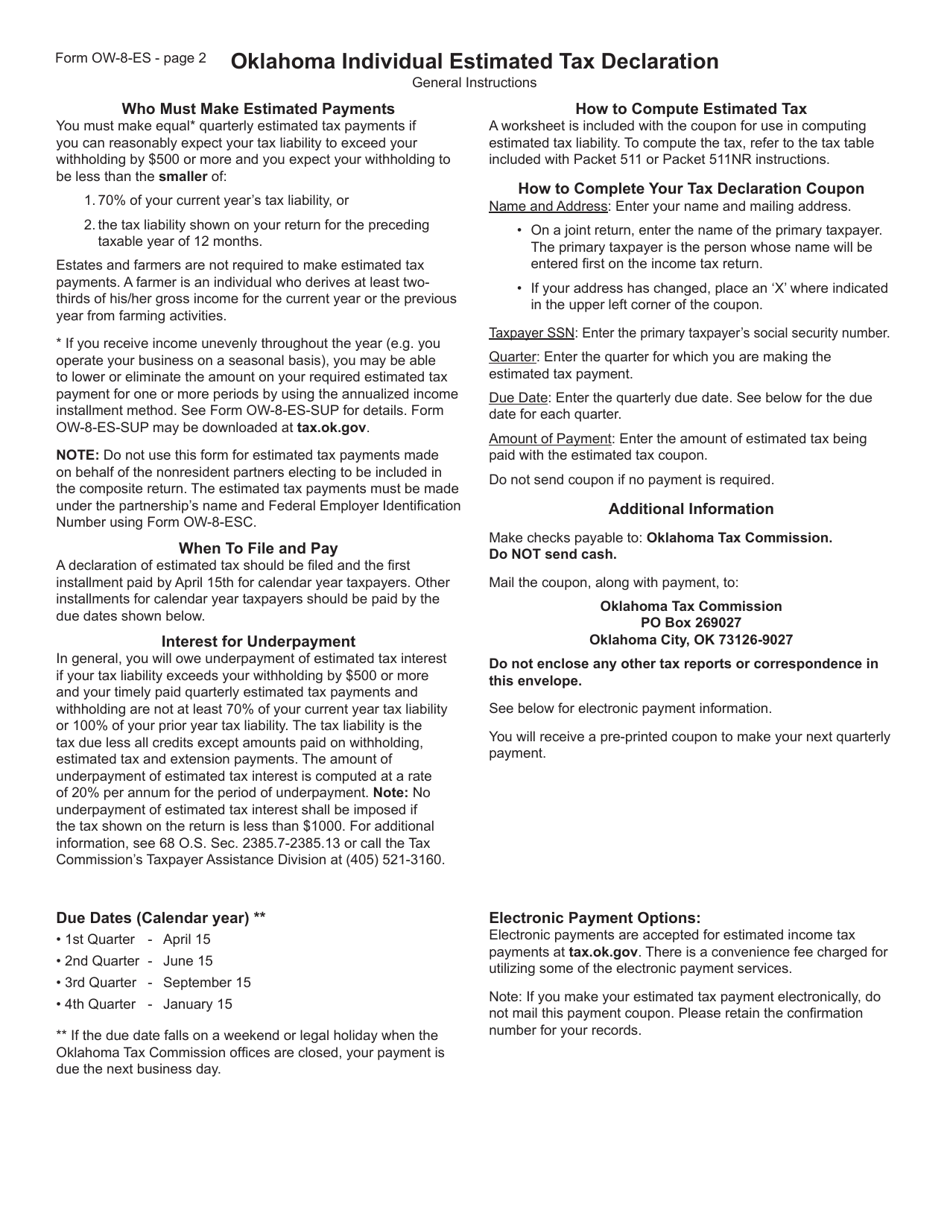

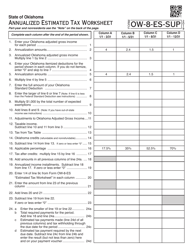

Form OW-8-ES

for the current year.

Form OW-8-ES Estimated Tax Declaration for Individuals - Oklahoma

What Is Form OW-8-ES?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OW-8-ES?

A: Form OW-8-ES is the Estimated Tax Declaration for Individuals in Oklahoma.

Q: Who needs to file Form OW-8-ES?

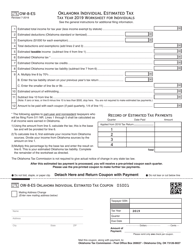

A: Individuals in Oklahoma who expect to owe at least $200 in state income tax must file Form OW-8-ES.

Q: What is the purpose of Form OW-8-ES?

A: The purpose of Form OW-8-ES is to declare and pay estimated quarterly income tax in Oklahoma.

Q: When is Form OW-8-ES due?

A: Form OW-8-ES is due on April 15th of each year, or the following business day if April 15th falls on a weekend or holiday.

Q: What happens if I don't file Form OW-8-ES?

A: If you are required to file Form OW-8-ES but fail to do so, you may be subject to penalties and interest on the underpaid tax amount.

Q: What information do I need to complete Form OW-8-ES?

A: To complete Form OW-8-ES, you will need to estimate your taxable income, deductions, and credits for the year.

Q: Can I make changes to Form OW-8-ES after filing?

A: Yes, you can make changes to Form OW-8-ES by filing an amended declaration, Form OW-8-ES-Am.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OW-8-ES by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.