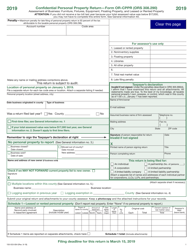

This version of the form is not currently in use and is provided for reference only. Download this version of

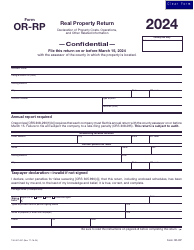

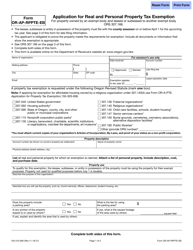

Form OR-CPPR (150-553-004)

for the current year.

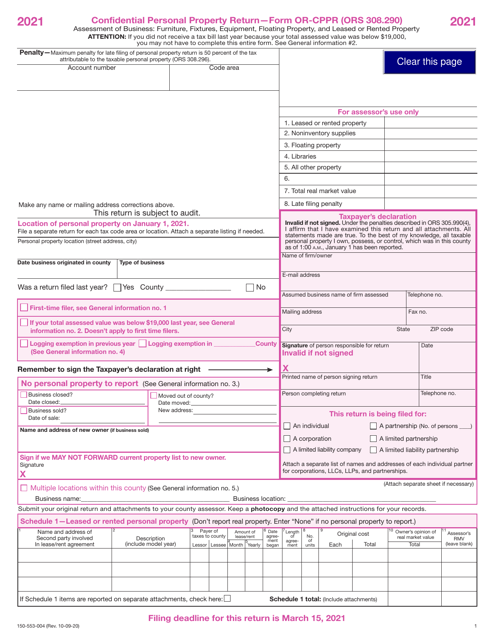

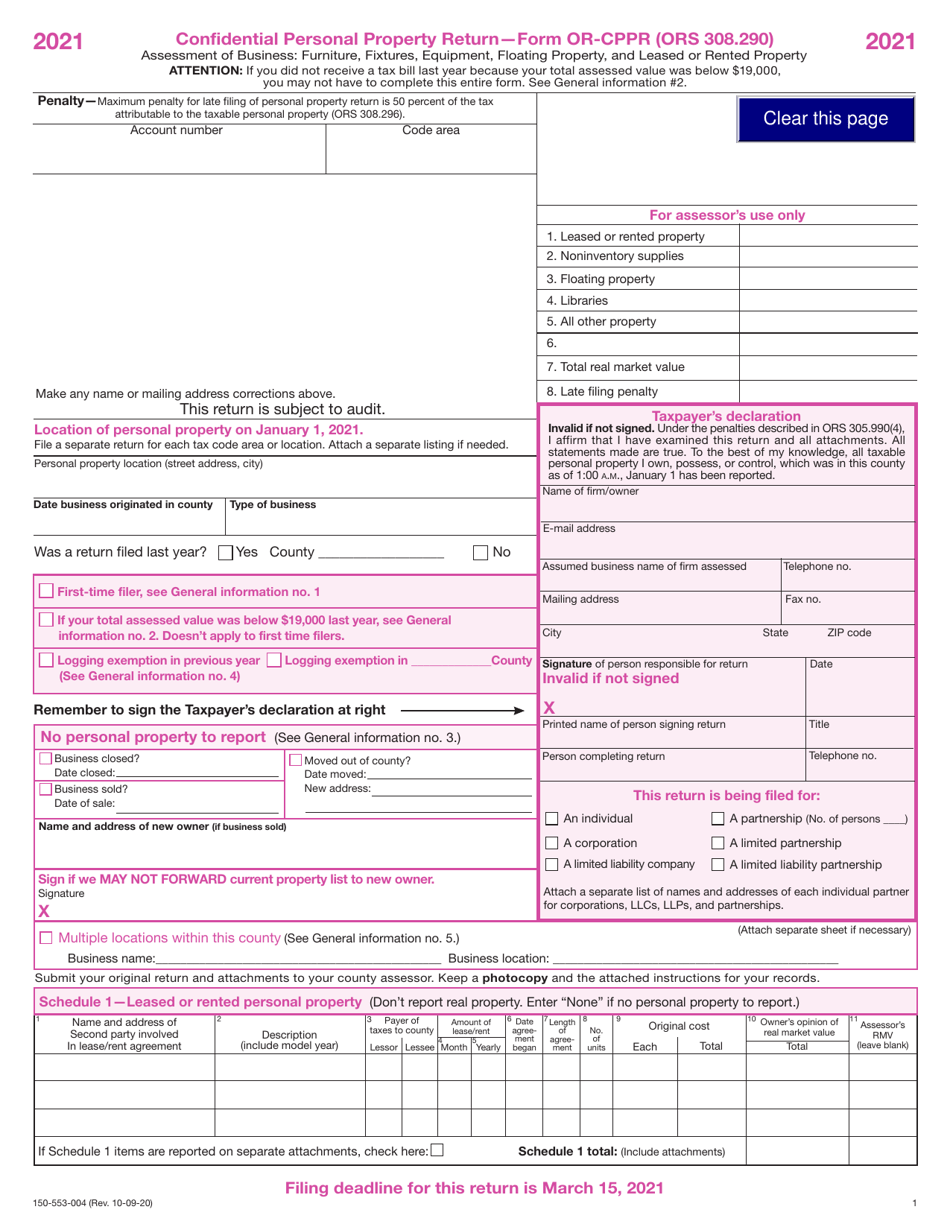

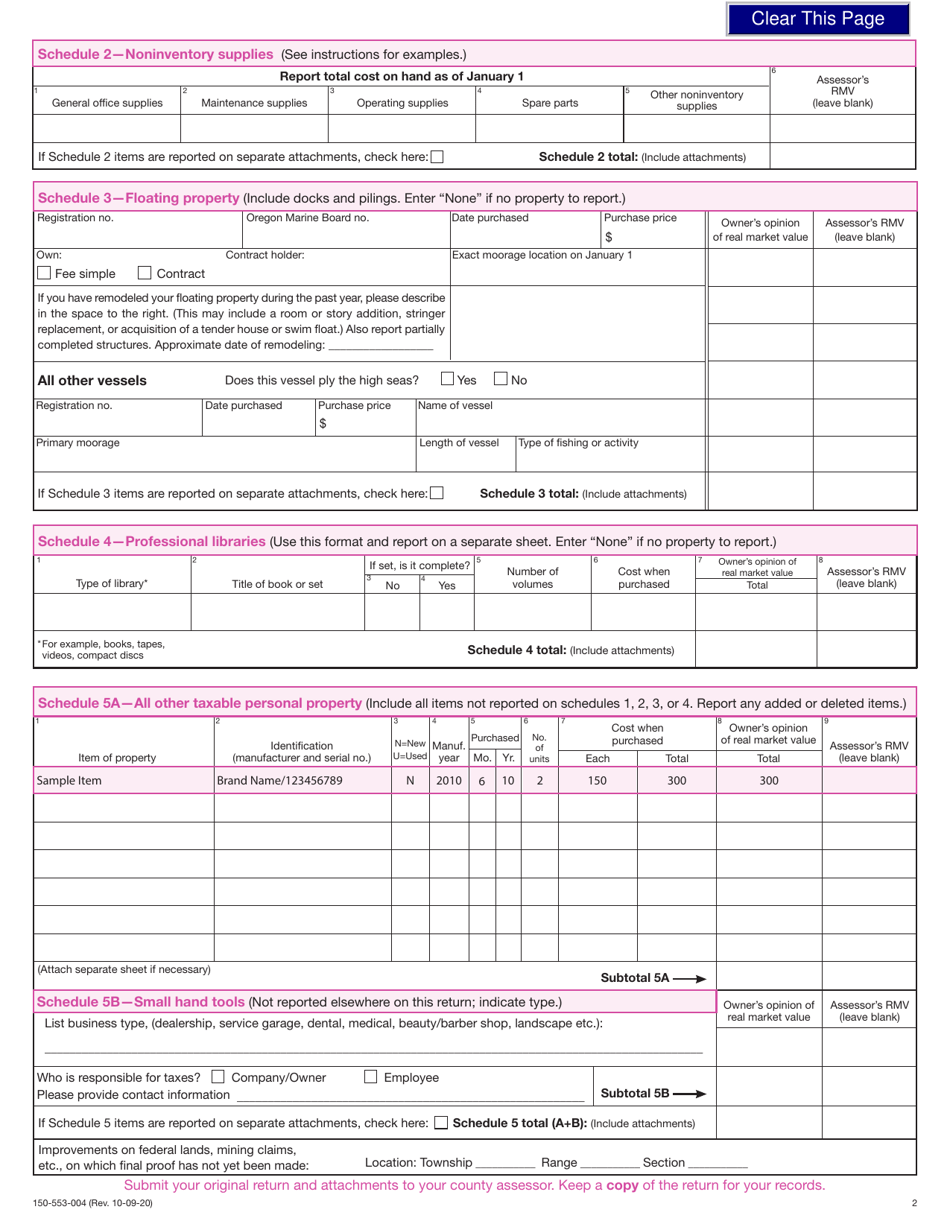

Form OR-CPPR (150-553-004) Confidential Personal Property Return - Oregon

What Is Form OR-CPPR (150-553-004)?

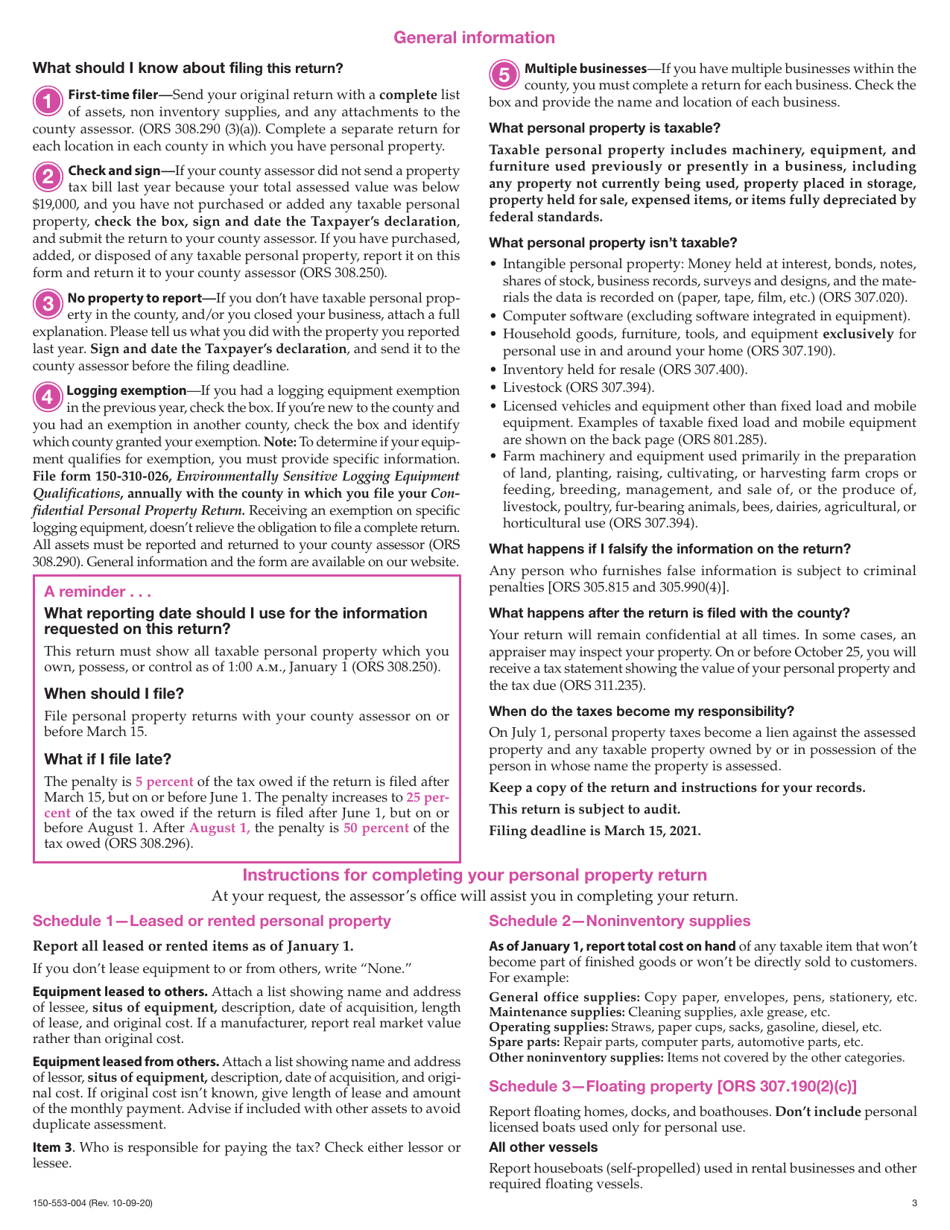

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

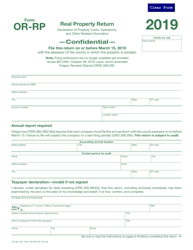

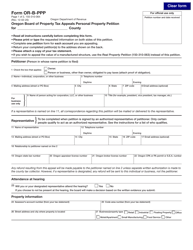

Q: What is OR-CPPR?

A: OR-CPPR is a Confidential Personal Property Return form for reporting personal property in Oregon.

Q: Who needs to file OR-CPPR?

A: Anyone who owns taxable personal property in Oregon is required to file OR-CPPR.

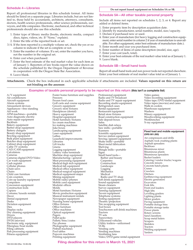

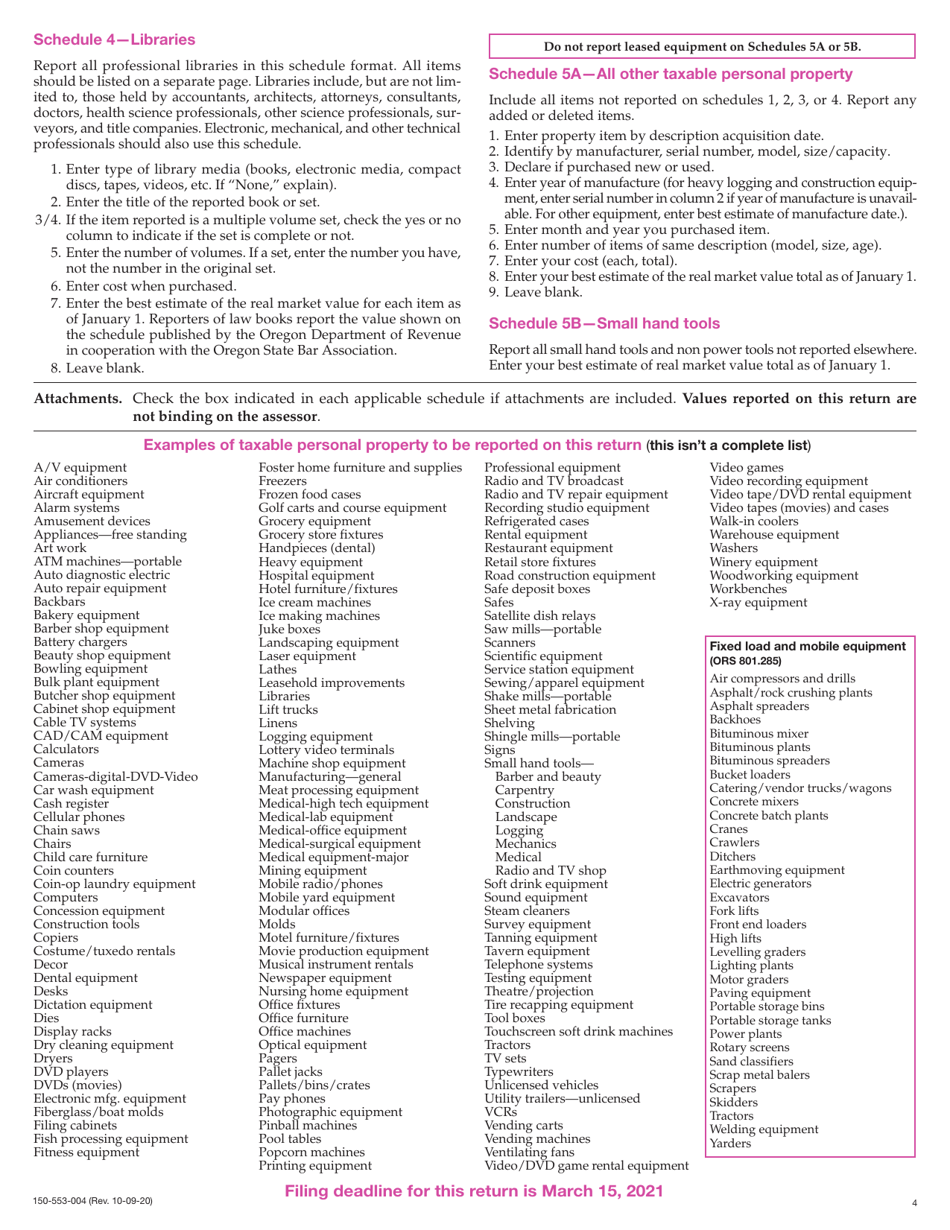

Q: What is considered personal property?

A: Personal property includes assets such as machinery, tools, equipment, furniture, and supplies.

Q: Is OR-CPPR confidential?

A: Yes, OR-CPPR is confidential and the information provided in the return is protected by law.

Q: When is the deadline to file OR-CPPR?

A: The deadline to file OR-CPPR is March 15th of each year.

Q: Is there a penalty for late filing?

A: Yes, there is a penalty for late filing. The penalty is 5% of the tax due, up to a maximum of $1,000.

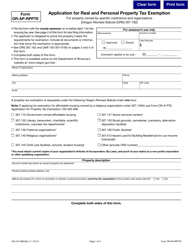

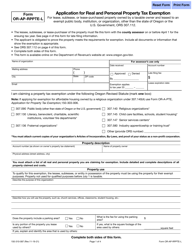

Q: Are there any exemptions for filing OR-CPPR?

A: Yes, there are certain exemptions for filing OR-CPPR. These exemptions include certain types of personal property, such as household goods, personal effects, and livestock.

Q: Can I amend my OR-CPPR after filing?

A: Yes, you can file an amended OR-CPPR if you need to make changes to your original return.

Form Details:

- Released on October 9, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-CPPR (150-553-004) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.