This version of the form is not currently in use and is provided for reference only. Download this version of

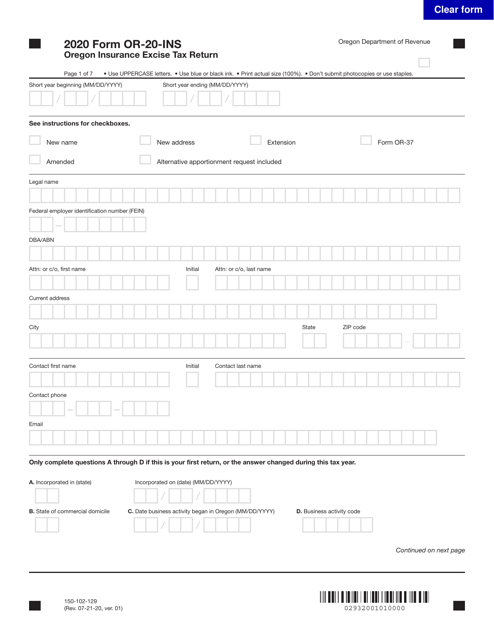

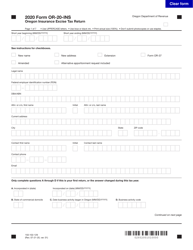

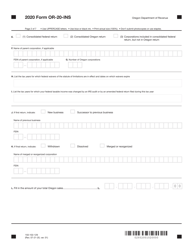

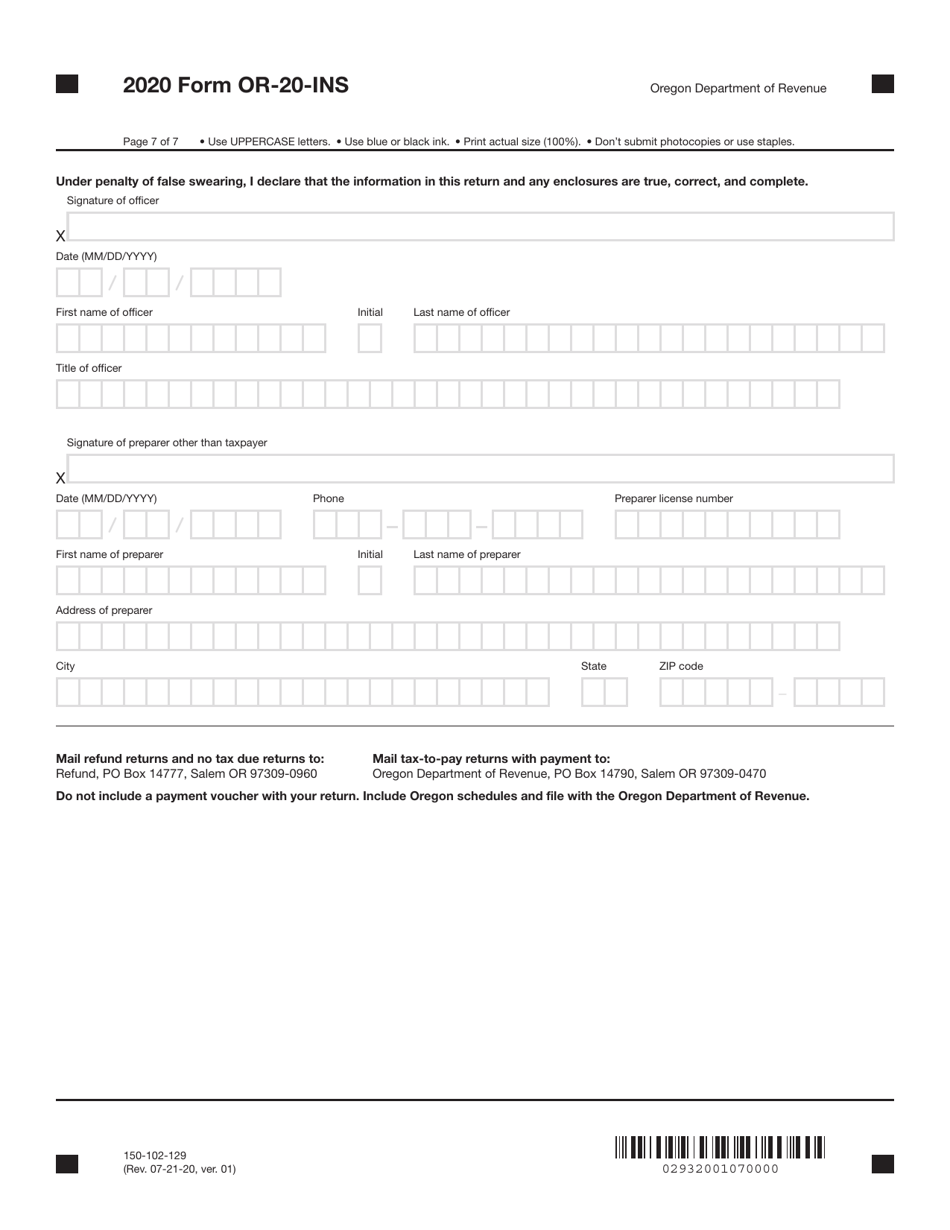

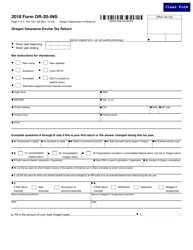

Form OR-20-INS (150-102-129)

for the current year.

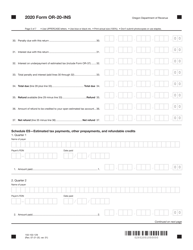

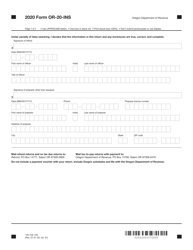

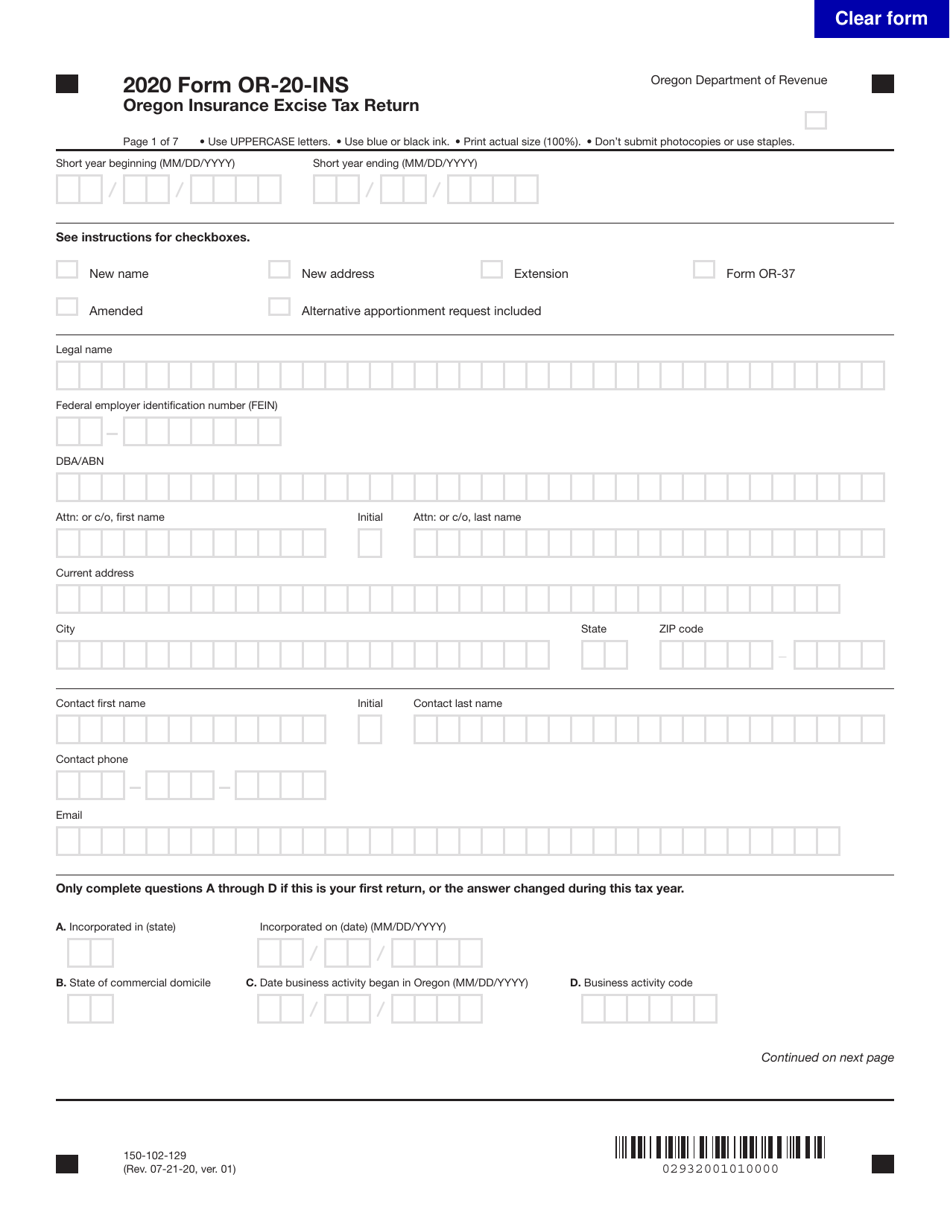

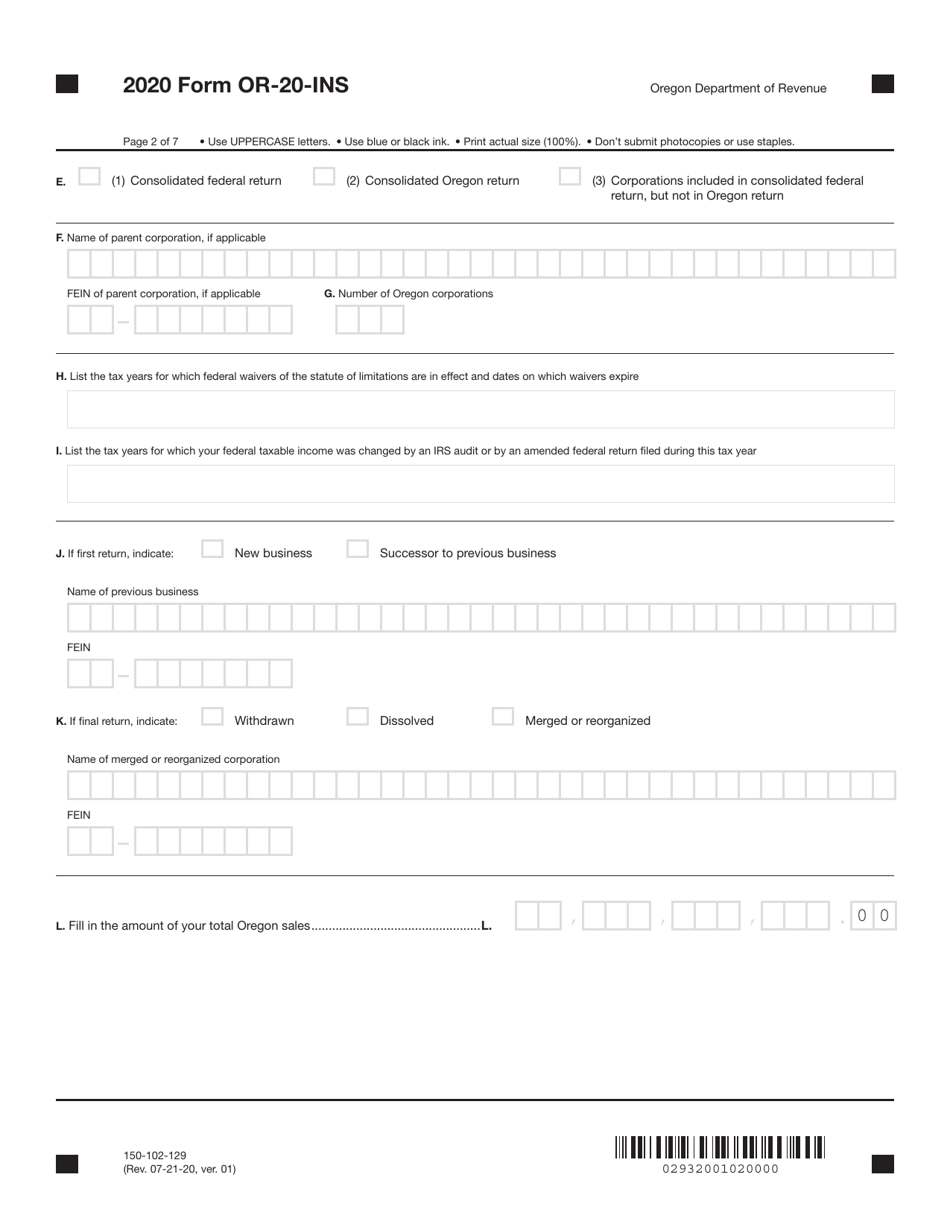

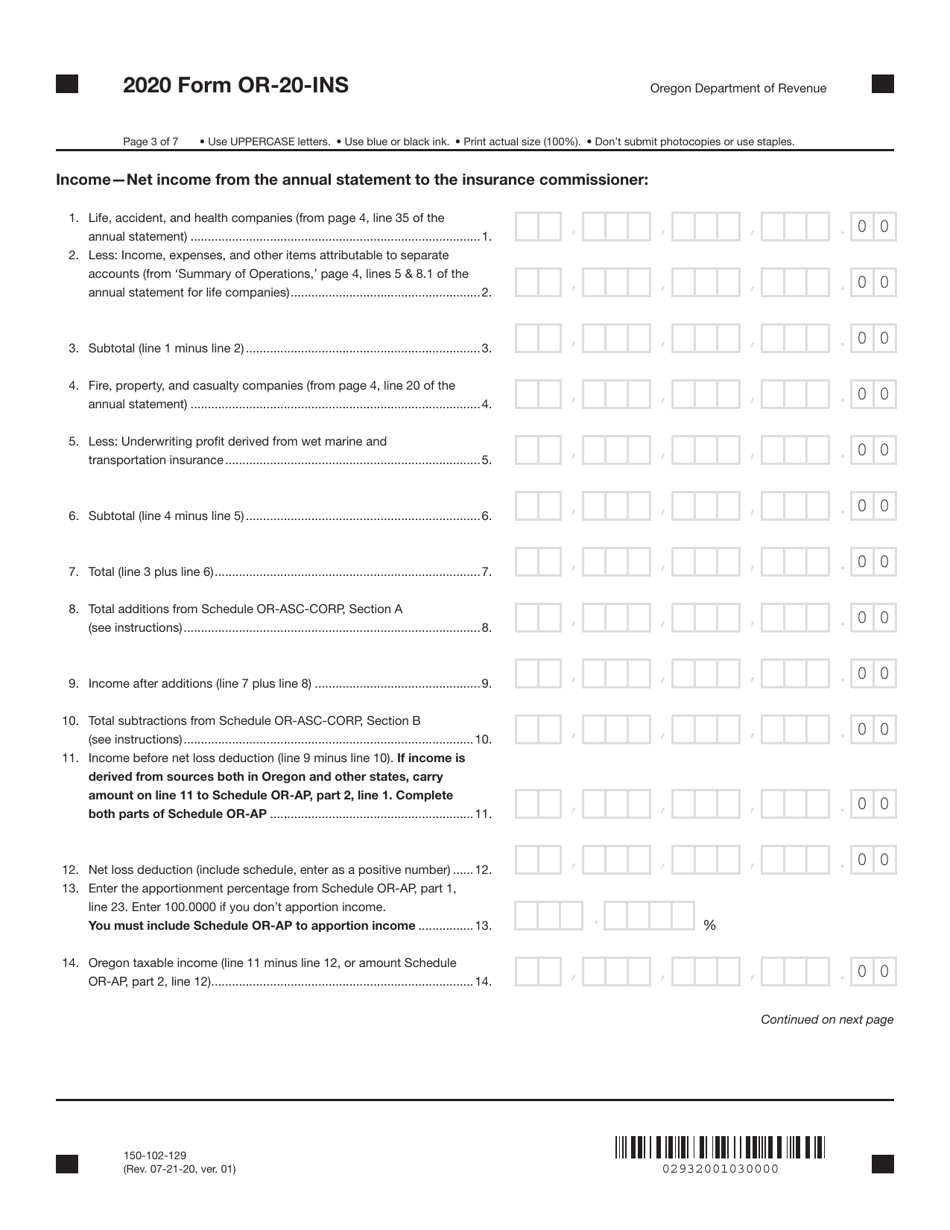

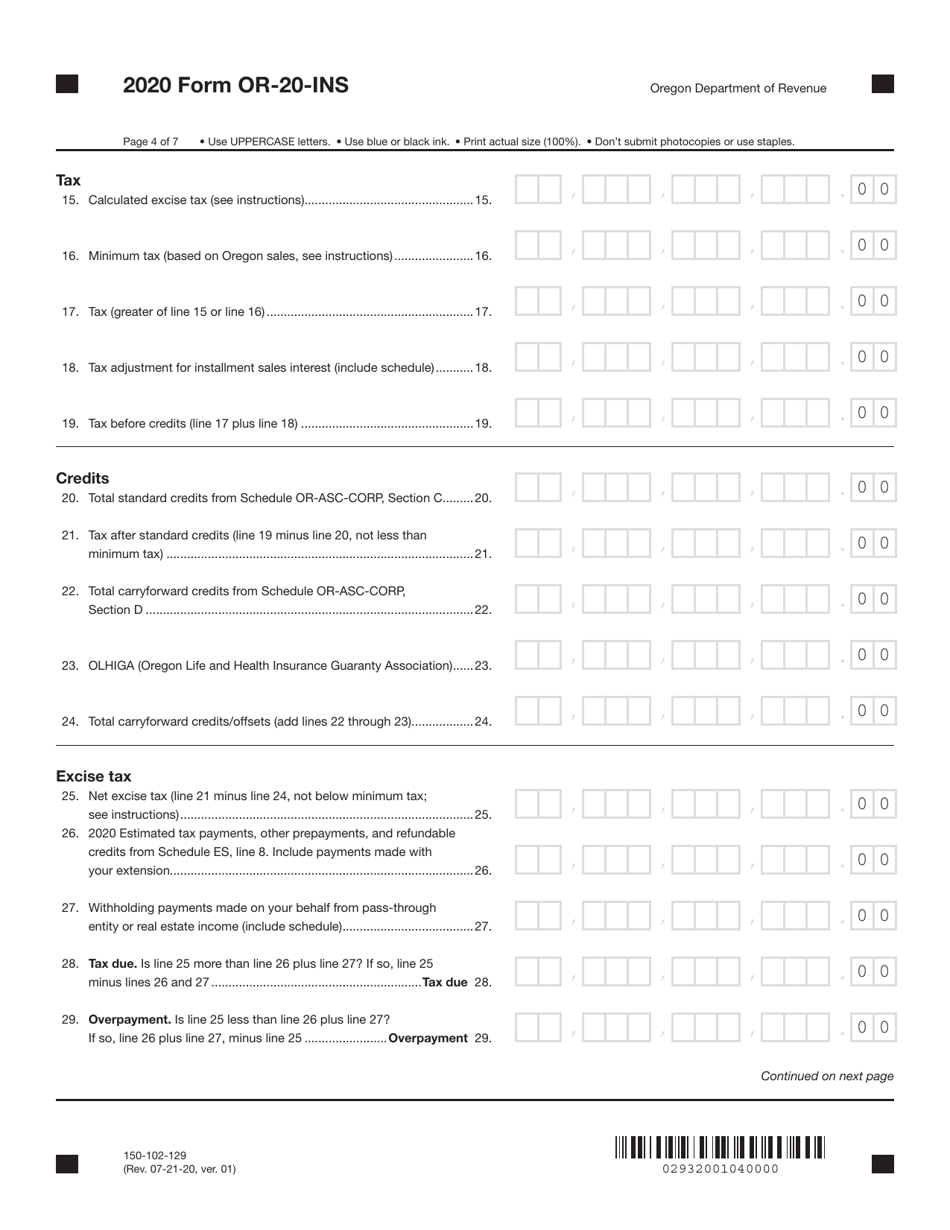

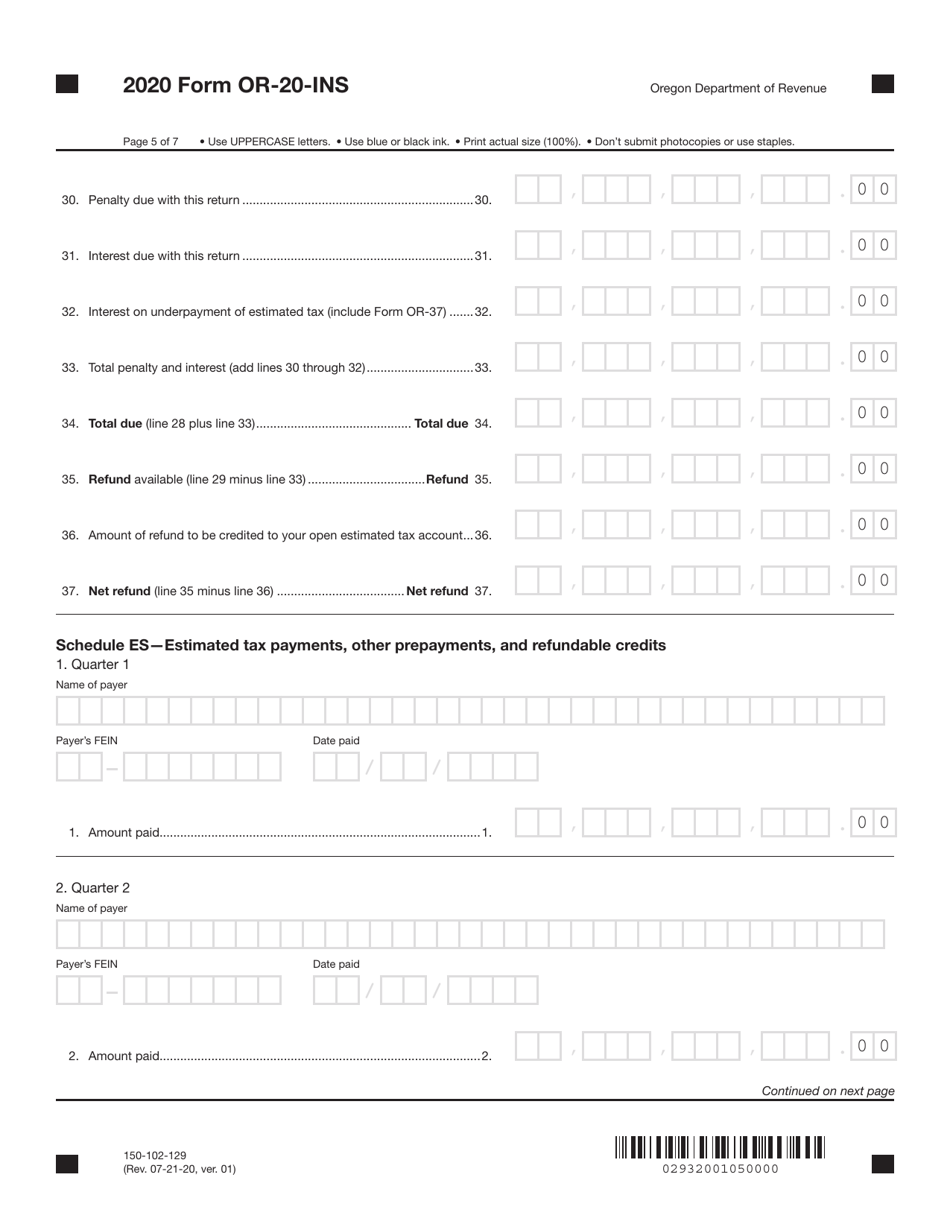

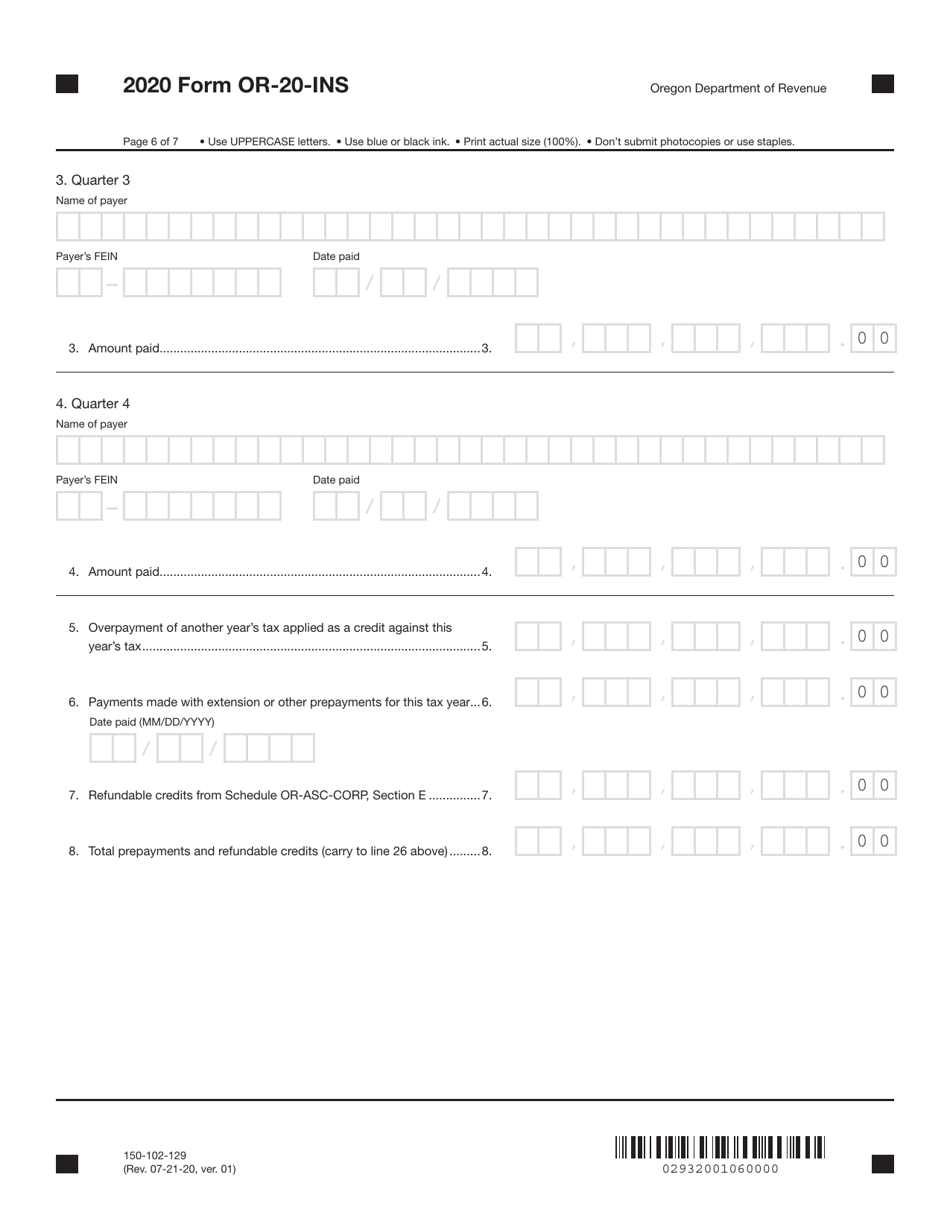

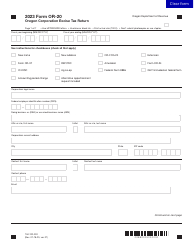

Form OR-20-INS (150-102-129) Oregon Insurance Excise Tax Return - Oregon

What Is Form OR-20-INS (150-102-129)?

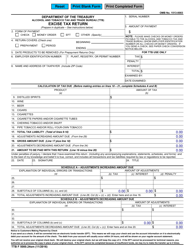

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-20-INS?

A: Form OR-20-INS is the Oregon Insurance Excise Tax Return.

Q: What is the purpose of Form OR-20-INS?

A: The purpose of Form OR-20-INS is to report and pay the Oregon Insurance Excise Tax.

Q: What is the Oregon Insurance Excise Tax?

A: The Oregon Insurance Excise Tax is a tax imposed on insurance companiesdoing business in Oregon.

Q: Who needs to file Form OR-20-INS?

A: Insurance companies doing business in Oregon need to file Form OR-20-INS.

Q: When is Form OR-20-INS due?

A: Form OR-20-INS is due on the 15th day of the third month following the end of the tax year.

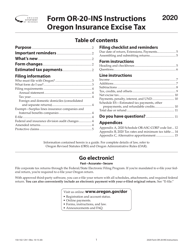

Q: How do I fill out Form OR-20-INS?

A: Instructions for filling out Form OR-20-INS are included with the form itself.

Q: Are there any penalties for not filing Form OR-20-INS?

A: Yes, there are penalties for not filing Form OR-20-INS or for filing it late.

Q: Can I e-file Form OR-20-INS?

A: Yes, you can e-file Form OR-20-INS if you meet certain requirements.

Form Details:

- Released on July 21, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-20-INS (150-102-129) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.