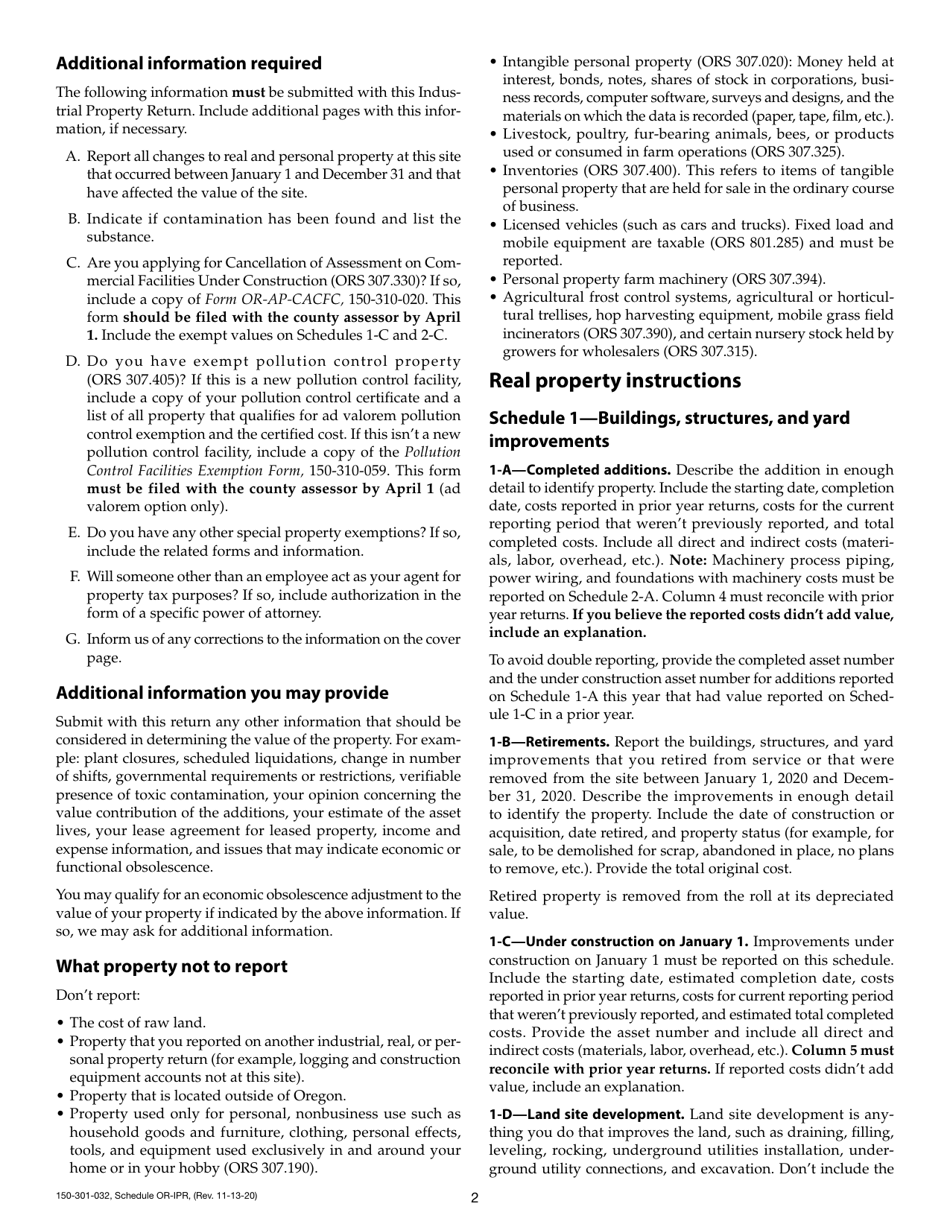

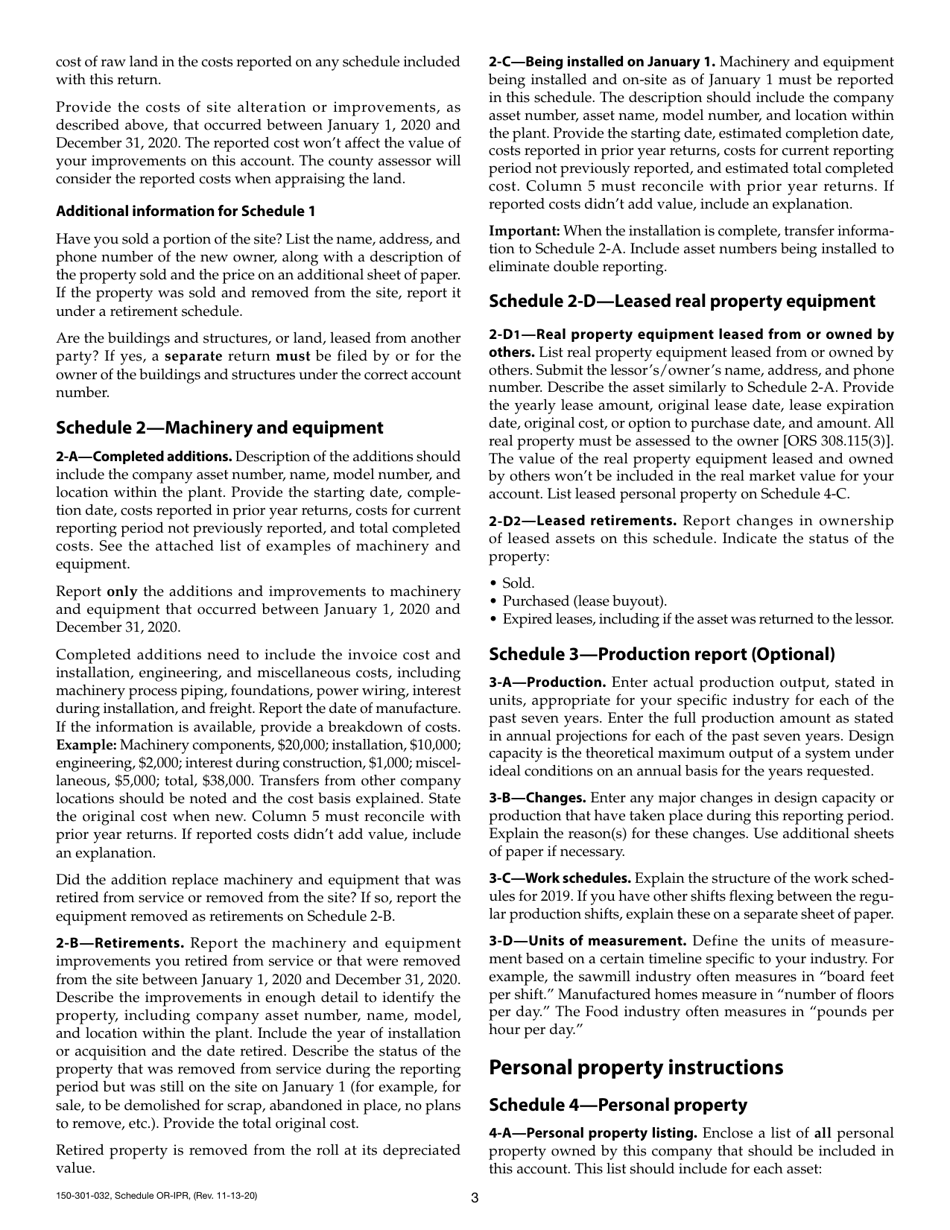

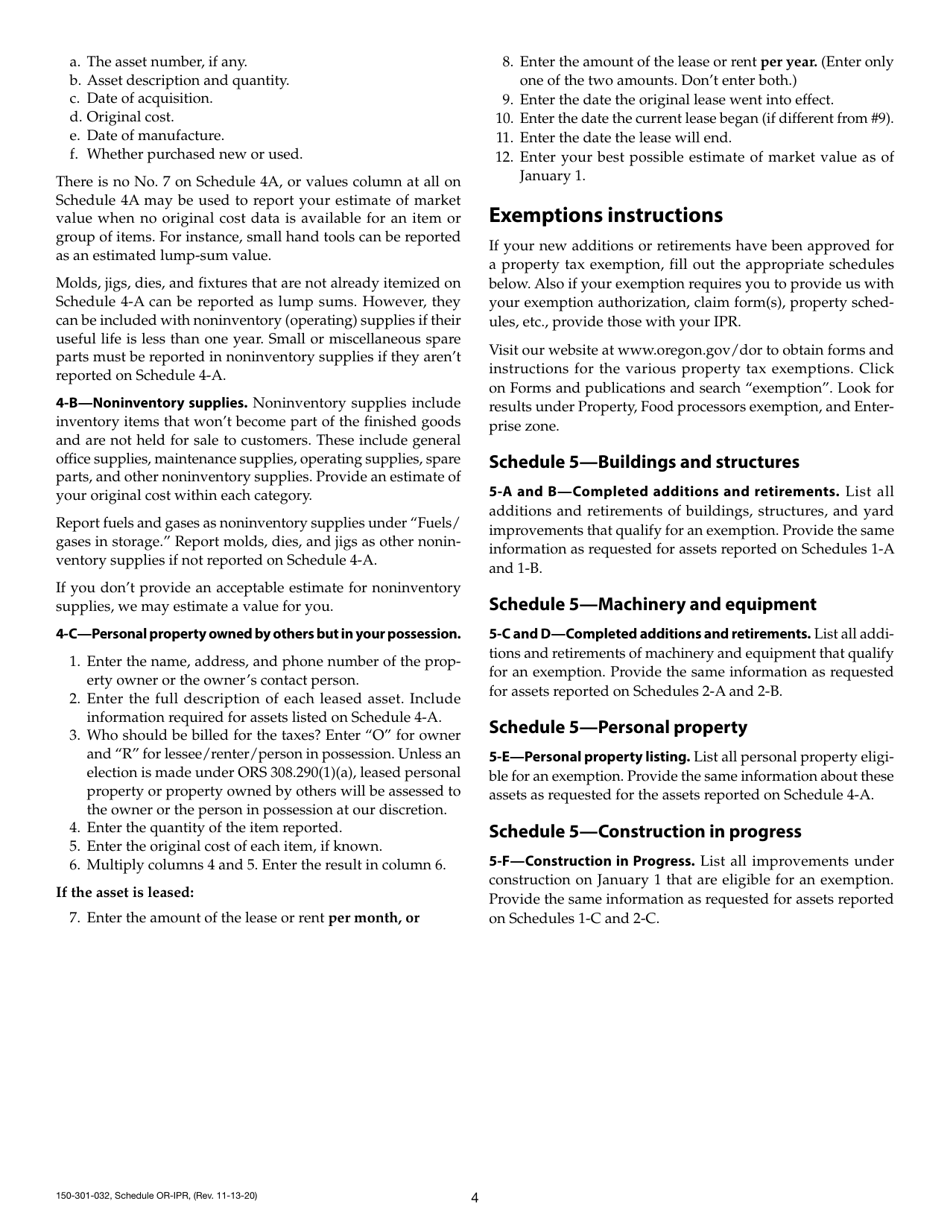

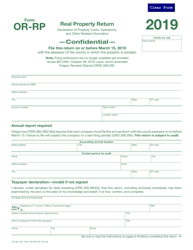

This version of the form is not currently in use and is provided for reference only. Download this version of

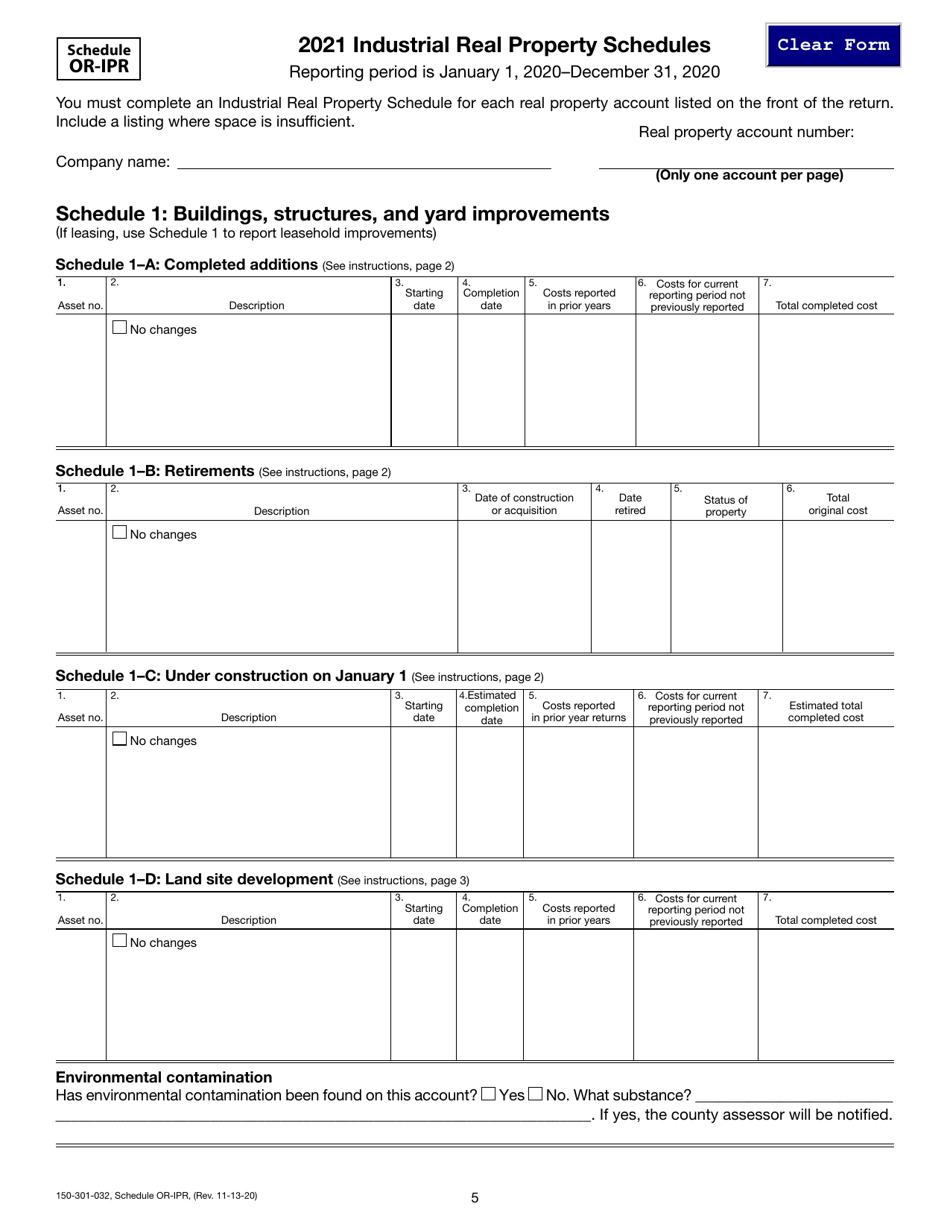

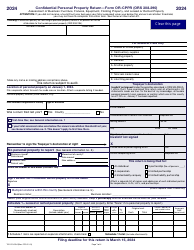

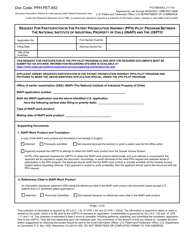

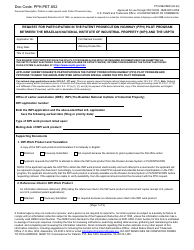

Form 150-301-032 Schedule OR-IPR

for the current year.

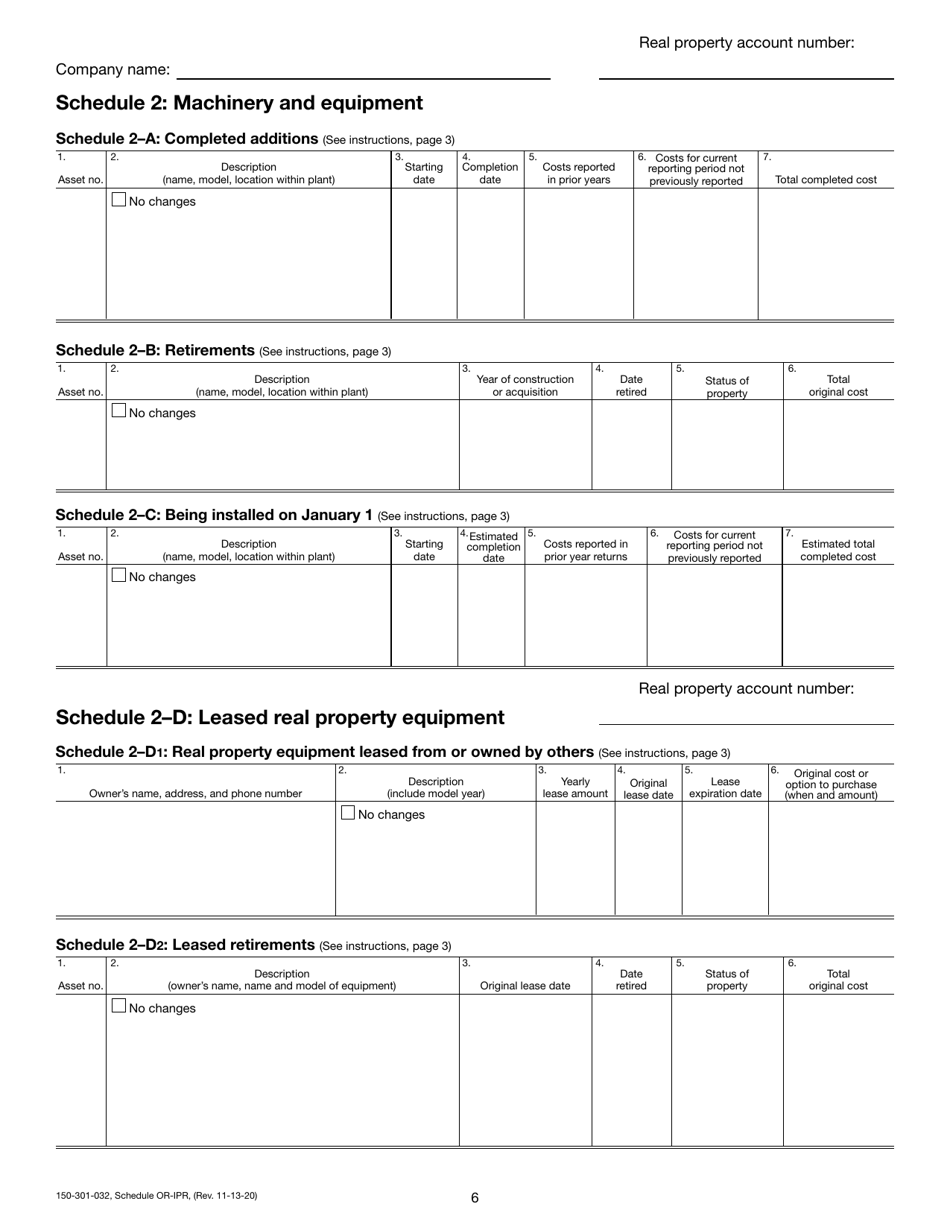

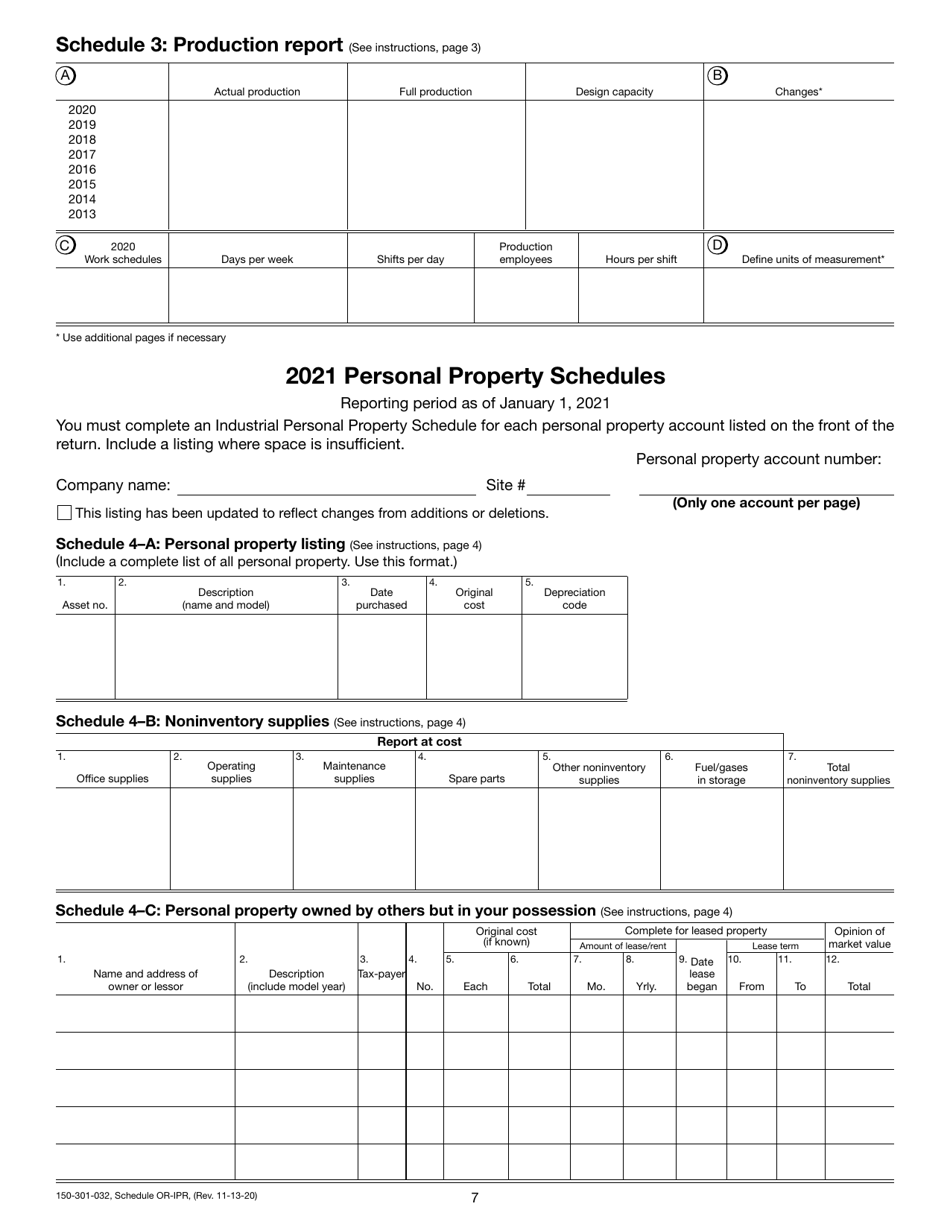

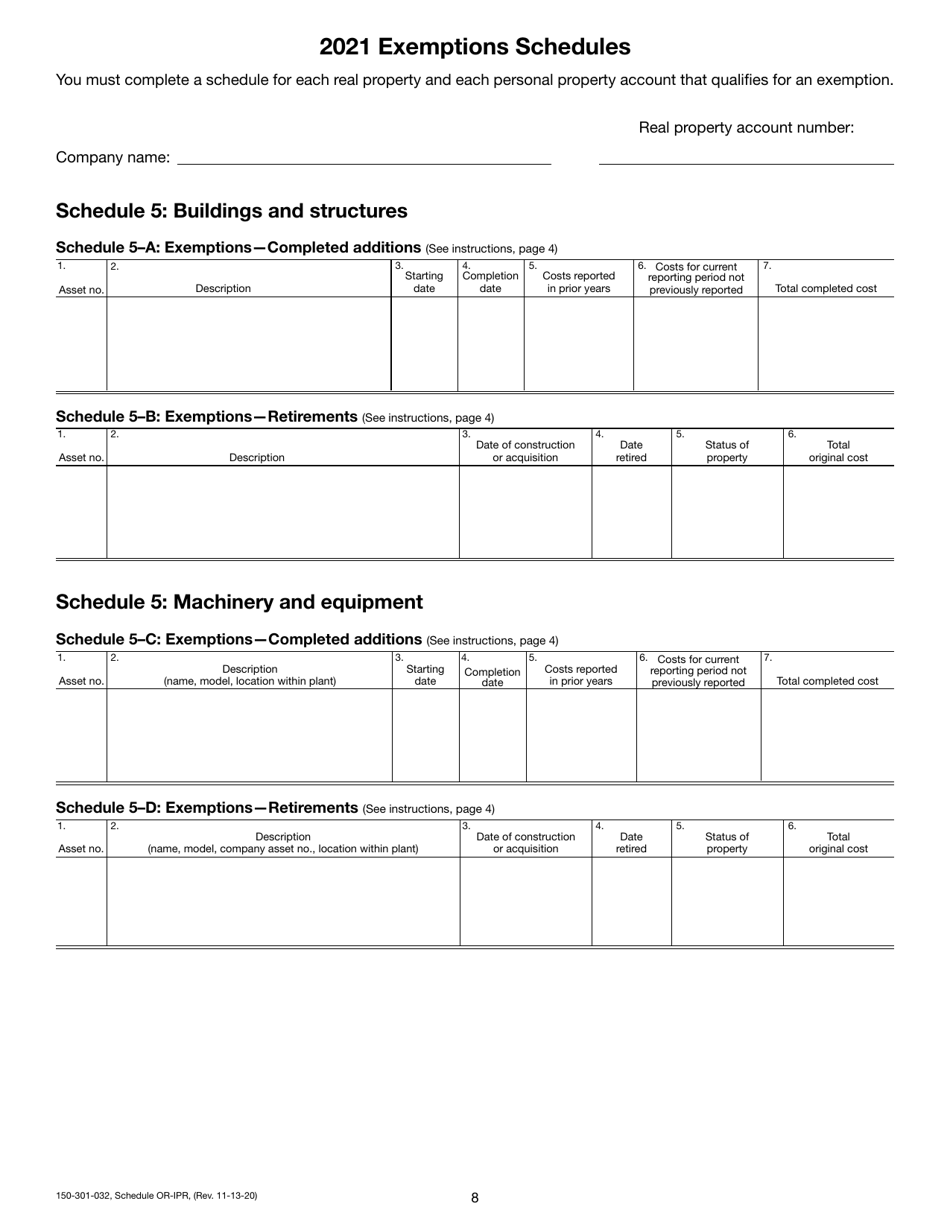

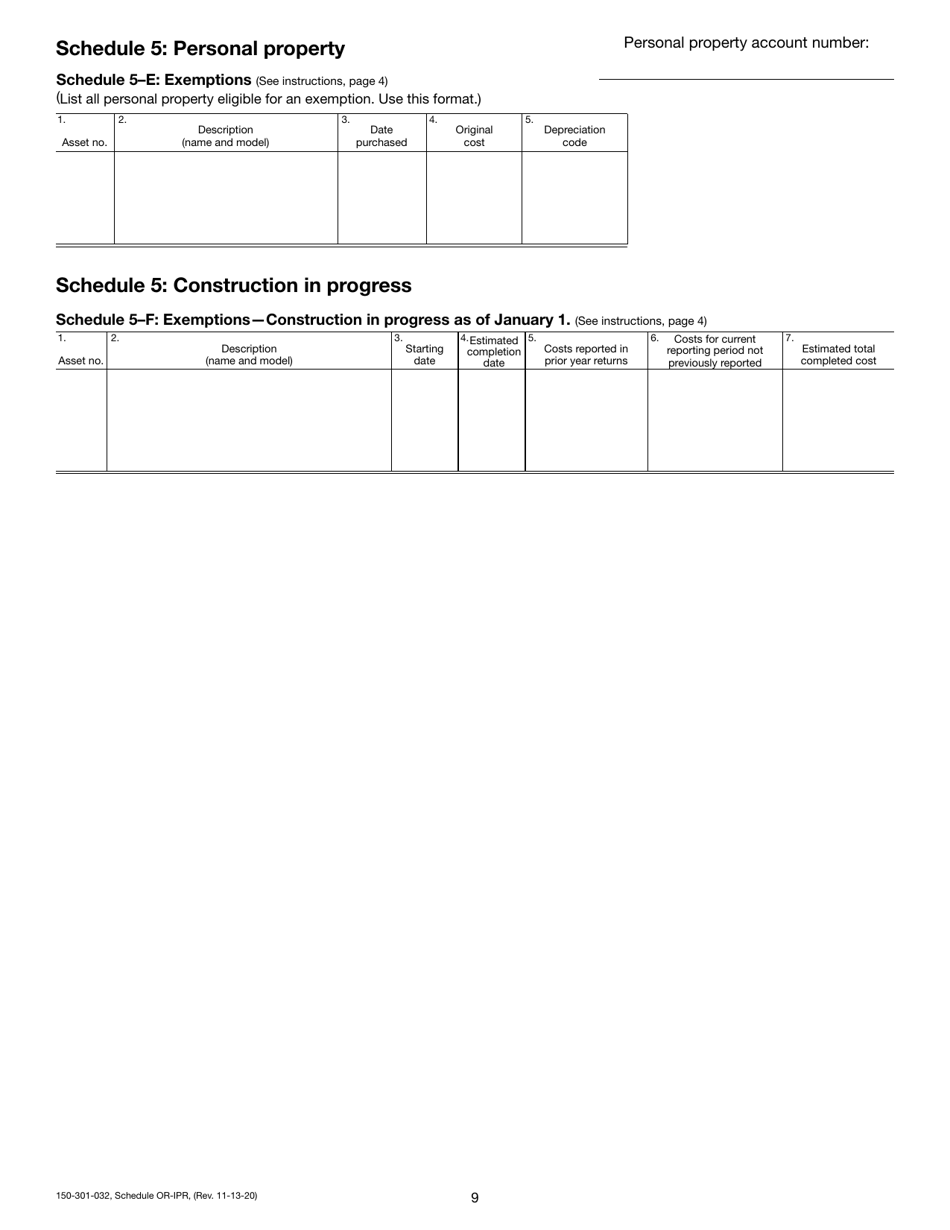

Form 150-301-032 Schedule OR-IPR Industrial Property Return - Oregon

What Is Form 150-301-032 Schedule OR-IPR?

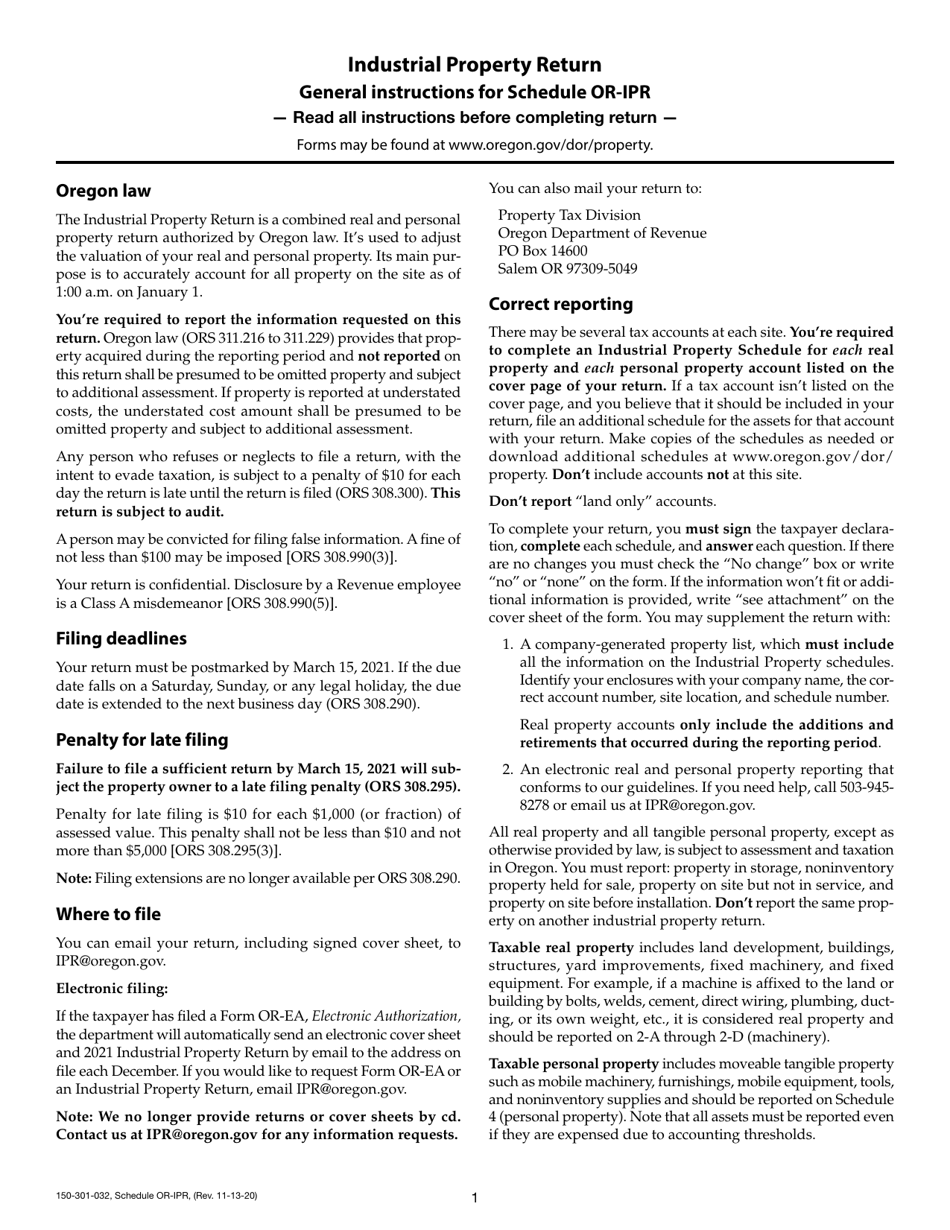

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

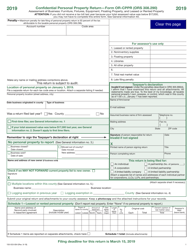

Q: What is Form 150-301-032?

A: Form 150-301-032 is a form used to file Schedule OR-IPR, the Industrial Property Return, in the state of Oregon.

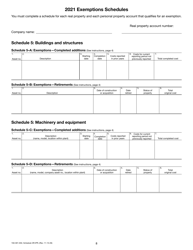

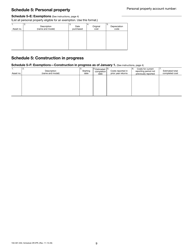

Q: What is Schedule OR-IPR?

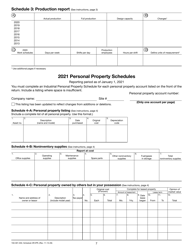

A: Schedule OR-IPR is a tax return form specifically for reporting industrial property in Oregon.

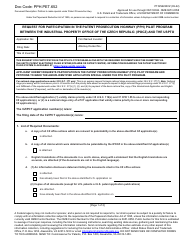

Q: Who needs to file Form 150-301-032?

A: Businesses or individuals who own or lease industrial property in Oregon need to file Form 150-301-032.

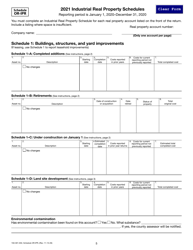

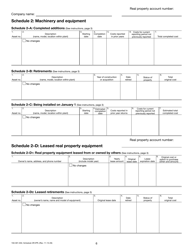

Q: What is considered industrial property?

A: Industrial property includes machinery, equipment, furniture, fixtures, and other similar tangible items used in manufacturing, processing, or assembling products.

Q: When is Form 150-301-032 due?

A: Form 150-301-032 is due on April 15th of each year.

Q: Are there any penalties for not filing Schedule OR-IPR?

A: Yes, there are penalties for failing to file Schedule OR-IPR, including a late filing penalty and interest on any taxes owed.

Q: Can I e-file Form 150-301-032?

A: No, at this time, Form 150-301-032 cannot be e-filed and must be filed by mail.

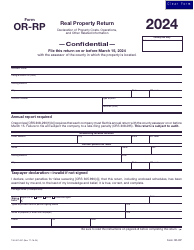

Form Details:

- Released on November 13, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-301-032 Schedule OR-IPR by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.