This version of the form is not currently in use and is provided for reference only. Download this version of

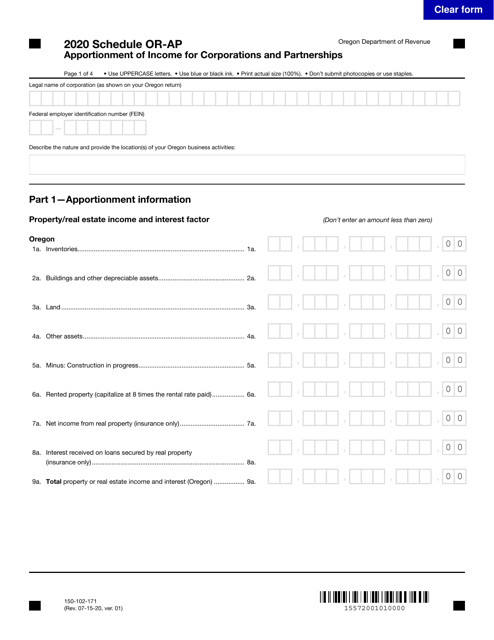

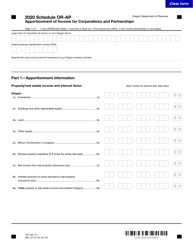

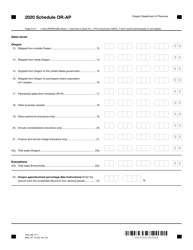

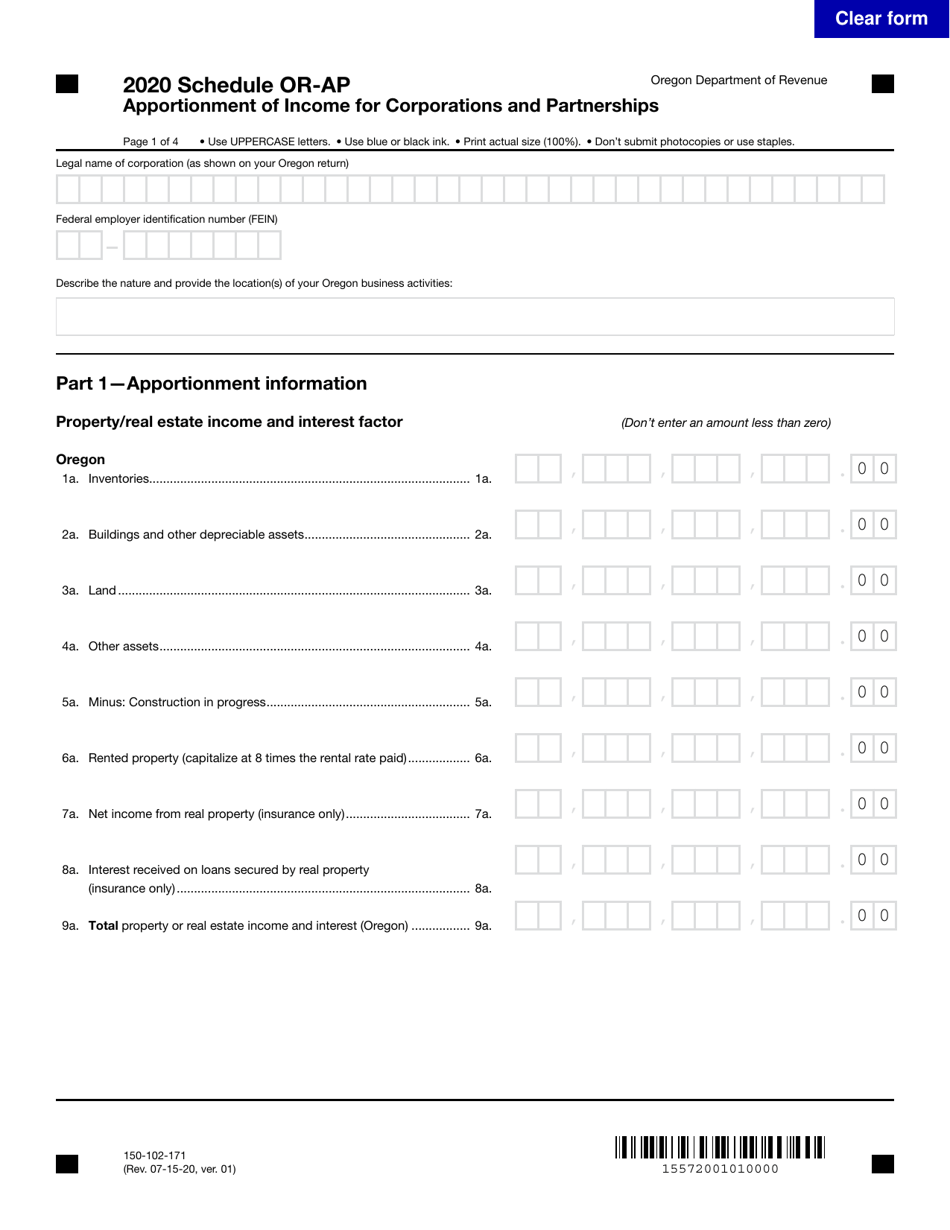

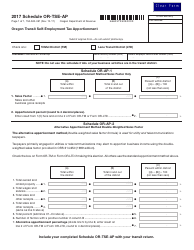

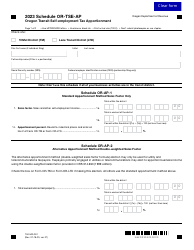

Form 150-102-171 Schedule OR-AP

for the current year.

Form 150-102-171 Schedule OR-AP Apportionment of Income for Corporations and Partnerships - Oregon

What Is Form 150-102-171 Schedule OR-AP?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-102-171?

A: Form 150-102-171 is the Schedule OR-AP, which is used for apportioning income for corporations and partnerships in Oregon.

Q: Who needs to fill out Form 150-102-171?

A: Corporations and partnerships who are doing business in Oregon and have income from both inside and outside the state need to fill out this form.

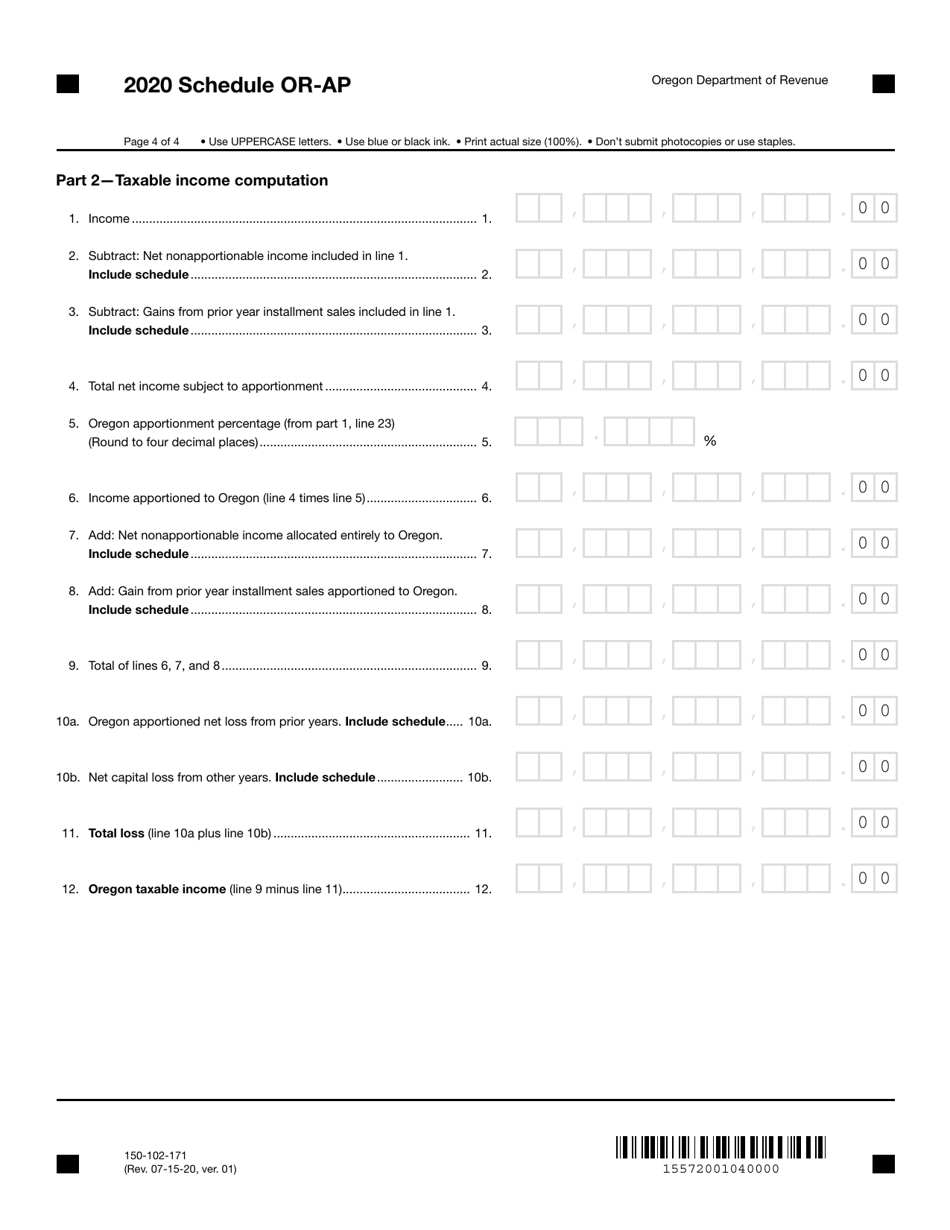

Q: What is the purpose of Form 150-102-171?

A: The purpose of this form is to determine the portion of a corporation or partnership's income that is subject to Oregon tax based on the apportionment formula.

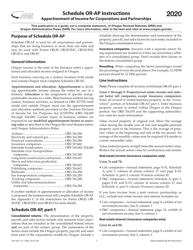

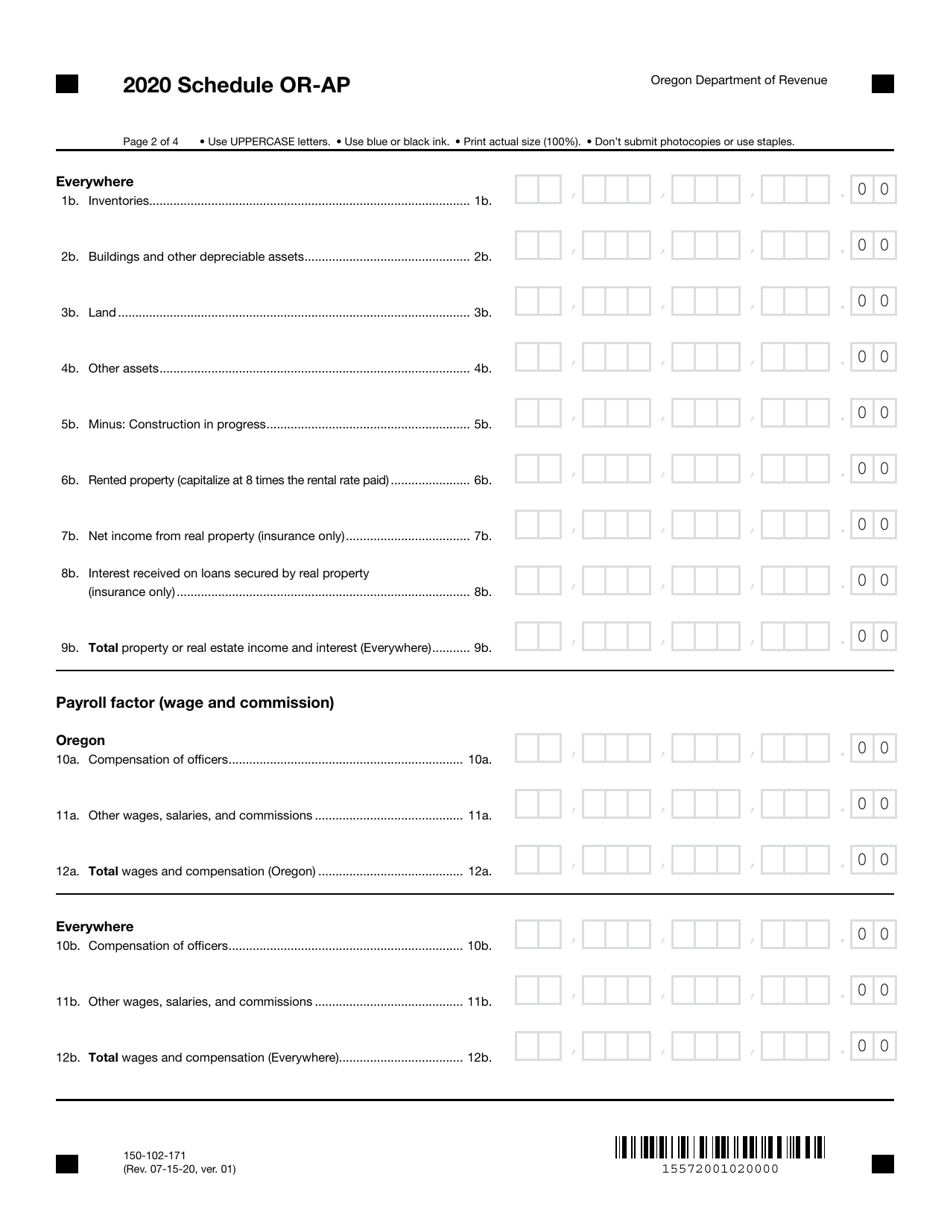

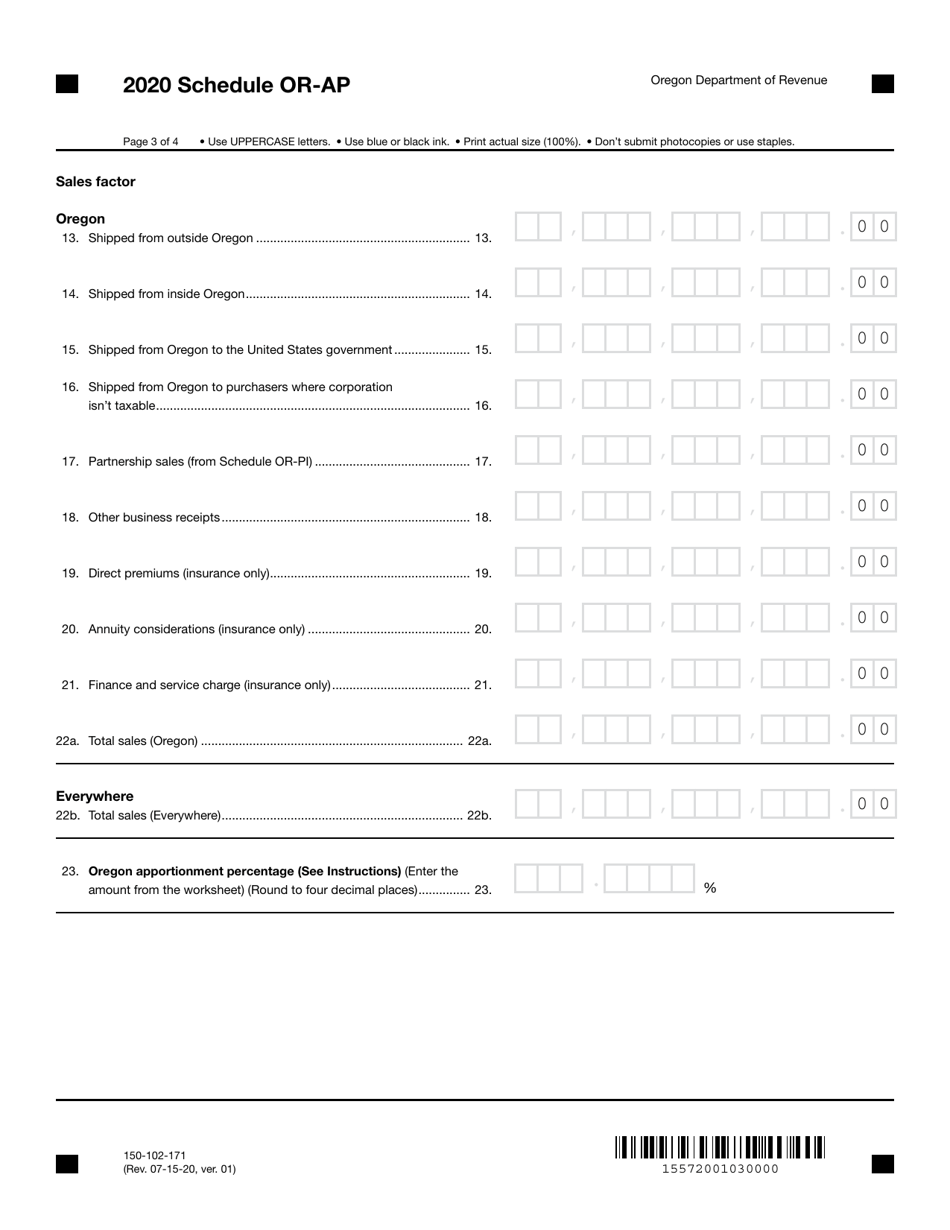

Q: How do I calculate apportionment on Form 150-102-171?

A: Apportionment is calculated using a formula that takes into account factors such as property, payroll, and sales in Oregon compared to total property, payroll, and sales everywhere.

Q: When is Form 150-102-171 due?

A: Form 150-102-171 is due on the 15th day of the 4th month following the end of the tax year.

Q: Is Form 150-102-171 required for all corporations and partnerships?

A: No, not all corporations and partnerships are required to file this form. It is only necessary for those with income from both inside and outside of Oregon.

Q: What happens if I don't file Form 150-102-171?

A: If you are required to file this form and fail to do so, you may be subject to penalties and interest on any tax owed.

Q: Are there any exceptions to filing Form 150-102-171?

A: There are some exceptions to filing this form, such as for corporations and partnerships that have all of their income from sources within Oregon.

Form Details:

- Released on July 15, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-171 Schedule OR-AP by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.