This version of the form is not currently in use and is provided for reference only. Download this version of

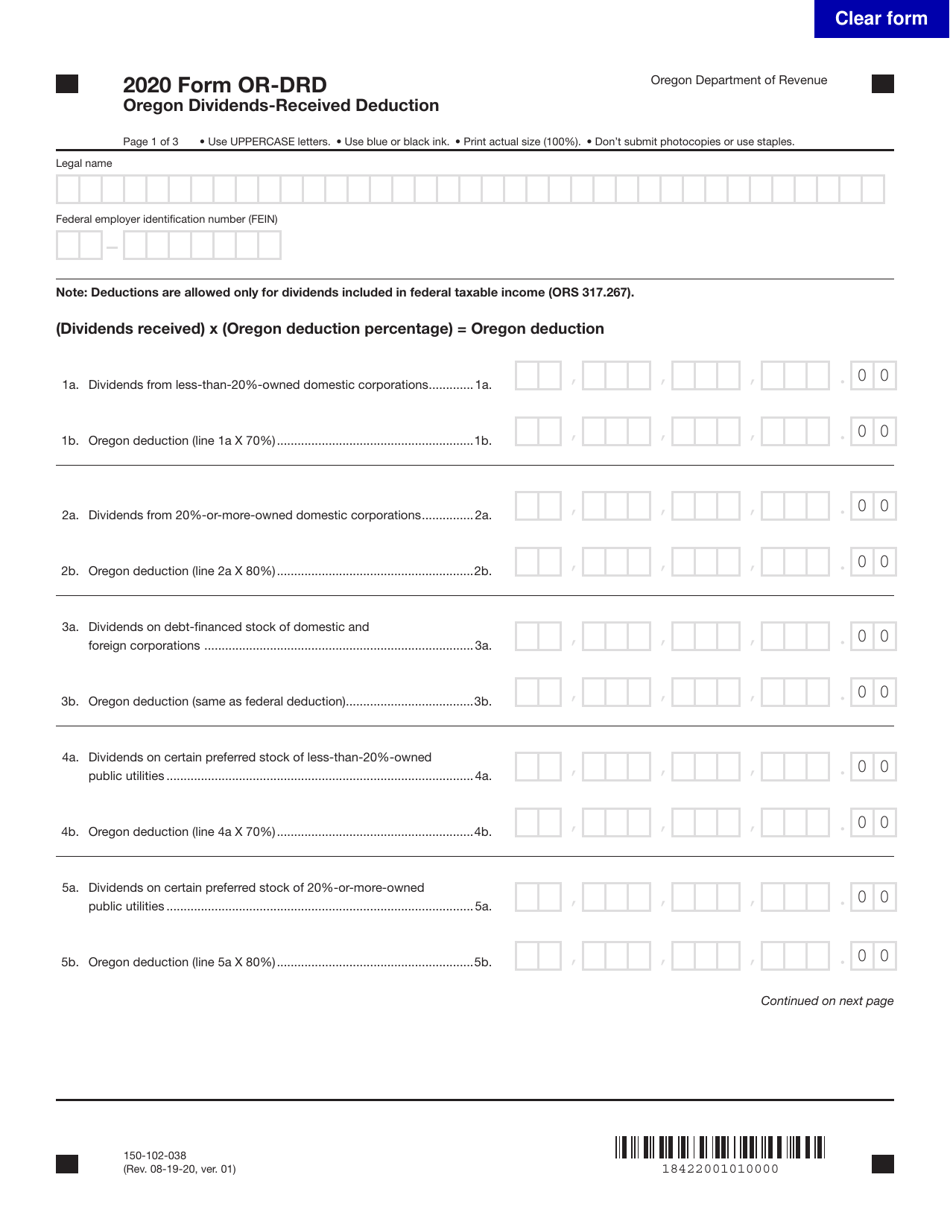

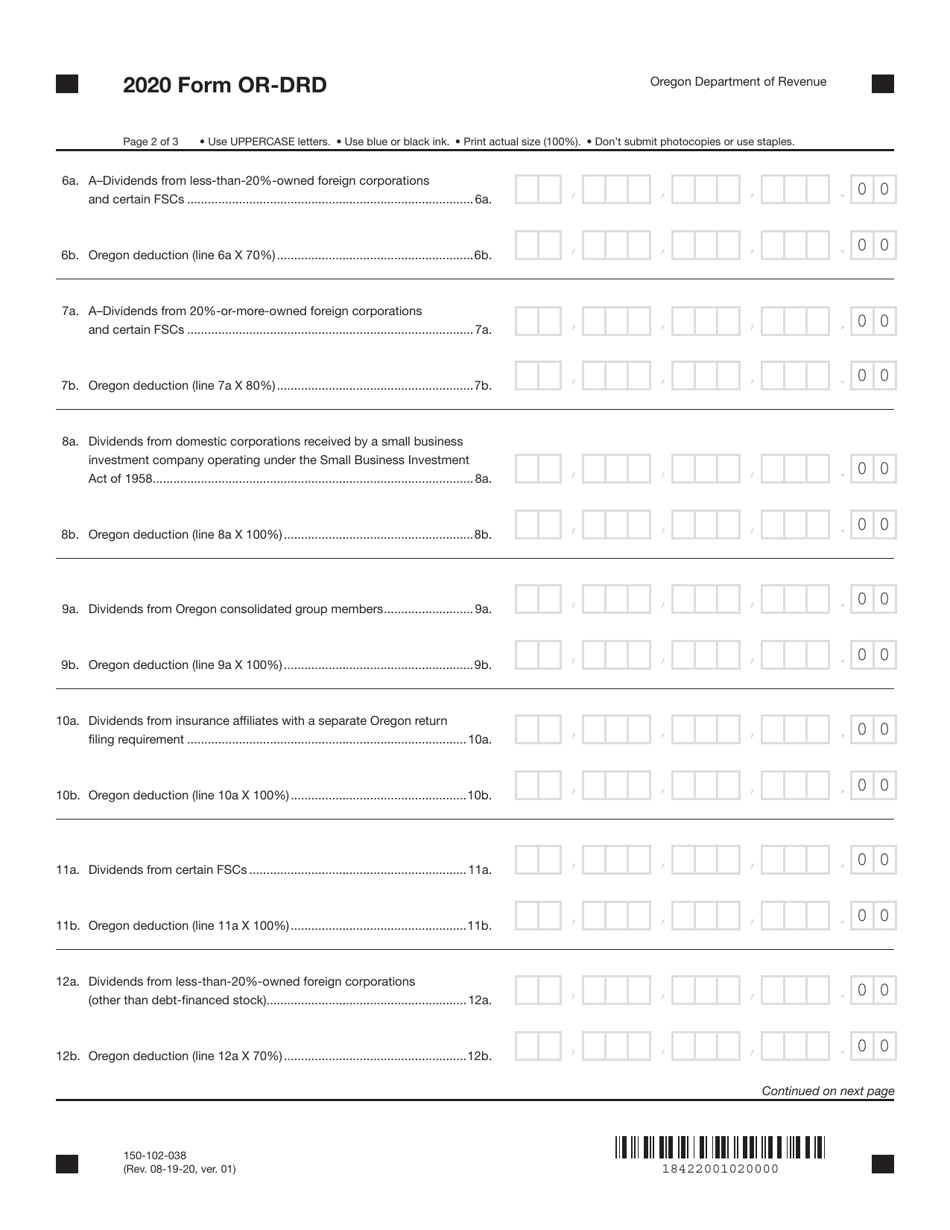

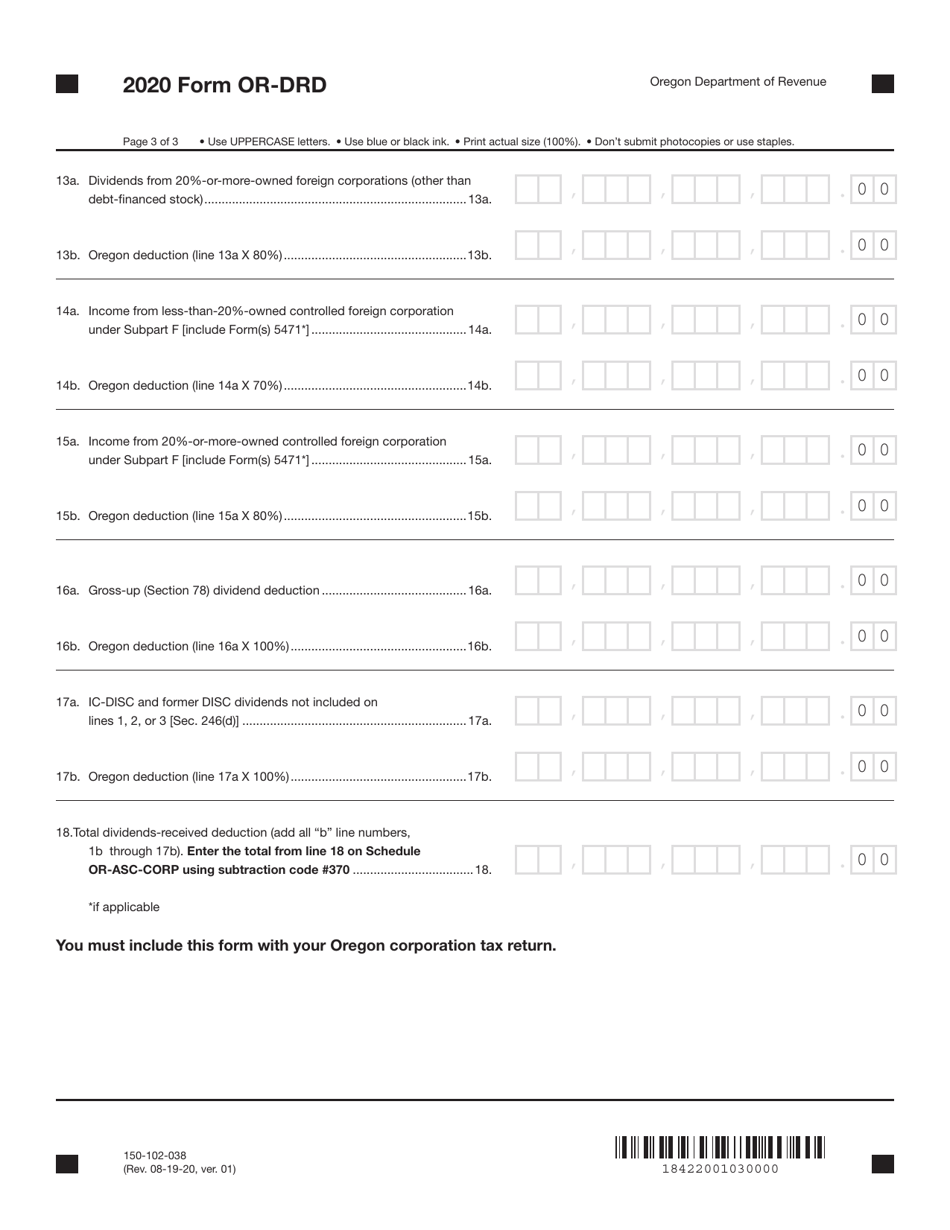

Form OR-DRD (150-102-038)

for the current year.

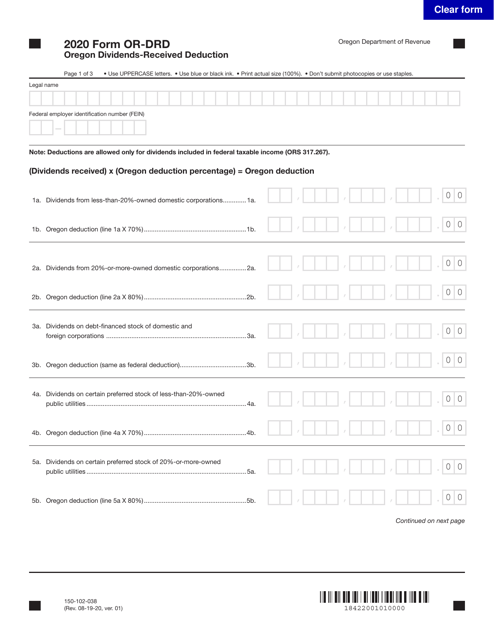

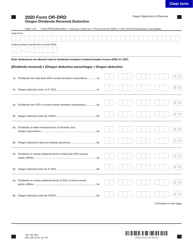

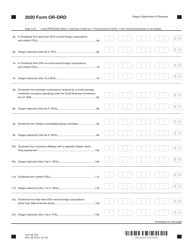

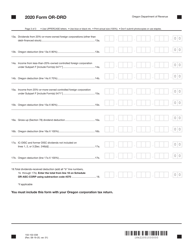

Form OR-DRD (150-102-038) Oregon Dividends-Received Deduction - Oregon

What Is Form OR-DRD (150-102-038)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-DRD?

A: Form OR-DRD is the Oregon Dividends-Received Deduction form.

Q: What is the purpose of Form OR-DRD?

A: The purpose of Form OR-DRD is to claim the Oregon Dividends-Received Deduction.

Q: What is the Oregon Dividends-Received Deduction?

A: The Oregon Dividends-Received Deduction is a tax deduction available to Oregon residents for dividends received from certain sources.

Q: Who is eligible to claim the Oregon Dividends-Received Deduction?

A: Oregon residents who have received eligible dividends may be eligible to claim the deduction.

Q: What types of dividends qualify for the deduction?

A: Dividends received from certain stock-owned corporations and certain mutual funds may qualify for the deduction.

Q: When is the deadline to file Form OR-DRD?

A: The deadline to file Form OR-DRD is the same as the deadline to file your Oregon state tax return, usually April 15th.

Q: Are there any limitations to the deduction?

A: Yes, there are limitations based on the amount of dividends received and your federal adjusted gross income.

Q: Can I claim the deduction if I received dividends from out-of-state sources?

A: No, the Oregon Dividends-Received Deduction is only available for dividends received from certain sources within Oregon.

Q: Do I need to include any supporting documents when filing Form OR-DRD?

A: Yes, you will need to include copies of all applicable federal and state schedules and forms when filing Form OR-DRD.

Form Details:

- Released on August 19, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-DRD (150-102-038) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.