This version of the form is not currently in use and is provided for reference only. Download this version of

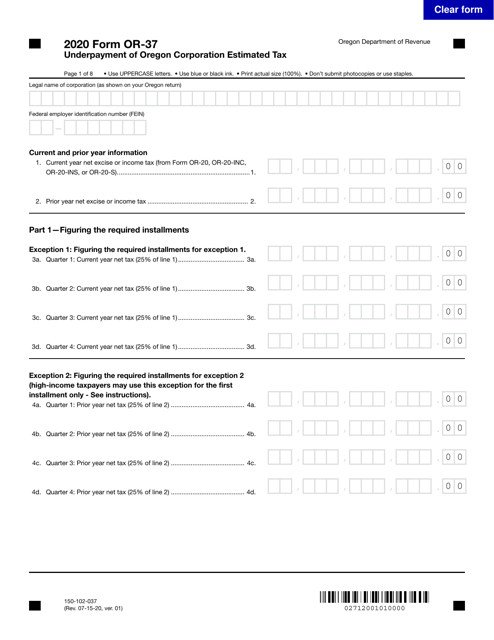

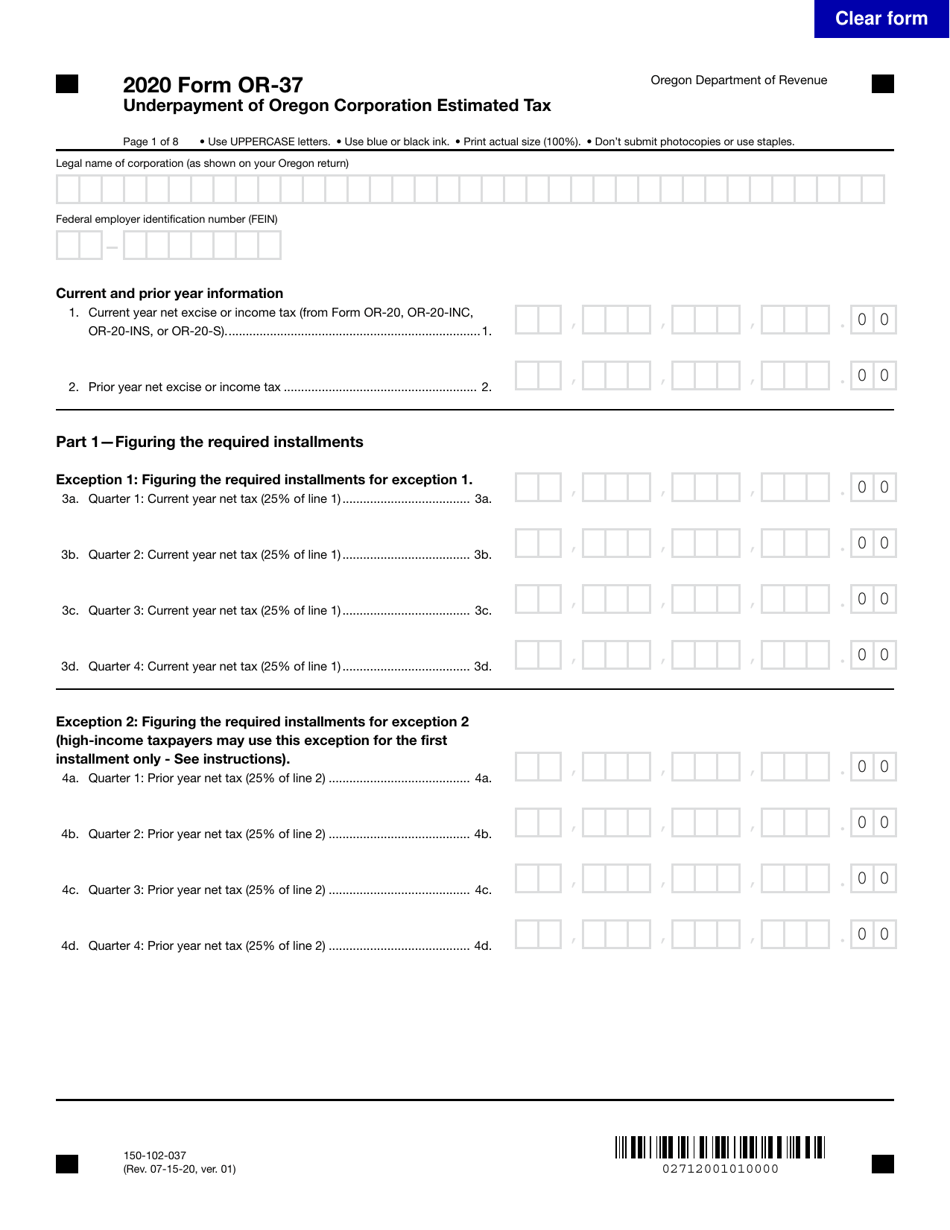

Form OR-37 (150-102-037)

for the current year.

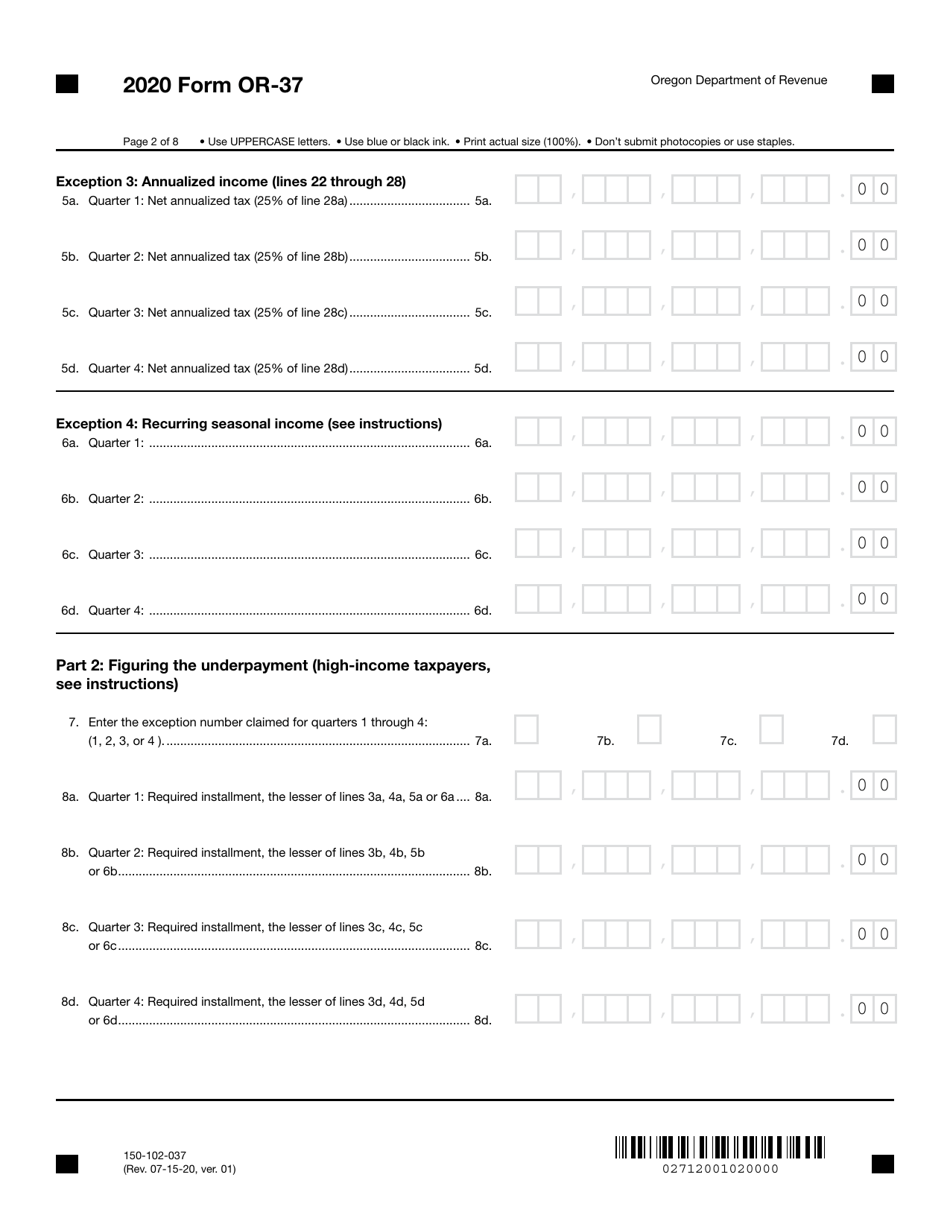

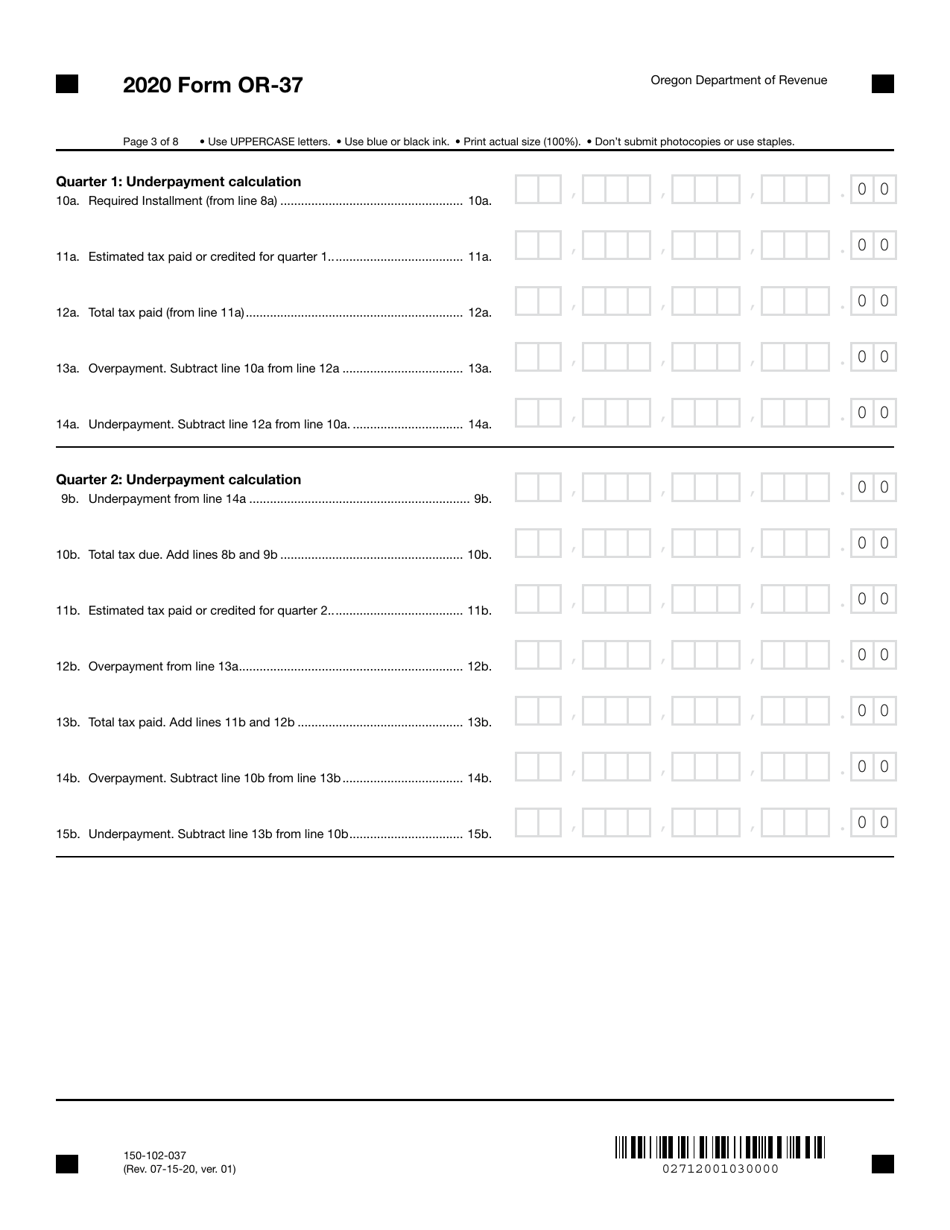

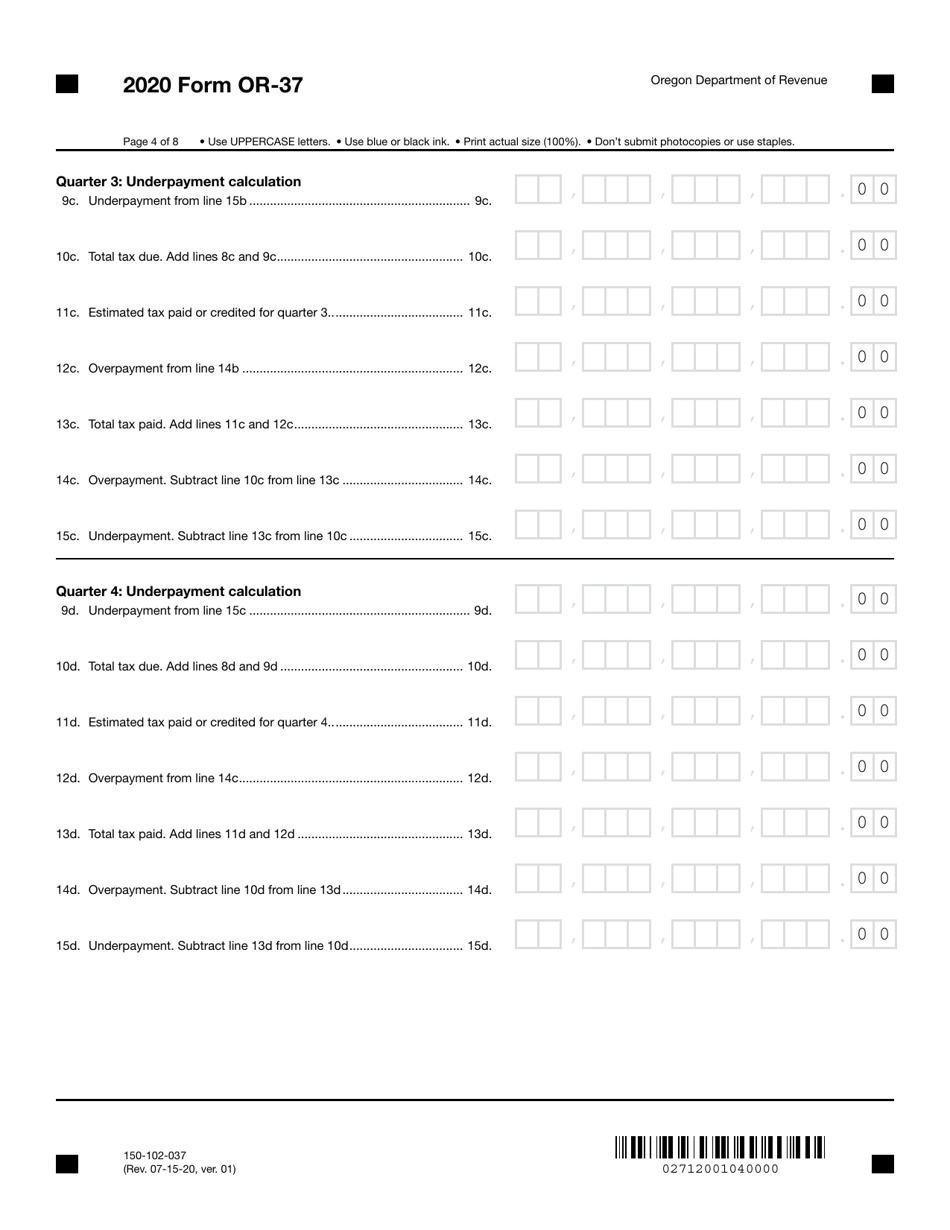

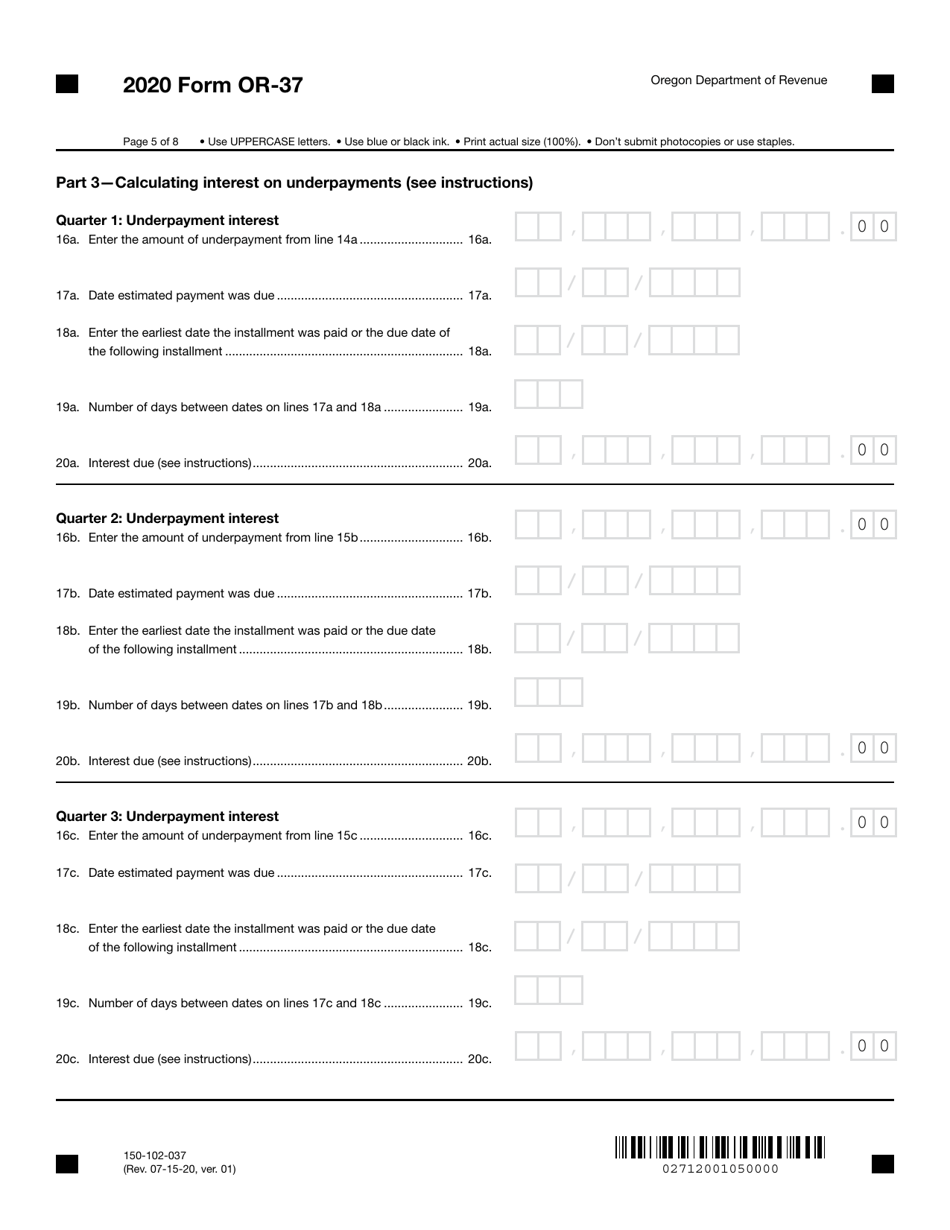

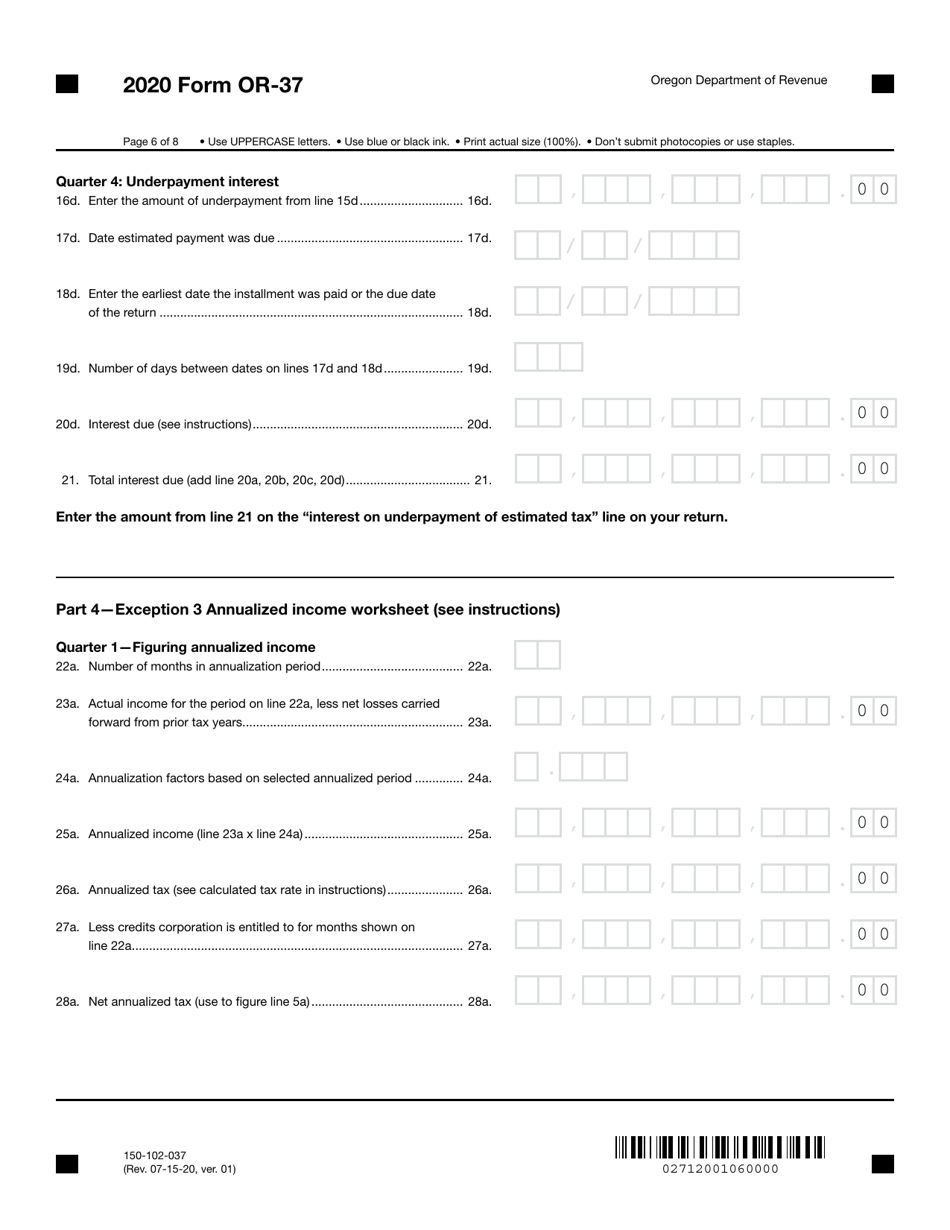

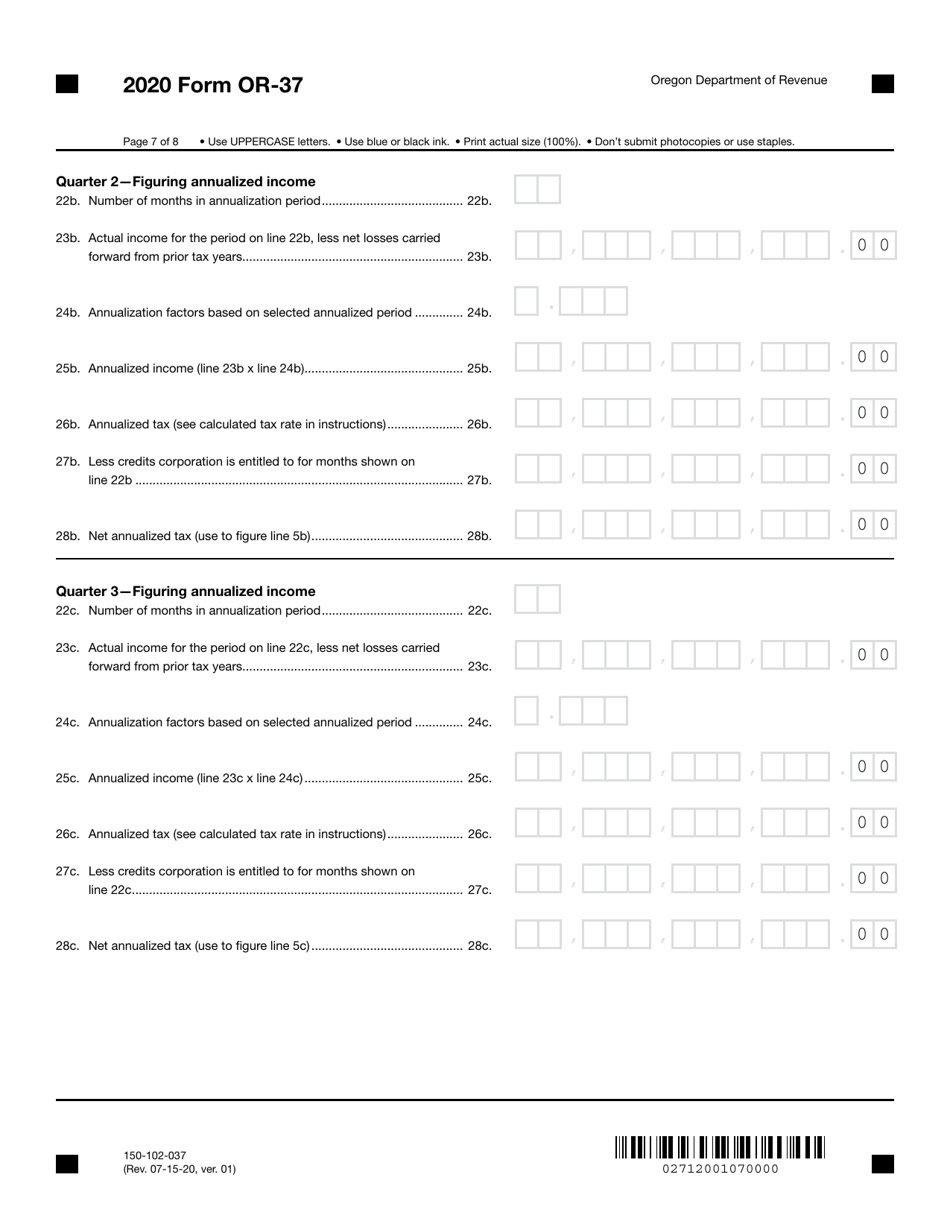

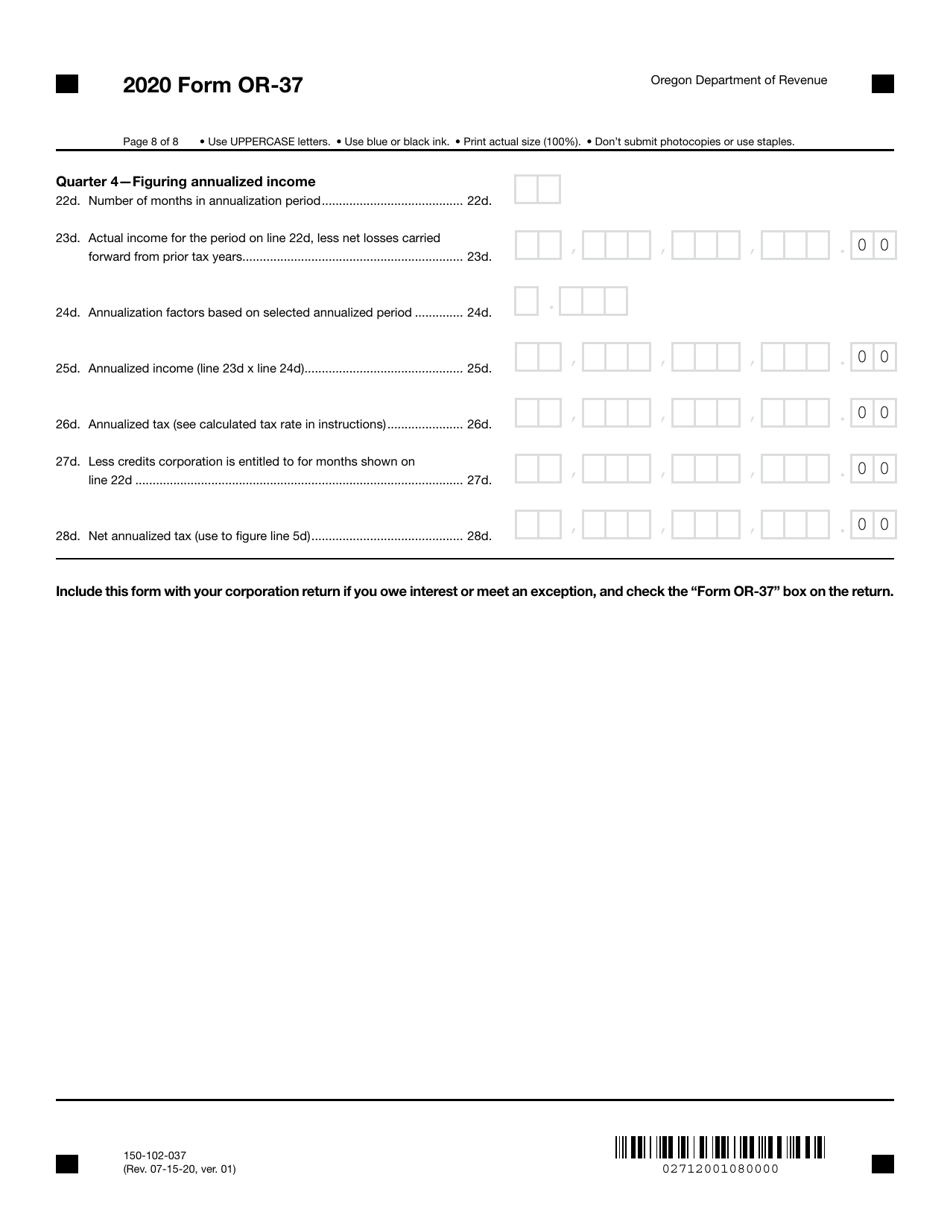

Form OR-37 (150-102-037) Underpayment of Oregon Corporation Estimated Tax - Oregon

What Is Form OR-37 (150-102-037)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-37 (150-102-037)?

A: Form OR-37 (150-102-037) is the form used for reporting underpayment of Oregon Corporation Estimated Tax.

Q: Who needs to file Form OR-37?

A: Corporations in Oregon who have underpaid their estimated tax must file Form OR-37.

Q: What is the purpose of Form OR-37?

A: The purpose of Form OR-37 is to calculate and report any underpayment of estimated tax by Oregon corporations.

Q: When is Form OR-37 due?

A: Form OR-37 is due on the original due date of the Oregon corporation tax return, which is generally the 15th day of the month following the end of the tax year.

Q: Are there any penalties for not filing Form OR-37?

A: Yes, there may be penalties for not filing Form OR-37 or for underpaying estimated tax. It is important to file the form and pay any underpayment to avoid penalties.

Form Details:

- Released on July 15, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-37 (150-102-037) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.