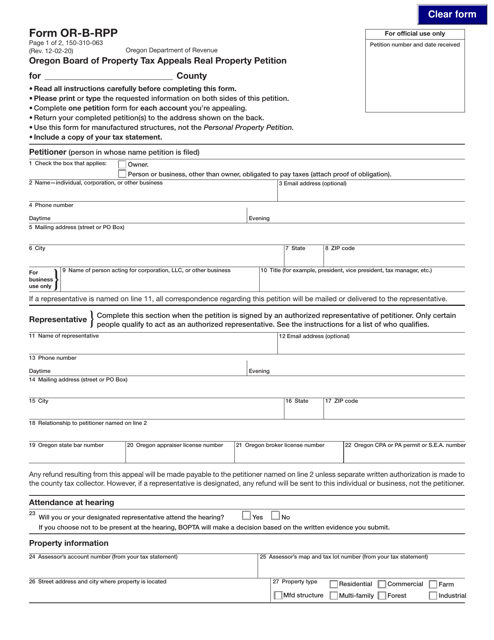

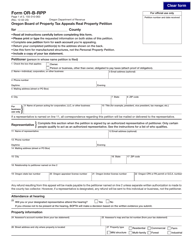

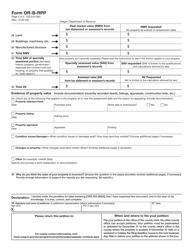

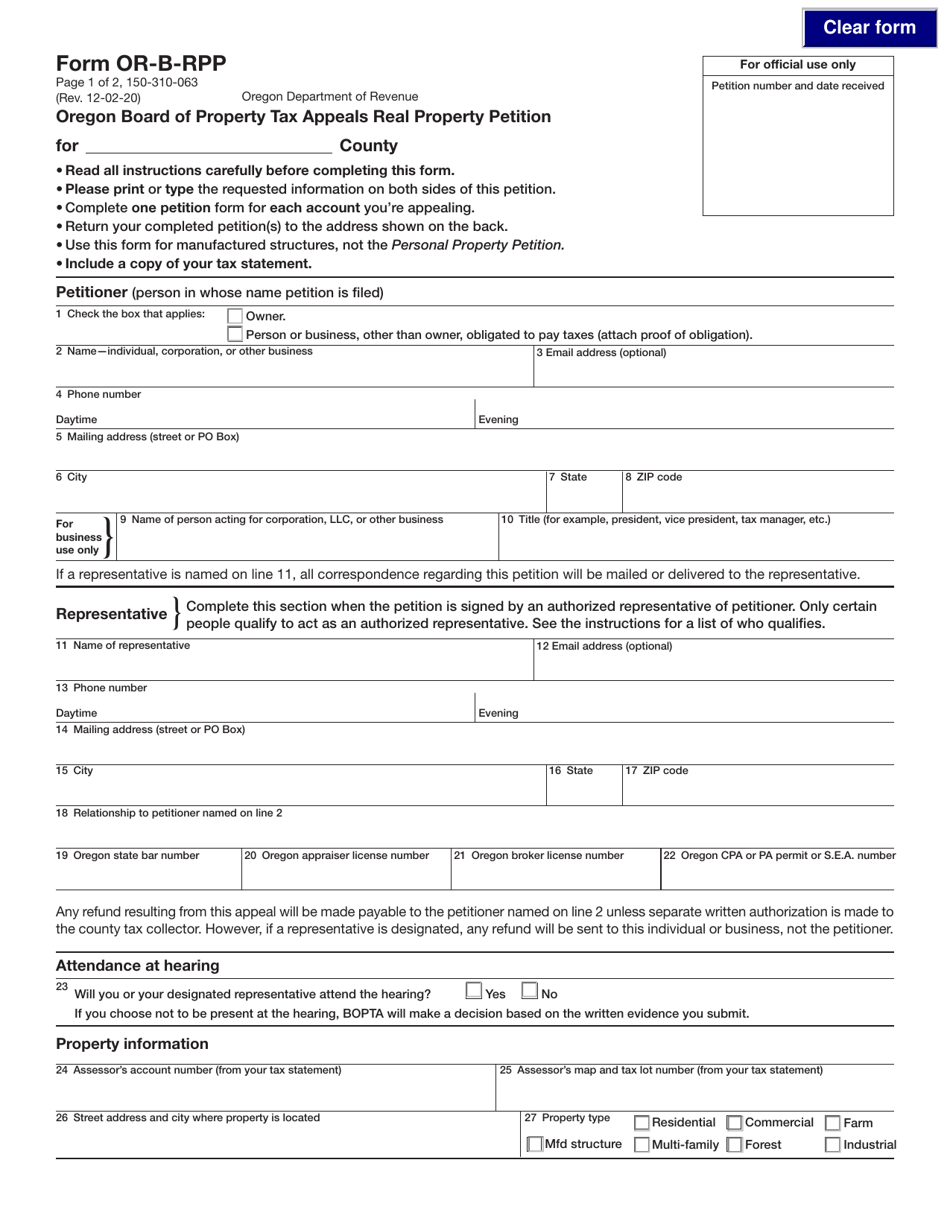

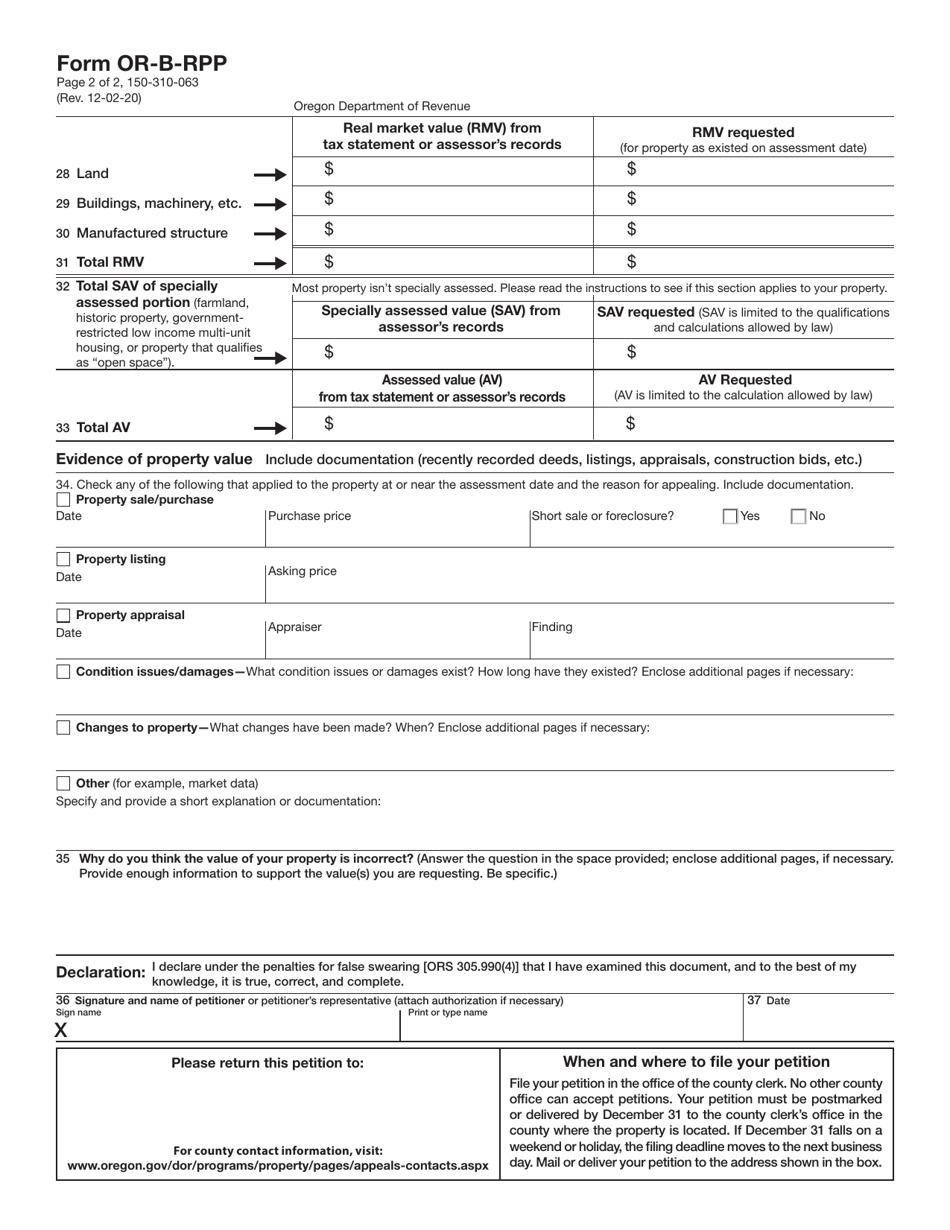

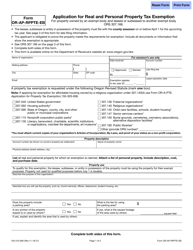

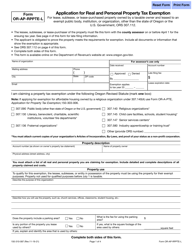

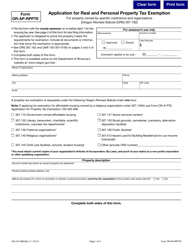

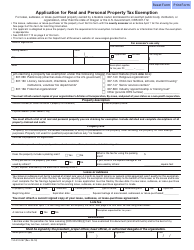

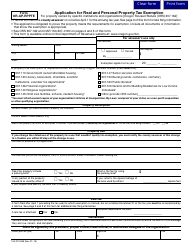

Form OR-B-RPP (150-310-063) Oregon Board of Property Tax Appeals Real Property Petition - Oregon

What Is Form OR-B-RPP (150-310-063)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is OR-B-RPP (150-310-063)?

A: OR-B-RPP (150-310-063) is the Oregon Board of Property Tax Appeals Real Property Petition form.

Q: What is the purpose of OR-B-RPP (150-310-063)?

A: The purpose of OR-B-RPP (150-310-063) is to file a petition with the Oregon Board of Property Tax Appeals for real property tax assessment appeals.

Q: Who can use OR-B-RPP (150-310-063)?

A: OR-B-RPP (150-310-063) can be used by property owners who want to appeal their real property tax assessment in Oregon.

Q: Is there a deadline to submit OR-B-RPP (150-310-063) form?

A: Yes, the OR-B-RPP (150-310-063) form must be submitted within the specified deadline mentioned on the form or as instructed by the Oregon Board of Property Tax Appeals.

Q: Are there any fees associated with OR-B-RPP (150-310-063)?

A: There may be some fees associated with filing the OR-B-RPP (150-310-063) form. Contact the Oregon Board of Property Tax Appeals for more information.

Q: Can I appeal multiple real property tax assessments using OR-B-RPP (150-310-063)?

A: Yes, you can appeal multiple real property tax assessments using separate OR-B-RPP (150-310-063) forms for each property.

Q: What happens after I submit OR-B-RPP (150-310-063) form?

A: After you submit the OR-B-RPP (150-310-063) form, the Oregon Board of Property Tax Appeals will review your petition and schedule a hearing if necessary.

Q: Can I seek legal assistance with OR-B-RPP (150-310-063)?

A: Yes, you have the option to seek legal assistance for filing the OR-B-RPP (150-310-063) form or representing yourself during the appeal process.

Form Details:

- Released on December 2, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-B-RPP (150-310-063) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.