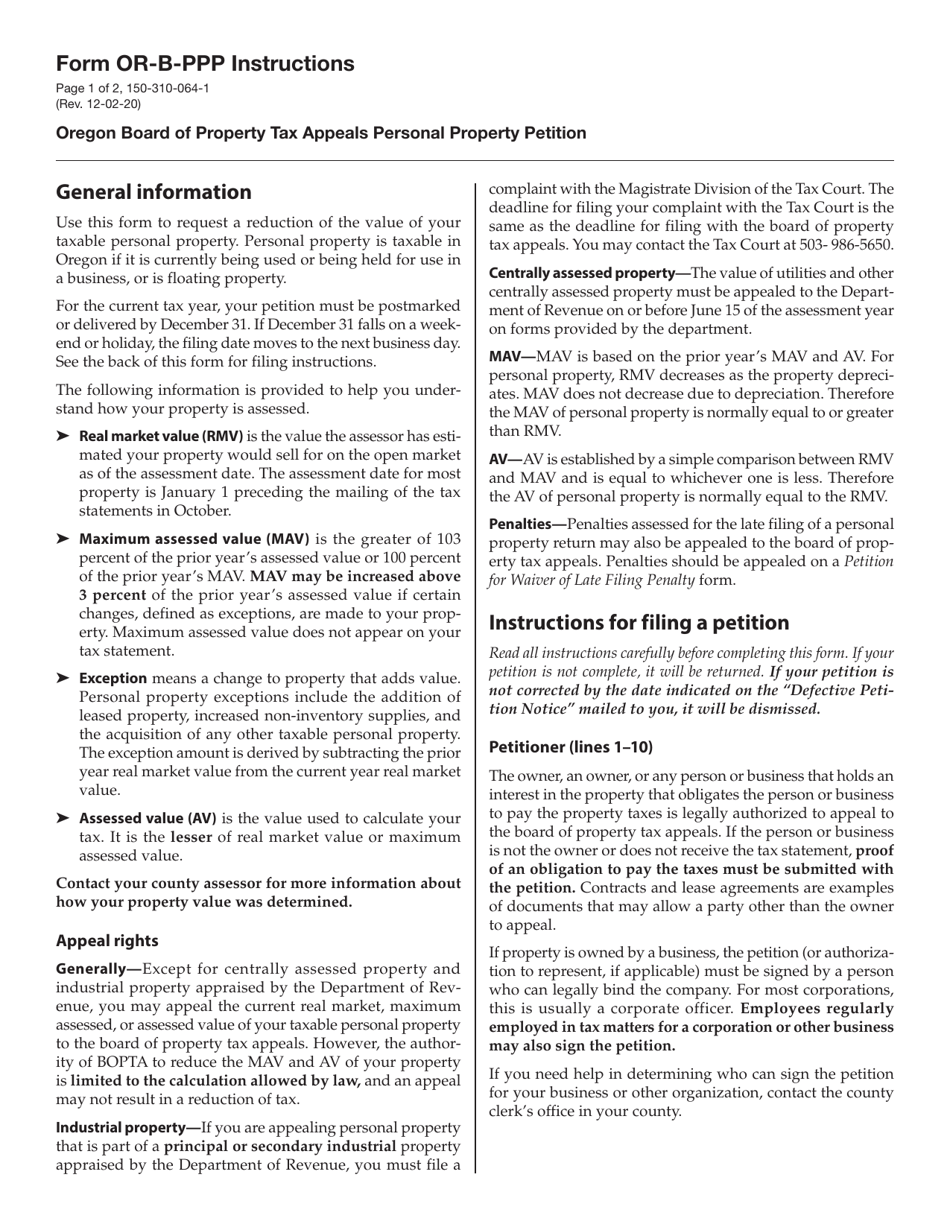

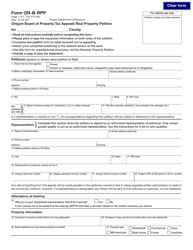

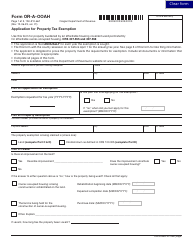

Instructions for Form OR-B-PPP, 150-310-064 Oregon Board of Property Tax Appeals Personal Property Petition - Oregon

This document contains official instructions for Form OR-B-PPP , and Form 150-310-064 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-B-PPP (150-310-064) is available for download through this link. The latest available Form 150-310-064 can be downloaded through this link.

FAQ

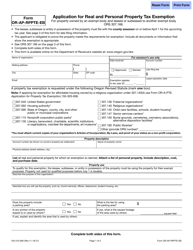

Q: What is Form OR-B-PPP?

A: Form OR-B-PPP is the Oregon Board of Property Tax Appeals Personal Property Petition.

Q: What is the purpose of Form OR-B-PPP?

A: The purpose of Form OR-B-PPP is to petition the Oregon Board of Property Tax Appeals regarding personal property taxes.

Q: Who needs to fill out Form OR-B-PPP?

A: Individuals or businesses who want to appeal their personal property tax assessment in Oregon need to fill out Form OR-B-PPP.

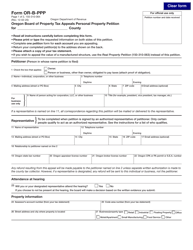

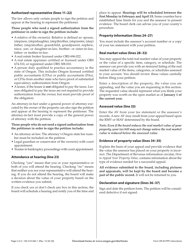

Q: What information do I need to provide on Form OR-B-PPP?

A: You need to provide your contact information, property description, assessment details, and reasons for the appeal on Form OR-B-PPP.

Q: Are there any fees associated with filing Form OR-B-PPP?

A: No, there are no fees associated with filing Form OR-B-PPP.

Q: What happens after I submit Form OR-B-PPP?

A: After you submit Form OR-B-PPP, the Oregon Board of Property Tax Appeals will review your petition and schedule a hearing if necessary.

Q: Can I appeal the decision of the Oregon Board of Property Tax Appeals?

A: Yes, you have the right to appeal the decision of the Oregon Board of Property Tax Appeals to the Oregon Tax Court.

Q: Is there a deadline for filing Form OR-B-PPP?

A: Yes, the deadline for filing Form OR-B-PPP is December 31 of the tax year in question.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.