This version of the form is not currently in use and is provided for reference only. Download this version of

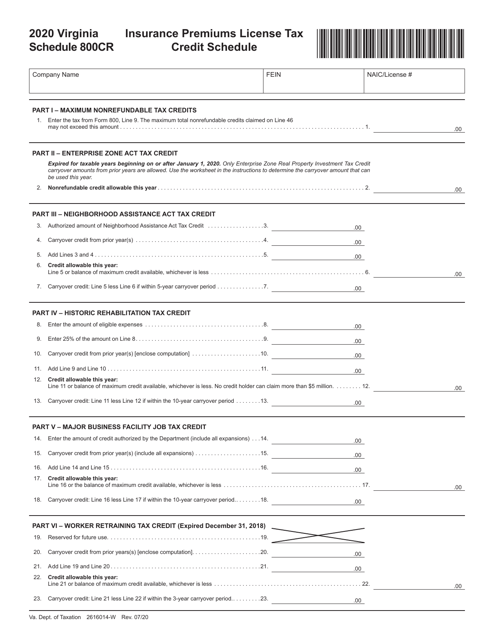

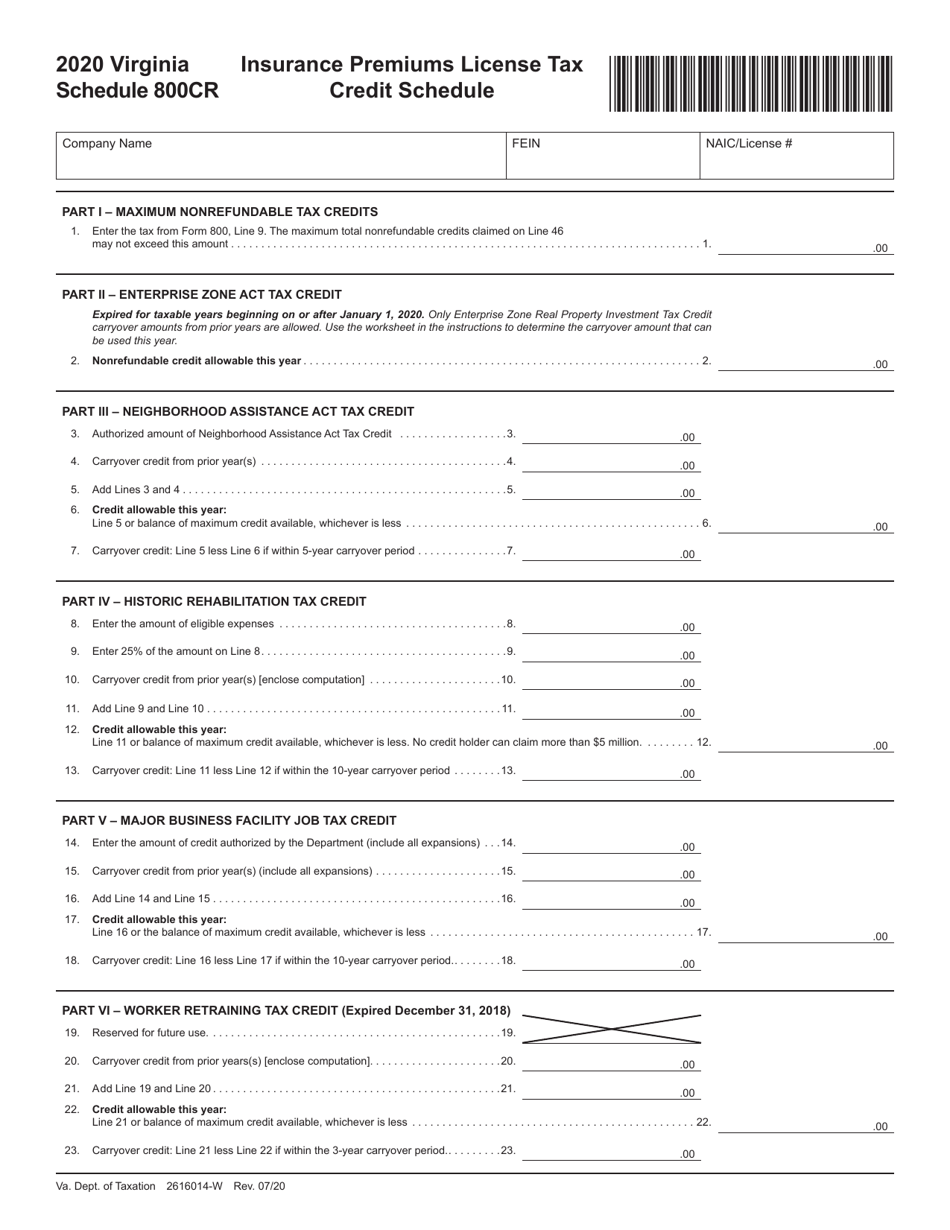

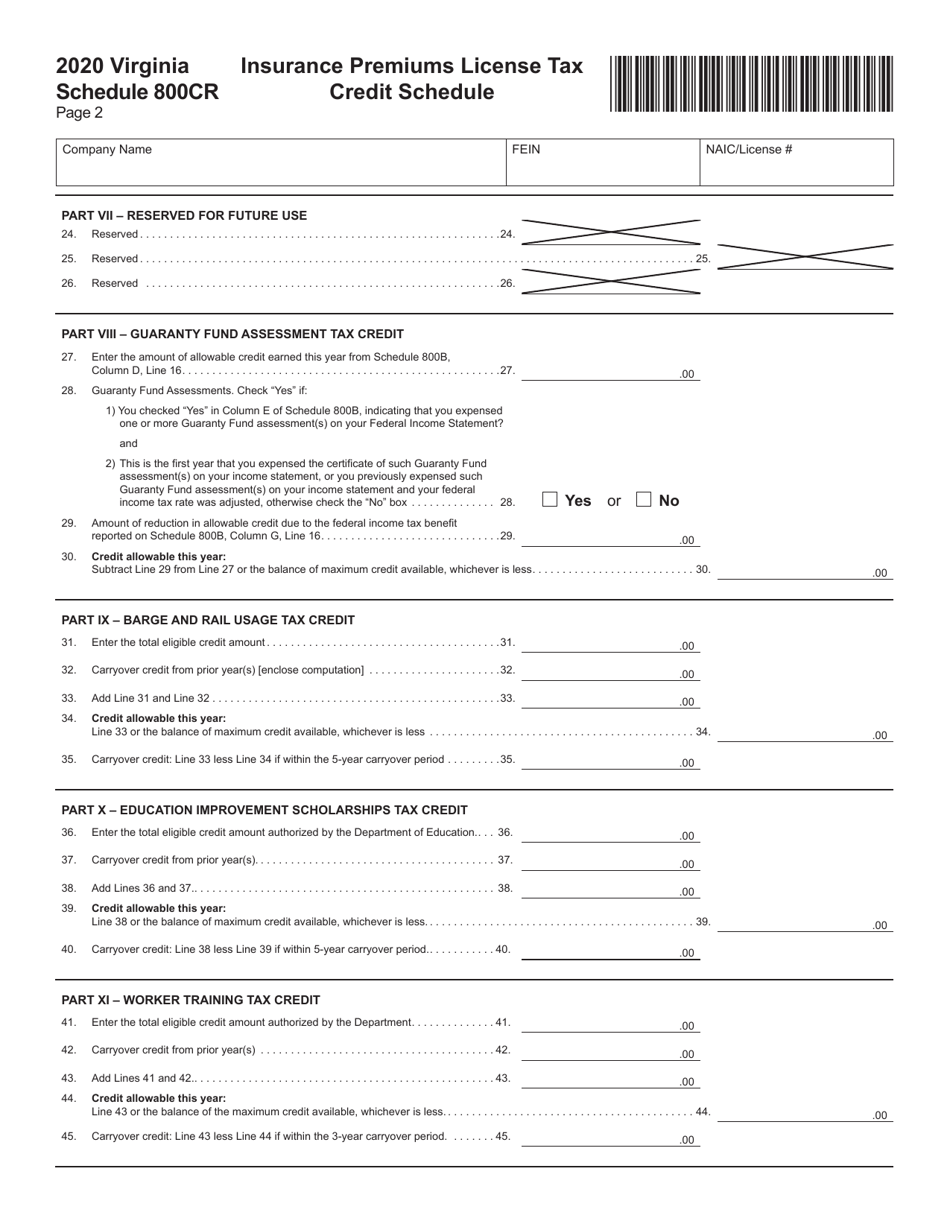

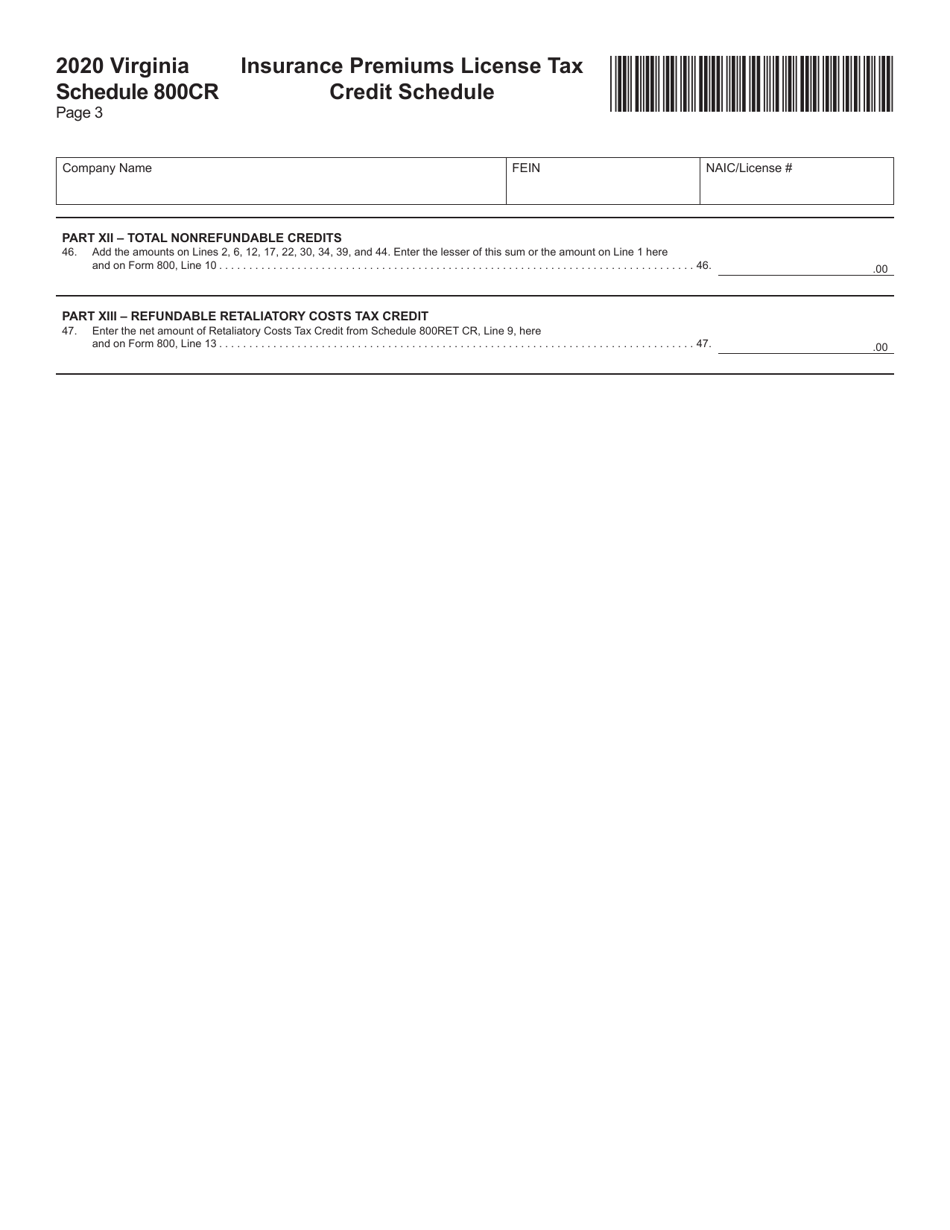

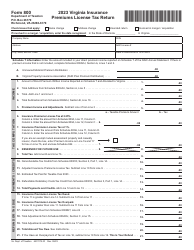

Schedule 800CR

for the current year.

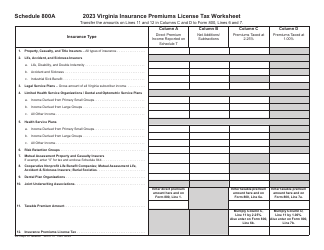

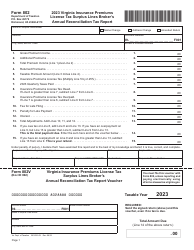

Schedule 800CR Insurance Premiums License Tax Credit Schedule - Virginia

What Is Schedule 800CR?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the 800CR Insurance PremiumsLicense Tax Credit Schedule?

A: The 800CR Insurance Premiums License Tax Credit Schedule is a form used in Virginia to calculate tax credits related to insurance premiums and license taxes.

Q: Who needs to file the 800CR Insurance Premiums License Tax Credit Schedule?

A: Anyone in Virginia who wants to claim tax credits for insurance premiums and license taxes needs to file the 800CR Schedule.

Q: What information do I need to complete the 800CR Insurance Premiums License Tax Credit Schedule?

A: You will need information about your insurance premiums and license taxes paid during the tax year.

Q: What tax credits can I claim with the 800CR Insurance Premiums License Tax Credit Schedule?

A: The schedule allows you to claim tax credits for insurance premiums and license taxes paid to the Commonwealth of Virginia.

Q: When is the deadline to file the 800CR Insurance Premiums License Tax Credit Schedule?

A: The deadline to file the 800CR Schedule is the same as the deadline to file your Virginia state tax return.

Q: Are there any limitations or restrictions on the tax credits claimed with the 800CR Insurance Premiums License Tax Credit Schedule?

A: Yes, there may be limitations on the amount of tax credits you can claim based on your insurance premiums and license taxes paid.

Q: How long does it take to process the 800CR Insurance Premiums License Tax Credit Schedule?

A: The processing time for the 800CR Schedule varies, but it typically takes a few weeks to receive your tax credit, if eligible.

Q: Can I amend my tax return to include the 800CR Insurance Premiums License Tax Credit Schedule?

A: Yes, if you discover that you are eligible for the tax credit after filing your tax return, you can file an amended return to include the 800CR Schedule.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

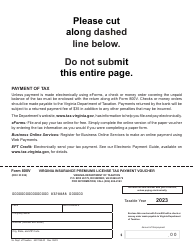

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 800CR by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.