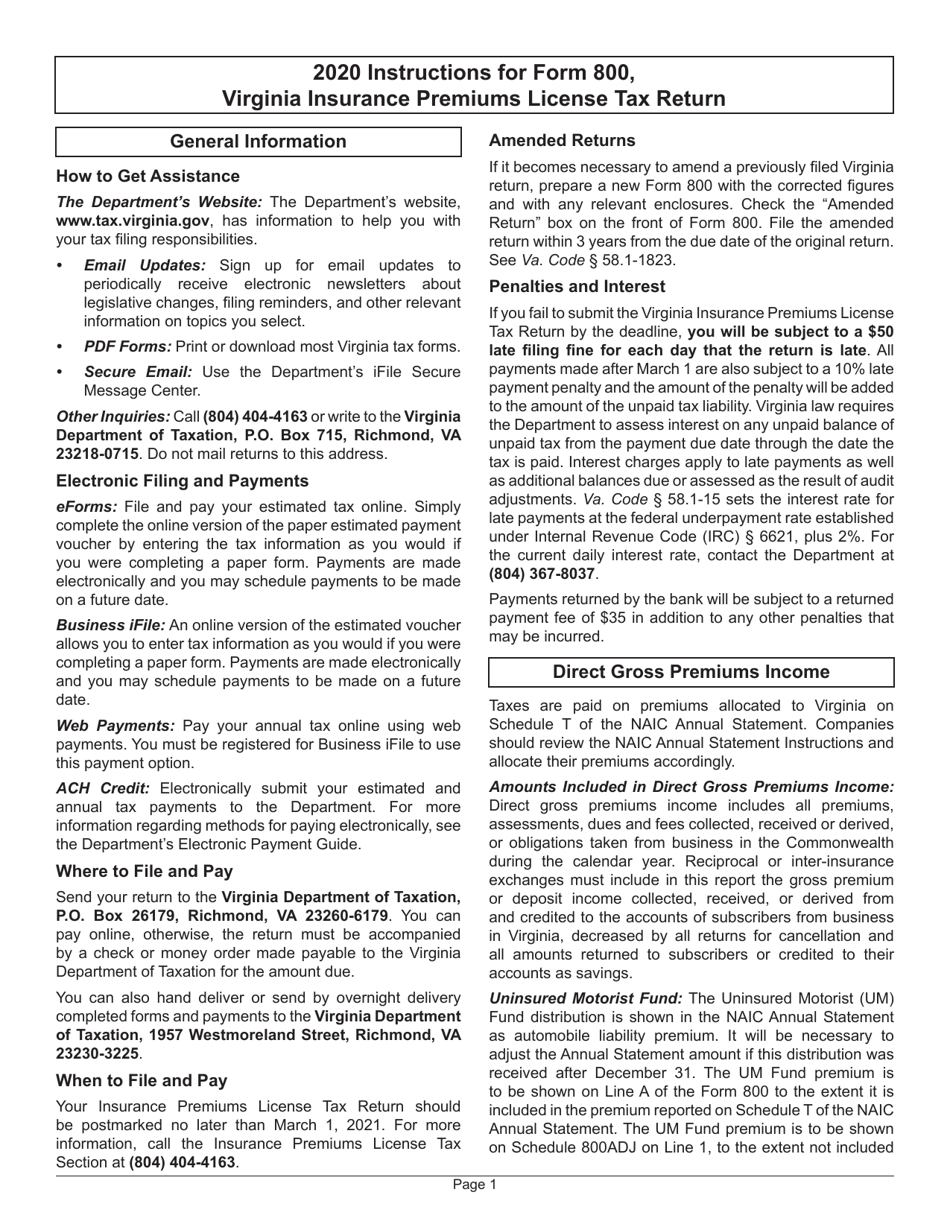

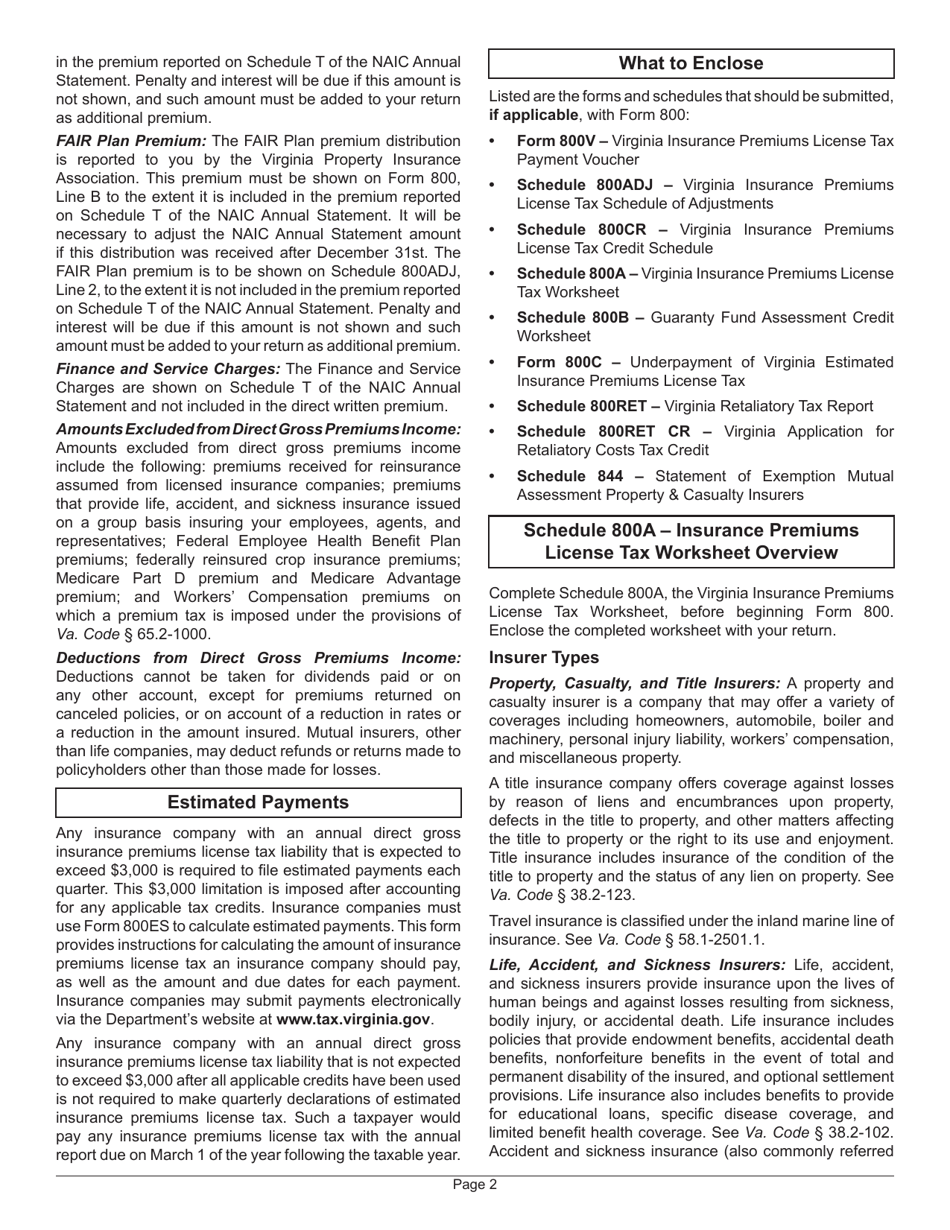

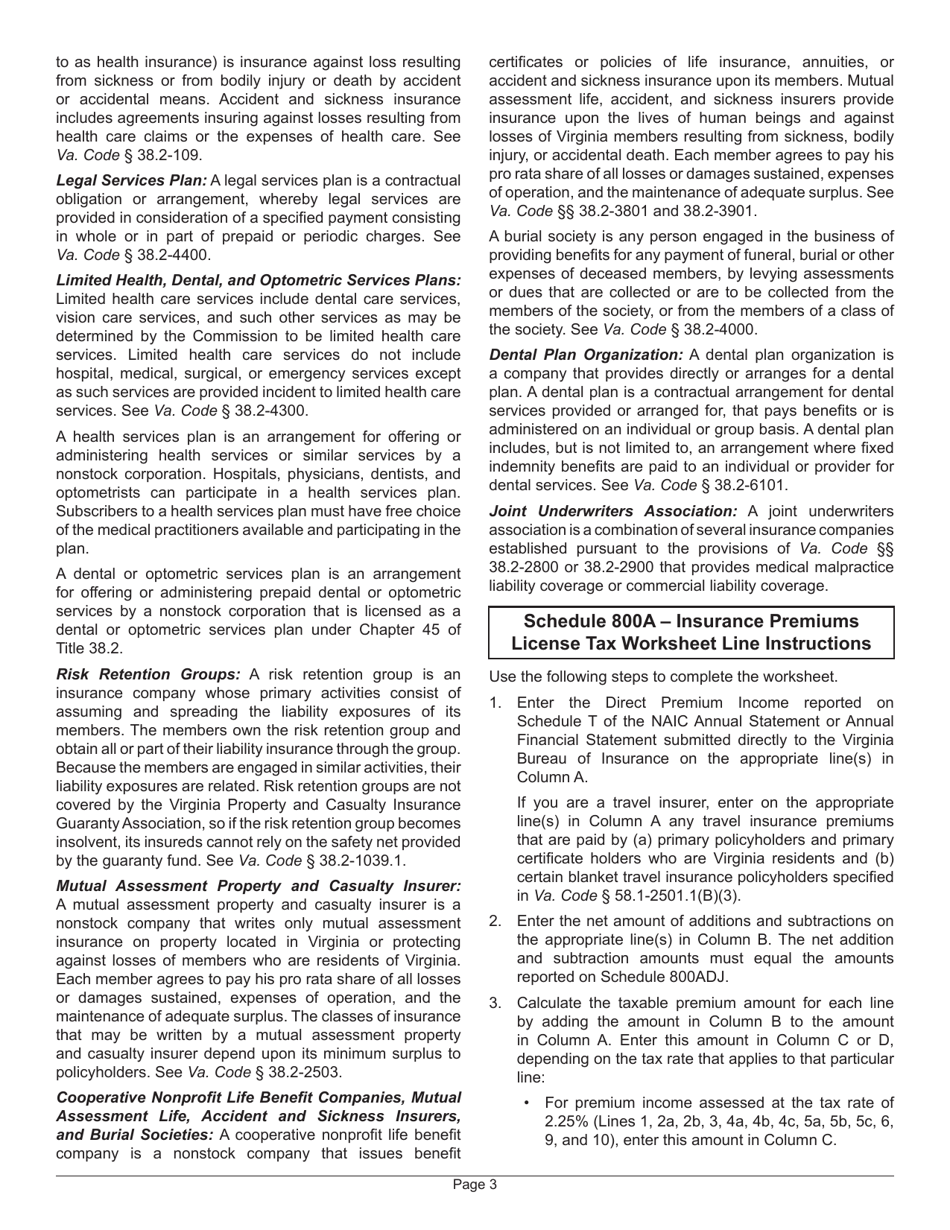

This version of the form is not currently in use and is provided for reference only. Download this version of

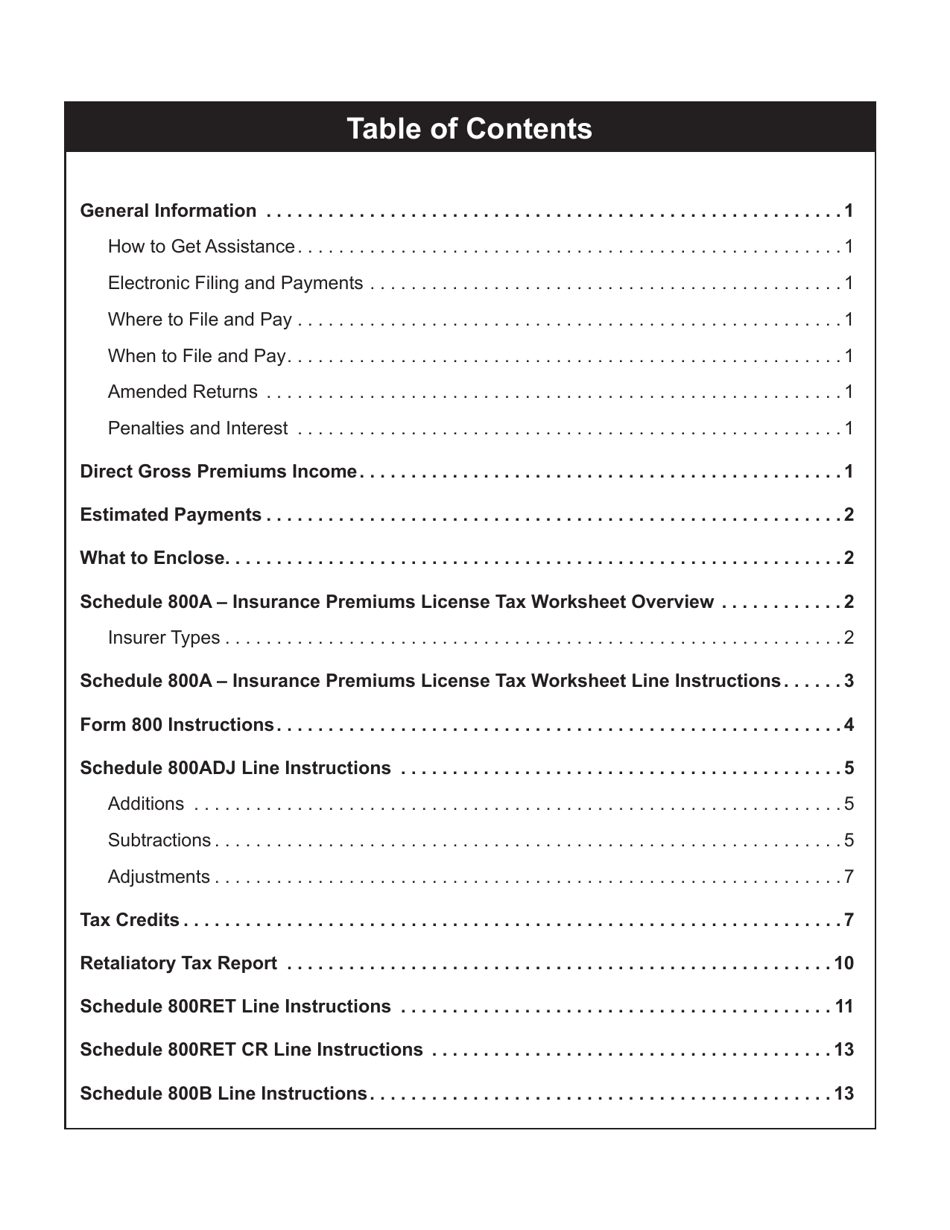

Instructions for Form 800

for the current year.

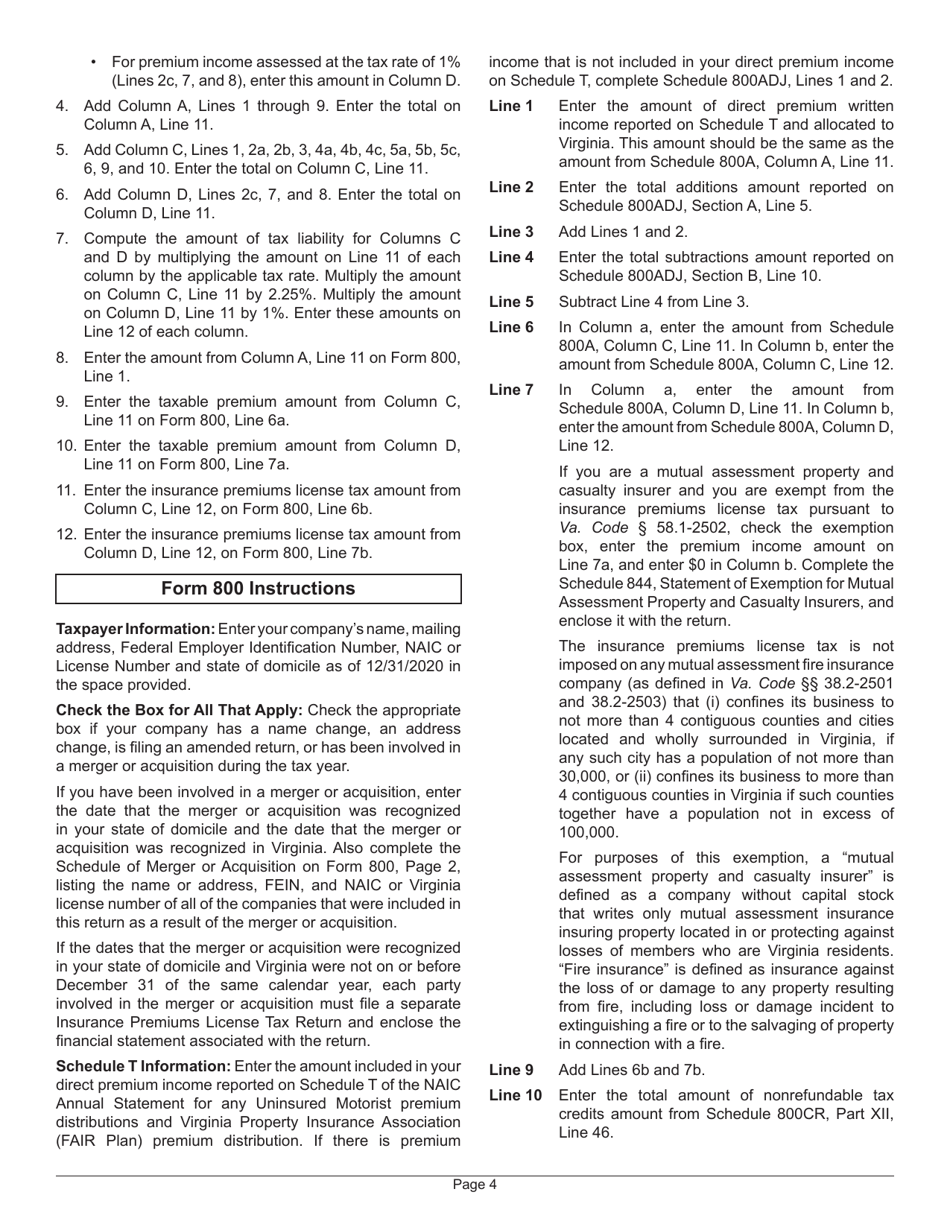

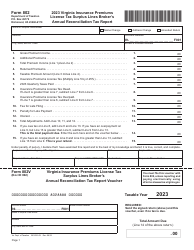

Instructions for Form 800 Virginia Insurance Premiums License Tax Return - Virginia

This document contains official instructions for Form 800 , Virginia License Tax Return - a form released and collected by the Virginia Department of Taxation. An up-to-date fillable Form 800 is available for download through this link.

FAQ

Q: What is Form 800?

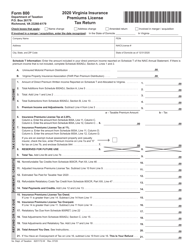

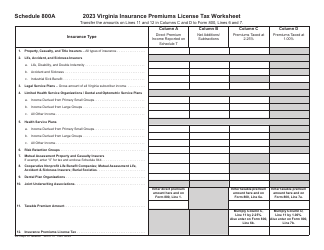

A: Form 800 is the Virginia Insurance Premiums License Tax Return.

Q: Who needs to file Form 800?

A: Insurance companies and health maintenance organizations (HMOs) doing business in Virginia need to file Form 800.

Q: What is the purpose of Form 800?

A: Form 800 is used to report and pay the Virginia Insurance Premiums License Tax.

Q: When is the due date for filing Form 800?

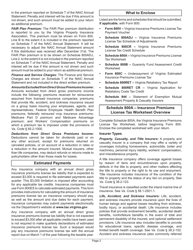

A: Form 800 is due on or before March 1st of each year.

Q: Are there any penalties for late filing of Form 800?

A: Yes, there are penalties for late filing of Form 800. It's important to submit the form by the due date to avoid penalties.

Q: How can I pay the Virginia Insurance Premiums License Tax?

A: You can pay the Virginia Insurance Premiums License Tax electronically or by mail using a check or money order.

Q: Are there any exemptions or deductions available for the Virginia Insurance Premiums License Tax?

A: Yes, there are certain exemptions and deductions available. You should refer to the instructions provided with Form 800 for more information.

Instruction Details:

- This 17-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.