This version of the form is not currently in use and is provided for reference only. Download this version of

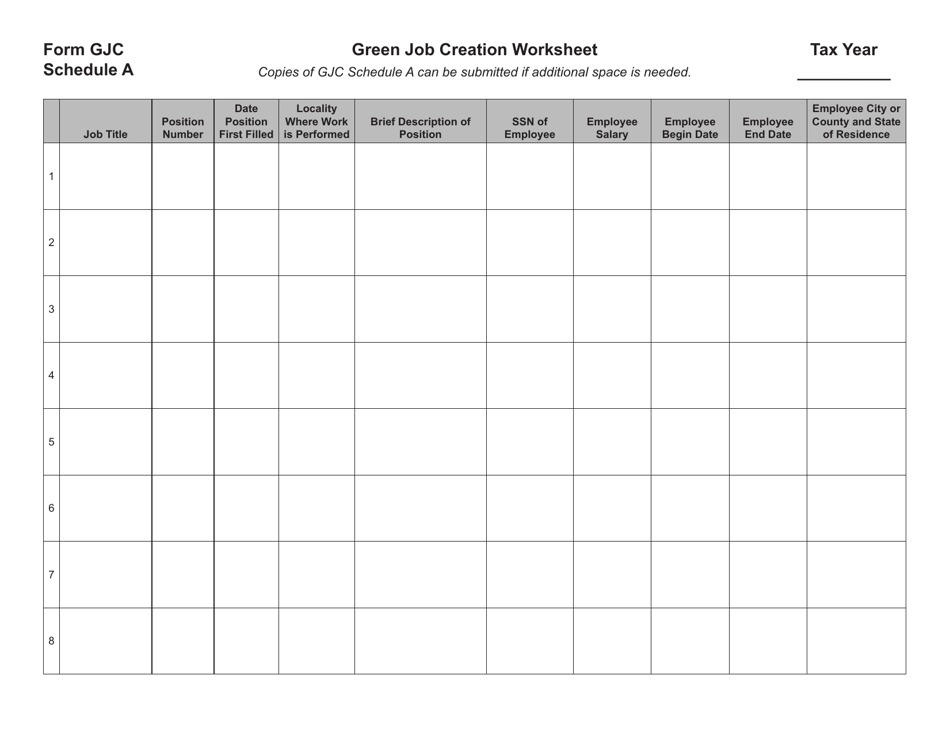

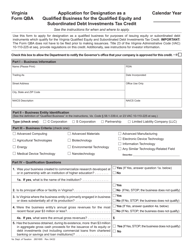

Form GJC

for the current year.

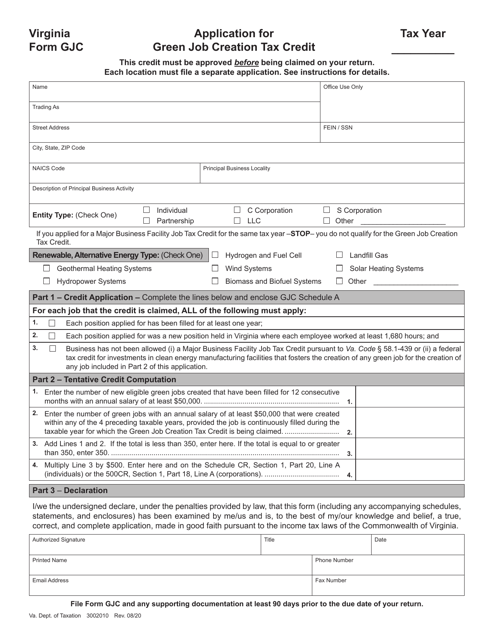

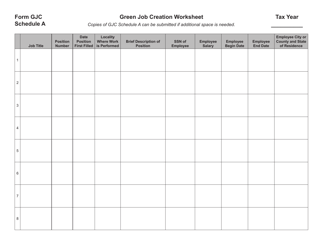

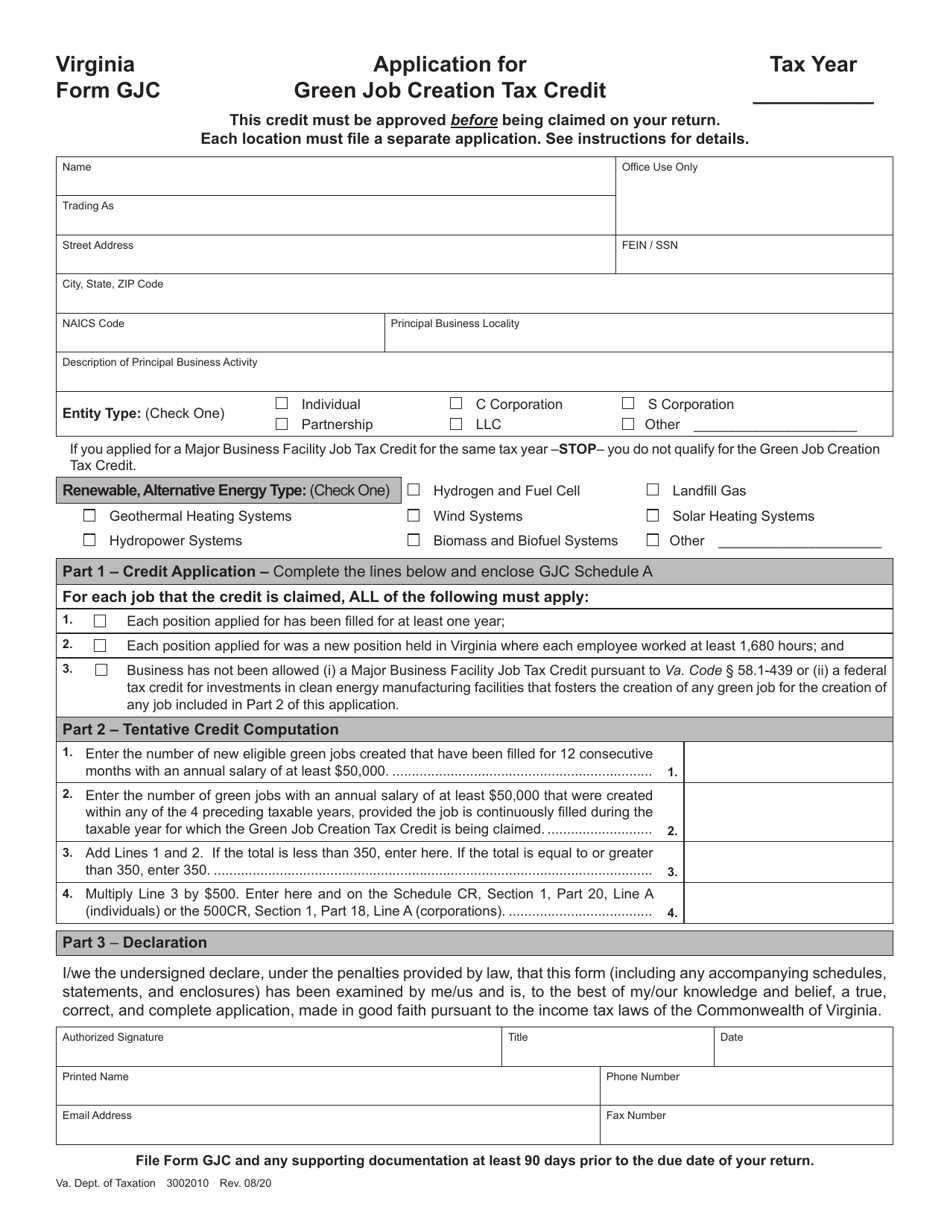

Form GJC Application for Green Job Creation Tax Credit - Virginia

What Is Form GJC?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

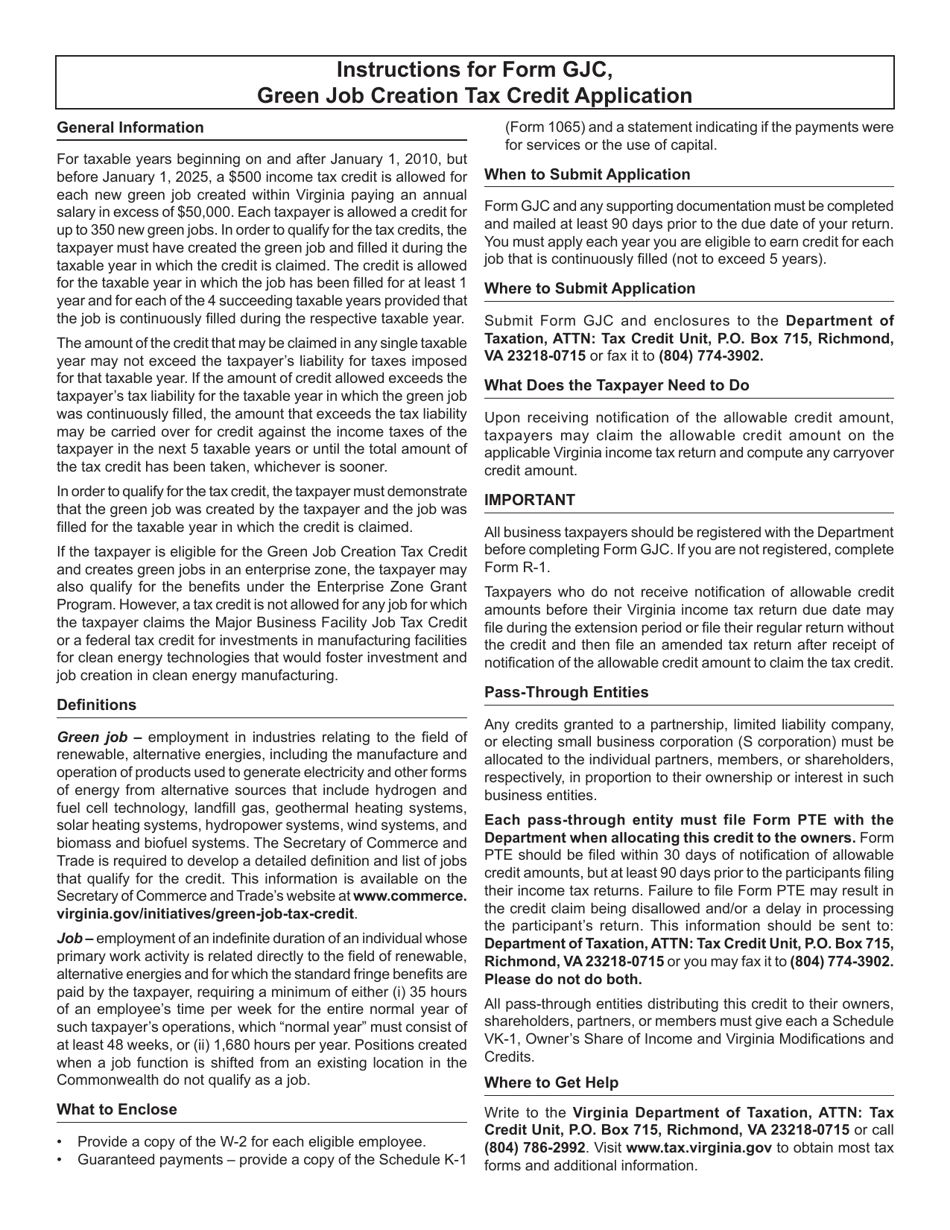

Q: What is the Green Job CreationTax Credit in Virginia?

A: The Green Job Creation Tax Credit in Virginia is a financial incentive offered by the state to businesses that create green jobs.

Q: How can I apply for the Green Job Creation Tax Credit in Virginia?

A: To apply for the Green Job Creation Tax Credit in Virginia, you need to submit Form GJC, which is the application form for this tax credit.

Q: What are the eligibility requirements for the Green Job Creation Tax Credit in Virginia?

A: The eligibility requirements for the Green Job Creation Tax Credit in Virginia include creating new full-time green jobs, meeting certain wage requirements, and obtaining certification from the Virginia Department of Environmental Quality.

Q: What are the benefits of the Green Job Creation Tax Credit in Virginia?

A: The Green Job Creation Tax Credit in Virginia provides a financial incentive in the form of tax credits to businesses that create green jobs, which can help reduce their tax liability and promote environmental sustainability.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GJC by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.