This version of the form is not currently in use and is provided for reference only. Download this version of

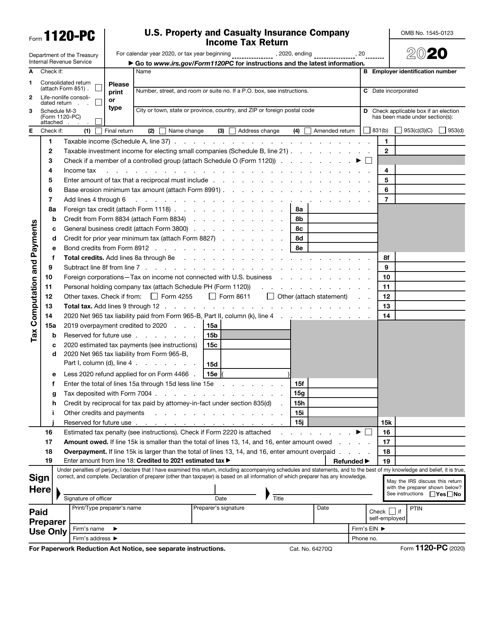

IRS Form 1120-PC

for the current year.

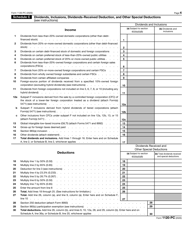

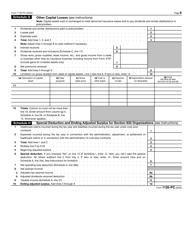

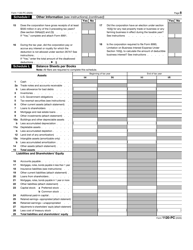

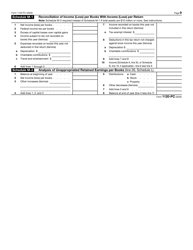

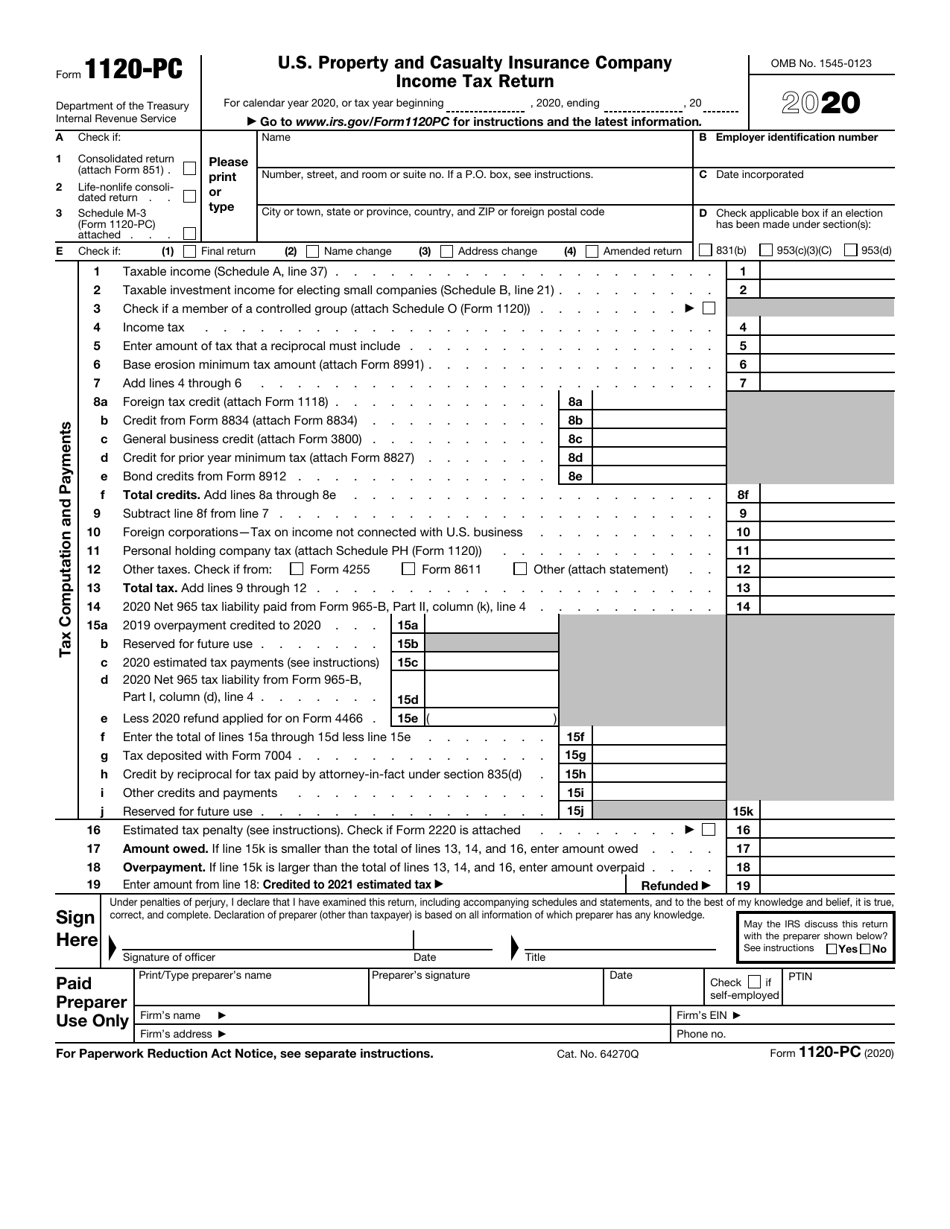

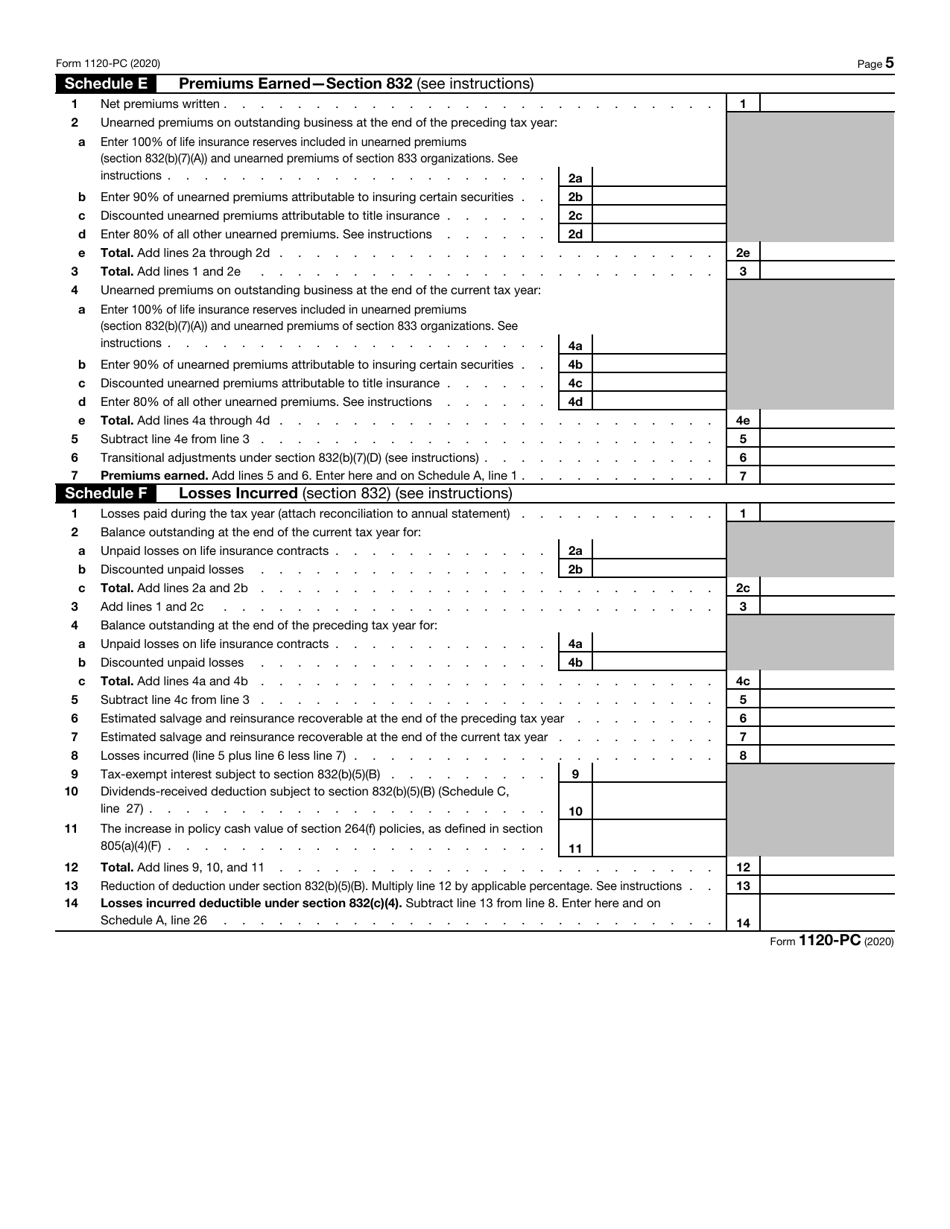

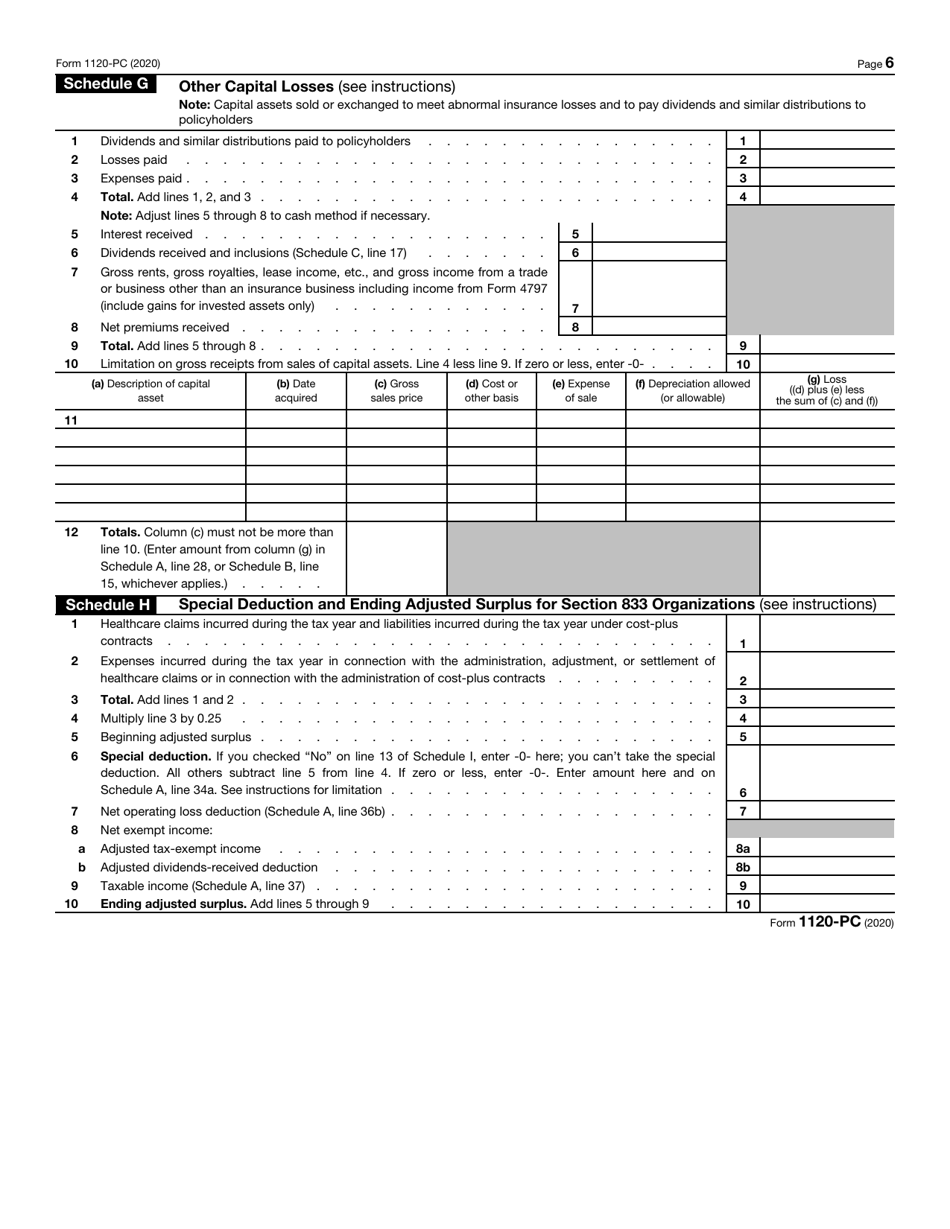

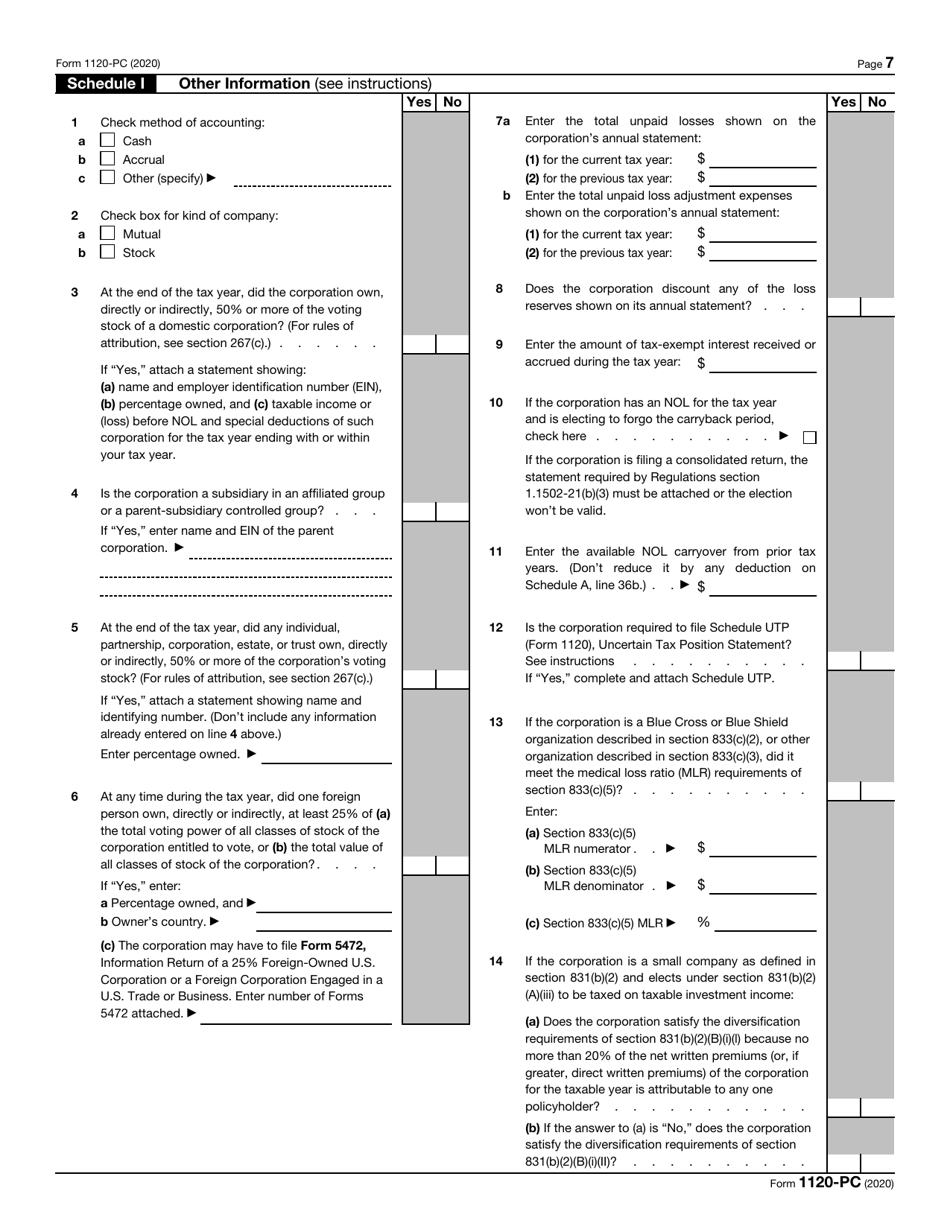

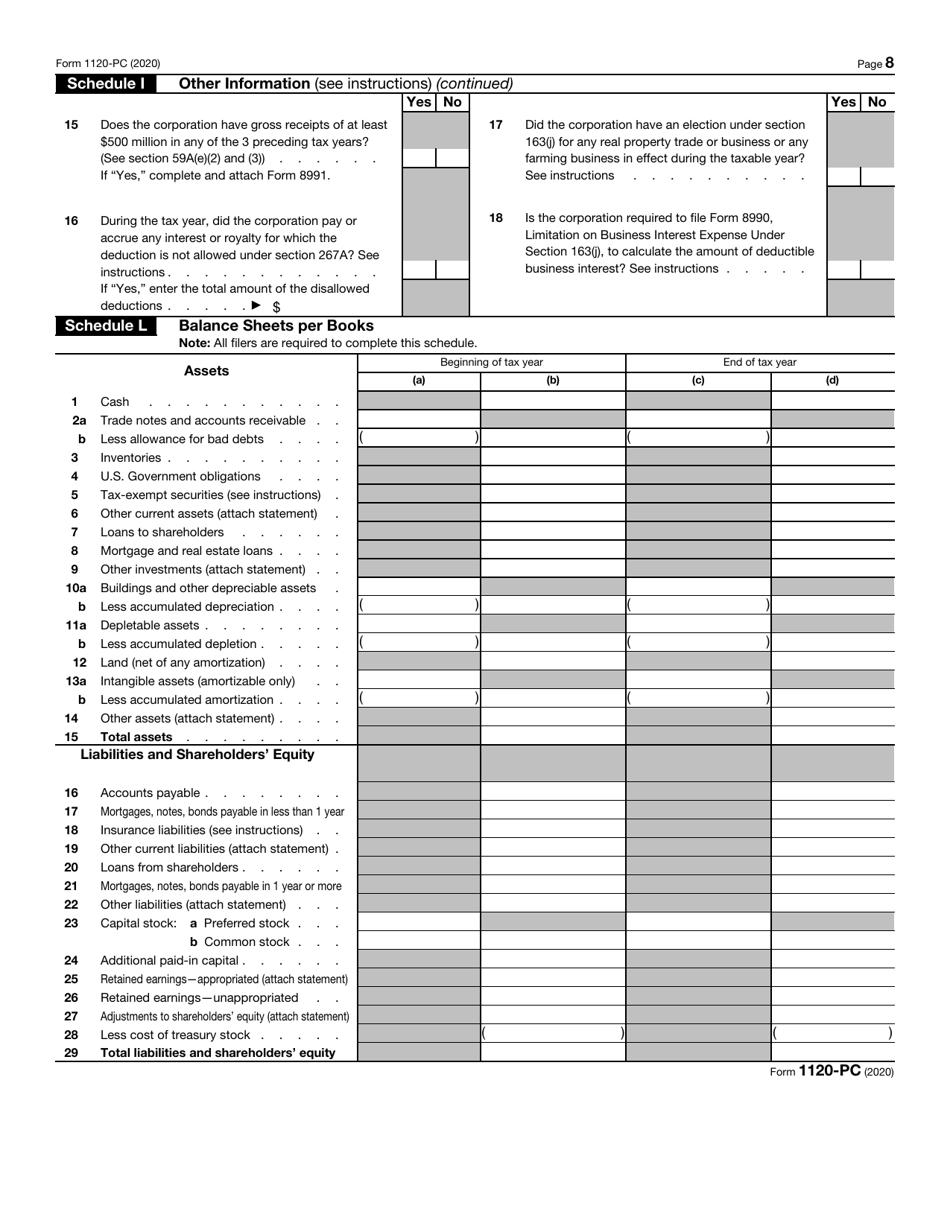

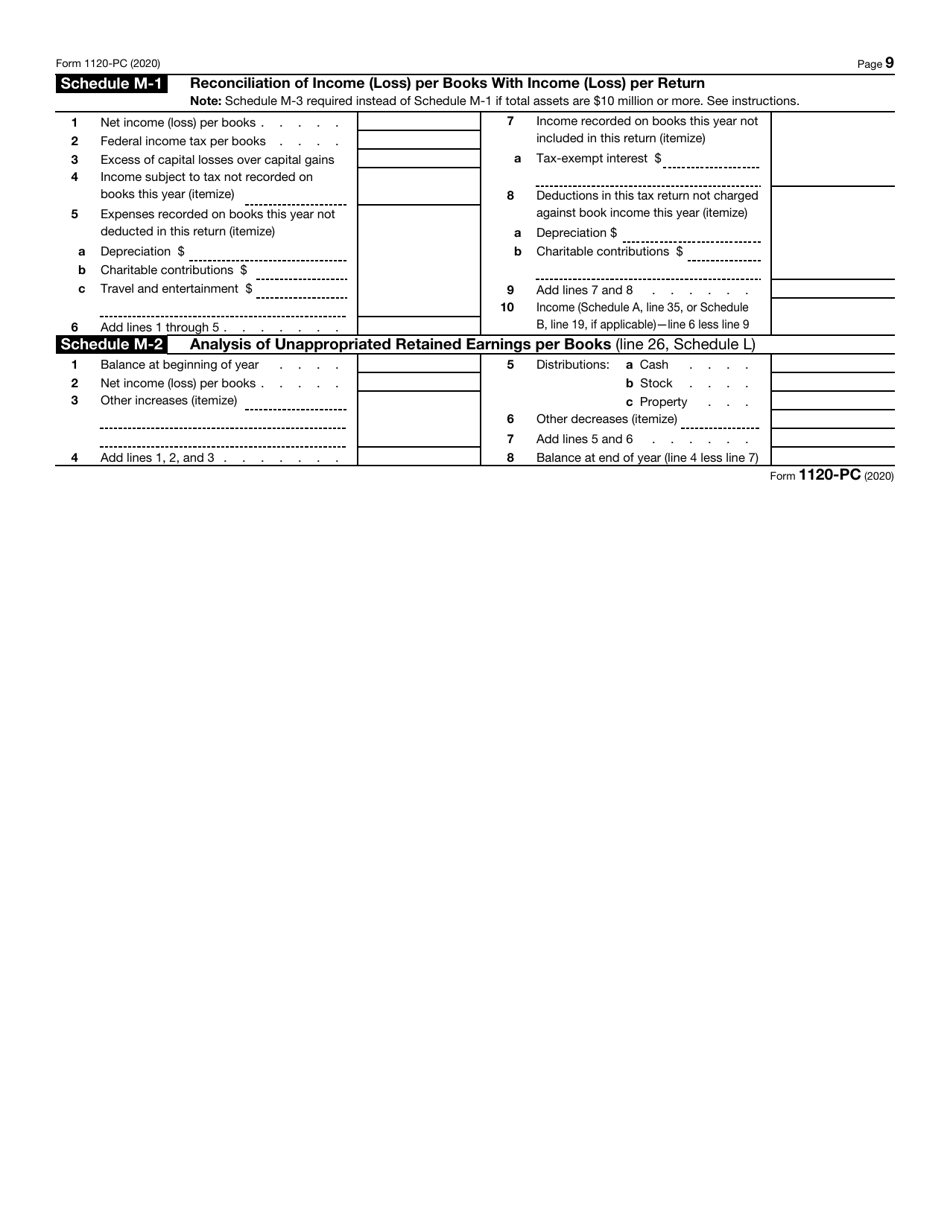

IRS Form 1120-PC U.S. Property and Casualty Insurance Company Income Tax Return

What Is IRS Form 1120-PC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-PC?

A: IRS Form 1120-PC is the U.S. Property and Casualty Insurance Company Income Tax Return.

Q: Who needs to file IRS Form 1120-PC?

A: U.S. property and casualtyinsurance companies need to file IRS Form 1120-PC.

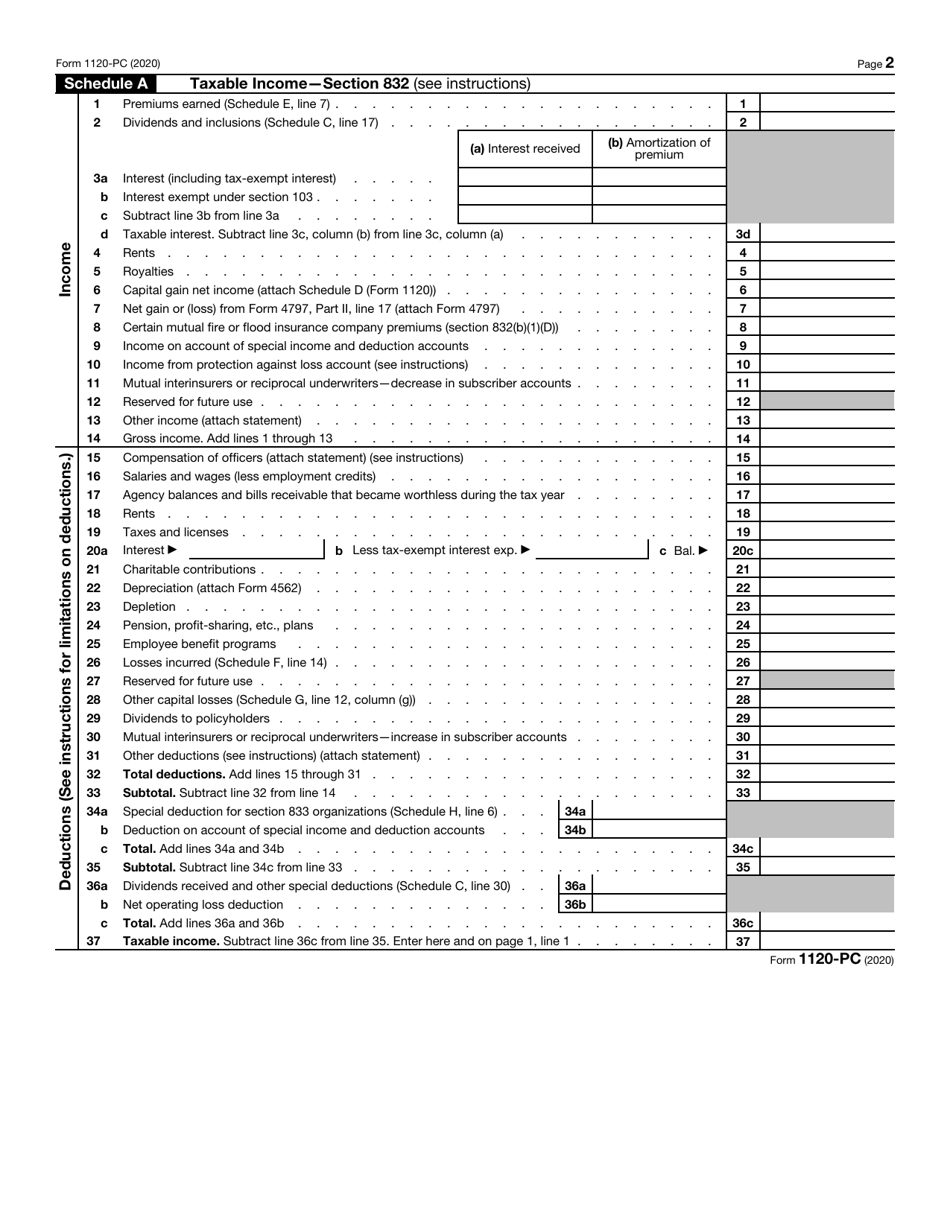

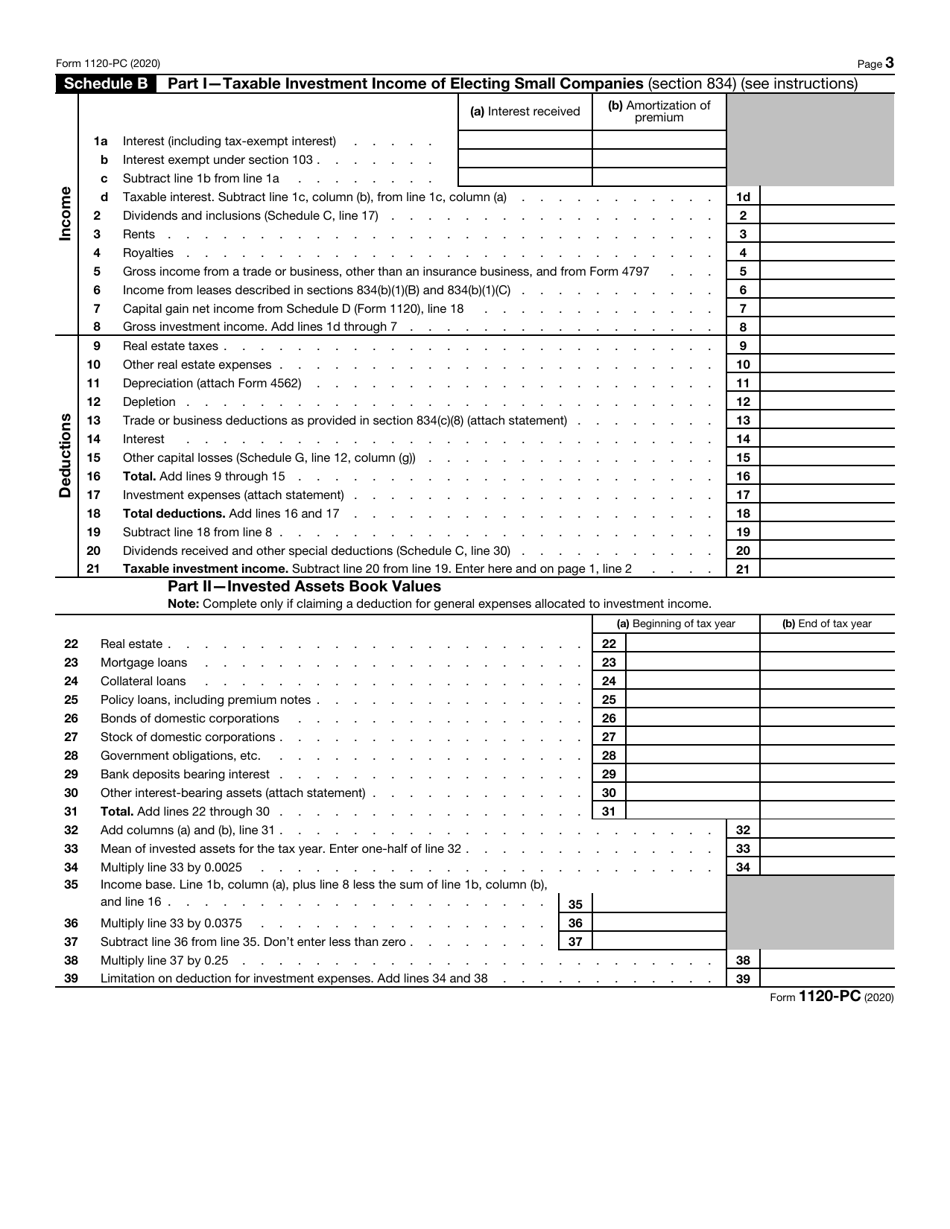

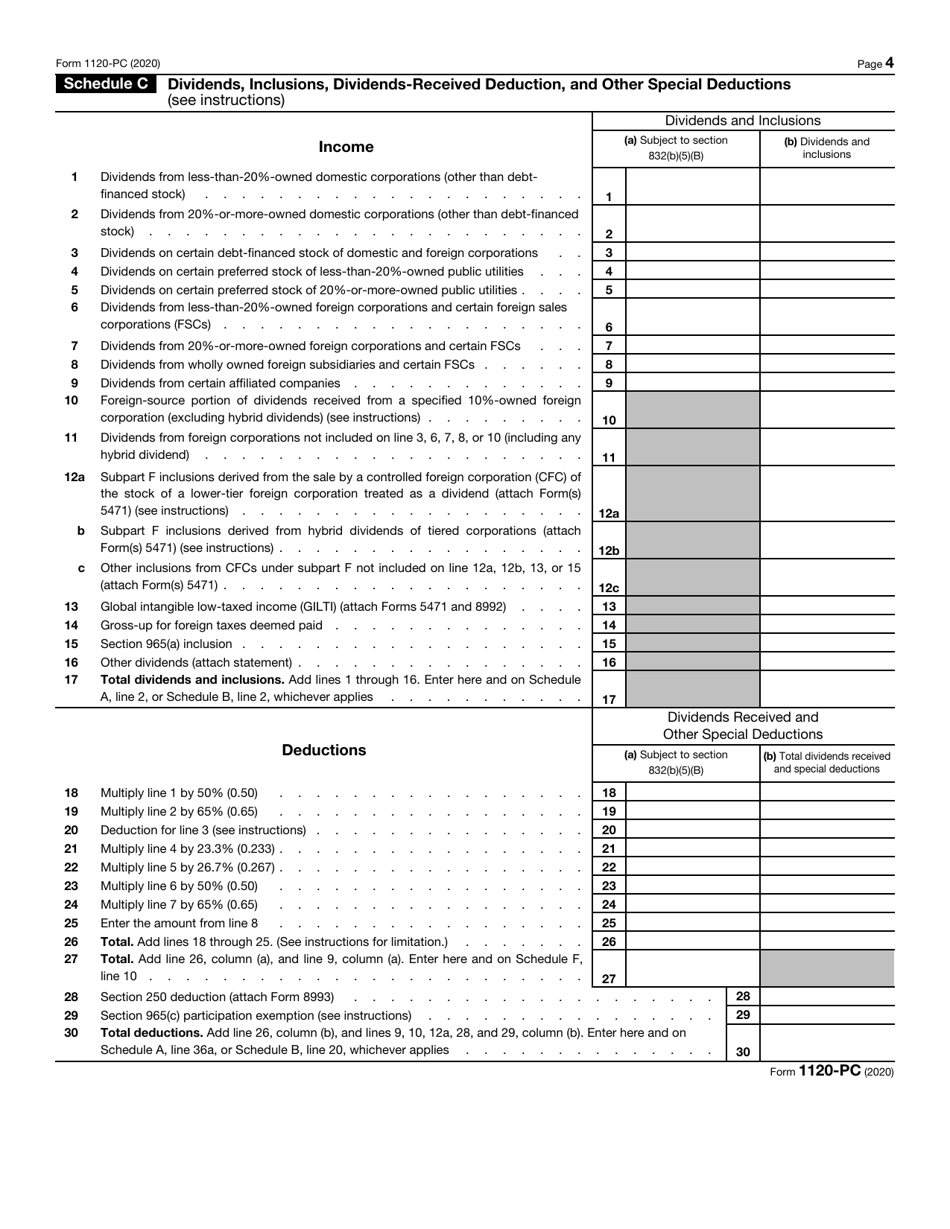

Q: What information does IRS Form 1120-PC require?

A: IRS Form 1120-PC requires information on the insurance company's income, deductions, credits, and tax liability.

Q: When is the deadline for filing IRS Form 1120-PC?

A: The deadline for filing IRS Form 1120-PC is the 15th day of the 3rd month after the end of the company's tax year.

Q: Is there a specific tax rate for property and casualty insurance companies?

A: There is no specific tax rate for property and casualty insurance companies. The tax rate depends on the company's taxable income.

Q: Are there any penalties for not filing IRS Form 1120-PC?

A: Yes, there are penalties for not filing IRS Form 1120-PC or for filing it late. The penalties vary depending on the circumstances.

Q: Can I e-file IRS Form 1120-PC?

A: Yes, you can e-file IRS Form 1120-PC if you meet the requirements for electronic filing.

Q: Do I need to attach any documents to IRS Form 1120-PC?

A: Yes, you may need to attach certain documents, such as schedules or supporting documentation, to IRS Form 1120-PC.

Q: Can I get an extension to file IRS Form 1120-PC?

A: Yes, you can request an extension to file IRS Form 1120-PC. You must file Form 7004 to request the extension.

Form Details:

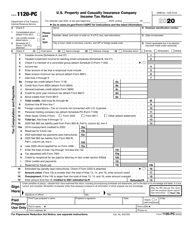

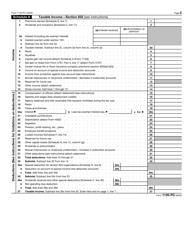

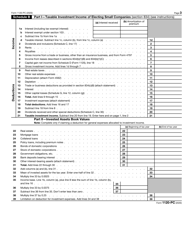

- A 9-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-PC through the link below or browse more documents in our library of IRS Forms.