This version of the form is not currently in use and is provided for reference only. Download this version of

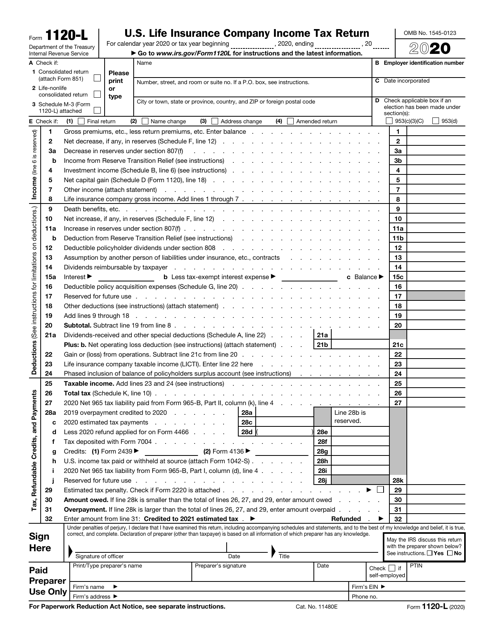

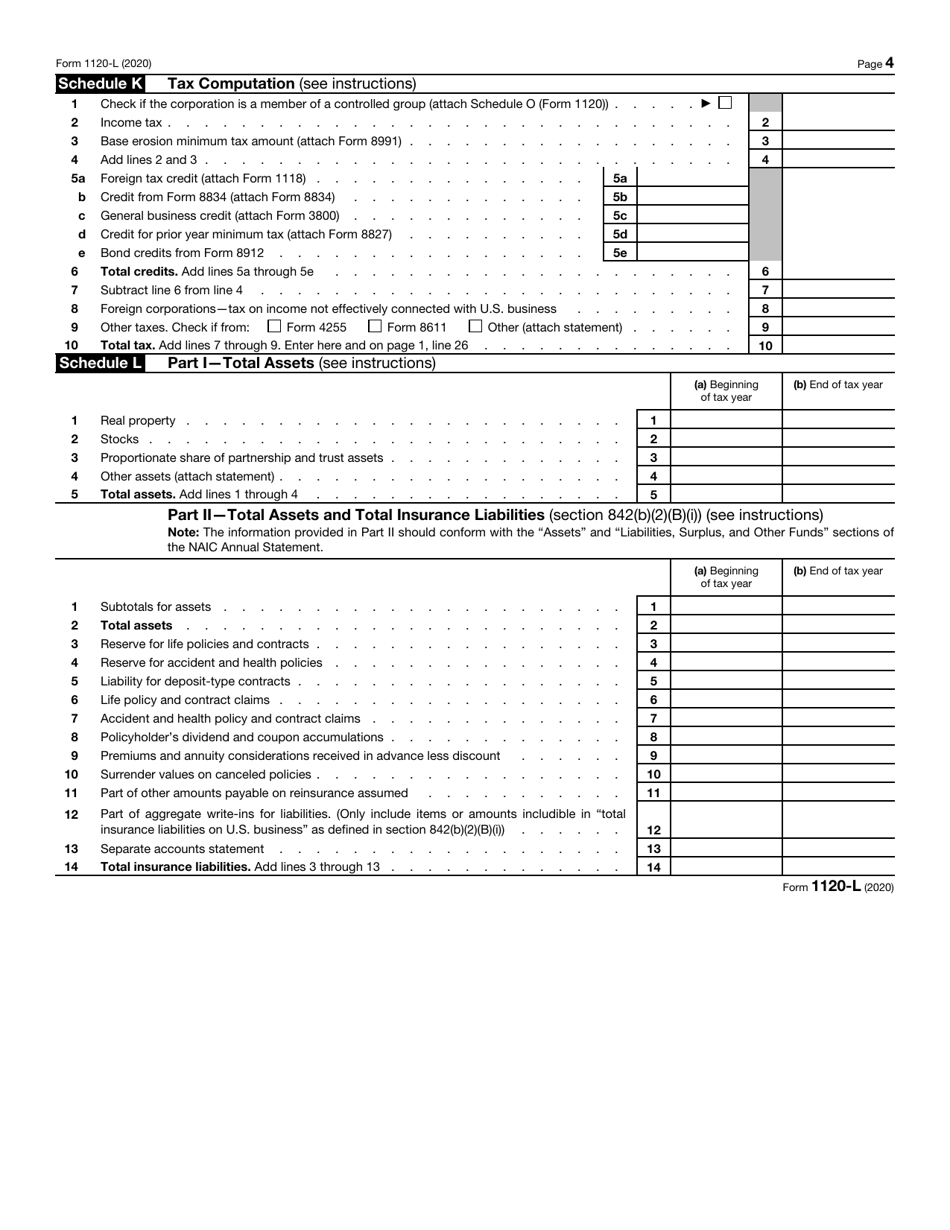

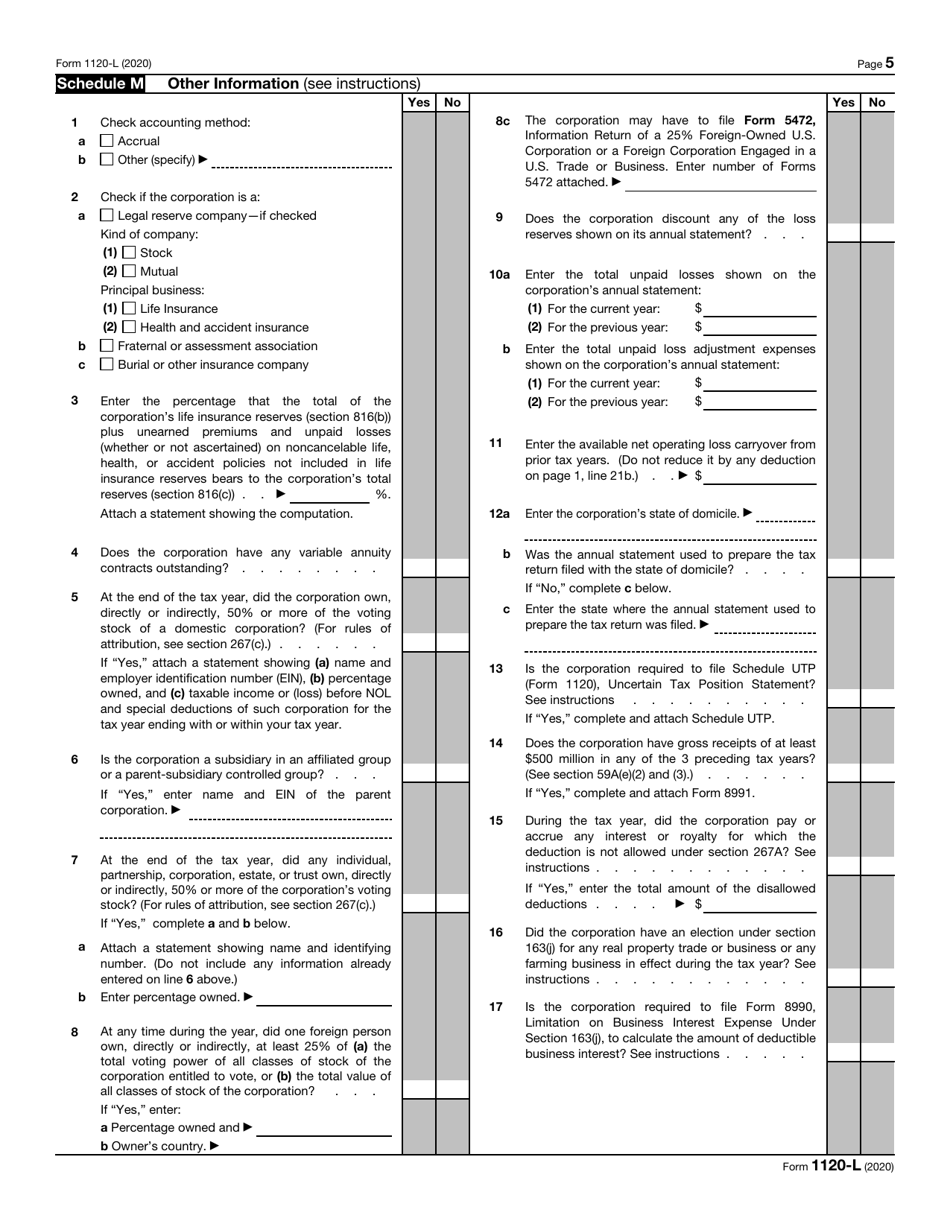

IRS Form 1120-L

for the current year.

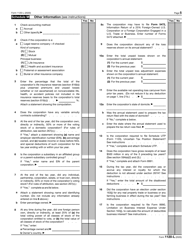

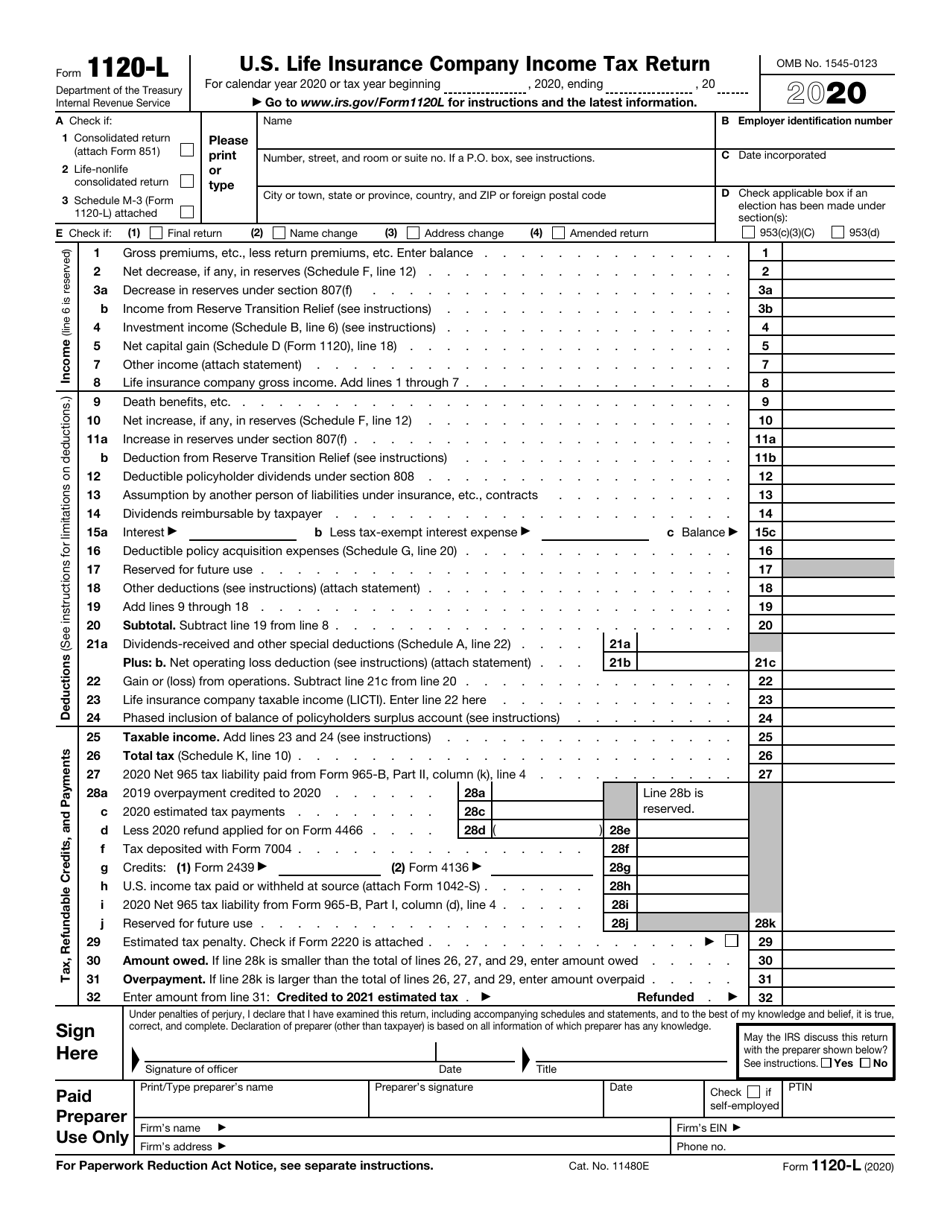

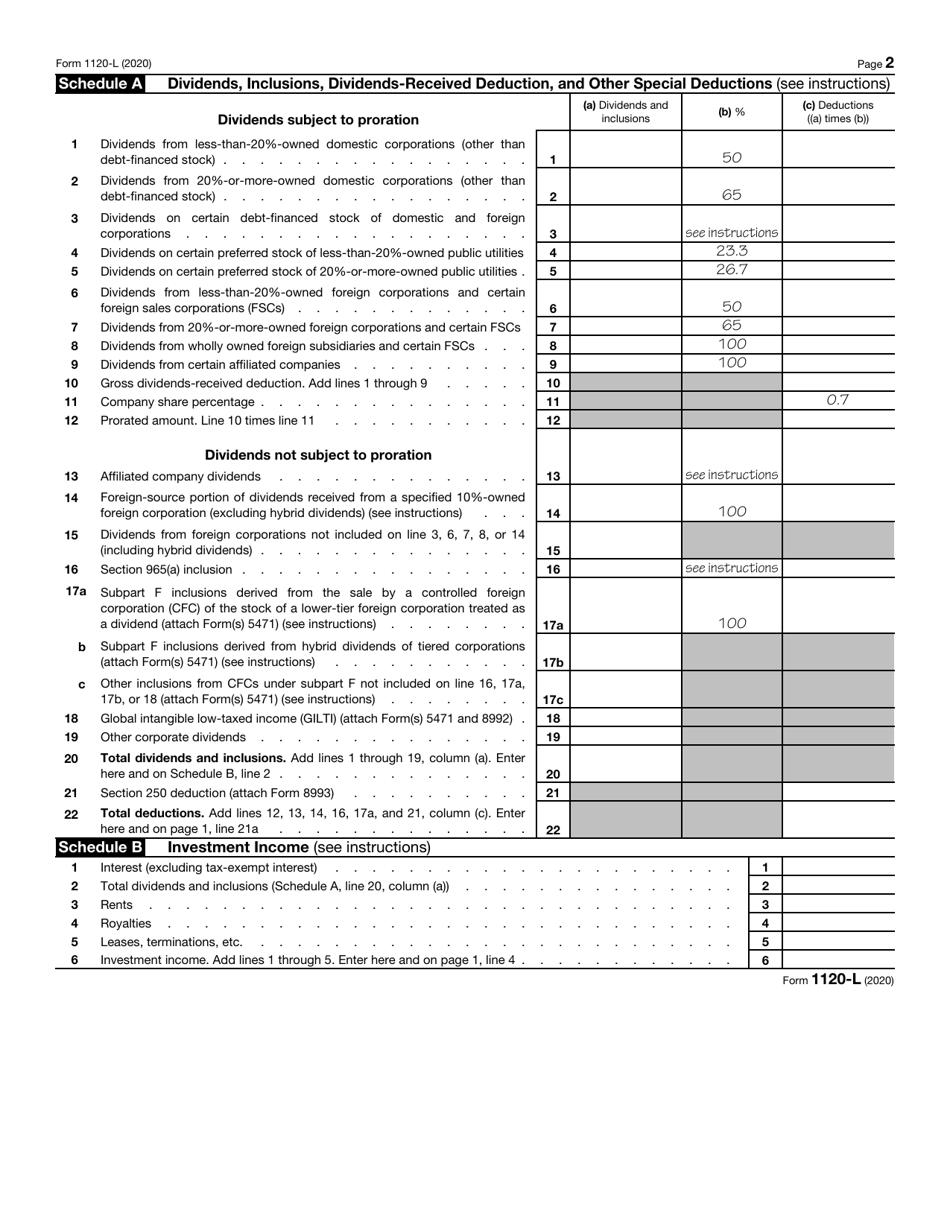

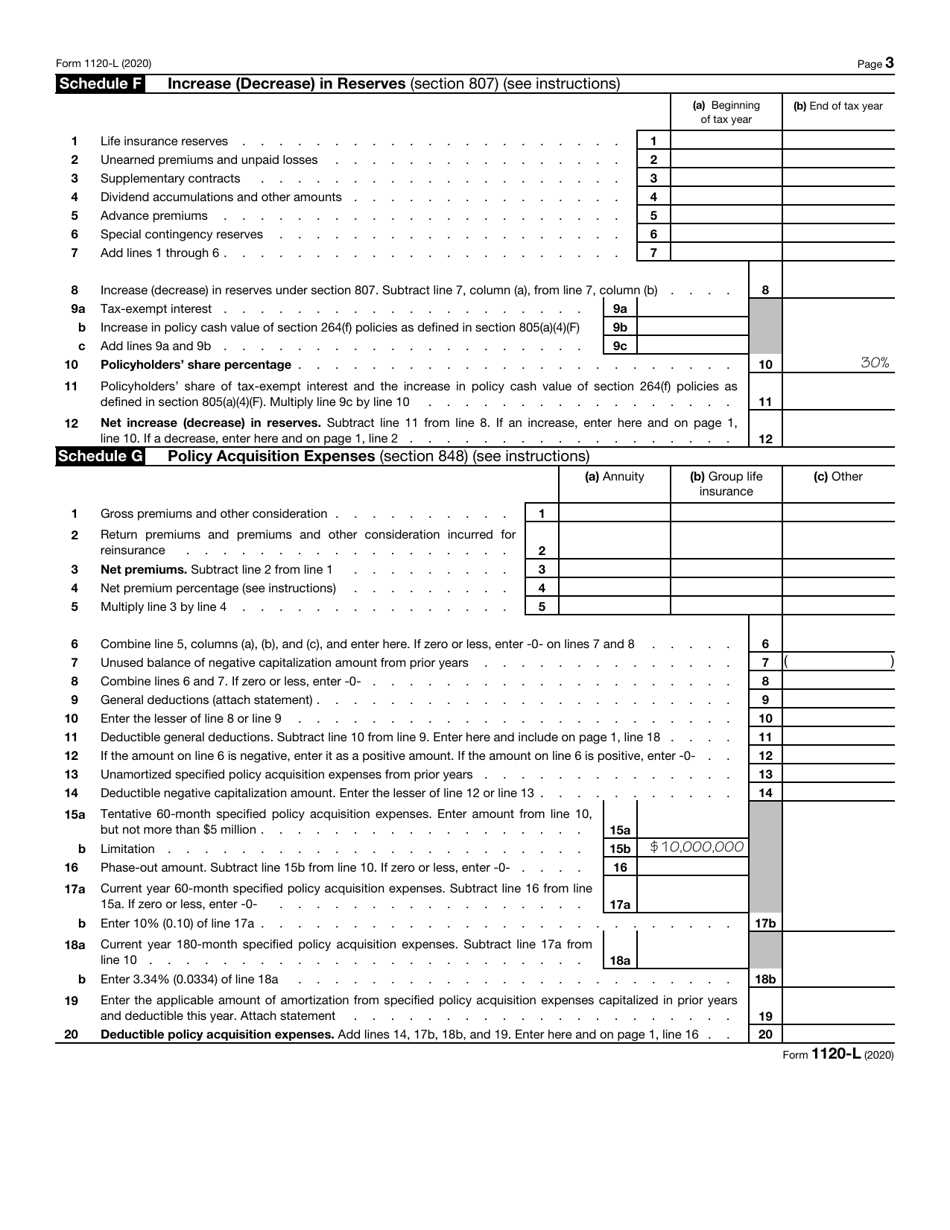

IRS Form 1120-L U.S. Life Insurance Company Income Tax Return

What Is IRS Form 1120-L?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1120-L?

A: IRS Form 1120-L is the U.S. Life Insurance Company Income Tax Return.

Q: Who needs to file IRS Form 1120-L?

A: U.S. life insurance companies need to file IRS Form 1120-L.

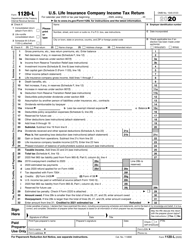

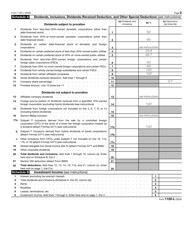

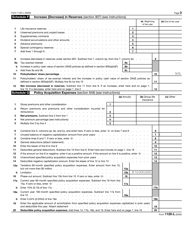

Q: What does IRS Form 1120-L cover?

A: IRS Form 1120-L is used to report the income, deductions, gains, and losses of U.S. life insurance companies.

Q: When is the deadline to file IRS Form 1120-L?

A: The deadline to file IRS Form 1120-L is usually March 15th.

Q: Are there any extensions available for filing IRS Form 1120-L?

A: Yes, an extension of time to file IRS Form 1120-L can be requested using Form 7004.

Q: Are there any taxes due when filing IRS Form 1120-L?

A: Yes, U.S. life insurance companies may need to pay estimated taxes throughout the year or face penalties.

Q: What supporting documents are required when filing IRS Form 1120-L?

A: U.S. life insurance companies should attach any necessary schedules and supporting documentation to IRS Form 1120-L.

Q: Can IRS Form 1120-L be filed electronically?

A: Yes, IRS Form 1120-L can be filed electronically using the IRS e-file system.

Q: Is professional assistance recommended for filing IRS Form 1120-L?

A: It is recommended to seek professional assistance or consult a tax professional when filing IRS Form 1120-L.

Form Details:

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-L through the link below or browse more documents in our library of IRS Forms.